Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

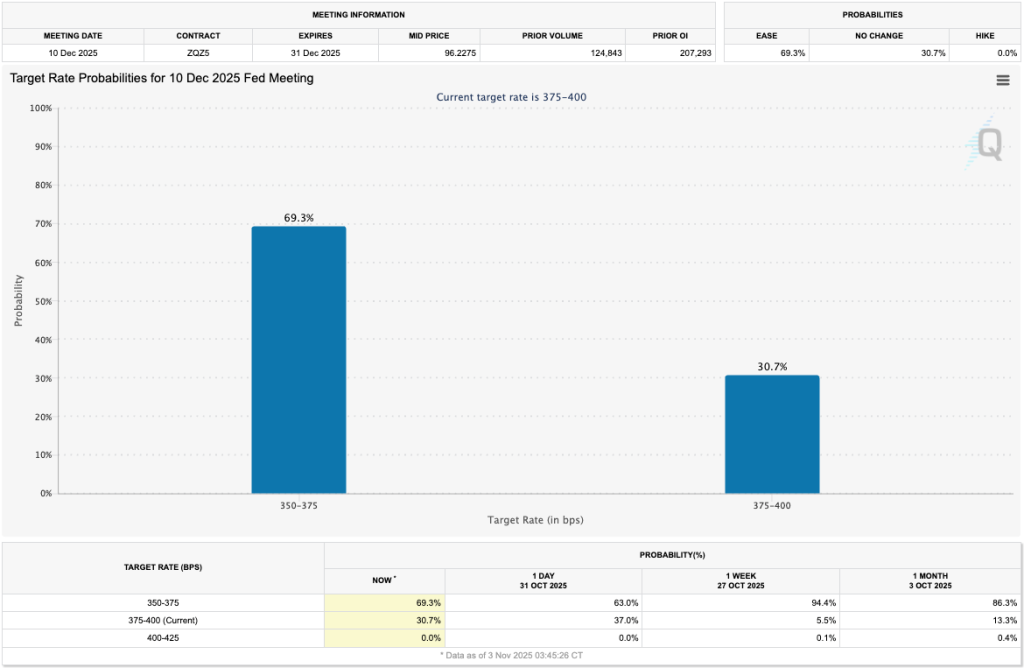

- Fed: Heavy week of Fed speakers; 69% odds of December rate cut. Data delays from government shutdown add uncertainty

- Markets: Dollar Index breaking higher (toward 101); Mag7 skew inversion hints at short-term equity pullback

- Bitcoin: BTC lagging; long-term holders still selling, ETF flows negative, institutional demand weak

- Outlook: Near-term downside to $98K–$104K likely; upside limited until flows and data improve

- Cryptonary’s Take: Short-term caution, but macro remains supportive into 2026.

Topics covered:

- This Week's Fed Speak.

- TradFi Indexes & Data.

- BTC and Flows.

- Cryptonary's Take.

This Week's Fed Speak:

The focus this week is on Fed speak. We have a plethora of Fed speakers everyday except Wednesday. We'll be closely watching the tone out of Fed speakers as to whether there is a dovish lean towards a December rate cut, or if there isn't, what do they suggest a rate cut might be dependent on?Our expectation is that many Fed members will say that it's dependent on if they get economic data before the next Meeting (on December 10th) and if that data then shows a continuation of the trends i.e., a weakening labour market and inflation. The market is currently pricing a December rate cut at 69.3%, up from 63.0% just a few days ago. We expect that should we not get the economic data, the Fed would lean towards pausing in December.

Target Rate Probabilities for December 10th Fed Meeting

This Friday (November 8th) we should have been receiving the Payrolls numbers (labour market data). However, with the continued government shutdown, the markets and the Fed continue to be blind until the US government reopens. Prediction markets have the government reopening sometime between mid-November and late-November. So for now, markets will continue to trade with the expectation that there won't be any economic data for at least a few weeks.TradFi Indexes & Data:

Whilst TradFi Indexes have soared to new highs in recent weeks, some warning signs have emerged. We have the Dollar Index breaking out of the 99.00-99.50 resistance zone, on reduced rate cut odds. This may result in a move up to 101.00-101.70 in the short-term (next 1-2 weeks).

DXY - Dollar Index - 1D Timeframe

Alongside this, investment bank Goldman Sachs noted last week that the Put-Call skew in the Mag7 complex inverted for the first time since last December. This is traders betting heavily on Mag7 outperformance to the upside, and it has historically resulted in negative returns over the following 30-day period.

SPX vs Mag7 1m Normalised Put-Call Skew:

Should we continue to see a rising Dollar Index (DXY), and a pullback in the Mag7 names over the coming 30 days (which have potentially reached peak optimism last week), this might prove to be a headwind for BTC (which is positively correlated to Mag7) over the coming weeks.

