In this article:

- Post FED and Inflation Data Resulting in Dollar & Yields Up Putting Pressure on Risk.

- Rebalancing.

- Price Action Pre and Post-Trump Inauguration.

- Cryptonary's Take.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Post-FED and inflation data

On 18th Dec, the FED and Powell delivered a hawkish cut. They cut by 25bps, as was widely expected, but they also updated their Summary of Economic Projections, which showed that they expected just 2 interest rate cuts in 2025, rather than the 4 they had expected in their SEP that they released in September.The market reacted negatively to this; risk assets sold off, whilst Bond Yields and the Dollar both moved substantially higher - a further tightening on risk assets.

$S&P down:

$DXY up:

$US 10Y up:

On Friday, the 20th (two days after the FED), we then had some inflation data come out, which surprised the downside, printing a 0.1% MoM for Core PCE, with the YoY coming in at 2.8%, below consensus. This enabled the market to see a slight relief rally.

However, overall, a strong dollar and higher yields are bearish for risk assets. This might be why we've seen Crypto sell-off, although Bitcoin has held up very well. The more significant drawdown has come in Alts and Memes. However, something to note is that this sell-off hasn't been solely isolated to Crypto; it's been included in all risk assets, including the Nasdaq and S&P.

Rebalancing

It's also possible that the sell-off was simply due to end-of-year re-balancing. This is where traders and firms are looking to lock in PnL (and, therefore, their bonuses) on the back of a good year of performance, which is what we've had. This selling was likely across the board, but during an illiquid period (pre- and post-Christmas), Alts/Meme struggled for liquidity, although Bitcoin didn't suffer much at all.We expect that this liquidity will come back in the new year when traders are back at their desks and looking to put on fresh positions for 2025.

Price action pre and post-Trump inauguration

Coming off the back of the FED (on the 18th), the market is quite initially fearful of a Trump Presidency and essentially the initial impact of his policies:- Are they going to be inflationary?

- Will they lead to a stronger dollar (which is bad for risky assets)?

- Will tariffs negatively impact US growth?

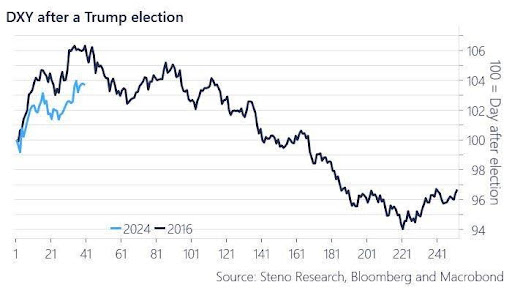

If we look back to Trump in 2016, we can see that the Dollar initially gained in value going into the inauguration (the same situation as today) before policies began to take shape, and the Dollar weakened.

DXY after a Trump election:

It's very possible we see this happen again in 2025. It suits Trump to have a strong dollar going into negotiations in the New Year, particularly with China, which needs a deal with the US so they can stimulate their own economy without devaluing the Yuan too significantly (refer to the last Market Update). Once these deals are struck, it's likely we'll see the DXY come down, which will aid growth in the US, but Trump will have secured attractive trade deals with trading partners by then.

Cryptonary's take

In all honesty, it's been a weird few weeks, and we have seen some violent drawdowns, particularly on Memes. However, we do still expect there to be a major upside for Crypto in 2025, but we think 2025 is the year we see the bull market top. Where we get that top, we're not sure as of yet, but we do expect it to be, price-wise, substantially higher.We're expecting markets to potentially remain shaky in January, but we expect risk appetite to dramatically improve following Trump negotiations with trade partners (probably from February onwards). So, that's the playbook over the coming 1-3 months for now.

In terms of positioning for that?

Bitcoin has held up very well, so there aren't any worries there in terms of holding BTC. The problem recently has been Alts and Memes. But, many of the larger (Blue Chip) memes are now down 60-70% and resting on top of very oversold levels. This is, therefore, not the level to be selling at, even if you want to be selling. We also note that Crypto prices in macro move extremely quickly, sometimes not even giving you a chance to sell or rotate.

We think this has happened here. So, whilst it's possible we still see a tricky environment in January, and it's possible BTC pulls back to $86k to $88k, say, we do actually think the move on the furthest end of the risk spectrum (Alts/Meme's) is done, i.e. they've had their drawdowns and are in the phase of bottoming out. This is also reflected in the charts.

We'd, therefore, just continue holding all positions, and whilst it's possible we don't see huge upside for another few weeks, we would expect a more substantial recovery and then movement into all-time highs by the end of Q1. Once Trump negotiates a deal with the Chinese, we expect the Chinese to inject a large amount of liquidity into their economy as they're crying out for it.

We could have this come February, and we'd expect Crypto to substantially benefit from that, whilst we might also be in an environment then where the Dollar is rolling over and beginning to come down (bullish for risk assets).

It's possible we still have some chop ahead, but we're expecting a strong quarter (Q1), even if it's choppy in the beginning.

Memes and Alts look attractive (charts-wise). For those that are underexposed, these are the levels/prices where we'd be looking to add exposure.

BTC: