This is what’s happening in Q2 | March 30th

Friends, we’re three months into the year, and what a quarter it has been. The question on everyone's mind is: What’s next? In this week’s report, we dissect the charts to understand where we are now, and what Q2 may bring.

Spoiler: MORE UPSIDE. Let’s dive in!

TLDR

- The Total Market Cap is at resistance. A weekly closure above $1.18T is needed to confirm further upside, otherwise pullback is on the cards.

- BTC is at resistance. A weekly closure above $28,750 is needed, otherwise expect $25,150 first.

- Ether could close this month’s candle above $1740. This would be the first time in ~9 months. Ether could reach $2000 in Q2.

- BNB needs to break $335 on the weekly timeframe for upside to continue. Until then, expect ranging between $300 - $335.

- XRP is at resistance. Take profits. Don’t buy.

- LTC is trading in a bullish market structure on the weekly timeframe. We expect it to reach $113 during Q2, the nearest resistance level. That’s +26% away from its current price.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Total Market Cap (Weekly)

The Total Market Cap index represents the entire valuation of the cryptocurrency market. We track this index to understand where the market is now and predict where it will go.

The Total Market Cap is at resistance. Although we’re expecting a pullback to $1.03T, we won’t rule out the possibility it could break resistance and go higher.

The Total Market Cap is at resistance. Although we’re expecting a pullback to $1.03T, we won’t rule out the possibility it could break resistance and go higher.

Unless the Total MCap (Market Cap) closes a weekly candle above $1.18T, the market will go down in the short-term.

A weekly closure above $1.18T would invalidate any downside, making our wallets a little bigger in the process. Despite some current obstacles (the need to break above $1.18T), we believe the Total MCap index will reach $1.35T in Q2.

Altcoins Market Cap (Weekly)

The Altcoins Market Cap index represents the entire valuation of the altcoins market (all coins other than BTC).

The Altcoins MCap index is in mid-range ($650B - $550B). With the Total MCap at resistance, we can only assume that a rejection (going down) will take the Altcoins market down with it.

The Altcoins MCap index is in mid-range ($650B - $550B). With the Total MCap at resistance, we can only assume that a rejection (going down) will take the Altcoins market down with it.

Despite indecision in the short-term, the Altcoins market will have a promising Q2. We believe it will reach $700B in the coming months. The reason is simple - we’re still above support on the higher timeframe ($550B), and we’re trading in a bullish market structure on the weekly timeframe.

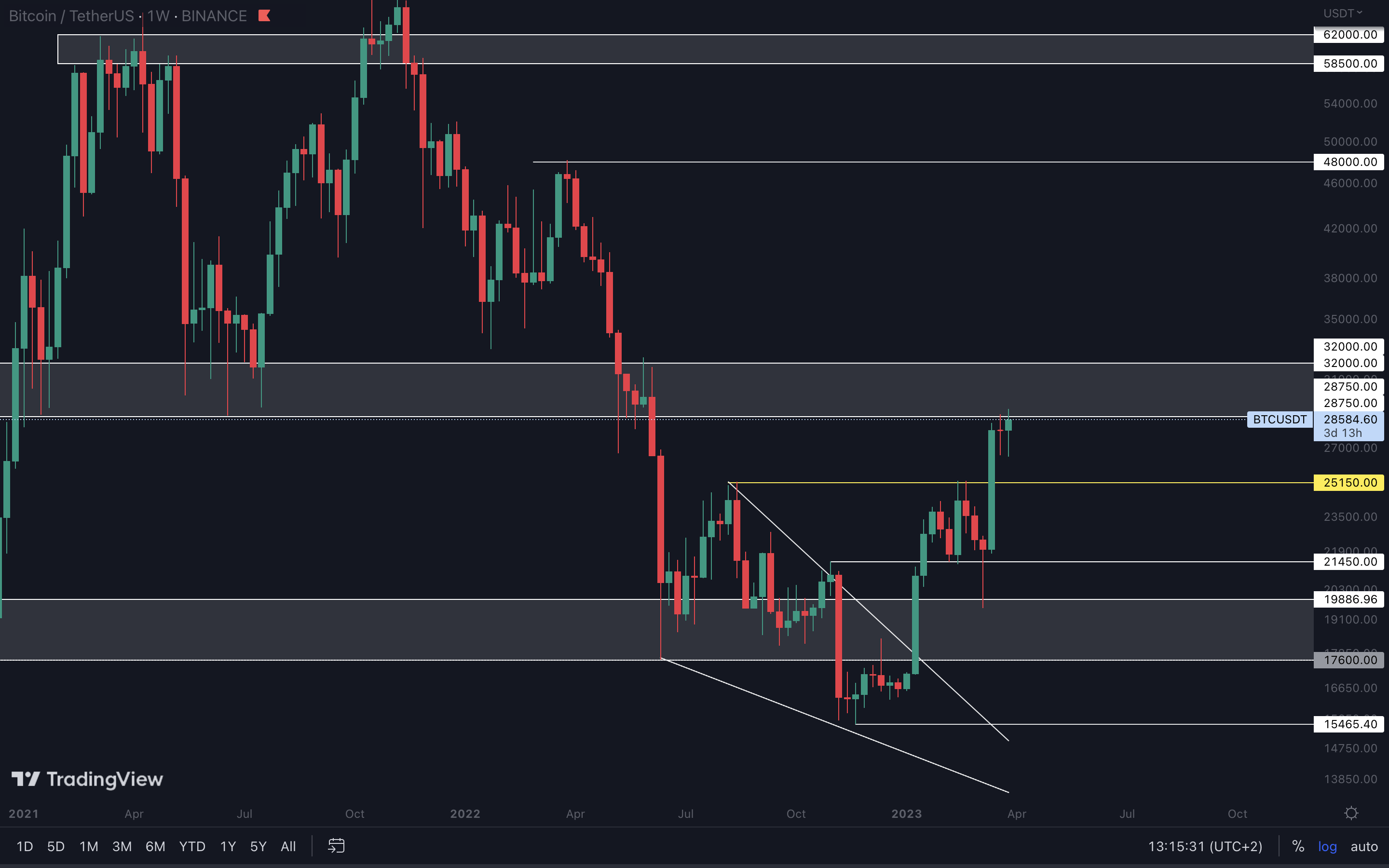

BTC | Bitcoin (Weekly)

This is the chart you should be watching at all times. It doesn’t matter if you hold BTC or not.

This is the chart you should be watching at all times. It doesn’t matter if you hold BTC or not.

Bitcoin is at resistance ($28,750). For upside to continue, it will need to close a weekly candle above this level. Otherwise, our expectations will come true, and Bitcoin will experience a pullback to $25,150. As for Q2, we’re in full bull-mode from a technical standpoint. We believe BTC will break $32,000 and reach higher targets, such as $35,000 or $40,000.

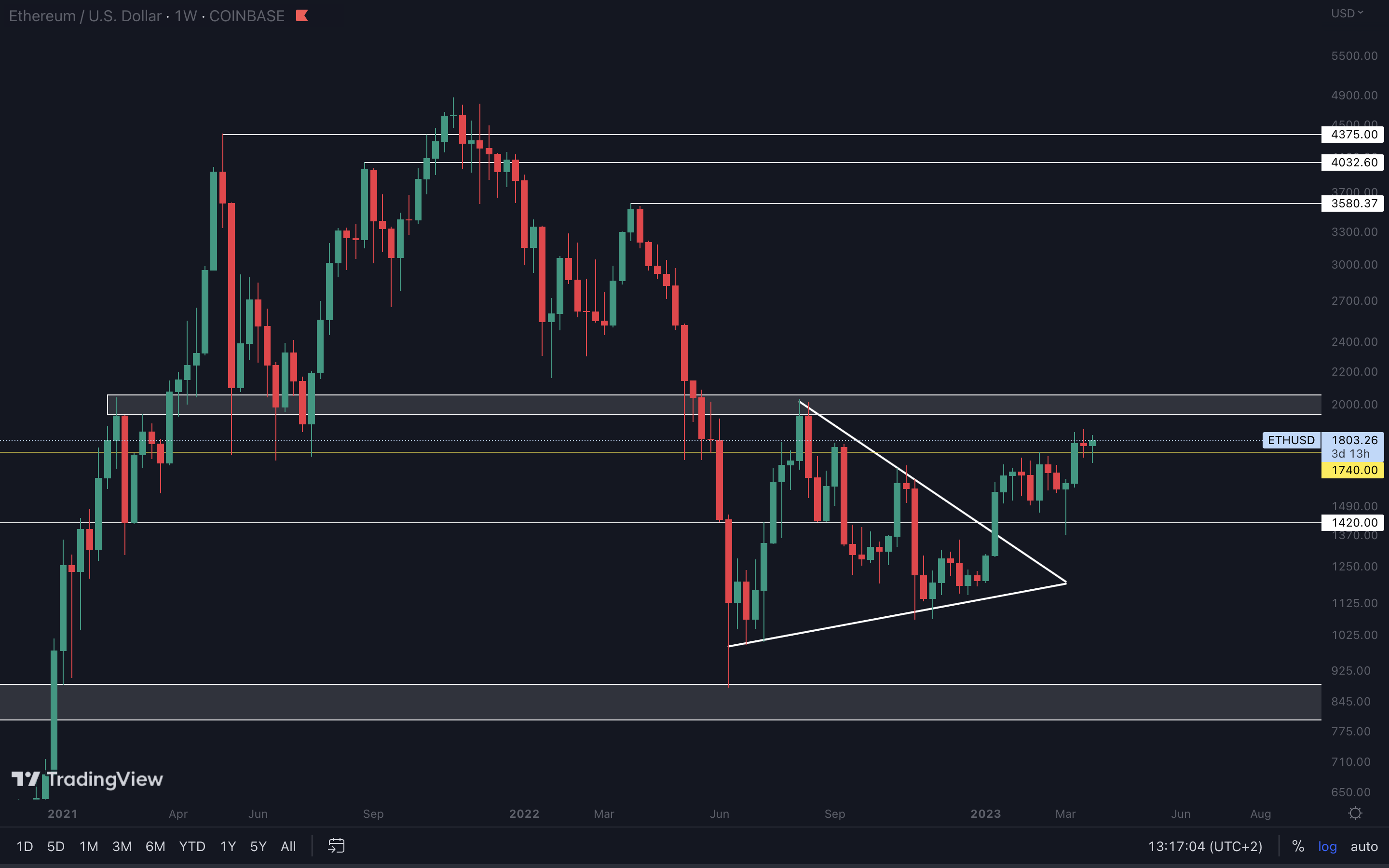

ETH | Ethereum (Weekly)

This could be the first time in ~9 months that Ether closes a monthly candle above $1740. It would clear the road for $2000 and above to be tested during Q2. However, we’re going to stick with the weekly timeframe from now.

This could be the first time in ~9 months that Ether closes a monthly candle above $1740. It would clear the road for $2000 and above to be tested during Q2. However, we’re going to stick with the weekly timeframe from now.

There’s a huge difference in Bitcoin and Ether’s price actions - one is at resistance and one is at support. They’re basically countering each other. One is saying “we could go down” and the other is saying “nah man, we’re pumping”.

For that reason, we wouldn’t recommend jumping into Ether to catch a move to $2000, despite it being at support. Bitcoin getting rejected from $28,750 would result in Ether losing $1740 as support. So, the risk/reward ratio isn’t that intriguing just yet.

BNB | Binance (Weekly)

BNB is trading in a weekly bullish market structure, so our expectations for Q2 are as you might’ve imagined - bullish. The asset tested the grey box as support this week, and is now experiencing some buying pressure due to Bitcoin’s performance.

BNB is trading in a weekly bullish market structure, so our expectations for Q2 are as you might’ve imagined - bullish. The asset tested the grey box as support this week, and is now experiencing some buying pressure due to Bitcoin’s performance.

We might see BNB range between $335 - $283 for a while, at least until Bitcoin breaks $28,750. A break above $28,750 would result in BNB closing above $335 on the weekly timeframe, and that would open the door for $430 - $460 to be tested in Q2.

XRP | XRP (Weekly)

XRP had a beautiful performance in the last two weeks. Maybe you made some money, maybe not. What’s important now is to keep the money you made or simply avoid losing money.

So, because the asset is now at resistance ($0.60 - $0.50), it’s best not to buy XRP to profit in the short-term. The risk/reward ratio is something you’d see in horror movies.

We recommend waiting for XRP to cool, and hoping that it gives us some indication as to where it’s going next.

XRP had a beautiful performance in the last two weeks. Maybe you made some money, maybe not. What’s important now is to keep the money you made or simply avoid losing money.

So, because the asset is now at resistance ($0.60 - $0.50), it’s best not to buy XRP to profit in the short-term. The risk/reward ratio is something you’d see in horror movies.

We recommend waiting for XRP to cool, and hoping that it gives us some indication as to where it’s going next.

ADA | Cardano (Weekly)

ADA has been steadily rising toward $0.40- $0.4450, and that’s exactly where it will go in the next few weeks.

ADA has been steadily rising toward $0.40- $0.4450, and that’s exactly where it will go in the next few weeks.

The asset has been in a long down-trend, 574 days to be specific. Multiple lower highs and lower lows have formed in this time. So unless we see a solid change in market structures on the weekly timeframe, ADA will continue its downtrend during Q2.

DOGE | Dogecoin (Daily)

The last two weeks have been indecisive for DOGE. It seems it doesn’t have enough volume to rise on its own, and that’s a concern for the falling wedge.

The last two weeks have been indecisive for DOGE. It seems it doesn’t have enough volume to rise on its own, and that’s a concern for the falling wedge.

Although the breakout is valid visually, we needed an increase in volume as well, but we haven’t seen that yet. The best thing to do here is link its price action to that of BTC. Watch the $28,750 level carefully, in case a break occurs..

A break above $28,750 for BTC would push DOGE to $0.08250 (first yellow line).

MATIC | Polygon (Weekly)

MATIC isn’t doing great right now either. The last few weeks have been indecisive, something we can see in the candles - long wicks and short bodies. This suggests that MATIC will require Bitcoin to perform well for it to reach $1.30 and above.

MATIC isn’t doing great right now either. The last few weeks have been indecisive, something we can see in the candles - long wicks and short bodies. This suggests that MATIC will require Bitcoin to perform well for it to reach $1.30 and above.

However, that’s just a short-term obstacle because MATIC is trading in a weekly bullish market structure. So, we’re going to see higher prices in Q2, such as $1.75 and $2.20.

SOL | Solana (Weekly)

SOL has been ranging for most of Q1, and that doesn’t seem to be stopping just yet. Our main priority throughout the quarter was to hold $19 as support, which it did. This kept the road open for $30.

SOL has been ranging for most of Q1, and that doesn’t seem to be stopping just yet. Our main priority throughout the quarter was to hold $19 as support, which it did. This kept the road open for $30.

However, SOL lacks volume. We’ll need Bitcoin to perform really well for it to reach $30 during Q2.

In the coming weeks, expect SOL to keep ranging above $19. We believe there are better opportunities out there. Nothing to be seen here.

DOT | Polkadot (Weekly)

DOT has been holding $6 as support and it may even close this month’s candle above it.

DOT has been holding $6 as support and it may even close this month’s candle above it.

From a technical standpoint, holding $6 as support would keep $7 on the cards, and potentially go even higher. However, keep in mind that Bitcoin is at resistance, and a rejection could result in DOT losing $6 as support and heading to $5.50 and below.

It might not be the best idea to buy now, given that the risk outweighs the reward.

LTC | Litecoin (Weekly)

LTC has been trading in a bullish market structure for some time, so the only thing to expect during Q2 is upside, specifically to $113.

LTC has been trading in a bullish market structure for some time, so the only thing to expect during Q2 is upside, specifically to $113.

Another bullish signal is that despite dropping ~30% in March, most of the selling pressure has been invalidated, bringing LTC to -4% at the time of writing.

This suggests strong demand. So, when Bitcoin breaks resistance ($28,750), we can expect LTC to perform well and reach the $113 - $145 resistance area.

Cryptonary's take

The market is locked and loaded for Q2. Strap in, upside is on the way. Expect a pullback in the next few weeks. This would be great for the market to keep things healthy, and not oversaturated or exhausted.

After that, expect yearly highs across the market!

Action points:

- When trading altcoins, tracking Bitcoin’s price action should be your #1 priority. Where it goes, the rest will follow.

- Bitcoin is at resistance. Securing profits is your best play, even if the market explodes to the upside. We don’t gamble - we trade.

- The market might go down in the short-term, but that should not change your conviction for the long-term. Leave your investments aside, those will be profitable later.