BTC and Flows:

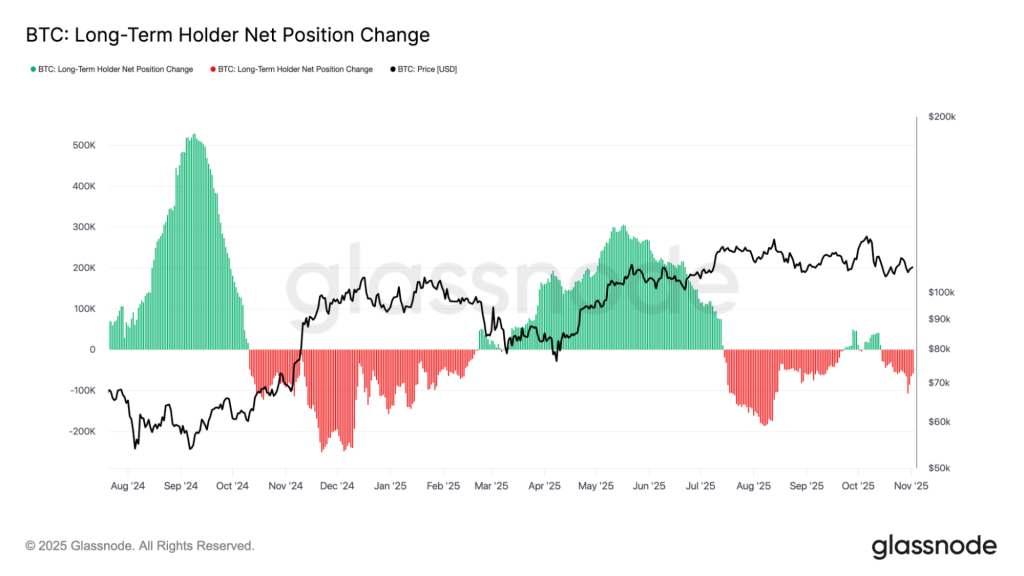

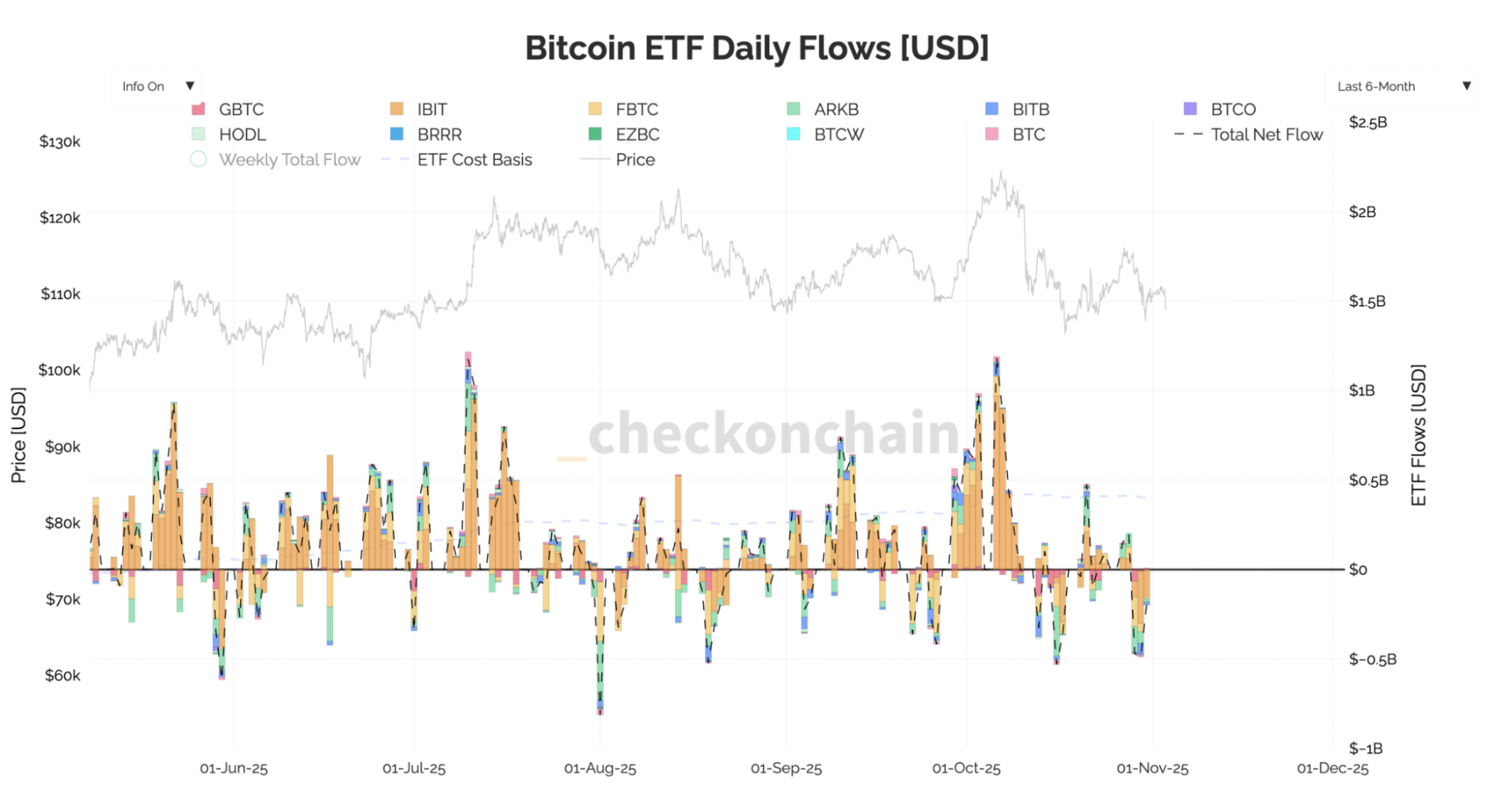

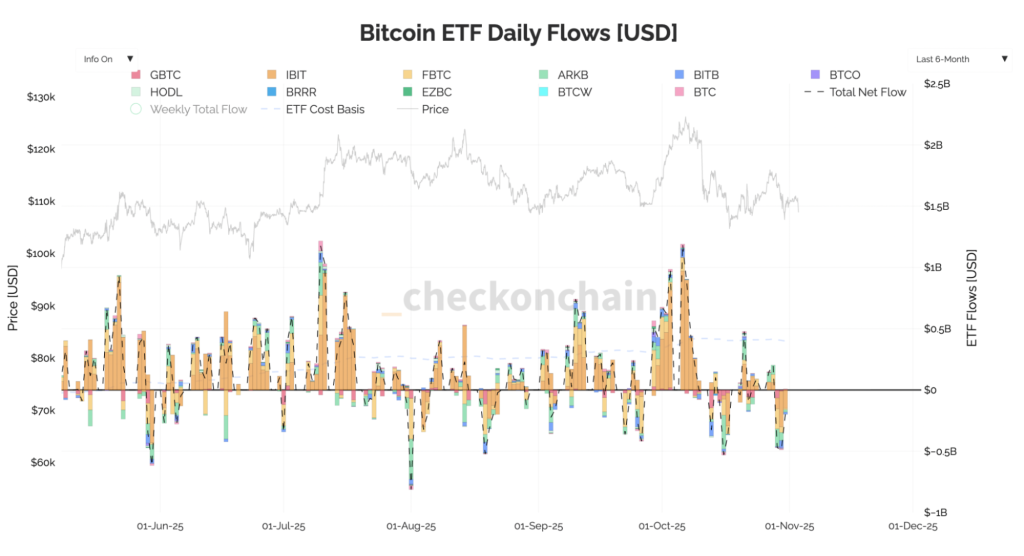

In recent weeks, BTC has underperformed TradFi indexes, despite supportive macro conditions. In this period, we've closely monitored flows from the Long-Term Holders and the ETF's. Both have been negative, and this has led us to be more cautious on the market in the short-term.

The Long-Term Holders are still reducing their size (the amount of BTC that they hold), however the pace of this reduction has slowed. Should this continue, sell pressure would ease and price would begin to stabilise.

Long-Term Holders Net Supply Change:

But, we'd like to start seeing the ETF flows turn positive again. In the last week, they were very negative, and so far, there aren't any signs of this turning around.

BTC ETF Flows (in USD):

The above can be summarised perfectly in one chart. For the first time since April, net institutional buying has dropped below the daily mind supply. The last time this happened was late February 2025. What followed was a move down in price for BTC from $96k to $76k.

Net Institutional Buying Against Daily Mined Supply

Over the coming weeks, we'll be paying close attention to the above metrics for a signal of an improvement in the flows. Until then, BTC will likely struggle to see sustained upside.Alongside the above, and away from flows, we can see that Bitcoin Dominance has broken out of a key resistance (60.00%), with a retest of 61.40% now looking likely.

BTC.D (Bitcoin Dominance) 1D Timeframe

Cryptonary's Take:

Whilst odds of a December interest rate cut still remain likely (69.4%), the market is repricing for less future cuts, and this is shown in an increasing Dollar Index which has broken out to new local highs. Last week, we also saw high optimism in the Mag7 names with the Put-Call skew reaching levels not seen in nearly a year. This has historically resulted in a pullback for prices. The mentioned setup is a headwind for risk assets and BTC and Crypto is unlikely to be immune to that.If we pair this with Long-Term BTC Holders offloading their supply and institutional buyers not stepping in to buy it, that result is lower prices. And whilst this environment persists, we're highly unlikely to see sustained upside for BTC.

In the coming weeks, our expectation is that BTC has further downside to go. Our target area remains $98k-$104k, with the highest probability window being the next 7-14 days. This timeframe aligns with:

- DXY reaching 101-101.70 (1-2 week target).

- Mag7 put-call skew historically producing negative returns over 30 days.

- Continued government shutdown delaying economic data.

Zoomed out, we maintain our conviction that BTC finishes the year between $125k-$135k. The macro backdrop remains supportive:

- December rate cut still 69% probability

- QT ending December 1st (announced Oct 29th)

- Big Beautiful Bill stimulus expected January 2026

- Fed likely expanding balance sheet in 2026 (liquidity positive)

Patience here should be rewarded in Q4 2025 and Q1 2026.

BTC 1D Timeframe:

An invalidation of the above thesis would be if BTC reclaimed the $116k level, and/or if we began to see a strong period of more substantial ETF inflows.

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms