TRX, Parcl, and Doge: Critical levels for upside moves

TRX, Parcl, and Doge are rallying with renewed strength, breaking key resistances, and reclaiming supports. These assets showcase clear bullish momentum, making them high-interest picks for traders navigating the current market phase.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Tron (TRX):

Overview

$TRX (Tron) is showing remarkable strength amid a wider market retracement, trading at $0.178 after hitting a new high of $0.184. This asset has consistently demonstrated bullish momentum, breaking key resistance levels one after another. Recently, it moved past the $0.168 resistance, and now it is eyeing the $0.18 mark with only a minor resistance remaining at $0.189 before a clear path opens toward its all-time high (ATH).Weekly time frame analysis

On the weekly time frame, $TRX is showing strength by breaking its April 2021 high, signalling renewed interest from traders and investors. Currently, the next challenge is the $0.18 resistance, followed by $0.189. If $TRX successfully breaks above these levels, it could see a strong move upward, as there's minimal resistance up to its ATH at $0.30, marked by a historical wick in January 2018.- Current price: $0.178

- Immediate resistance: $0.18, followed by $0.189

Key support levels

- $0.168: Recently broken resistance, now a strong support level on the weekly time frame.

- 20 EMA at $0.151: The 20 EMA on the weekly provides additional support, reflecting the broader uptrend.

- $0.144: A secondary support zone, adding further strength to $TRX's base if it dips further.

Cryptonary's take

$TRX is positioned for a breakout opportunity with a powerful bullish structure that has continued to outshine the broader market. The potential to push past the $0.18 and $0.189 levels opens a pathway toward its ATH, making it an asset to watch closely. For traders, waiting for possible retracements to $0.168 may provide optimal entries. With sustained momentum, $TRX could be primed to "rip" higher in the coming weeks, aligning with the interests of both swing and momentum traders.PARCL:

Market context (Bitcoin & Parcl)

When we started covering Parcl back in April, we were looking at an asset that was launching in a bearish market environment. Bitcoin had taken a 16% hit, and Parcl followed that negative sentiment, struggling to gain any real momentum right out of the gate. This period wasn't exactly ideal for growth, as Parcl entered the market during a downtrend where broader market sentiment was poor.Now, with Bitcoin rallying and the broader market shifting, Parcl has been able to show its true performance potential. This is where things get interesting, as we're finally seeing Parcl react positively to the bullish momentum of the current cycle.

Parcl price action

Looking back, our calls have been spot-on. When we marked the right shoulder around the $0.18 level, we were anticipating a move, and it played out exactly as we expected. Parcl rallied 200% to the high printed on Monday, reclaiming the $0.4 level, which we identified as a critical point way back in our initial analysis. This is a key level that's held significance in the past, offering support in April, May, and even into June, so we're seeing a consistent pattern here. As of this morning, Parcl is showing solid demand at the $0.4 level.Once we broke through on Saturday, we saw a clean retest, with the price now using $0.4 as a near-term floor. This level has proven itself historically, and with the price action we're seeing, there's good reason to treat $0.4 as our immediate support. For those looking to build a position, we're calling this the "buy box"-an accumulation zone between $0.4 and $0.3.

Playbook

Right now, our focus is on monitoring the support at $0.4. With the bounce we've seen today, this area is likely to hold as a strong base moving forward. However, we also have our eyes on a potential re-test of $0.295 - $0.3, as that region could provide another buying opportunity if the market sees some pullback. What we're really watching for is the next leg up.A solid break above $0.5 would signal more bullish momentum and could lead to significant upside in line with the broader market's bullish cycle. It's crucial to keep an eye on Bitcoin's movements here, as any major shifts in BTC's momentum will undoubtedly impact Parcl's performance.

Key levels

- $0.4 - Reclaimed support level, now acting as our buy box floor

- $0.5 - Key breakout level for confirming bullish continuation

Cryptonary's take

Parcl's early struggle to gain momentum wasn't surprising, given the bearish market conditions during its launch. However, our analysis has been on point in calling the reversal and setting key levels that have played out effectively. With the recent 200% rally and reclaim of $0.4, Parcel is now in a position to capitalize on the broader market's bullish shift.If we see a breakout above $0.43, it's a strong confirmation of continued upside potential. In this market phase, Parcel has finally shown what it's capable of. We're looking to see further growth, provided the overall market conditions hold up. For those looking to accumulate, $0.4 - $0.3 is our buy zone, with $0.5 as the next major resistance to watch.

DOGE:

Market context

In our last analysis, we correctly identified Dogecoin's potential for a major upside move. We had pinpointed $0.13 as a critical breakout level, and that level has played out perfectly. Doge faced resistance at $0.13 back on September 28th and again on October 16th and 17th. When it finally broke out on October 26th, it came back to retest $0.13, signalling a major shift in market sentiment.Sellers who previously kept pushing Doge down from this level seem to be out of the picture, paving the way for a more bullish stance. Fast forward, Doge has since captured a massive move, adding tens of billions to its market cap in the wake of this breakout. It's now the sixth-largest crypto asset by market cap, with nearly $30 billion in daily trading volume, showing how significant the interest and momentum behind Doge are.

Since November 8th, Doge's market cap surged from $28 billion to a high of $63 billion, an impressive $30+ billion gain. This indicates a powerful sentiment shift that's driving the asset forward in this cycle.

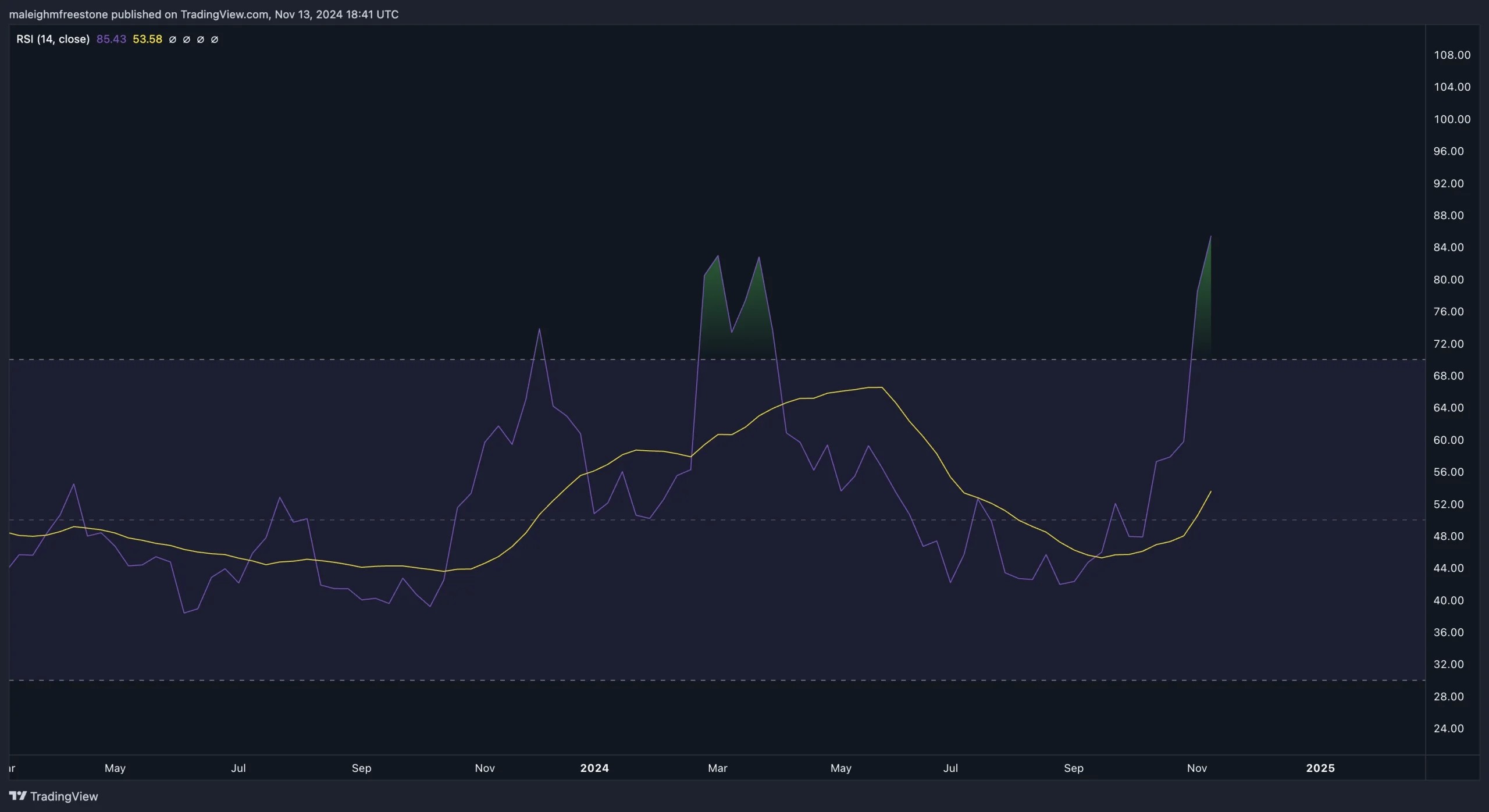

Currently, we're seeing Doge slightly overheated on the RSI, with readings around 90 on the daily timeframe, indicating the potential for a pullback. We're still significantly below the all-time high, with the price currently around 80% off that mark. But the momentum and sentiment indicate that reclaiming all-time highs is a real possibility this cycle.

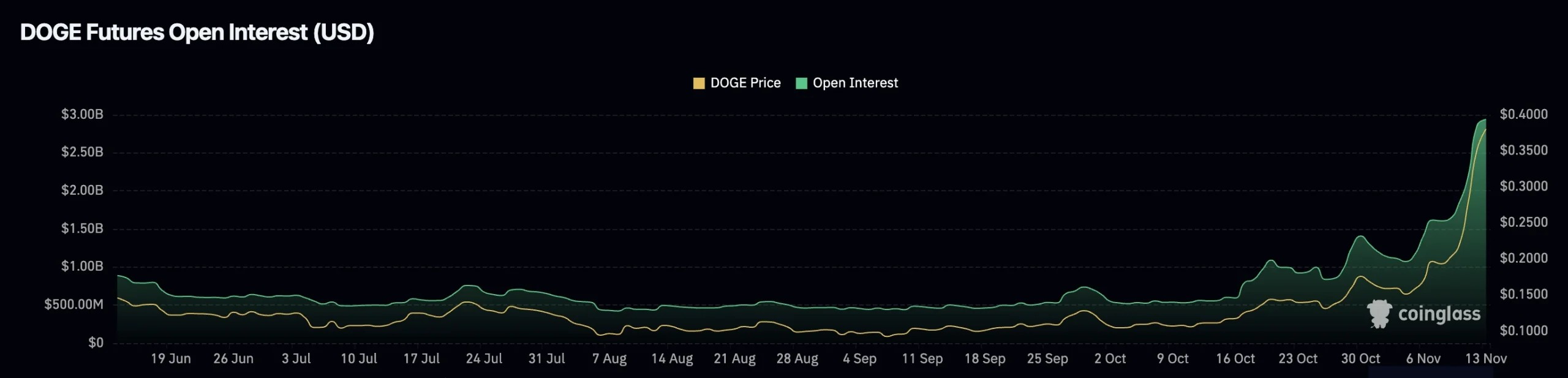

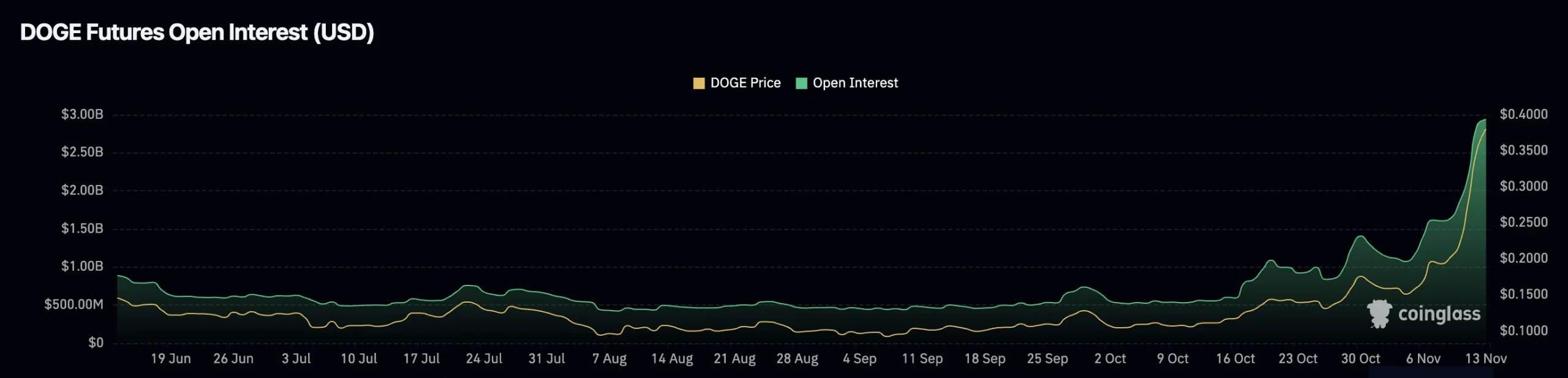

Market mechanics: Open interest and funding rate

- Open interest: Doge's open interest has spiked significantly. On October 7th, open interest sat around $554 million, but as of today, it's risen to $2.94 billion. This uptick indicates strong interest in Doge from leverage traders and suggests that the market is increasingly viewing Doge as a high-stakes asset.

- Funding rate: On November 12th, Doge's funding rate hit 0.05, signalling high demand for leveraged longs. While it corrected to around 0.01, it has since inched back up to 0.02, showing a gradual buildup of bullish positioning. This isn't yet at unhealthy levels, but it's something to monitor closely, as it could indicate potential volatility or a short squeeze if bullish momentum continues.

With elevated open interest and increasing funding rates, we're seeing clear signs that the market is heating up for Doge. This positioning underscores the potential for strong moves, but it also suggests that we should be cautious of pullbacks, especially if funding rates continue to climb.

Playbook

Our playbook now revolves around support at $0.35, recently reclaimed by Doge. This level has acted as a strong demand. Following the breakout on Saturday, Doge came down to retest $0.35 as support early this morning, showing a solid bullish reaction. We're establishing a "buy box" between $0.3 and $0.35 as an accumulation zone, providing an ideal entry region.Given the overheated RSI and high open interest, we might see a pullback as some traders take profits. Our strategy is to watch for a retest of $0.35 or potentially down to $0.3 for a spot accumulation. If Doge holds these levels, we'll target the $0.43 level next. A clean break above $0.43 could pave the way for further upside, potentially pushing Doge toward $0.63.

Key levels

- $0.3 - $0.35: Accumulation zone or "buy box"

- $0.43: Key breakout level for additional upside

- $0.65: Target level upon successful breakout of $0.43

Risk management

With Doge's recent surge in demand and bullish momentum, you have to be smart here. Spot positions are recommended around the $0.3 - $0.25 region, given this zone's historical strength as support. Due to elevated open interest and funding rates, caution with leverage is advised. Additionally, keeping an eye on Bitcoin's price action and following the market directions as BTC's momentum could influence Doge's next move.Cryptonary's take

We've been spot-on with Doge, from calling the $0.13 breakout to tracking its insane surge in demand. Doge has stepped up this cycle, pulling in massive trading volume and becoming a highlight asset in the market. While Doge isn't part of our holdings or in our CPRO picks, it's one we're watching closely because of its market influence. If Bitcoin keeps pushing, Doge could follow suit and make a serious run toward $0.63.For now, spot accumulation between $0.3 and $0.35 looks solid, but if you're considering leverage, wait for clean retests or breaks to avoid getting caught in any shakeouts.