This Week's Setup: Powell Subpoena Escalation

This week opens with a clear shift in narrative after a rare and significant escalation around the Federal Reserve over the weekend. The move unsettled traditional markets, briefly lifted hard assets, and reintroduced policy risk just as rate-cut expectations were already being pushed out. With inflation data ahead and Bitcoin still range-bound, this report breaks down what actually changed, and what matters next...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Stronger US labour data pushed out near-term Fed rate cut expectations, capping BTC upside in the short term.

- This week’s CPI is key: a 2.7% print should reinforce disinflation and be broadly market-positive; a hot surprise is not the base case.

- Powell subpoena escalation has triggered risk-off moves in TradFi, while hard assets (Gold, Silver, BTC) initially caught a bid.

- BTC remains range-bound, but on-chain flows are improving as long-term holder selling slows, suggesting downside pressure may be easing.

- Base case: BTC retests $94k-$95k (relief rally), with $98k as max upside; downside risk opens below $89k toward $84k.

Topics covered:

- This Week's Data.

- Powell Subpoenaed and Market Reaction.

- BTC Flows Update.

- Cryptonary's Take.

This Week's Data:

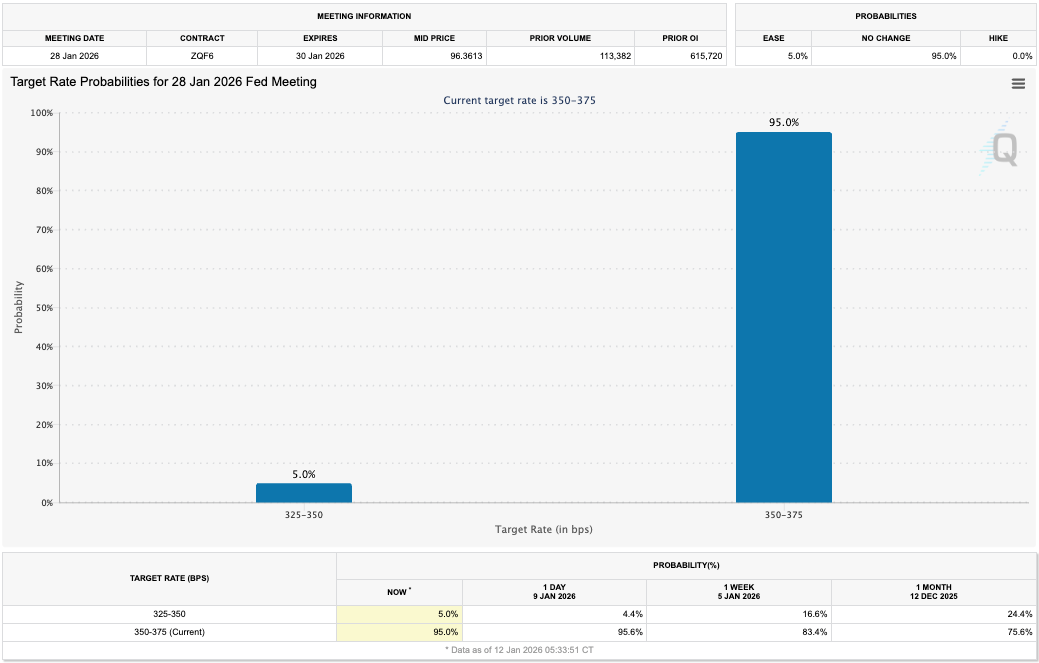

Firstly, we'll start with last week's labour market data and the impact that it had on potential future rate cuts.Payrolls came in at 50k jobs added, with the Unemployment Rate ticking down to 4.4%. This stronger-than-expected data saw the odds of future cuts priced out, particularly for the late-January and mid-March Meetings. Post data print, the odds of a January rate cut moved down to 5.0%, having been at 16.6%, whilst the odds of a rate cut for the mid-March Meeting were at 44.2%, and are now down to 27.8%.

Target Rate Probabilities for 28th January 2026 Fed Meeting:

In short, this means that there is less likelihood of Fed interest rate cuts in the upcoming Meetings. However, we do expect this to change, and to change significantly once Powell is replaced, although the market will likely price in more rate cuts before they're delivered by a new Fed Chair.

Therefore, with future rate cuts now pushed out further, this will likely cap upside for BTC in the near-term; maybe that cap being at the $100k-$105k area. But once the market prices in more cuts off the back of a likely uber-dovish new Fed Chair, it's possible that BTC breaks out of the $100k-$105k resistance and heads higher.

The Inflation Data:

This week's key economic data is the inflation data that comes out tomorrow (Tuesday). The forecasts are for CPI to tick up slightly, with both Core YoY and Headline YoY to come in at 2.7%. Last month, forecasts were for 3.0%, with the figures coming in much lower at 2.6% for Core and 2.7% for Headline. So, should we see prints of 2.7% for both, that would 'lock in' the view that we're seeing inflation come down materially, and therefore, we would expect markets to react positively to this print.In terms of seeing a negative market reaction, we'd likely have to see a far hotter print, i.e., Core and Headline numbers north of 2.9%. However, this isn't our base case, and not something we're expecting. Our expectation is for an unchanged print and for markets to take this event in their stride.

Powell Subpoenaed and Market Reaction:

Over the weekend, we learnt that the US central bank had been subpoenaed by the Justice Department on Friday, threatening a criminal indictment against Chair Powell over the Fed's renovation of its Washington Headquarters, citing "incompetence". This comes after the Trump administration asked Attorney General Pam Bondi to direct US attorneys to look into potential taxpayer abuses of spending, i.e., where has the government overspent? And they've chosen Chair Powell and his potential 'over spend on renovating the Fed's Washington Headquarters'.Threatening a criminal indictment on Chair Powell is a huge escalation in tensions between Powell and Trump and his want for lower rates. Chair Powell responded with a defiant video message where he said, "the threat of criminal charges is a consequence of the Fed setting interest rates based on our best assessment of what will serve the public, rather than the President' and 'public service sometimes requires standing firm in the face of threats. This is a punchy response from Powell.

It's likely the case that this is a pressurised move on Powell, not just to get him to lower rates, but for him to step down from the Fed once his term as Chairman is over. Historically, Fed Chairs have stepped down from the board when their term as Chair finishes, but Powell can stay on as a normal voting member. But, Trump likely wants the seat vacant to put in his own dovish candidate, giving him another Federal Reserve seat, alongside nominating a new Chair. Perhaps this is why we've seen a delayed announcement with regards to naming a new Fed Chair i.e., because Powell hasn't played ball behind the scenes about stepping down when his term as Chair is over.

Senator Tillis (a Republican) now says he will oppose the confirmation of any nominee for the Fed - including the Fed Chair vacancy - until this legal matter is resolved. This opposition freezes a Chair nomination (a Republican defecting has the Senate deadlocked in a vote), and therefore it puts the pressure back on Trump to alleviate the pressure on Powell and the Fed, should he want to get a Fed Chair nominated and passed and make Powell serve out the rest of his term as a lame duck.

Market's Reaction?

The market reaction to this in TradFi has been clear: risk-off. Bond Yields are up slightly, the Nasdaq is down 0.84% in pre-market trading, and Gold and Silver are both up 1.77% and 5.02% (both all-time highs), respectively.Nasdaq 1D Chart; down 0.84% at the time of writing.

Whilst Gold and Silver are both printing new all-time highs today. Although technically speaking, both are printing bearish divergences despite the macro fundamentals remaining constructive.

Gold 1D Chart; breaking upwards upon escalating pressure upon the Fed and their independence.

Silver 1D Chart; also breaking out to new all-time highs.

Interestingly, upon the release of Powell's video message, BTC was bid up to $92k along with other hard assets like Gold and Silver. However, it has since been sold at with price returning to $90,700 - roughly the same level price was before Powell's video message.

BTC 1D Chart:

BTC Flows Update:

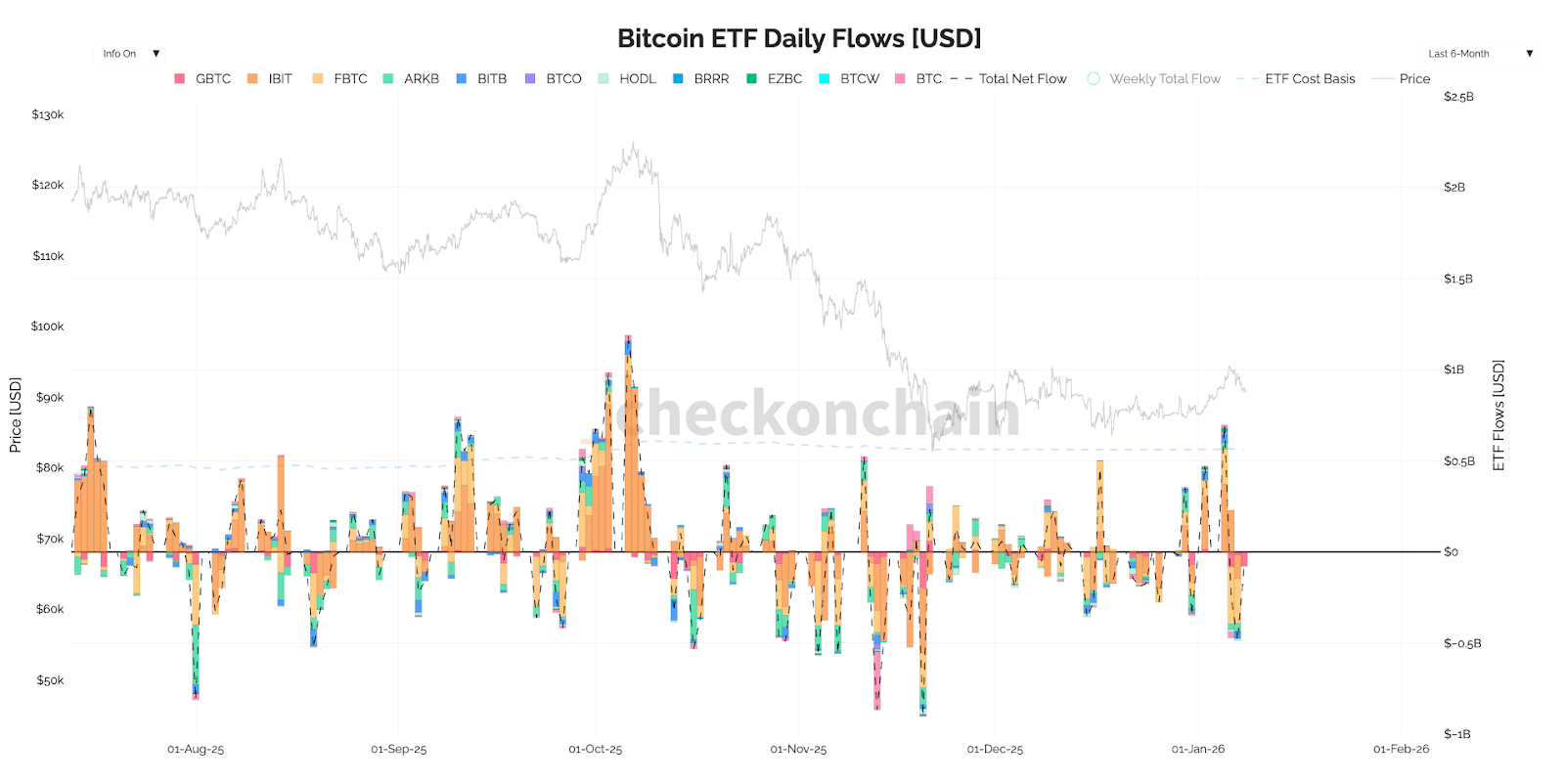

In recent weeks, we've been closely tracking BTC's flows for an indication of a potential breakout direction for price. With BTC range-bound between $84k and $94k on a wider lens, and range-bound between $89k-$94k on a more zoomed-in view, these flows may be the key to identifying which way the tide is turning, and therefore which direction BTC is next likely to breakout to.We've seen that the ETF flows have been relatively neutral recently, and despite a volatile last week, that has essentially remained the same. So zoomed out, we've gone from significant ETF outflows in November to neutral flows in December and January.

ETF Flows by USD:

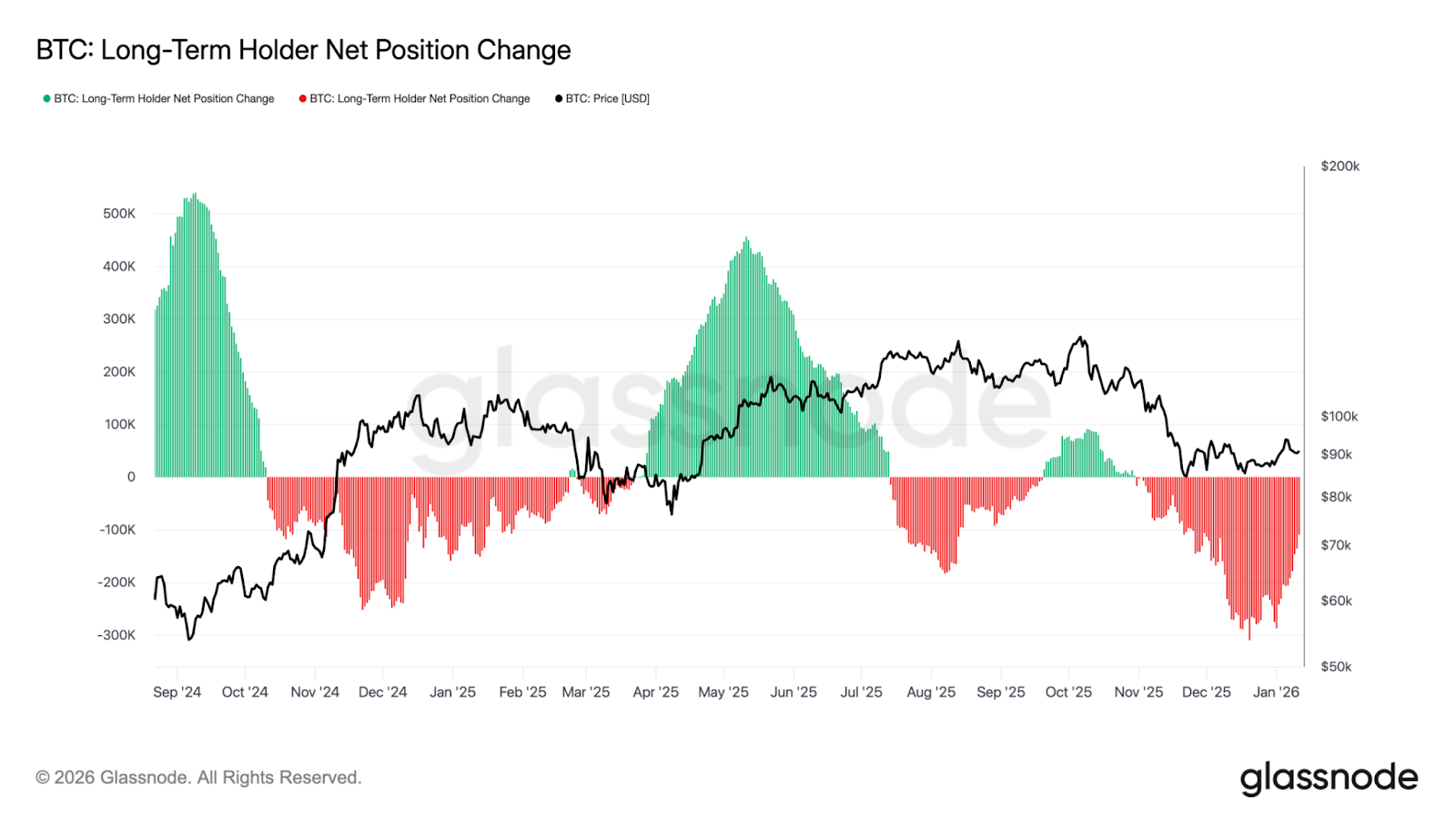

The issue we've had in recent months with the flows dynamic, and hence our bearish/risk-off stance, has been that Long-Term Holders were selling down their coins in significant quantities. It is still the case today that Long-Term Holders are selling down their supply. However, in the chart below, we can see that the level of net selling has significantly decreased over the last week, and this potentially implies that the majority of the Long-Term Holder selling may be behind us. Should this case materialise further, then this can aid prices to go higher in the immediate term, which may mean BTC can retest the $94k-$95k resistance.

Long-Term Holder Net Position Change: we're seeing less and less selling from Long-Term Holders.

This is a dynamic that we'll continue to monitor, but we're perhaps at the start of the tide beginning to turn - constructive for price action.

Cryptonary's Take:

BTC has stabilised in the low $90k's whilst we move into another week where we're navigating a plethora of risks, whether that be Trump escalating pressure on the Fed, or be it economic data (although we expect this week's inflation data to be positive for markets), whilst we have increasingly volatile geopolitical tensions with the riots in Iran that's simmering in the background with President Trump constantly poking.However, markets have navigated macro and geopolitical risk well of late, and we're beginning to see a potential improvement in the flows data for BTC, with Long-Term Holder selling diminishing. This may provide a supportive backdrop for BTC in the immediate term, and therefore, we expect a retest of $94k-$95k. Should that level be tested, we'll reassess again as to whether the rally has room to run further based on all the indicators and metrics we track.

For now, our view is a retest of $94k-$95k, with $98k as maximum upside - so a relief rally. But, with price rejecting at $92k overnight, we'd be less inclined to play a potential Long from $90k to $94k now, and we'd prefer to exercise patience and see how price action develops over the coming days. The trades will likely be Longs at $80k-$84k or Shorts at $98k - we wouldn't particularly choose to play a trade now at $90k, due to last night's $92k rejection. This is despite our bias still being for upside in the short-term to $94k-$95k.

An invalidation of our thesis would be a breakdown below $89k, to where we'd expect a retest of $84k, or a breakout of $98k to the upside.

Cryptonary, OUT!

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms