This Week's Setup: This Isn't 2022 - Here's Why We're Accumulating

Markets just entered the kind of inflection zone that rarely lasts long. Oversold signals are building, macro catalysts are converging, and the next directional move will be shaped by what happens this week. Let’s break down the setup and map where the real opportunities lie...

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

TLDR:

- Key catalysts: Nvidia earnings and September Jobs Report set the tone for short-term volatility.

- Jobs outlook: A 50k print likely means no December rate cut; soft data helps unless it signals recession.

- Macro into 2026: Expect renewed rate cuts, a dovish incoming Fed Chair, and major fiscal stimulus boosting markets.

- Market stance: Some choppiness expected into mid-December, but next 2-5 weeks look like prime buy-zone conditions.

- Crypto: BTC down 26% with oversold signals; $85k-$93k seen as the preferred gradual accumulation zone.

Topics covered:

- This Week's Macro to Watch.

- Macro Outlook.

- When To Get Risk-On & Buy Zones.

- Cryptonary's Take.

This Week's Macro to Watch:

This week, we have two key macro events: Nvidia Earnings, and September's Jobs report.Recently, we have seen some fragility in the AI names, which was somewhat catalysed by OpenAI executives calling for a US government guarantee towards their capital expenditure plans. When one of the larger AI players is looking for a government 'backstop', this can result in traders questioning the health of the AI rally. In the last week, we've seen a pullback in some of these AI names (Amazon, Meta, Microsoft, and Nvidia), and for a recovery to be had, Nvidia will likely need to report positively this Wednesday.

In terms of a positive report, the market won't necessarily be looking for beats on the numbers, but rather positive future guidance for the upcoming quarters i.e., a continuation in the large capex spend from the AI hyperscalers, benefitting Nvidia. The market will also be looking at commentary around China, and Nvidia's expectations for any possible progression into the Chinese market - which looks unlikely for now.

September's Jobs Report:

The expectation is that we'll get September's Jobs report this Thursday, with consensus numbers being at 50k jobs added - remember this is September's data, and we've had a lot of private data out since, that's shown a more material weakening in the labour market. We expect there to be volatility upon the release of these numbers, so prepare positions accordingly going into the event.Should the numbers come in strong (Unemployment rate at or below 4.4%, and Payrolls above 50k) then we'd expect the market to sell down slightly, as this would be a confirmation of no Fed cut at the December Meeting.

Should the numbers come in soft (Unemployment north of 4.4%, and negative Payrolls), then the market could move higher as it might result in the odds of a December Fed rate cut getting priced back in. However, if the numbers are too weak, the market could sell off on recession fears. However, we'd have to see the Unemployment Rate at 4.6% or higher for this to happen.

Our expectation is for just shy of 50k jobs added, and for the market to react negatively to this, as it would likely mean that the Fed holds rates at their December Meeting.

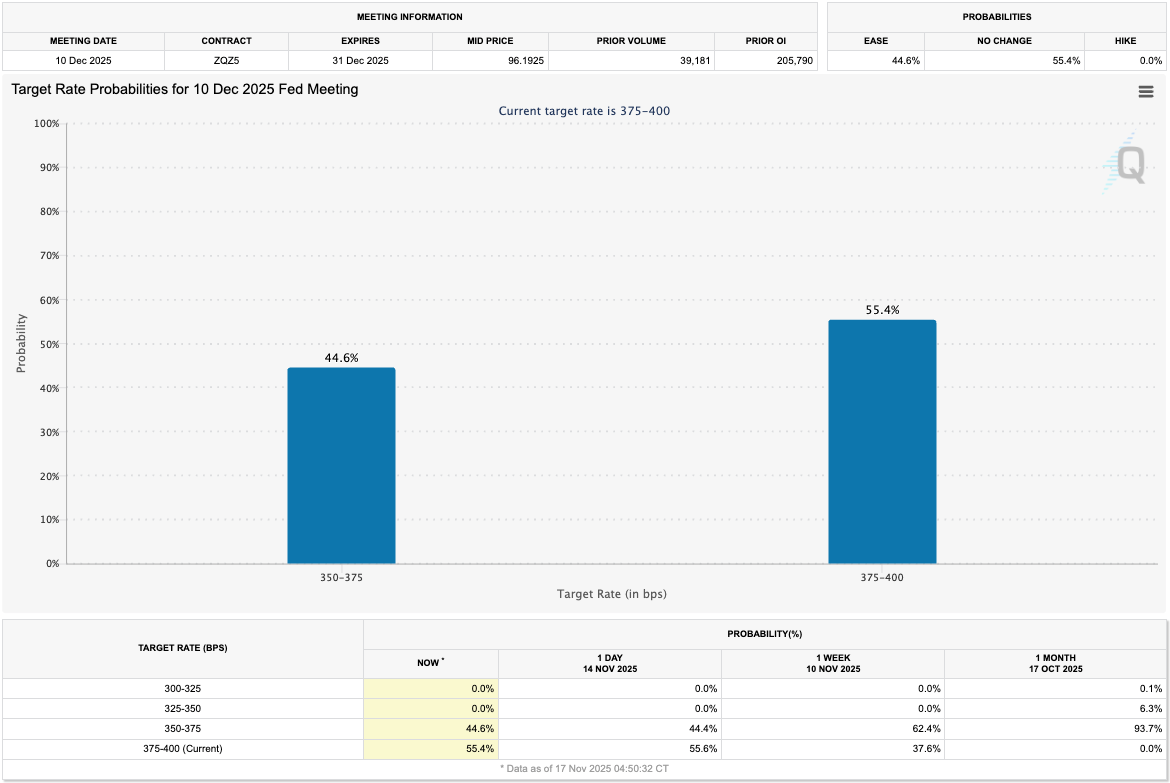

The market is currently priced at a 44.6% chance that the Fed cuts in December.

Target Rate Probabilities for Dec 10th Fed Meeting:

Macro Outlook:

How are we set up from a macro perspective going into Q1 2026?Rate Cuts: We've recently had the odds of a December rate cut dialled back following hawkish Fed speak. However, we expect the labour market to continue weakening, whilst we're also expecting inflation to have locally topped as we're seeing core components like 'Housing' are coming down. This should set the Fed up to continue cutting rates in 2026. But, should we see a 50k jobs added report this Thursday, then we'd expect the Fed to hold rates at their December 10th Meeting. But, in early 2026, we'd expect the Fed to continue cutting rates again due to the fact we expect lower inflation and weaker Payrolls numbers to come for October, and November's data - although we might not have a clear picture on all this (due to the government shutdown and the catchup process that's now happening) until January (once we've had the data releases completely catch up).

New Fed Chair: For now, the market is concerned with the data, or lack of data. But beyond this, we will have a new Fed Chair come May 15th 2026 and it’s likely that this new Fed Chair will be a dove, and align with Fed members like Miran. The administration's objective here will be to insert a dovish Fed Chair that will help to sway the board into bringing interest rates lower.

Big Beautiful Bill: Trump's Big Beautiful Bill is a sweeping tax and spending package that permanently extends the Tax Cuts and Jobs Act, while adding new cuts (e.g., no tax on tips, overtime). The Congressional Budget Office estimates that it adds $3-3.8 trillion to the national debt over the next decade. Implementation is staggered with major tax relief hitting in early 2026.

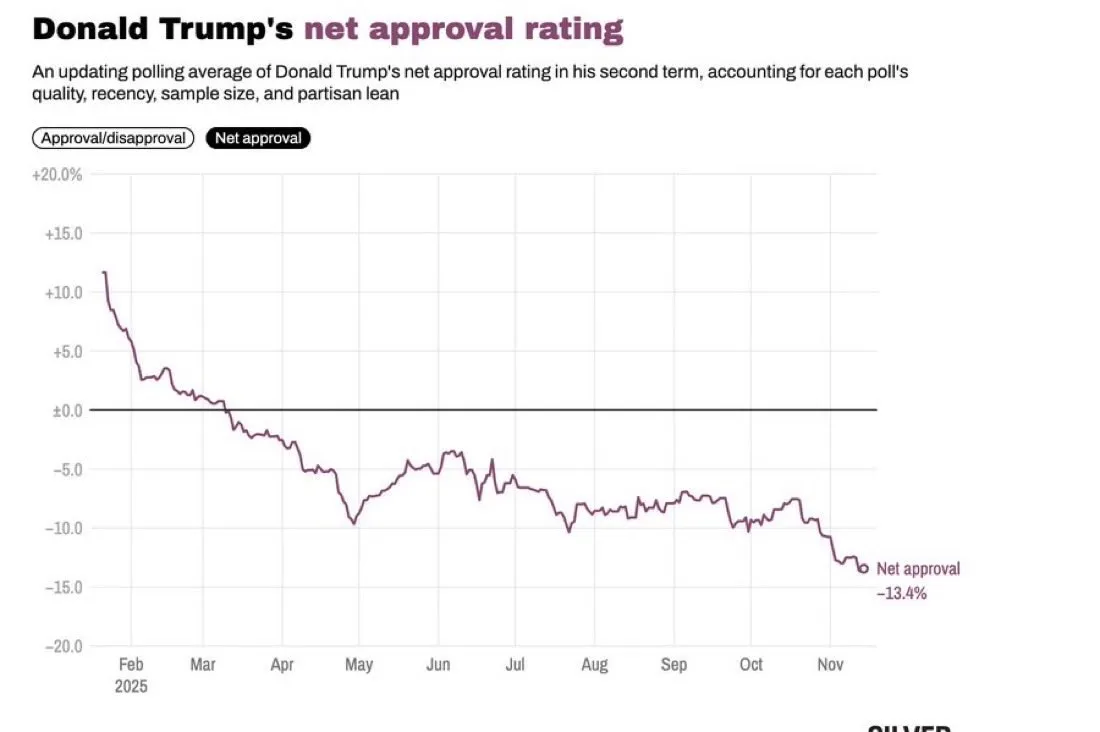

This is a fiscal bazooka that should positively affect markets in 2026, going into the mid-terms in November. Alongside this, we've seen the Trump administration come out and suggest that they're willing to lower some tariffs. This comes as Trump's approval rating drops to a term-low.

Trump's Net Approval Rating:

Ultimately, 2026 is an election year, and the mid-terms are pivotal for the Trump administration. Should the Republicans lose, Trump would become somewhat of a lame duck in power. We expect the Trump administration to do what they can to 'juice' the markets in 2026, in the hope that this will aid Republican chances of winning the mid-terms.

Alongside this, it's highly likely that we'll have accommodative monetary and fiscal policy in 2026 - the key drivers of asset markets in the years since Covid.

We're expecting the bull market to continue well into 2026, but for the upcoming weeks to still be tricky, as we're expecting a Fed to hold rates at the December 10th Fed Meeting, and there to continue to be questions on the health of the AI rally, as the hyperscalers looks to raise debt to fund the capex rather than free cash flow.

However, the upcoming weeks could give us great buying opportunities for 2026, and with what we expect to be the continuation of the bull market.

So, where will we be looking to buy, and how are we playing it?

When To Get Risk-On & Buy Zones:

Firstly, we're playing against price, and the macro timeline. The macro timeline is what we've laid out above - continued headwinds for risk assets with a Fed that is more hawkish in the short-term, whilst there are questions around the AI names, and whether they can continue to drive the market.So, we're expecting these headwinds, and potential choppiness to take more weeks. From this viewpoint, it's possible that we have continued headwinds going into the 10th December Fed Meeting, and maybe in the 1-2 weeks that follow this into year-end.

The likelihood is that the next 2-5 weeks will provide the buying opportunity that we'll look to take advantage of for a continued bull market in 2026.

