This Week's Setup: Fed Hawkish Cut Ahead?

The market is preparing for a big announcement from the Fed. It sounds complicated, but the idea is simple: their decision could push prices up or send them lower. Here’s a clear, beginner-friendly breakdown of what might happen...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Fed expected to cut rates, but guidance likely hawkish; divergence in the Dot Plot could show fewer cuts in 2026.

- Multiple dissents are possible, which may slow future cuts and pressure risk assets.

- Liquidity strains are visible (repo rate spikes); Bill purchases could help, but may be insufficient unless large in size.

- Base case: negative market reaction and hawkish cut expected; no cut would trigger sharper downside (especially Russell 2000 & crypto).

- Crypto risk elevated with BTC/ETH bear flag structures; hawkish outcome likely means retest of recent lows (BTC near $80k).

Topics covered:

- This Week's Data.

- Wednesday's Fed Meeting.

- Charts.

- Cryptonary's Take.

This Week's Data:

This week, the market will be focused on Wednesday's main event - the Fed Meeting -we'll come onto this in the section below. However, we will also receive some economic data, Job Openings on Tuesday.The last JOLT's Job Openings data we have is August's data, due to the US government shutdown. So on Tuesday, we'll get September's JOLT and October's JOLT's data. The expectations are for September's data to tick down to 7.2m, and for October's data to show a decrease again, down to 7.0m. Should we get the data as forecasted, that would show the number of Open Jobs in the US is declining, but granted, at a steady rate. This would, however, support the view that we're seeing a continued weakening in the labour market. This should result in more interest rate cuts in 2026, particularly if we're to see the labour market deteriorate more substantially.

Wednesday's Fed Meeting:

This Wednesday, we have a Fed Meeting. Let's dissect it.The key points to watch are:

- Does the Fed cut rates?

- Are there dissents?

- What does the updated Dot Plot look like?

- Do they announce a plan to adjust their balance sheet?

- Does the Fed cut rates?

Target Rate Probabilities for 10th December 2025 Fed Meeting:

With the market widely expecting a cut at this Wednesday's Meeting, the focus will be on the Dot Plot (how many cuts are expected in 2026), forward guidance from Powell going into Q1 and Q2 of 2026, despite the fact he'll be replaced mid-May 2026 and therefore his voice is likely to be less important in 2026, and if the Fed plans to expand its balance sheet in the future.

Are there dissents?

But firstly, at Wednesday's Meeting, we might see some dissents from more hawkish voting members should a rate cut happen. It's possible that these dissents (i.e., a vote not to cut rates) come from Schmid, Logan and Hammack. Having this many dissents (potentially) can slow the pace of future rate cuts as the Fed as a whole moves forward in a slower and more gradual way. This opens the door for a more extended pause (a series of Meetings where the Fed doesn't cut rates) after the December Meeting. This would be the most hawkish outcome, and we'd expect risk assets to react negatively to this. However, we'd want to see this potential hawkish tone reiterated from Powell himself at the Press Conference as well.We're currently seeing a hawkish cut in the market pricing, with a January rate cut only priced at 21.8% likelihood.

What does the updated Dot Plot look like?

Firstly, it is widely expected that the updated Dot Plot will show significant divergence among committee members regarding the number of cuts in 2026. The markets will be looking for the majority of Fed members to be looking for/expecting 3 interest rate cuts in 2026. Should the Dot Plot show less, then risk assets would likely react negatively to this, as it would be a hawkish reflection.Guessing what the Dot Plot is going to show is ultimately a guessing game; however, seeing as we've had a shift recently with several Fed members becoming more hawkish in their stance, we risk seeing an updated Dot Plot that shows an increase in the median Dot, i.e., fewer rate cuts for 2026.

Do they announce a plan to adjust their balance sheet?

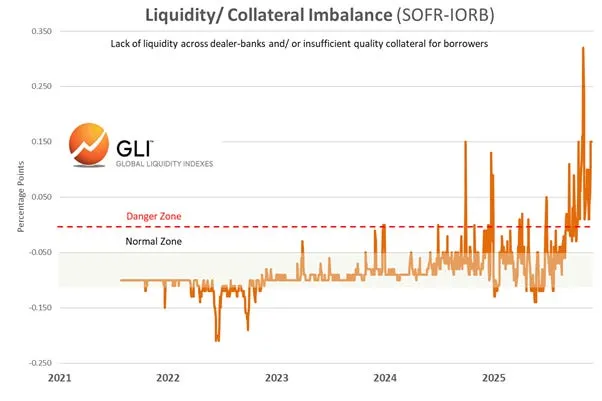

So far, the above would suggest that we're going to get a hawkish cut, which is likely to produce a negative reaction in risk assets. However, a saving grace for risk assets might be if the Fed announces Bill purchases, having just come to the end of their QT (quantitative tightening) programme just a week ago.Bill purchases are needed to give markets more liquidity, as current liquidity levels are insufficient, as we can see reflected in repo tensions - recent spikes in repo rates.

Repo Rates Spike:

A spike in repo rates means that lenders have charged borrowers higher rates, due to their being a lack of liquidity. Banks and financial institutions typically use this facility to lend and borrow from each other.

Should Powell and the Fed announce Bill buying, the market and risk assets would likely celebrate this as an increase in liquidity. However, it's unlikely to be a sufficient enough increase in liquidity to really help push asset prices higher, and rather it's more just to "increase the ampleness of reserves" in the system. It will, however, depend on how much Bill buying per month is done. If it's between the $20b-$30b per month level, this might not be enough. However, if significantly north of that, then this might be enough to really "prop up" markets and, by extension, risk assets.

Fed Meeting Summary:

Ultimately, we're expecting a hawkish cut (the Fed cut rates, but Powell delivers hawkish commentary). But, it's possible that risk assets can go higher, particularly if they announce Bill purchases. Should this happen, you'll see all over Twitter that "the Fed has restarted QE". That won't be correct, Bill buying isn't that. QE is the Fed buying the long-end and taking duration out of the market. However, should the Fed announce a large Bill purchasing programme, then that will improve liquidity. Our big question is whether or not the Bill purchases programme will be enough.Overall, if we had to make a call, we're expecting a hawkish cut and for the market reaction to be a negative one.

One last point, should the Fed not cut rates, we'd of course expect the market to puke lower on this, with the far end of the curve to puke the hardest, i.e., the Russell 2000 and Crypto.

We will be providing live commentary throughout Wednesday’s Meeting on our channels, with an in-depth Market Update following on Thursday.

Charts:

Going into Wednesday's Meeting, we have the Dollar Index at local lows and the stock indexes at their highs, whilst Crypto has staged a rebound. But, narrowing in on Crypto, the chart structure that stands out most to us is the bear flags that are developing on both BTC and ETH. And in the last few months, this has been a typical chart formation that has resulted in breakdowns for price.BTC 1D Chart:

ETH 1D Chart:

Should we see a hawkish cut from Powell and the Fed on Wednesday, then we'd expect a continuation lower for BTC and ETH, particularly as a hawkish cut would also likely result in a rebound in the Dollar Index as well (negative for risk assets).

DXY 1D Chart:

Cryptonary's Take:

This week's focus is undoubtedly on Wednesday's Fed Meeting, with the market currently expecting a rate cut, but for more hawkish forward guidance around that, particularly in the Dot Plot. We therefore expect risk assets to react negatively following the Meeting, should we see the number of future cuts (particularly those for Q1 2026) get priced out.But should Powell be neutral, the market would likely respond positively to this, as we'd say the market is expecting Powell to be hawkish, considering the amount of hawkishness we've seen out of other Fed members recently.

In the last two months, Fed Meetings and the expectations for rate cuts have driven Crypto and its price direction. Should we see a neutral Powell and the Fed embrace more cuts in 2026, then this could mark the beginning of the turnaround for Crypto. However, should we get a hawkish Powell and a hawkish Dot Plot, it's likely that we see Crypto retest its lows, i.e., BTC to retest the $80k level.

For now, this remains our base case.

Peace!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms