The waiting ends now... | April 10th

This week might be the one we’ve been waiting for, friends. There are lots of macro-related events you should be watching: 1️⃣ Consumer Price Index (CPI) - Wednesday, April 12th 2️⃣ FOMC meeting minutes - Wednesday, April 12th; 3️⃣ Ethereum Shanghai Upgrade - Wednesday, April 12th; 4️⃣ Producer Price Index (PPI) - Thursday, April 13th; 5️⃣ Q1 Earnings Season - Friday, April 14th. The market will be driven by these events. Historically, they usually come in package with increased volatility and fakeouts, so you ought to be careful when surfing the market this week! With that said, let’s dive in!

TLDR

- This will be a macro-driven week. Expect lots of volatility.

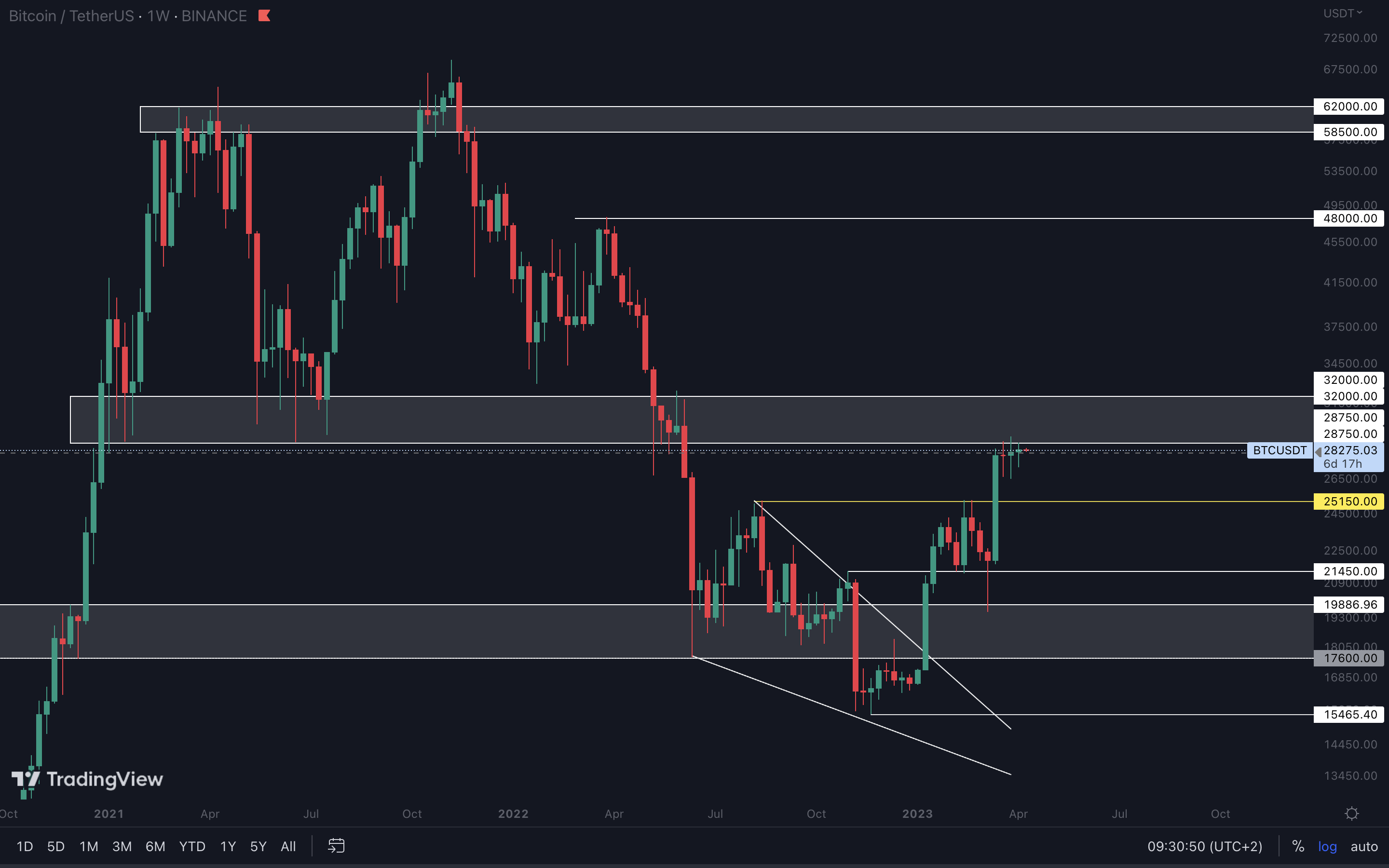

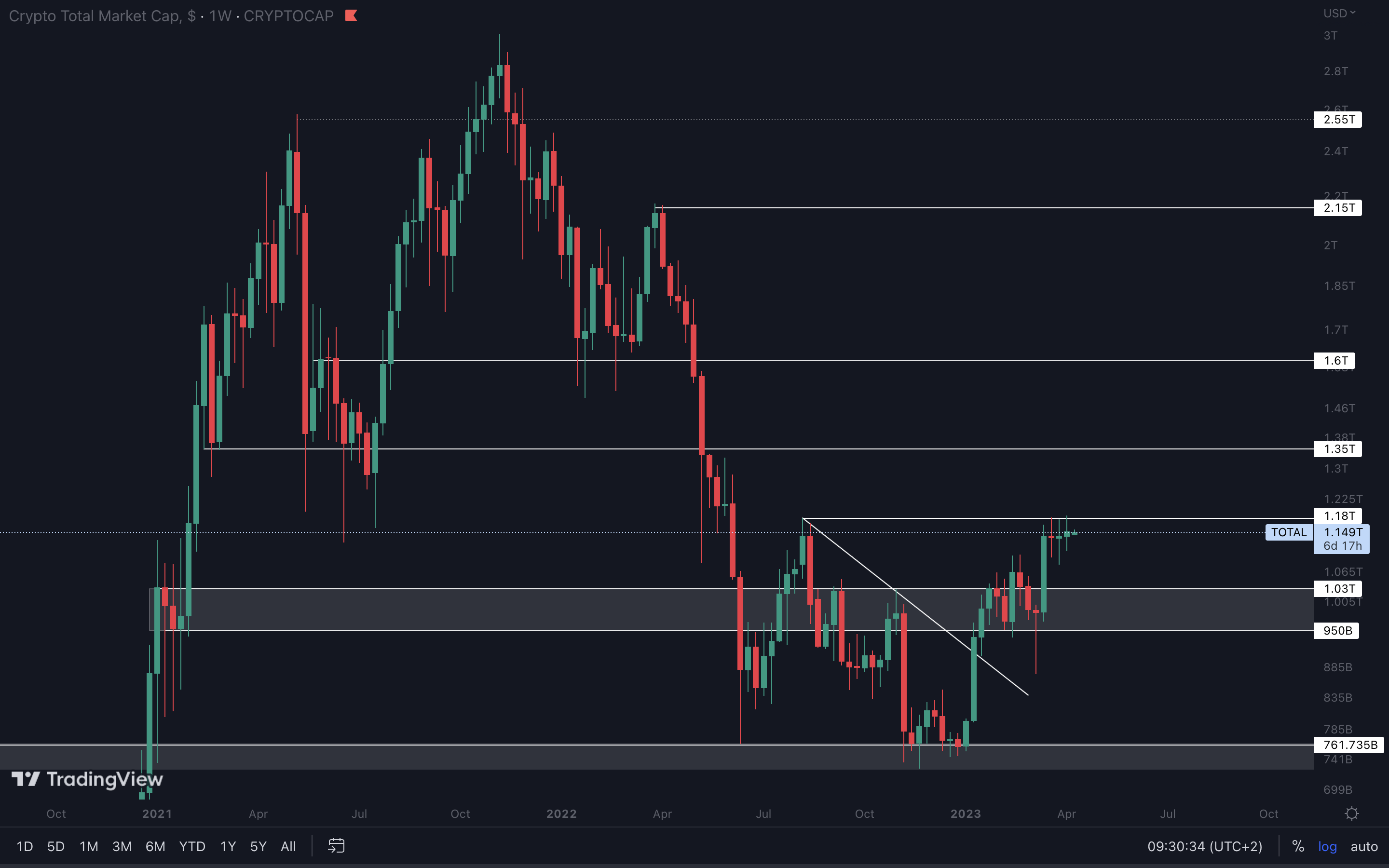

- The Total Market Cap and Bitcoin remain at resistance, but we might see something of significance happening this week, either a break to the upside or a rejection to the downside.