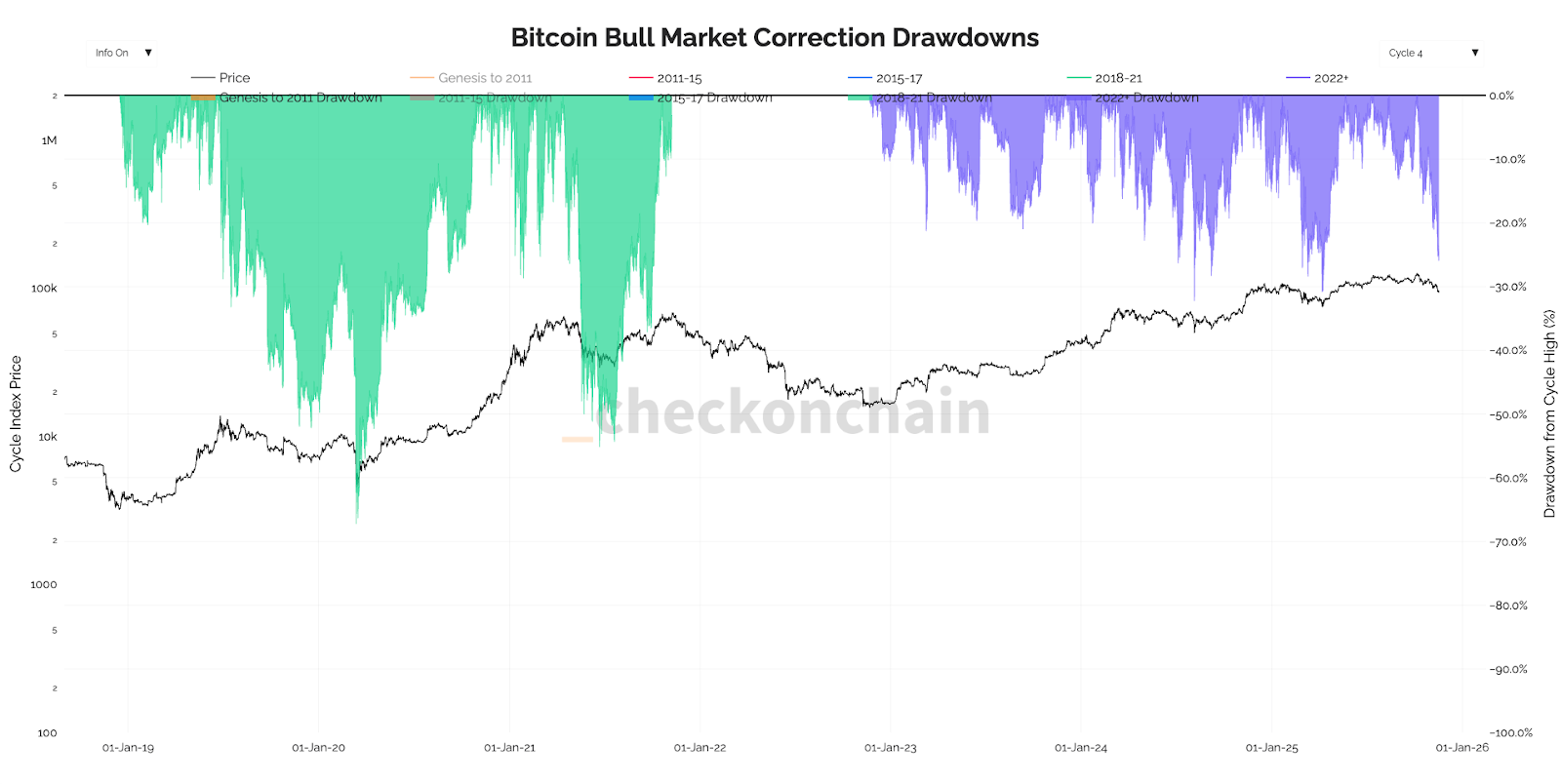

If we look at the charts, we can already see that the Major assets have pulled back considerably from their 2025 highs, with most charts now oversold or close to oversold territory. BTC has pulled back 26.0% from its all-time high. Should it match the deepest pullback percentage we've seen this bull market (low-to-mid 30s), and we maintain we're in a bull market - then this would suggest BTC could pull back to as low as $85k-$88k.

Bitcoin Bull Market Correction Drawdowns:

Whilst it's possible that price can go lower (down to say $85k-$88k), price has already pulled back substantially, with the charts now either in oversold territory or close to oversold territory. Now isn't the time to be bearish, but the time to be targeting price zones to risk-on again.

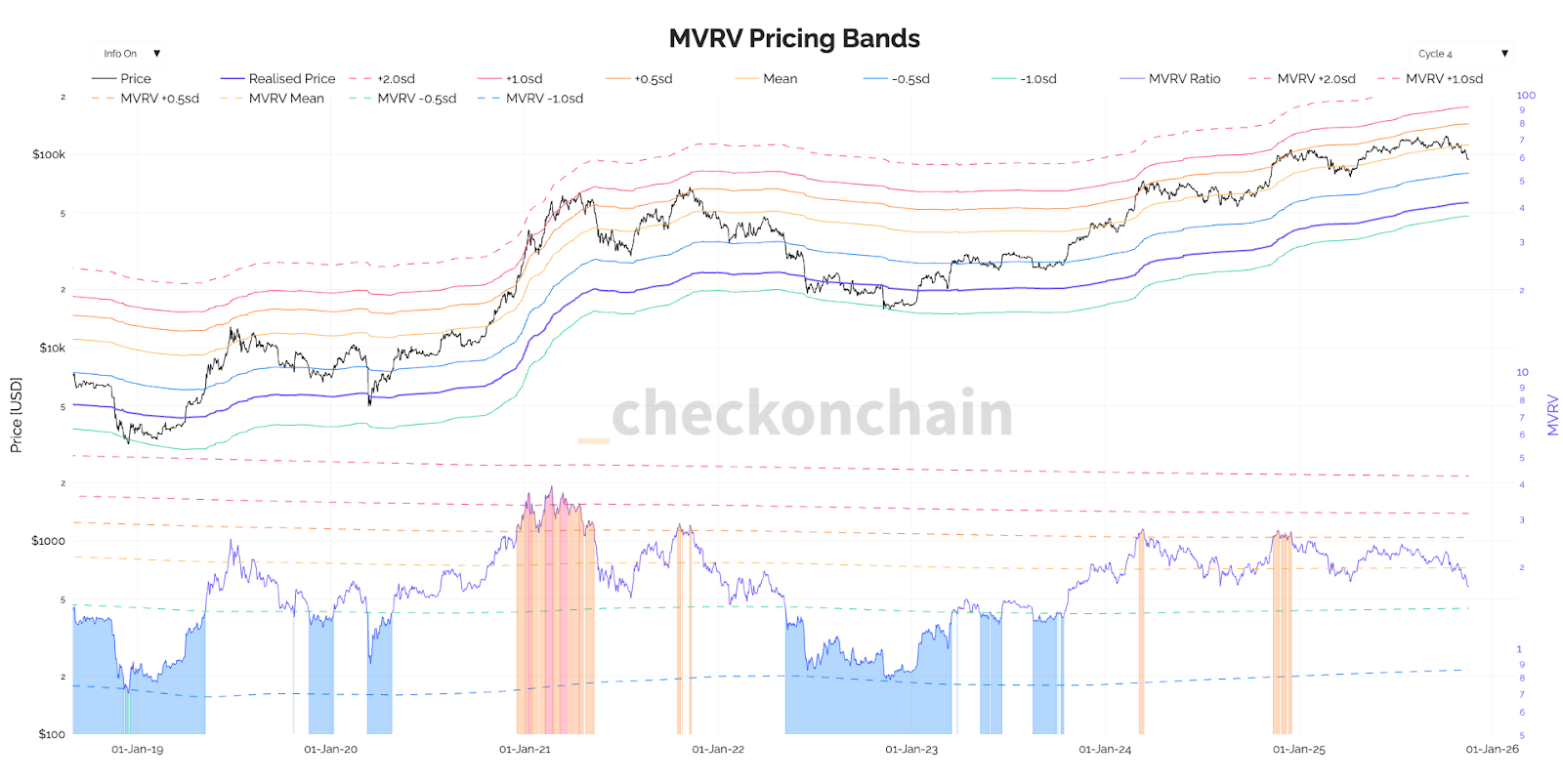

If we look at the MVRV Pricing Bands, we can see that in the 2024 and 2025 bull market, price has always remained above the -0.5 standard deviation line. This line sits at $80,000. While the MVRV -0.5 SD sits at $80k, we don't see this as likely given it would represent the deepest pullback this cycle (as outlined above). Our preferred accumulation zone is $85k-$93k, but if price wicks down to $80k, that would represent extreme value and an aggressive buy opportunity.

MVRV Pricing Bands:

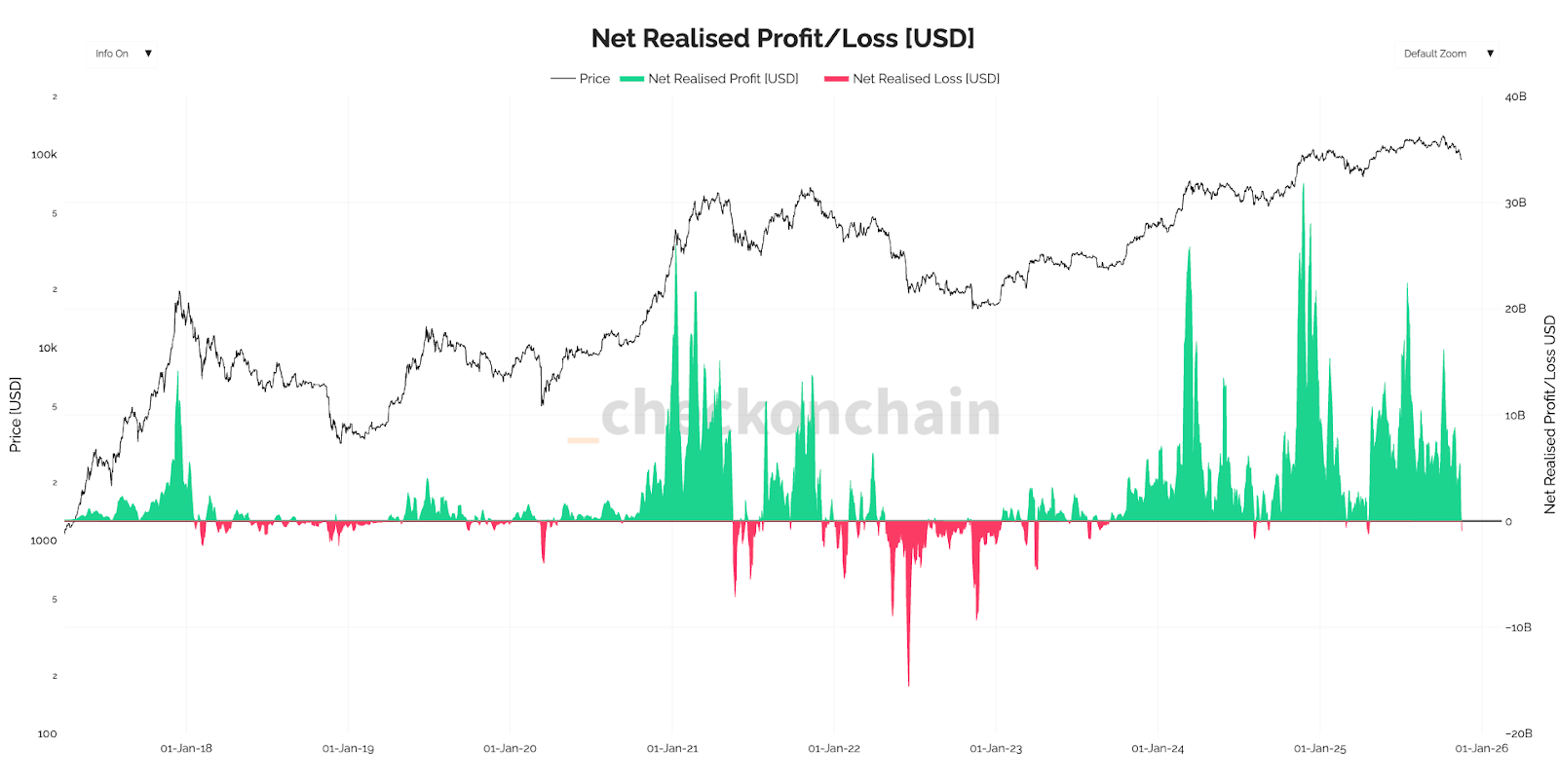

If we then look at the Net Realised Profit and Loss metric, we can see that this price pull back for BTC has now reached the zone that has seen the network move into loss taking. This looks very similar to the August 2024 lows, and the April 2025 tariff lows.

Net Realised Profit/Loss:

Looking at the Majors, BTC, ETH and SOL, are all putting in bullish divergences (lower lows in price, higher lows on the oscillators) just above oversold territory.

BTC 1D Timeframe - Bullish Divergence:

ETH 1D Timeframe - Bullish Divergence:

SOL 1D Timeframe - Bullish Divergence:

This week's Nvidia earnings will be an early indicator. A positive report could accelerate any bounce from current levels, while disappointment could push us closer to that $85k level. Either way, our $85k-$93k accumulation zone should capture the opportunity.

Cryptonary's Take:

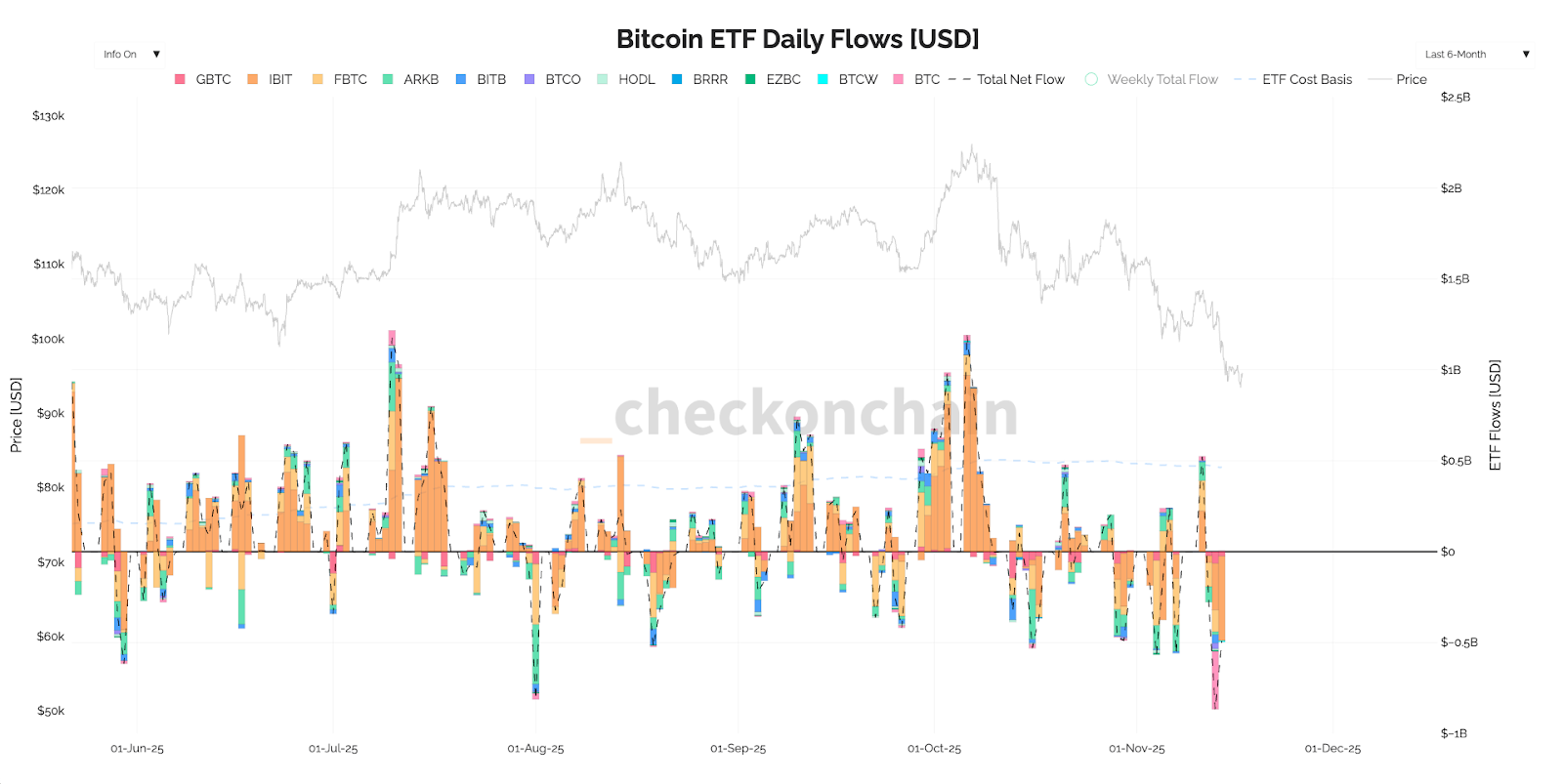

You'll notice other on-chain analysts flagging current levels as a critical short-term inflection point, and they're right about the confluence of oversold signals. However, our macro lens suggests the next 2-5 weeks will resolve toward the bull case given the 2026 setup we've outlined. We're positioning accordingly with patient, layered buys rather than trying to time an exact bottom.Ultimately, this isn't the time to get bearish, and to be looking to de-risk. That should've been done a few weeks ago when the Long-Term Holder selling increased alongside the ETF's becoming large net sellers of BTC - we pointed this out at the time when BTC was sitting at $110k, and this led us to a more cautious stance.

Now, in the short-term there are still macro headwinds on the horizon: a hawkish Fed and a market that will look to Nvidia's Earnings to calm AI stock concerns. And this may stay with us until we have more clarity on the data, which can then lead the Fed to providing more clear forward guidance. But, with BTC down nearly 26% from its highs and with what we expect to be an accommodative macro backdrop in 2026, our focus has shifted from a cautious stance to a 'when can we start looking to get proactive again' stance.

We're not rushing to buy with meaningful size right now, as we still have some headwinds in front of us going into mid-December. But we are now of the view of 'when can we start risking on again'?

Looking at all the above we have laid out, we have: Majors in or very close to oversold territory, whilst they're putting in bullish divergences and on-chain data that would suggest a local bottoming area could be between here ($93k) and $85k. Therefore, we're looking to layer buy orders between $85k and $93k with half the capital (USDT/USDC) we're planning to deploy.

The reason being is that we expect the bull market to continue in 2026, as we expect the macro backdrop to support it, and therefore a 26% drawdown in BTC is an area where we start to become attracted to buying again with a view to selling later into 2026.

What would invalidate our thesis would be if we continue to see LTH's and ETF's continue to sell down in drastic size. However, as prices come lower (say into $85k-$93k) then we'd expect this selling pressure to more significantly ease, if not actually reverse into net buying. For now, the selling is still significant, but BTC is down 26% from all-time highs, and therefore this may be when we start to see the ETF selling slow down.

ETF Flows:

Continue reading by joining Cryptonary Pro

$1,548 $1,197/year

Get everything you need to actively manage your portfolio and stay ahead. Ideal for investors seeking regular guidance and access to tools that help make informed decisions.

For your security, all orders are processed on a secured server.

As a Cryptonary Pro subscriber, you also get:

3X Value Guarantee - If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund. Terms

24/7 access to experts with 50+ years’ experience

All of our top token picks for 2025

On hand technical analysis on any token of your choice

Weekly livestreams & ask us anything with the team

Daily insights on Macro, Mechanics, and On-chain

Curated list of top upcoming airdrops (free money)

3X Value Guarantee

If cumulative documented upside does not reach 300% during your 12-month membership, you can request a full refund.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut through the noise and consistently find winning assets.

Our track record speaks for itself

With over 2.4M tokens and widespread misinformation in crypto, we cut

through the noise and consistently find winning assets.

Frequently Asked Questions

Can I trust Cryptonary's calls?

Yes. We've consistently identified winners across multiple cycles. Bitcoin under $1,000, Ethereum under $70, Solana under $10, WIF from $0.003 to $5, PopCat from $0.004 to $2, SPX blasting past $1.70, and our latest pick has already 200X'd since June 2025. Everything is timestamped and public record.

Do I need to be an experienced trader or investor to benefit?

No. When we founded Cryptonary in 2017 the market was new to everyone. We intentionally created content that was easy to understand and actionable. That foundational principle is the crux of Cryptonary. Taking complex ideas and opportunities and presenting them in a way a 10 year old could understand.

What makes Cryptonary different from free crypto content on YouTube or Twitter?

Signal vs noise. We filter out 99.9% of garbage projects, provide data backed analysis, and have a proven track record of finding winners. Not to mention since Cryptonary's inception in 2017 we have never taken investment, sponsorship or partnership. Compare this to pretty much everyone else, no track record, and a long list of partnerships that cloud judgements.

Why is there no trial or refund policy?

We share highly sensitive, time-critical research. Once it's out, it can't be "returned." That's why membership is annual only. Crypto success takes time and commitment. If someone is not willing to invest 12 months into their future, there is no place for them at Cryptonary.

Do I get direct access to the Cryptonary team?

Yes. You will have 24/7 to the team that bought you BTC at $1,000, ETH at $70, and SOL at $10. Through our community chats, live Q&As, and member only channels, you can ask questions and interact directly with the team. Our team has over 50 years of combined experience which you can tap into every single day.

How often is content updated?

Daily. We provide real-time updates, weekly reports, emergency alerts, and live Q&As when the markets move fast. In crypto, the market moves fast, in Cryptonary, we move faster.

How does the 3X Value Guarantee work?

We stand behind the value of our research. If the documented upside from our published research during your 12-month membership does not exceed three times (3X) the annual subscription cost, you can request a full refund. Historical context: In every completed market cycle since 2017, cumulative documented upside has exceeded 10X this threshold.

Terms