Trading ETH: Overbought signals and bullish ambitions

ETH is currently at a technical tipping point – its bullish persistence locking horns with overbought warnings and a heavy tilt towards retail long positions. Now, when retail leans too hard in one direction, the market has a way of tipping the scales back. So, what’s on the cards?

TLDR

- ETH is currently challenging a major resistance level at $1,933.

- The RSI indicates overbought conditions and a bearish divergence on the daily chart.

- The market dynamics show a heavily long-oriented retail sector, hinting at possible vulnerability and a chance for a shakeout.

- We advise caution in the short term but see the potential for ETH to rise in the coming weeks.

Disclaimer: Not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results. “One Glance” by Cryptonary sometimes uses the RR trading tool to help you quickly understand our analysis. They are not signals, and they are not financial advice.

Macro analysis

The macro context follows through to all other assets that essentially trade with a high correlation to other risk assets.Technical analysis

ETH has moved higher over the last few days and remains in the uptrend. However, we initially saw price reject into the $1,900 to $1,933 range, with the major horizontal resistance at $1,933. Alongside this, the RSI has been overbought on the daily and also put in a bearish divergence, which ultimately is not positive for price. However, the RSI on the 3D is not overbought, and the daily has reset somewhat - so this could still have some more upside.

The key for ETH will be getting above the $1,933 level. If price can do this, then this would open the door for a move to $2,120 and then to $2,340.

On the downside, the critical support is $1,745, although it’d be much better if the local level of $1,850 could hold.

ETH 1D

Market mechanics

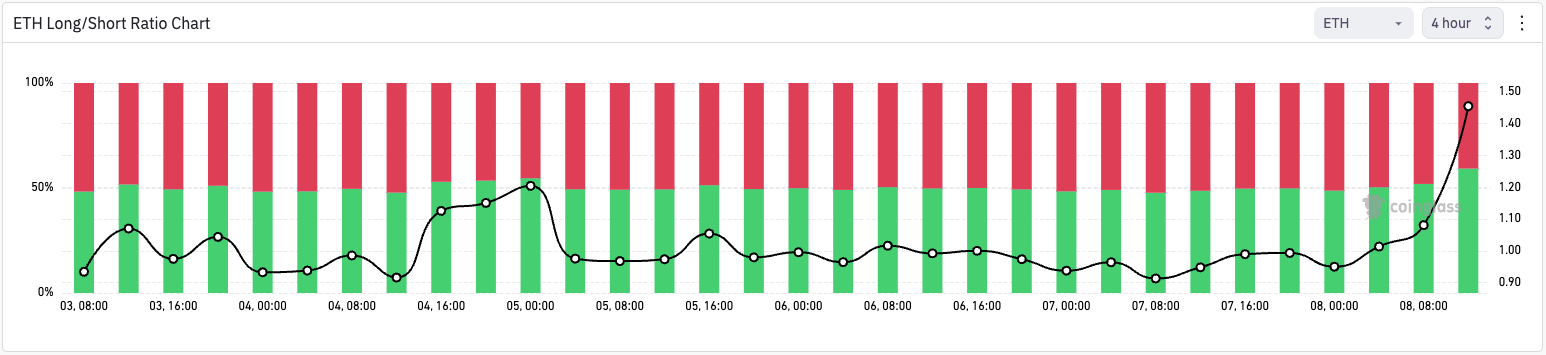

The funding rate is positive, but not to the point where it’s frothy - overheated. The open interest has increased but remains somewhat low and, therefore, again, not overheated.However, looking at the long/short ratio, we can see that it’s massively weighted towards longs. This tells us more participants are long, and massively so. Therefore, this is retail-heavy, and they could be wiped out, meaning the price would be driven lower to wipe these retail longs out.

Note: this is a big change in the 4hr for this metric, and it could reset relatively comfortably. But, currently, this is retail longs being somewhat too heavy and therefore offside here.

Cryptonary’s take

We consider the macro, where we’re tracking Fed- speak today and tomorrow, where we think a more hawkish narrative could see the DXY go higher, which may suppress risk assets.The mechanics suggest an ape’ing in of retail longs, which should be somewhat vulnerable to being shaken out.

Despite the overall market being strong, we would be more cautious here over the next few days. We think there’s a good chance ETH will continue higher over the next week or so, but the mechanics suggest some vulnerability in the very short term.

Anything sub $1,800 would be great long-term entries if you have a time horizon of 12 - 18 months.

As always, thanks for reading.

Cryptonary, out!