We'll explore identifying where the strength lies, the importance of strategic patience, and how to best position ourselves for the next significant market movement. In a relatively flat market, it's crucial to recognize opportunities that may not be immediately apparent.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Understanding the current market environment

The recent quiet period in the market has been marked by low volume and a lack of clear direction. This isn't a time to be aggressive with trades or to over-leverage, as this can lead to unnecessary losses. Instead, adopting a strategy rooted in patience and discipline is crucial. In this context, think of your capital as an army, as we have discussed before. You wouldn't deploy your troops in uncertain terrain without clear visibility. Similarly, in this flat market, it's essential to conserve your resources and avoid impulsive decisions that could erode your capital.Key considerations:

- Risk management: Avoid unnecessary risks, especially with leverage, as they can deplete your capital during uncertain times.

- Patience: Waiting for the right market conditions is essential. Use this time to refine your strategies and prepare for future opportunities.

- Market sentiment: The current sentiment is one of short-term uncertainty, which typically signals that the market is in a consolidation phase rather than trending strongly in either direction. On higher time frames, we have been somewhat sideways and downwards if we look at the Market cap chart.

Analyzing the market: Identifying strength

Looking at the broader market, particularly Bitcoin, on the weekly timeframe, we see a clear bull flag pattern. This consolidating correction typically signals a potential for a significant upward move. This pattern is not just limited to Bitcoin but is also observable across the total market cap, especially among altcoins.The market has been choppy since reaching all-time highs, with intermittent positive swings that haven't broken into a clear trend. This kind of environment is indicative of consolidation, where the market is preparing for its next move, either up or down.

Market sentiment

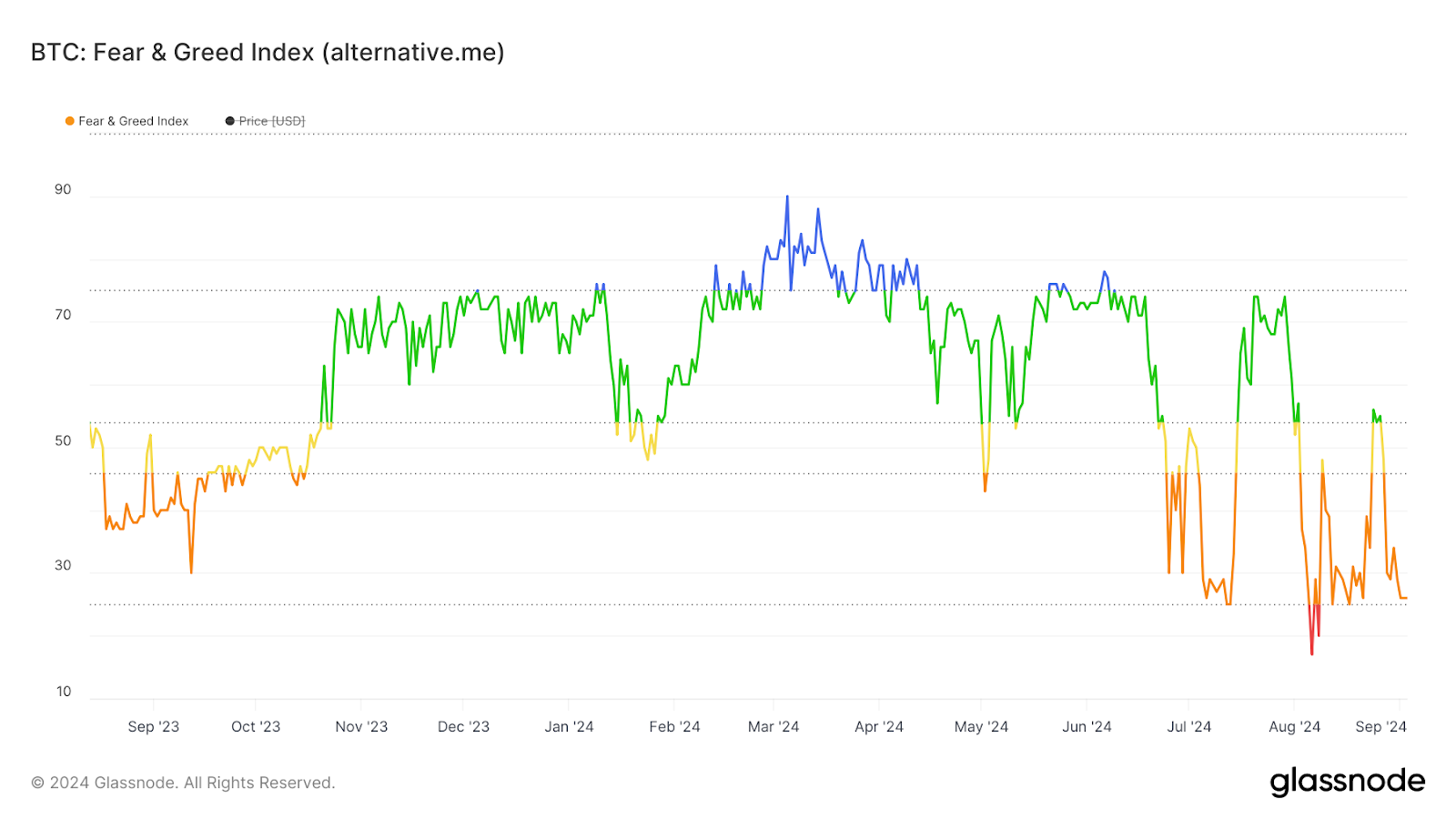

Analyzing volume, particularly in assets like Solana and Ethereum, we observe that while current levels are lower than during previous market peaks, they haven't dropped to extreme lows. This suggests that while the market isn't euphoric, it's also not in a deep slump.This stability in volume aligns with the broader market sentiment, which, according to the Fear and Greed Index, is currently leaning towards fear. This fearful sentiment often precedes significant upward moves. Historically, markets tend to rally after periods of extreme caution, making this an important indicator to watch.

BTC: Fear & Greed Index

In more detail, when we look at assets like Bitcoin, Solana, and Ethereum, we notice that the volume, or the amount of buying and selling happening, hasn't dropped to those really low levels we saw back in October when the market was pretty dead.

Instead, the volume is holding steady, which tells us a couple of things: Interest in the market: There's still interest and engagement in the market. People are trading, just not at the high levels we have seen in this cycle.

This is important because it shows the market is alive, even if it's not bursting with activity.

Potential for a move: The stable volume suggests that the market is waiting, like a coiled spring. It's not making big moves but is not ready to drop off a cliff. This usually indicates that the market is consolidating and preparing for its next significant move, which could be to the upside if the right catalysts come into play.

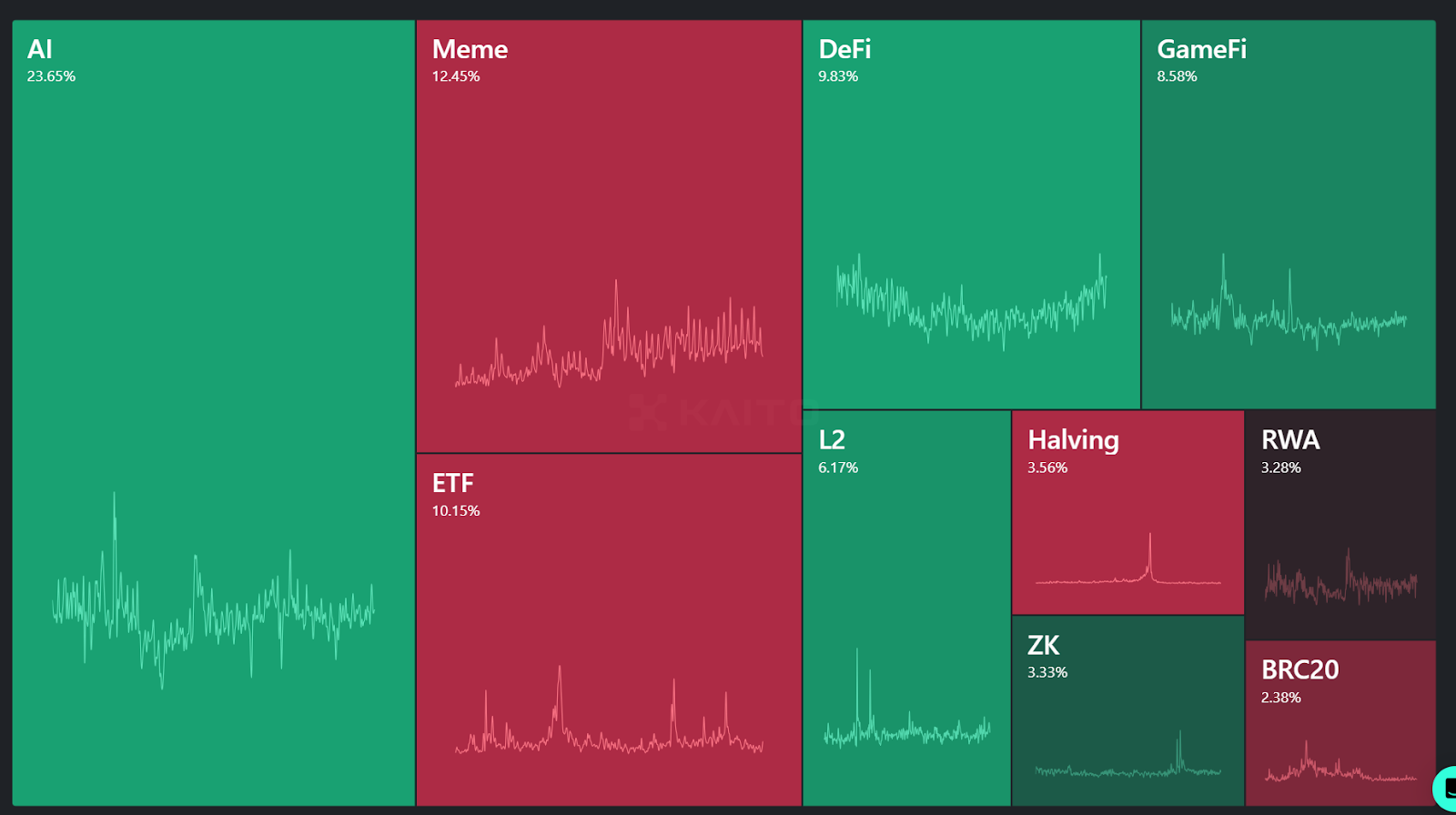

Memecoins as market leaders

Interestingly, memecoins like Pepe and Popcat are currently among the most bullish charts in the crypto space. Despite the overall flat market, these assets have shown resilience, indicating that this is where the market's attention and capital are focused. This resilience is not just random; it reflects a shift in market behaviour where investors are increasingly looking at high-risk, high-reward assets even in uncertain times. Memecoins, often dismissed as purely speculative, are actually showing strong structural integrity, with consistently higher highs and higher lows.

Why memecoins?

Market attention: Memecoins have captured significant market attention, which is critical for their price stability and growth.Structural strength: These assets are displaying strong technical patterns, suggesting that they may lead the next market rally.

Risk and reward: While riskier, these assets offer potentially outsized rewards, making them attractive during consolidation phases.

Compared with utility tokens

When we compare meme coins with utility tokens, we notice a significant difference in performance. While utility tokens like Arbitrum are typically seen as safer, they haven't shown the same level of resilience. This shift suggests that the traditional idea of safety might be less valuable in the current market.Key takeaway: Memecoins vs. utility tokens; memecoins are currently outperforming utility tokens, challenging the conventional wisdom of risk management.

Focus on resilience: The key in this market phase is to focus on assets that are showing strength, even if they are considered riskier.

Developing a balanced portfolio

Given the current market conditions, the most effective strategy is to build a balanced, or "barbell," portfolio.This involves allocating a significant portion of your portfolio to low-risk assets like Bitcoin, Ethereum, and Solana while reserving a smaller portion for high-risk, high-reward plays like meme coins. For instance, if Bitcoin reaches our 2024 target of $145,000, that represents a 150% gain from current levels. You can secure a solid foundation by ensuring that a substantial part of your portfolio is invested in these lower-risk assets. The smaller, high-risk portion can then be allocated to assets like Pepe or Popcat, which, despite their higher risk, have shown considerable potential for outsized gains.

Portfolio Allocation Strategy: Low-risk Assets (70-80%): Bitcoin, Ethereum, and Solana are the foundation of your portfolio, offering stability with strong growth potential. High-risk assets (20-30%): Memecoins like Pepe, Popcat, and other promising high-risk plays can provide the opportunity for significant returns.

Market playbook

This is not the time to take on leveraged trades or set tight stop losses. The market is still consolidating, and the focus should be on building a strong base rather than trying to time short-term movements.Your best move is to continue accumulating spot positions, focusing on assets that have shown strength and resilience during this consolidation phase. Key Actions: Build Spot Positions: Focus on accumulating low-risk assets while selectively investing in high-risk, high-reward opportunities.

Avoid Leverage: The current market is not suitable for leveraged trades, as the risk of capital erosion is too high. Prepare for the Next Move: Stay patient and continue building your portfolio. The market's next significant move could be the one that rewards this strategic patience.

Cryptonary's take

To sum up, we're in a period of market consolidation with a relatively fearful sentiment in comparison to periods we have seen so far. However, these conditions often precede significant upward moves. Now is the time to focus on building your portfolio, not through aggressive trades but by strategically accumulating strong assets. The market may be quiet now, but those who are patient and disciplined will be well-positioned to capitalize on the next major move.We'll continue monitoring the market and will provide another update once we start seeing shifts that warrant attention. Until then, stay focused and disciplined, and remember that the best opportunities often arise in periods of uncertainty.

REMINDER! This is just a reminder: While Pepe is noted and mentioned in this piece for its strength, it is NOT an asset in Cryptonary's barbell portfolio. It was referenced in this piece to showcase the strength of Meme coins relative to Utility across the market. It's not an asset held by the team.