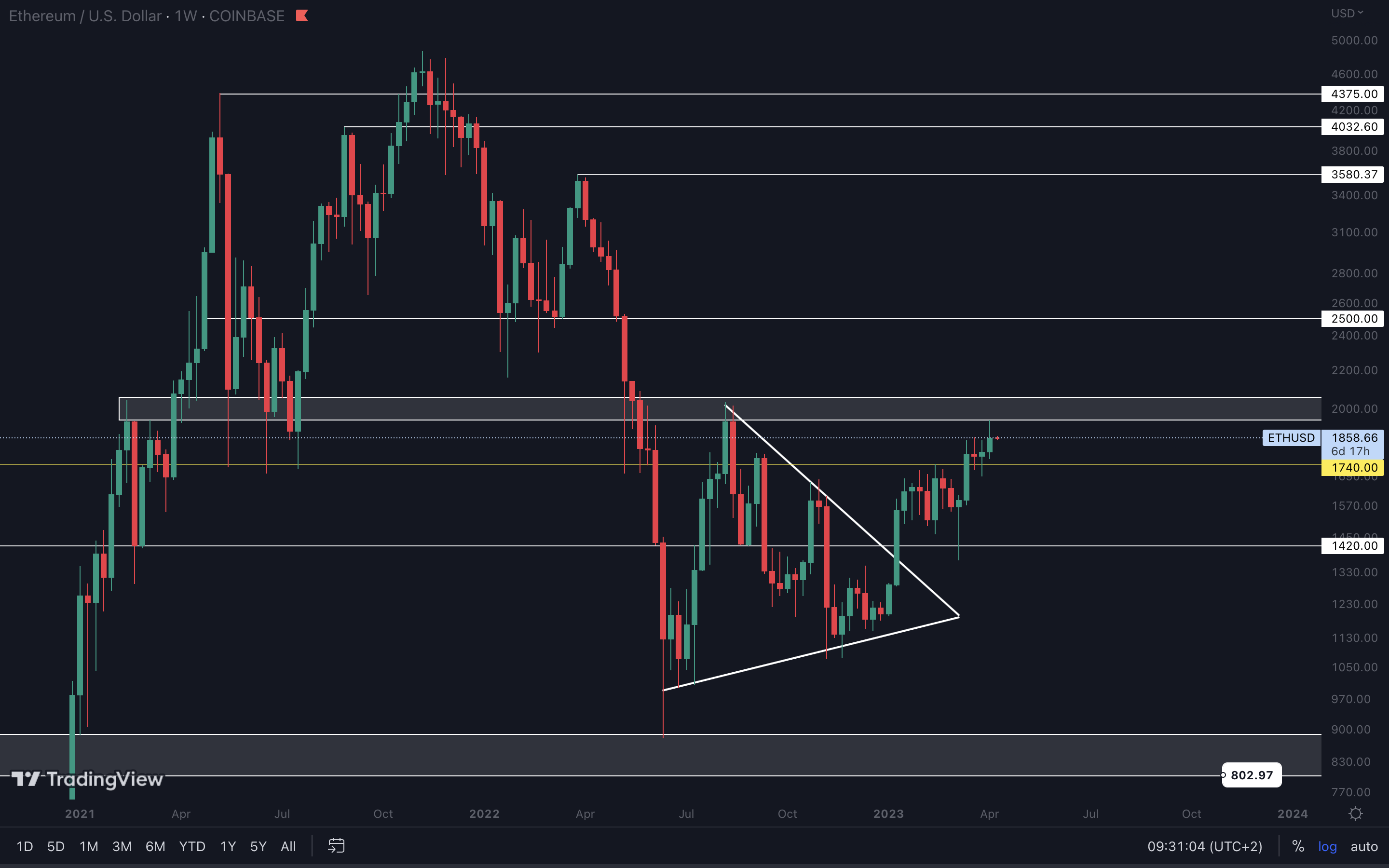

- Ether is on track for $2000 as long as $1740 holds as support.

- DYDX, LDO, PENDLE, RUNE, THOR are all under resistance. These assets will have to close above their respective levels in order to go higher.

- SYN is headed for $0.90 to retest this level as resistance. A rejection from that level is likely (as in going lower).

- OP is stuck in a range between $2.50 and $2. A break of either one of these levels is required before we can see any significant moves.

- HEGIC’s current support area between $0.01590 - $0.01815 is a good region to accumulate from.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Total Market Cap (Weekly)

The Total Market Cap index represents the entire cryptocurrency market. We track this index to understand where the market is now and predict where it will likely go next.

This is the third indecisive week in a row, but we’re slowly approaching a decisive move. The Total Market Cap remains under resistance ($1.18T) - think of this level as a roadblock. The road to upside is blocked by this obstacle, but once we break it, we can easily reach our next destination ($1.35T). For the time being, the best thing to do is wait until the Total Market Cap either closes a weekly candle above $1.18T, or gets rejected and heads lower to $1.03T.

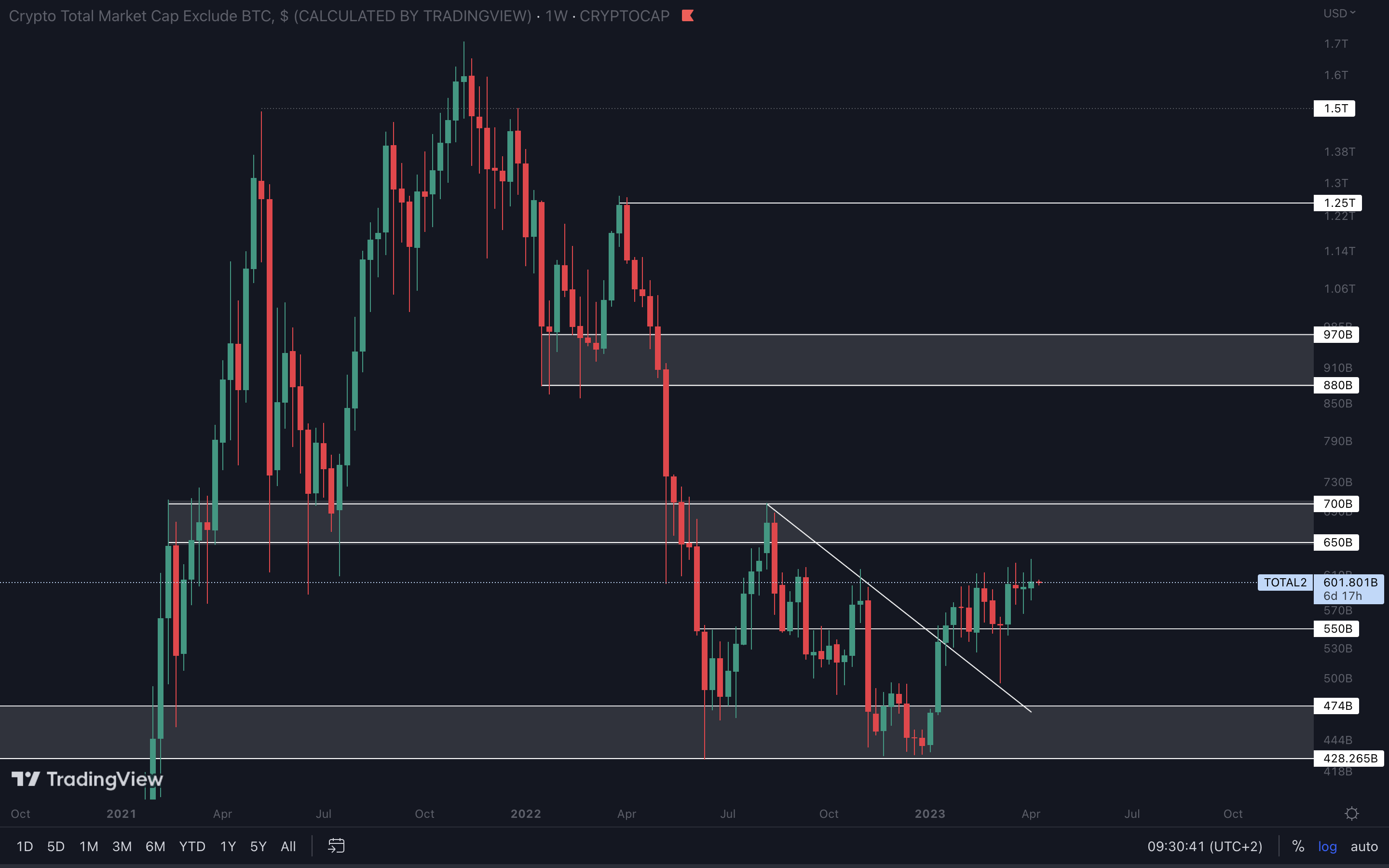

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire evaluation of the altcoins market (all coins other than BTC).

The Altcoins Market Cap index remains in mid-range ($650B - $550B), so there are about equal odds for both directions. For that reason, only the Total Market Cap can decide where the altcoins market is headed, because we will not be seeing this index rising on its own right now. After all, we’re in a bear market. We remain confident that the Total Market Cap will experience a pullback very soon, so the altcoins market will be heading back to $550B. If we’re wrong (which is a real possibility), the next resistance for this index is the $650B - $700B region.

Cryptonary's Watchlist

BTC | Bitcoin (Weekly)

ETH | Ethereum (Weekly)

Ether tested $1900 last week, and it looks ready to reach $2000. Unfortunately, that is not line with Bitcoin’s price action, and it could easily invalidate any further upside for Ether if it were for it to go lower. For the time being, our only priority here would be holding $1740 as support. We are bearish on the short-term, but holding $1740 as support could still mean Ether can reach $2000 at some point during Q2, and the chances of that happening are very high.

DYDX | dYdX (Weekly)

DYDX closed under resistance ($2.50). From a technical standpoint, failing to break above this level will result in the asset getting rejected (going lower). Avoid buying for now.

LDO | Lido DAO (Weekly)

Despite having some buying pressure coming in last week, most of it has been invalidated because the candle closed flat. This means sellers might have the upper hand and they could push LDO’s price back to support at the $1.9775 - $1.85 region. Significant upside can be confirmed here only when LDO closes a weekly candle above $3.10. Until then, we should expect downside or ranging between $1.85 - $3.10.

HEGIC | Hegic (Weekly)

The $0.01815 - $0.01590 region is a very good area to buy from. This is where HEGIC previously saw resistance in the past, but after breaking above it, it is now retesting it as support. If you decide to buy, you have to take into consideration that Bitcoin going to $25,150 will result in HEGIC losing this region as support. Both risk and reward have to be accounted for. From a technical standpoint, holding $0.01590 (the bottom of the current support area) on the weekly timeframe keeps the door open for $0.02725.

PENDLE | Pendle (Weekly)

PENDLE saw a 60% increase last week. It definitely holds the “outperformer” title right now. We can see that it broke through resistance ($0.52) at some point, but closed the week under it. This is an indication that sellers are present and PENDLE might have a hard time closing above resistance for now. If it can close above $0.52 on the weekly timeframe, then $0.90 is next. In the meantime, it wouldn’t be wise to enter given that the asset is at resistance.

Cryptonary's Watchlist

DOT | Polkadot (Weekly)

We haven’t seen any significant progress from DOT. Last week’s candle closed red despite experiencing some buying pressure (wick to the upside), so we might see DOT testing $6 again this week. We don’t view DOT as a solid investment in the short-term, because there are better opportunities that could come this quarter. Only a weekly closure above $7 could light some spark for it in the short-term.

RUNE | THORChain (Weekly)

RUNE performed quite well last week, bouncing from its $1.43 support right into the $1.67 resistance level. Now, we can only confirm more upside if RUNE closes above $1.67 on the weekly timeframe. In the meantime, expect ranging between $1.43 and $1.67.

SOL | Solana (Weekly)

SOL has been steadily dropping inside the $22 - $19 region for three weeks now. We can only assume that this will continue, and SOL will test $19 soon (1-2 weeks, depending on Bitcoin’s price action). In our opinion, there are better assets to accumulate/trade with right now, such as PENDLE, RUNE or HEGIC. SOL lacks volume and demand, and that makes it less intriguing.

SNX | Synthetix (Weekly)

From a technical standpoint, holding $2.50 keeps the door open for $3.50. However, we don’t think this level will be reached anytime soon purely because it requires much more demand than what it is showing right now.

From a technical standpoint, holding $2.50 keeps the door open for $3.50. However, we don’t think this level will be reached anytime soon purely because it requires much more demand than what it is showing right now.

A well-performing BTC will aid SNX in rising to $3.50, but we’ll have to see it rising significantly ($30,000 and above) for a chance at $3.50.

SYN | Synapse (Weekly)

SYN was unable to reclaim $0.90 last week. As a result, it got rejected and is now on a clear path toward $0.57. However, not even 24 hours into the new week, we can already see buyers stepping in and pushing the price higher.

SYN was unable to reclaim $0.90 last week. As a result, it got rejected and is now on a clear path toward $0.57. However, not even 24 hours into the new week, we can already see buyers stepping in and pushing the price higher.

Today’s performance could be a sign that SYN will retest $0.90 again this week, but what’s important is that it closes a weekly candle above this level. Unless we see it closing above $0.90, the asset remains on track for $0.57.

MINA | Mina Protocol (Weekly)

Three weeks ago, sellers pushed MINA’s price lower and closed red, marking a weekly lower high. This resulted in another two weeks of downside which brought MINA to the $0.69 - $0.62 support area. This would’ve been a good level to buy from if MINA wouldn’t have marked a weekly lower high three weeks ago, but if we pair it with Bitcoin’s potential pullback, MINA holding $0.69 - $0.72 as support might be a difficult task, and we can see it losing support. It would be best to wait for events to unfold naturally and to act only after they’ve happened. This will increase your odds of catching a better entry for both your short-term and long-term investments.

ASTR | Astar Network (Weekly)

There’s no reason to believe that ASTR will not retest $0.05500 again in the coming weeks, because this has been the direction it was headed for since failing to hold $0.082 as support six weeks ago. Expect ASTR to reach $0.0550 in the coming weeks. This level needs to hold, otherwise the asset will enter the $0.0550 - $0.03250 range again, and there’s no telling when we’ll see a breakout again.

THOR | THORSwap (Weekly)

Two weeks ago, THOR saw an impulse in buying pressure which invalidated all the selling pressure (the wick to the downside). This resulted in a green weekly closure, after which buyers pushed THOR’s price even higher, retesting $0.20 as resistance. For upside to continue here, we will have to wait for THOR to close a weekly candle above $0.20. Closing into resistance keeps the odds of a rejection (going lower from here) high, which is why we don’t recommend buying here just yet.

OP | Optimism (Weekly)

OP is stuck between $2.50 and $2. Before we can confirm a significant move in either direction, the asset will have to close above or under one of these levels. In the meantime, we should expect OP to continue ranging until Bitcoin starts moving, and that could happen this week given all the macro events that are about to unfold.

Cryptonary’s take

The market seems to be indecisive at this time. The macro events from this week could shed some light on where we’re going next, but expect the market to be extremely volatile. We strongly believe that Bitcoin will experience a pullback from the $28,750 - $32,000 region, but we can’t rule out the possibility that it can rise a bit more first, somewhere inside this region. It’s a waiting game. The patient ones always win.Action points:

- Avoid trading if you’re inexperienced. This is a big week for the market, and trading without experience could easily result in losses.

- If Bitcoin breaks $28,750, trading a move to $30,000 might be a good idea. After the ranging from the past three weeks, Bitcoin breaking in either direction will come with a large volume increase, which will help you close your trades a lot faster.