Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Tron ($TRX):

Overview

Tron ($TRX) has been a standout performer in the current crypto market, demonstrating exceptional strength and outperforming most assets. Notably, $TRX is one of the few assets, alongside Bitcoin, that has successfully crossed its 2021 all-time high (ATH). This speaks volumes about its bullish momentum and the confidence it has garnered among traders and investors alike.Last week, $TRX decisively broke its 2021 ATH at $0.184 and also cleared the $0.1893 resistance level with a powerful green weekly candle, marking a significant milestone for the asset. Currently trading at $0.20, $TRX is poised for further upside as it approaches the next major resistance at $0.30, its ATH from January 2018.

Weekly time frame analysis

- 2021 ATH breakout: The breakout above $0.1844 and $0.1893 was clean and decisive, supported by high volume and strong momentum. These levels, which previously acted as resistance, are now expected to serve as robust support in case of any pullbacks.

- Support levels: Below the current price, $0.1893 and $0.18 are critical levels of support, marking areas where buyers are likely to step in if the price retraces. These levels have been flipped into support after the breakout, adding to the asset's bullish structure.

- Next resistance: The next significant resistance for $TRX lies at $0.30, which is its all-time high from 2018. This level is a psychological barrier as well as a technical resistance, and breaking above it could lead to price discovery and even higher targets.

- Trend strength: During the weekly time frame, $TRX consistently forms higher highs and higher lows, showcasing a bullish textbook structure. The sustained strength in its price action highlights its potential to continue outperforming the market.

Cryptonary's take

$TRX is a rare asset in this market cycle, as it has managed to break above its previous ATH from 2021, a feat that very few cryptocurrencies have accomplished. Its ability to clear significant resistances, supported by strong volume and bullish price action, underscores its position as a market leader. For traders, the current zone near $0.20 is an area of interest, with $0.18 and $0.1893 acting as key support levels.On the upside, $0.30 is the next major hurdle, and a break above this could result in exponential gains as $TRX enters price discovery mode. That said, the market remains highly volatile, and while $TRX's structure is undoubtedly strong, it's essential to manage risks, especially if broader market conditions shift. For now, $TRX is showing all the signs of sustained bullish momentum, making it a top asset to watch in the coming weeks.

Shiba Inu ($SHIB)

Overview

$SHIB has been consolidating for the past week, following a strong rally from $0.0000176 to $0.00003, where it formed a higher high. Currently trading at $0.000025, $SHIB appears to have regained its bullish momentum, taking support from the yellow uptrend line marked in the chart. This consolidation phase could indicate the potential for another upward move, provided key levels are held.Daily time frame analysis

- Key levels:

- Resistance: The $0.0000284 region is the current resistance for $SHIB on the upside. Breaking and sustaining above this level would open the door for further bullish momentum.

- Support: The $0.0000238 zone is the immediate support. Below that, the $0.0000215 level is a critical area to watch, providing additional support.

- Major support: The $0.0000176 zone aligns with the daily 200 EMA, offering a strong foundational support level in case of a deeper pullback.

- Trendline support:$SHIB has respected the yellow uptrend line, indicating that buyers are actively defending this structure. The trendline continues to act as dynamic support, reinforcing the bullish setup.

- Potential scenarios:

- If $SHIB consolidates and sustains above $0.0000238, it could gain the momentum needed to test and potentially break the $0.0000284 resistance, leading to a move higher.

- A failure to hold $0.0000238 would likely see the price testing the $0.0000215 support zone, where buyers are expected to step in.

Wondering about the latest Shiba Inu (SHIB) price prediction? Explore our in-depth analysis to stay informed!"

Wondering about the latest Shiba Inu (SHIB) price prediction? Explore our in-depth analysis to stay informed!"

Cryptonary's take

$SHIB remains a strong contender in the meme coin space, with a solid structure and key levels to watch. Its ability to hold the uptrend and consolidate within this range suggests that a breakout above $0.0000284 could trigger a new leg higher. However, with the market still prone to volatility, $SHIB must maintain its support levels to avoid deeper retracements. The $0.0000215 and $0.0000176 zones, bolstered by the 200 EMA, provide a healthy base for the asset. For now, $SHIB is positioned for further gains if it continues to hold its bullish structure. Let's see how the consolidation resolves in the coming days!DOGE:

Market context

In our last analysis, we correctly identified the $0.35 bid box as a key support level for Dogecoin, and the price has respected this level beautifully. Since Sunday, $0.35 has acted as a key zone, holding firm despite increased activity in the market. This shows our accuracy in identifying actionable levels and highlights the strength of this support.From a higher-level perspective, Doge is still about 100% off its all-time high, but the current price action suggests that it's building momentum for another potential leg up. With growing open interest and strong buyer interest, Doge remains well-positioned in this cycle.

Market mechanics: Open interest and funding rate

Open interest

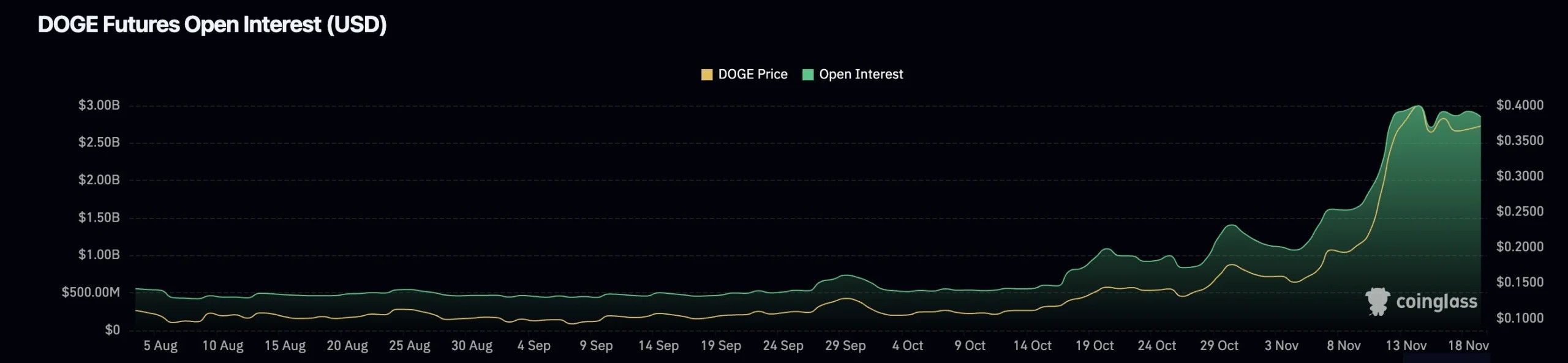

Open interest in Dogecoin has now reached its highest level ever, a major milestone that reflects significant leverage participation on both the buy and sell sides. The market is clearly heating up, with traders positioning heavily in anticipation of major moves. This heightened activity shows Doge's relevance and its ability to attract capital.

Funding rate

Funding ramped up significantly earlier today, on the 19th, peaking at 0.0546 before cooling to 0.02. While traders are slightly biased toward the long side, funding hasn't hit extreme levels of concern yet. However, elevated funding combined with all-time-high open interest signals a potentially volatile market. A short squeeze or liquidity flush could occur if momentum shifts too aggressively in either direction.![]()

Curious about DOGE's next move? Our DOGE price prediction offers a deep dive into market trends!

Playbook

Our playbook focuses on the $0.35 support zone, which has proven to be a solid area of demand. Price has retested this level early today and held well, reinforcing it as a reliable region for accumulation. This creates a strong foundation for potential upside, but we're also prepared for a deeper pullback if broader market conditions shift.- Buy box: Between $0.30 and $0.35, this remains an ideal accumulation zone for spot positions.

- Upside targets: The next area of interest is $0.43, and a move above this level could pave the way toward $0.63, aligning with Doge's recent momentum.

Key levels

- $0.30-$0.35: Spot accumulation zone.

- $0.43: A significant level to watch for further upside as it's the recent high swing.

- $0.63: The next potential target if Doge clears $0.43 with strength.

Risk management

With Doge's momentum increasing, it's important to manage risk appropriately:- Spot Positions: Focus on building at $0.30-$0.35. This range has shown consistent demand and offers a solid entry.

- Leverage Trades: Be cautious with high open interest and funding levels. If you're considering leverage, wait for A+ level setups

- Keep an eye on Bitcoin's price action, as broader market moves could influence Doge.

Cryptonary's take

We've been spot on with Doge from the $0.35 level to tracking its growing momentum. The increase in open interest and strong market participation shows that Doge is attracting attention this cycle. While it's not part of our holdings or CPRO picks, it's a key asset to monitor for market sentiment and broader implications. If the $0.35 level holds, Doge is well-positioned to push toward $0.43 and beyond.For now, spot accumulation in the buy box looks like the best strategy, with leverage trades requiring extra caution due to market conditions. Stay sharp, stick to the plan, and let the levels guide you.