Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Markets upbeat ahead of key events: Fed decision, Trump-Xi meeting, and Mag 7 earnings following softer inflation data.

- US-China trade talks advancing; a tariff rollback deal seems near, with markets already pricing in optimism.

- Fed likely to cut 25bps and guide another in December; hints at ending QT by year-end could further lift risk assets.

- Earnings strong: 87% beat EPS, 8.5% YoY growth; Mag 7 results and AI capex guidance could fuel year-end rally.

- Gold cooling, BTC rising (8%) -> signs of rotation; watching for BTC ETF inflows and possible breakout above $117k.

- Cryptonary bullish: expects smooth week and continued grind higher into year-end, BTC targeting $130k+.

Topics covered:

- US-China Trade Talks.

- Wednesday's Fed Meeting.

- Corporate/Mag 7 Earnings.

- Gold and ETF Flows.

- Cryptonary's Take.

US-China Trade Talks:

On Sunday, 26th, news broke that the US and China were ready to make a trade deal that would result in the removal of the additional 100% tariff that Trump imposed on China. China's trade representatives called it a "preliminary consensus" on some key issues, including fentanyl and ship fees. Whilst Treasury Secretary Scott Bessent (the trade negotiator for the US) said that they reached a "substantial framework" (for a deal).Markets reacted positively to this, with risk assets moving higher. BTC is up 2.8% since, with the Nasdaq, S&P, and the Russell all gapping up into Monday's open.

Whilst a full trade deal hasn't yet been agreed (although it seems somewhat inevitable), constructive talks between both sides sets up for a full deal to be done, with this potentially being announced when President Trump and President Xi meet this coming Thursday. Markets are expecting a positive outcome, so if there were to be a breakdown in talks from here, that would likely result in a more drastic correction for risk assets. If a trade deal is agreed and announced, the market will likely move higher, but we wouldn't expect a substantial move, as a deal is close to already being fully priced.

Wednesday's Fed Meeting:

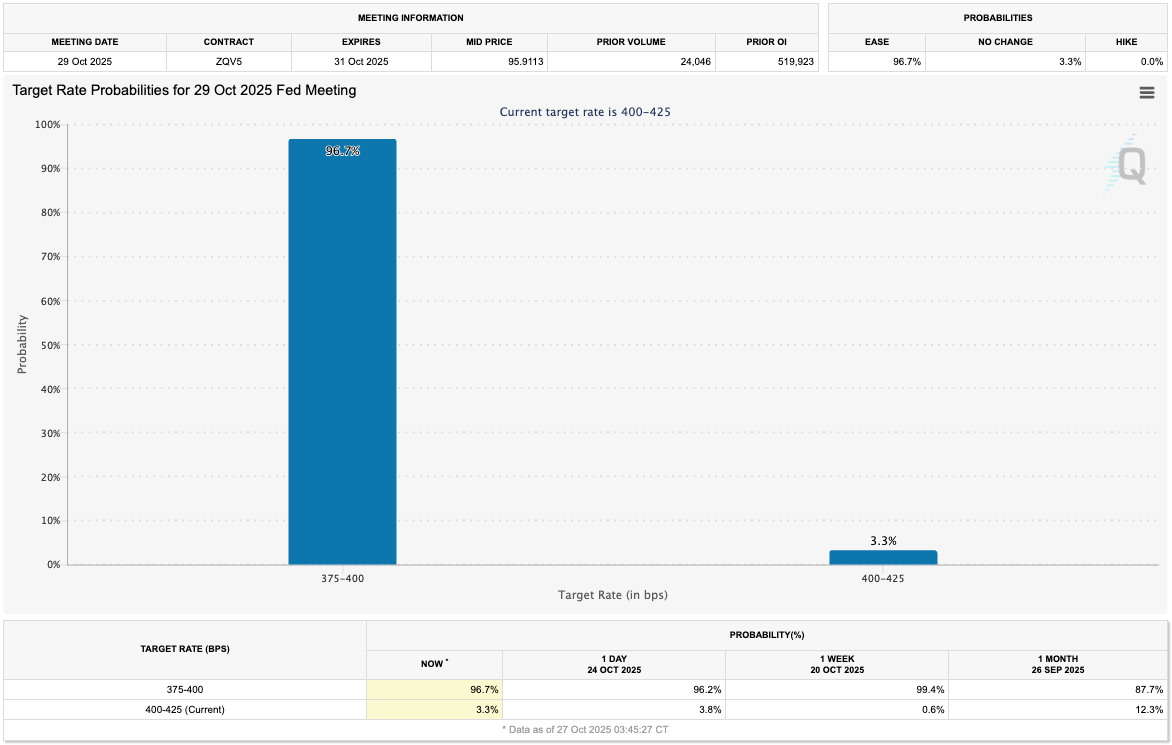

This Wednesday, the Fed meets to decide its next monetary policy decision. It's expected that the Fed will cut interest rates by 25bps, along with forward guidance for another 25bps rate cut at December's Meeting. The market is currently pricing a 96.7% chance for a cut this coming Wednesday, and a 95.5% chance of another cut in December.Target Rate Probabilities for this Wednesday's Meeting:

Markets will be paying close attention to Powell's Press Conference for any clues from Powell for the path for rates in 2026. Should Powell suggest that the Fed is looking to cut rates further in 2026, then this'll provide support for markets for the foreseeable future, and therefore it'll likely result in a move higher for risk assets off the back of this.

Lastly, quantitative tightening (QT - the rolling off of assets from the Fed's balance sheet or in its current form, a shortening of duration). There have been suggestions from Fed members over the last fortnight that QT could come to an end soon. Whilst the end of QT may be announced at this week's Fed Meeting, we expect it to be forward guided to end by year-end, rather than this week, despite some calls on Crypto Twitter for this to be the case. Markets would likely react positively to this.

This Week's Corporate/Mag 7 Earnings:

Another focus for markets this week will be on the corporate Earnings, particularly some of the Mag 7 companies that are reporting: Apple (Thursday), Microsoft (Wednesday), Google (Wednesday), Amazon (Thursday) and Meta (Wednesday).The corporations that have reported so far have reported positively, with Earnings growth at 8.5% YoY (the best in 4 years) and 87% beating EPS (Earnings Per Share) estimates. Should we see similarly this week, markets will most likely move higher as a result.

Of course, markets will be looking for Earnings to beat the estimates, but what's arguably more important for the Mag 7 names reporting this week (Apple, Microsoft, Google, Amazon and Meta) is that there is guidance for increased capital expenditure going forward with regards to the AI race. Should we see guidance for increased capital expenditure for AI, then this is what can really carry the market higher going into year-end.

Gold and ETF Flows:

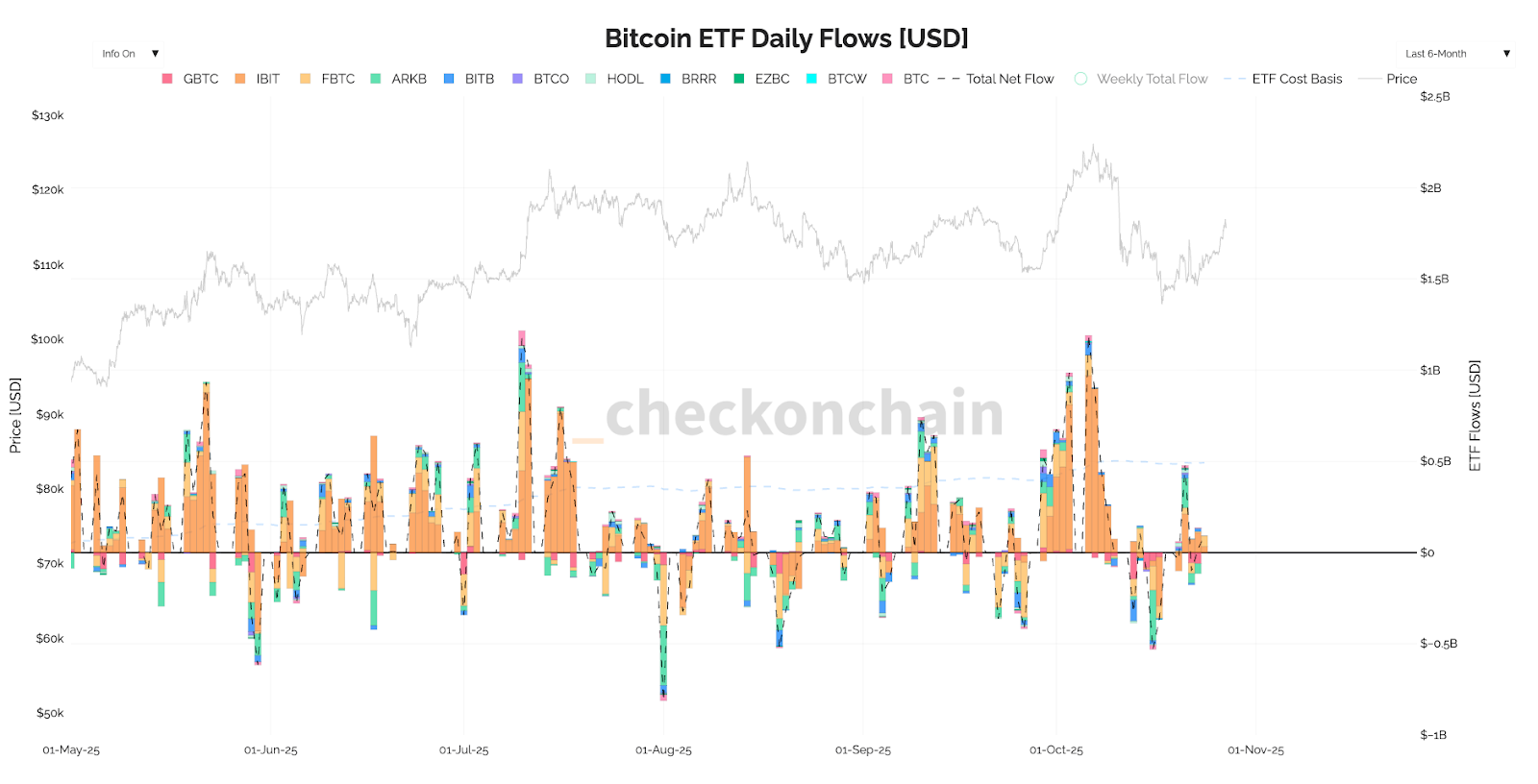

As we've reported in recent weeks, especially since the 10/10/2025 leverage flush out that we saw in Crypto, we've been looking for the flows to return to Crypto that can help fuel a new leg higher for the space. For that, we've been focused on Gold and the BTC ETFs. Our theory has been that once Gold pulls back from its highs/consolidates, that can be the catalyst for a rotation back into BTC.Last week, we saw Gold put in what was a local price top, paired alongside the top signals of all top signals - retail individuals queuing outside shops to buy physical Gold. Since then, Gold has pulled back 7.85% from its local high, whilst BTC is up 8.40% in the same timeframe. This is what we were looking for: a rotation.

In the chart below, we can see BTC (orange line) overlaid on the Gold chart. BTC pulled back as Gold shot higher. Since Gold has pulled back over the last week, BTC has bottomed and moved higher.

Gold Overlaid with BTC 1D Chart:

However, we still have lacklustre BTC ETF inflows, with ETF flows remaining nondirectional.

BTC ETF Flows:

This week, we'd like to see this change. As Gold consolidates, we'd expect to see more substantial net inflows into the BTC ETF. We'll be monitoring this closely this week, particularly as BTC sits just below a key price resistance at $117k.

BTC 1D Chart:

Cryptonary's Take:

Markets are buoyant going into a busy week where we have a Fed Meeting, corporate Earnings, and a Trump-Xi meeting that could result in a new and improved trade deal.We expect that this week will go smoothly despite the plethora of things that could cause a hiccup in markets. We expect a 25bps cut from the Fed with a likely guide for another 25bps cut at the December Meeting, alongside an announcement ending QT, although this could come by year-end, rather than this week. Trump-Xi provides plenty of room for hiccups to happen; however, we expect a deal to be reached (or announced as being close) due to both parties needing to make a deal, as both need each other.

Assuming we're right, we'd expect the market to continue grinding higher by EOW, and this would fantastically set up a rally into year-end, backed by the Fed cutting rates, a US-China trade deal, and positive corporate Earnings alongside corporate buybacks beginning again next week.

Over the coming days, it's possible we see prices chop around, even with the possibility of a pullback for BTC to the CME gap between $112,300-$113,480. We'd be light buyers in this range as it's our base case that BTC is north of $130k by year-end.

We remain bullish and positioned accordingly.