Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro

There has been relatively little change in the macro picture over the past week; however, we have FED Chair Powell speaking tomorrow (24/05/2022) and the FED Meeting Minutes on the following day. Discussion around whether a 75-basis point rate hike is actually off the table or not will be interesting, and we should be expecting increased volatility for all scenarios. In the last seven days, Bitcoin has been relatively stable after its price breakdown in the week prior. We have seen a low of $28,600 and a high of $30,700, currently sitting at $29,000 at the time of writing.TLDR

- Expect the market to react at this week's FED meeting - a short-term direction will be chosen.

- Over the past few weeks, there have been more inflows of Bitcoins to Exchanges than outflows.

- After last week’s capitulatory style selling, short-term holder spent outputs have returned to an average level.

- Whales are selling while retail continues to accumulate.

Total Market Cap

As we mentioned in last week's Analysis Digest report, the Total Market Cap has lost its $1.35T support level by closing two candles under it. This makes the situation quite simple - unless $1.35T is reclaimed on the weekly timeframe, then a $1T support test remains possible. Expect volatility tomorrow.

Altcoins Market Cap

The Altcoins Market Cap is susceptible to Total Market Cap moves, which can already be seen as we dropped from $1.3T back to $600B just two weeks ago. We're still above the $645B support level, so the Altcoins Market Cap is looking a lot better than the Total Market Cap, and only a weekly loss of $645B will indicate further downside. Until that happens, we should expect ranging between $782B and $645B.

The Altcoins Market Cap is susceptible to Total Market Cap moves, which can already be seen as we dropped from $1.3T back to $600B just two weeks ago. We're still above the $645B support level, so the Altcoins Market Cap is looking a lot better than the Total Market Cap, and only a weekly loss of $645B will indicate further downside. Until that happens, we should expect ranging between $782B and $645B.

Bitcoin - Technical & On-Chain Analysis

Bitcoin has been relatively stable this week and even closed above its $30.000 psychological & technical support level. Ahead of the FED meeting tomorrow, BTC has dropped to $29.3k at the time of writing, which means market participants are expecting bearish sentiment to take over the market tomorrow. Of course, that can only be confirmed tomorrow and remains a probability for now, as this can easily be misguiding.

Bitcoin has been relatively stable this week and even closed above its $30.000 psychological & technical support level. Ahead of the FED meeting tomorrow, BTC has dropped to $29.3k at the time of writing, which means market participants are expecting bearish sentiment to take over the market tomorrow. Of course, that can only be confirmed tomorrow and remains a probability for now, as this can easily be misguiding.

Closing this week above the $30.000 support level is crucial and should indicate that sellers are finally losing control after eight red weeks. We should be expecting a solid reaction tomorrow after the aftermath of the FED meeting is announced. Trade carefully, or even better, do not trade at all.

The On-Chain metrics are also in confluence with the technicals, as investors are losing their conviction, selling in losses, or waiting for break evens to sell their coins. A short-term rally has a high probability of happening and can be fueled by tomorrow's FED meeting. Still, the overall picture remains bearish, so it's best to be cautious, take profits if it's somehow the case and let the market do its thing.

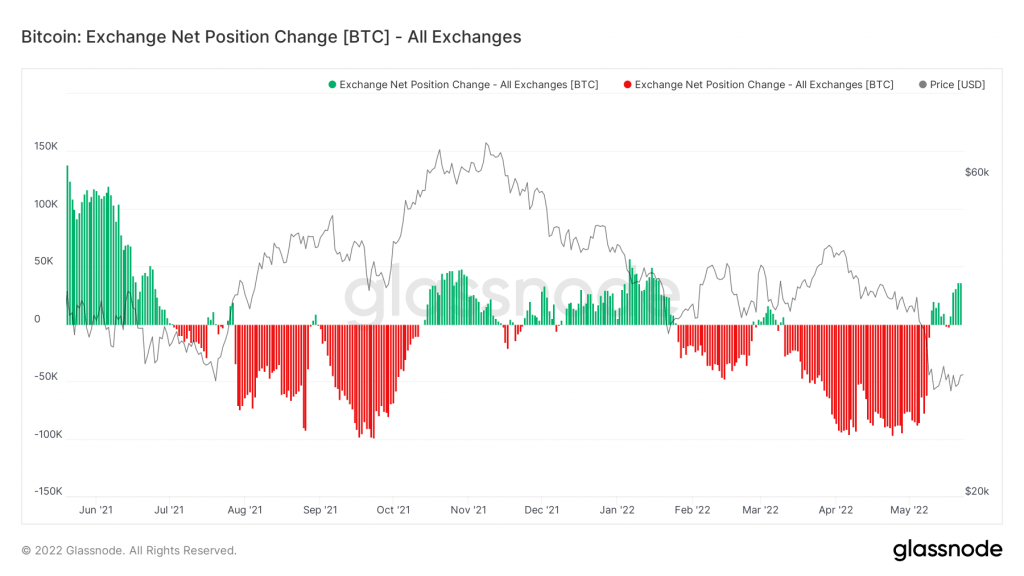

Metric 1 – Exchange Net Position Change

The Exchange Net Position Change is now showing more considerable green spikes (coins flowing into Exchanges from cold storage wallets). We saw in the prior months that there were enormous net outflows of currencies from Exchanges showing a willingness amongst investors to accumulate; the last week suggests that this sentiment has changed.

Bitcoin – Exchange Net Position Change

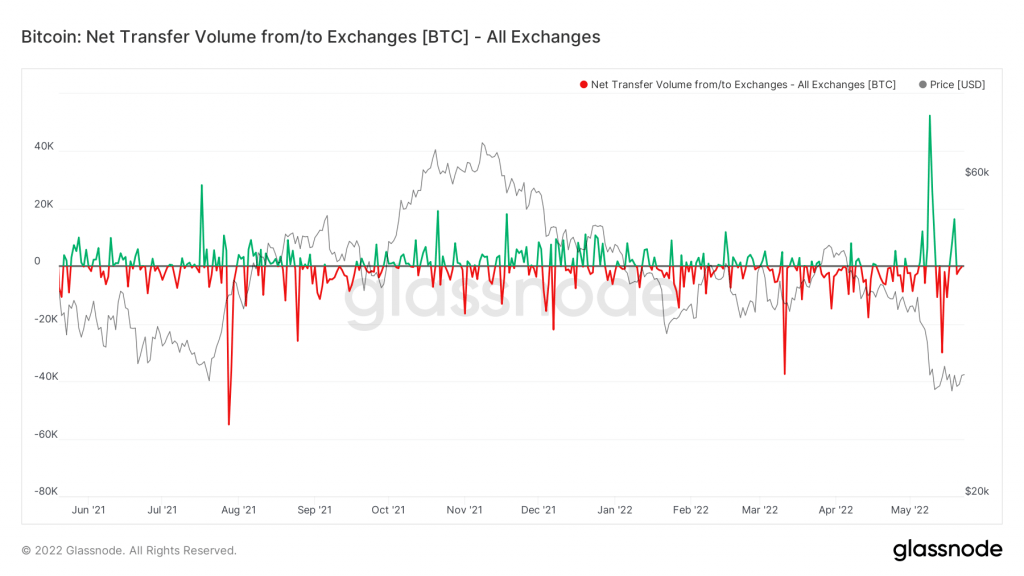

Metric 2 – Exchange Netflow Volume

The Exchange Netflow Volume gives us a more accurate reading of the number of coins flowing into or out of Exchanges on individual days. In this last week, we can see that there has been another reasonably significant spike that is similar to the inflows we saw at the all-time high. This shows that even after we had the large inflow on May 9th, which caused the move down, we had another large inflow of Bitcoins to Exchanges just a week later.

Bitcoin – Exchange Net Position Change

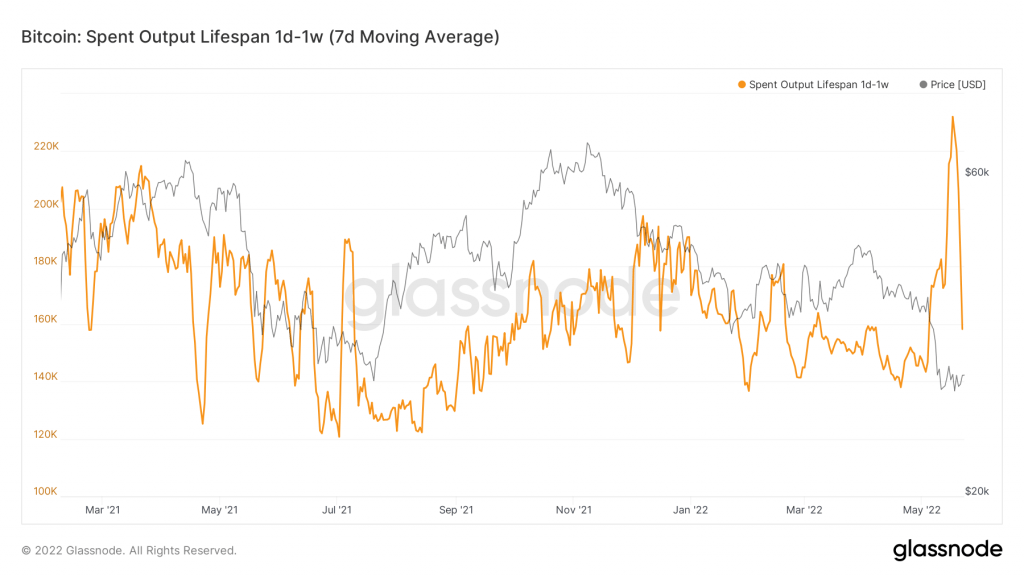

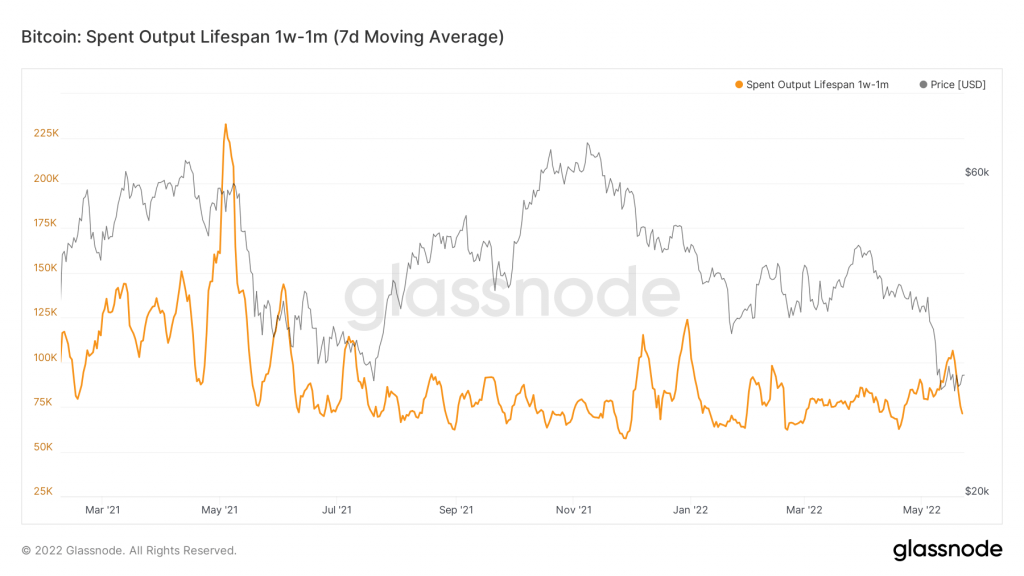

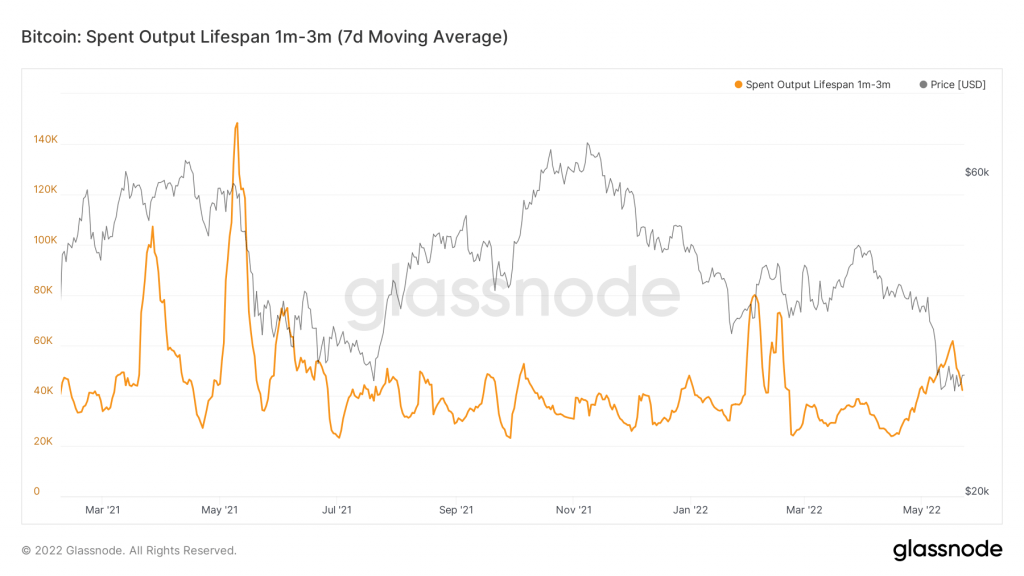

Metric 3 – Short-Term Holder Selling

The below metrics show that short-term holders (young coins) were spent in the significant price move down last week. This is capitulatory in nature, and it is important we see this come down to more normal levels. If so, it may mean some of the weaker short-term, paper hands have been flushed out and this could lean towards a short-term price rally (only short-term because the macro picture still has potential problems on the horizon, and therefore price rallies will likely continue to struggle to get momentum).

Bitcoin – Spent Outputs 1D – 1W

Bitcoin – Spent Outputs 1W – 1M

Bitcoin – Spent Outputs 1M – 3M

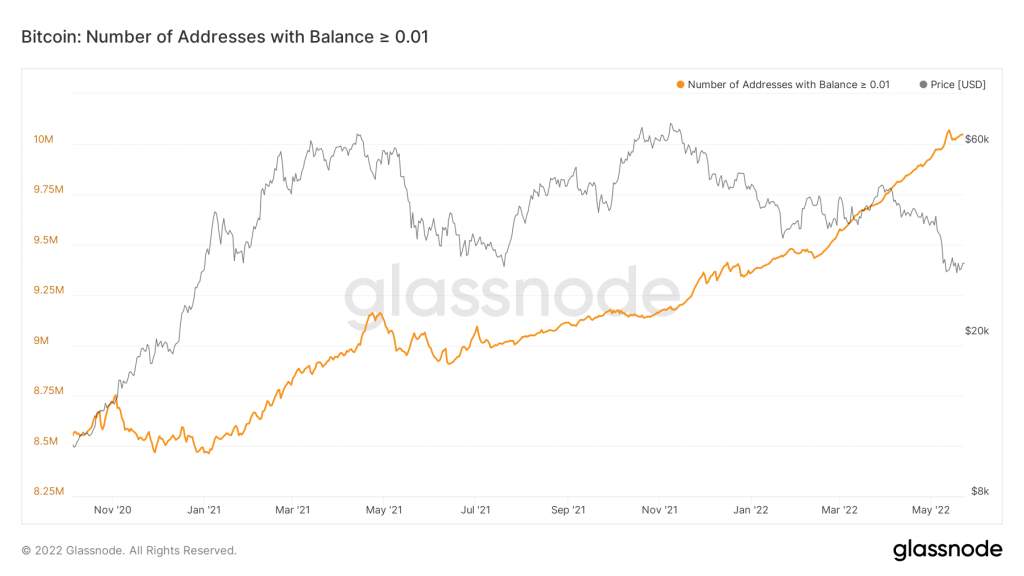

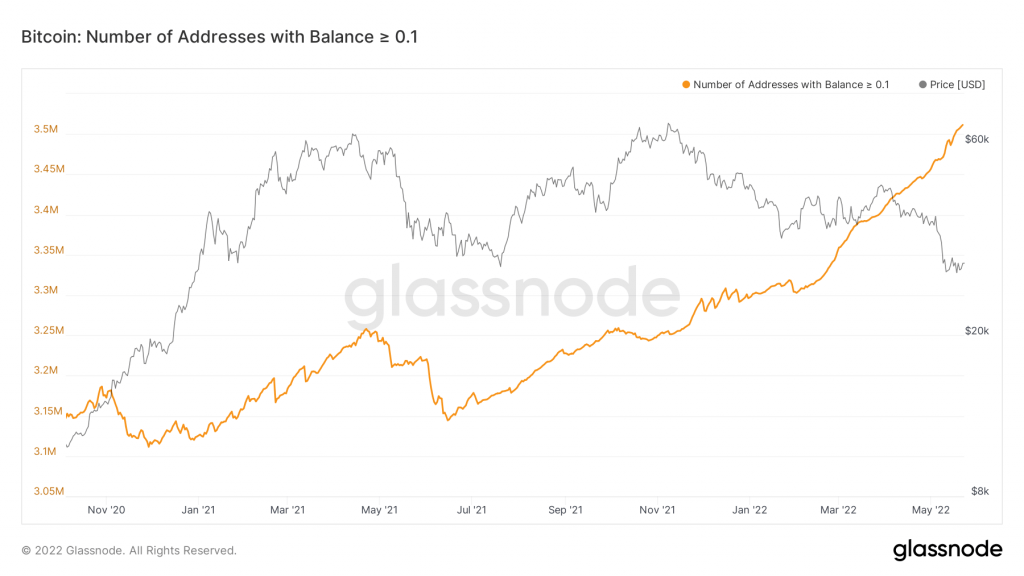

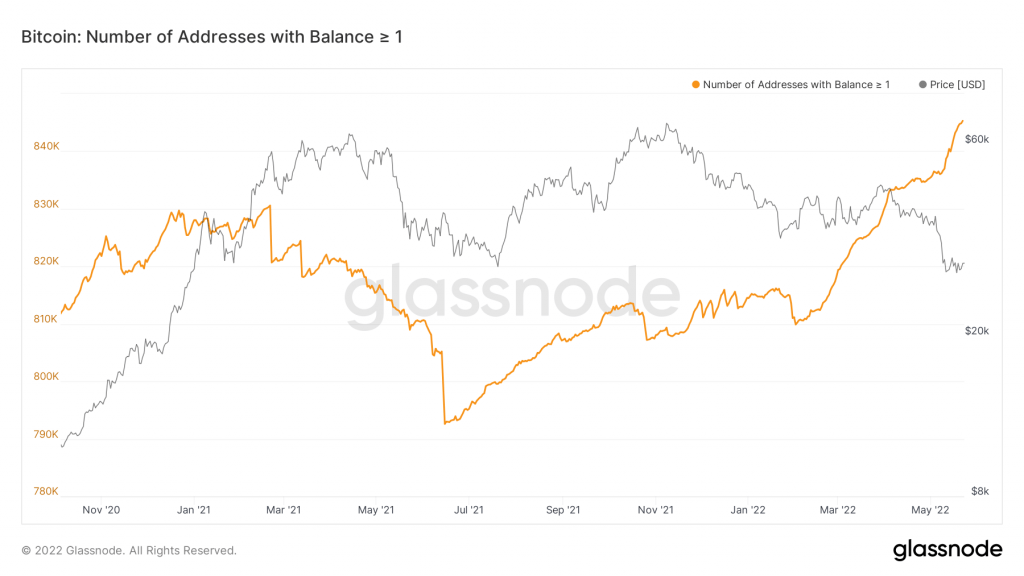

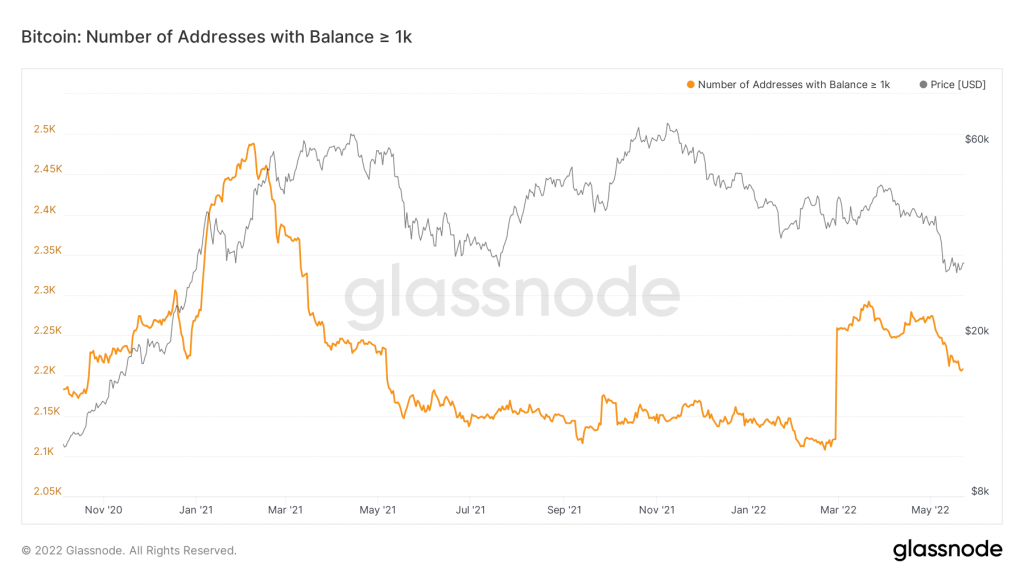

Metric 4 - Addresses

If we turn our attention to the wallet addresses, we continue to see the smallest wallets and the largest wallets act completely oppositely. We see the smallest wallets (wallet balances > 0.01, 0.1, and 1 Bitcoin), are increasing in number. This means that the smallest wallets are increasing the amount of Bitcoin they own, adding exposure to the asset. Whereas if we look at the largest wallet cohorts (wallet balances > 1,000 Bitcoin), we can see that they are decreasing their exposure to Bitcoin, effectively still risking off from the asset. Historically, the large wallet cohorts are the most profitable and therefore we should look to emulate them, rather than the smallest wallet cohorts.

Bitcoin – Wallet Balance > 0.01 Bitcoin

Bitcoin – Wallet Balance > 0.1 Bitcoin

Bitcoin – Wallet Balance > 1 Bitcoin

Bitcoin – Wallet Balance > 1,000 Bitcoin

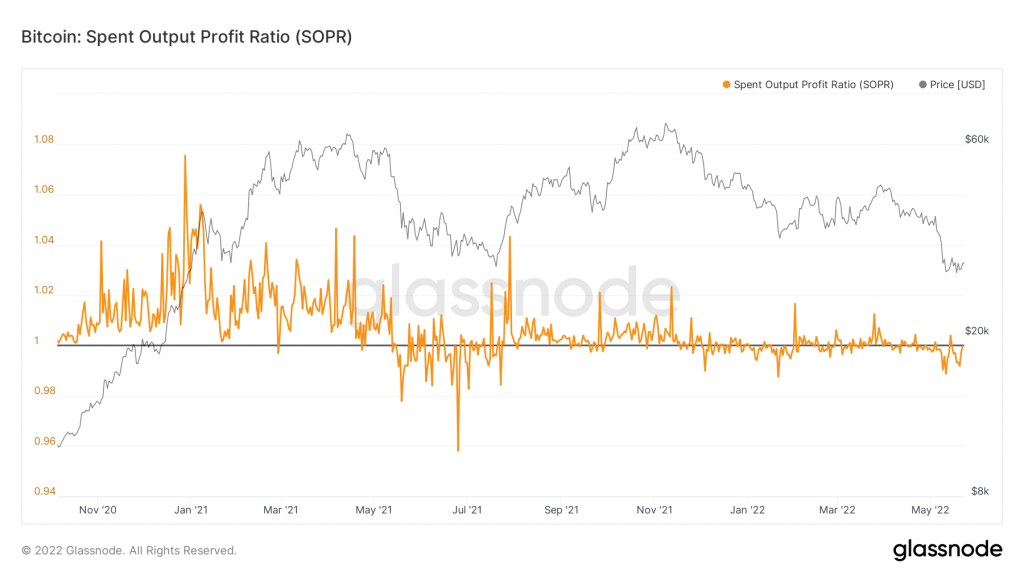

Metric 5 – aSOPR

The aSOPR is a metric showing a horizontal break-even line, charting the difference between the price sold and the price paid, i.e., did investors sell at a profit or a loss? When the orange line is above the horizontal black break-even line, investors are selling at a profit. In the past few weeks, we can see that the orange line has been significantly below the horizontal black line, meaning investors have been selling at a loss. This is expected, mainly after seeing the spike in the number of young coins spent. However, we also know that we struggle to get above the black horizontal line. This means that as investors are in unrealised losses, they are holding their coins and waiting to break even. But, when they’re getting to break even, they are selling the coins. This indicates that sentiment is weak as investors are looking to get out as close to break-even as they can and then sell their coins; they have little conviction that the market can rally.

Bitcoin – aSOPR

Ether

ETH remains under its $2150 resistance level, and a reclaim is necessary for further upside. Although $1900 is just an intermediate support level, $1700 remains the key level we need to watch out for. There's no debate that the price cannot quickly get there. For now, Ether will follow Bitcoin's price action, so monitoring BTC is essential. Let's take a look at the ETH/BTC pair.

ETH remains under its $2150 resistance level, and a reclaim is necessary for further upside. Although $1900 is just an intermediate support level, $1700 remains the key level we need to watch out for. There's no debate that the price cannot quickly get there. For now, Ether will follow Bitcoin's price action, so monitoring BTC is essential. Let's take a look at the ETH/BTC pair.

ETH/BTC

DOT

DOT is at a crucial point, as it now has the lowest weekly candle closure since January 2021. A weekly reclaim of $10.5 needs to occur, backed by increased volume for confirmation. Otherwise, DOT risks dropping to $6-$7.

DOT is at a crucial point, as it now has the lowest weekly candle closure since January 2021. A weekly reclaim of $10.5 needs to occur, backed by increased volume for confirmation. Otherwise, DOT risks dropping to $6-$7.

SNX

Price is still just above its $2.5 key support level, and that's enough to invalidate further downside. A weekly reclaim of $3.6 or a weekly break under $2.5 will indicate SNX's direction.

Price is still just above its $2.5 key support level, and that's enough to invalidate further downside. A weekly reclaim of $3.6 or a weekly break under $2.5 will indicate SNX's direction.

RUNE

Still above its $3 support level, but still at risk, as RUNE now has the lowest weekly candle closure since, you guessed it, January 2021. Most assets can be found in the same scenario, which goes without saying - this year will be a ranging one for RUNE, even for crypto in general. Monitoring BTC is recommended here, as the $3 - $3.5 area has proven to be highly demanded in the past; a rise in BTC's price will most likely give RUNE a nice rally.

Still above its $3 support level, but still at risk, as RUNE now has the lowest weekly candle closure since, you guessed it, January 2021. Most assets can be found in the same scenario, which goes without saying - this year will be a ranging one for RUNE, even for crypto in general. Monitoring BTC is recommended here, as the $3 - $3.5 area has proven to be highly demanded in the past; a rise in BTC's price will most likely give RUNE a nice rally.

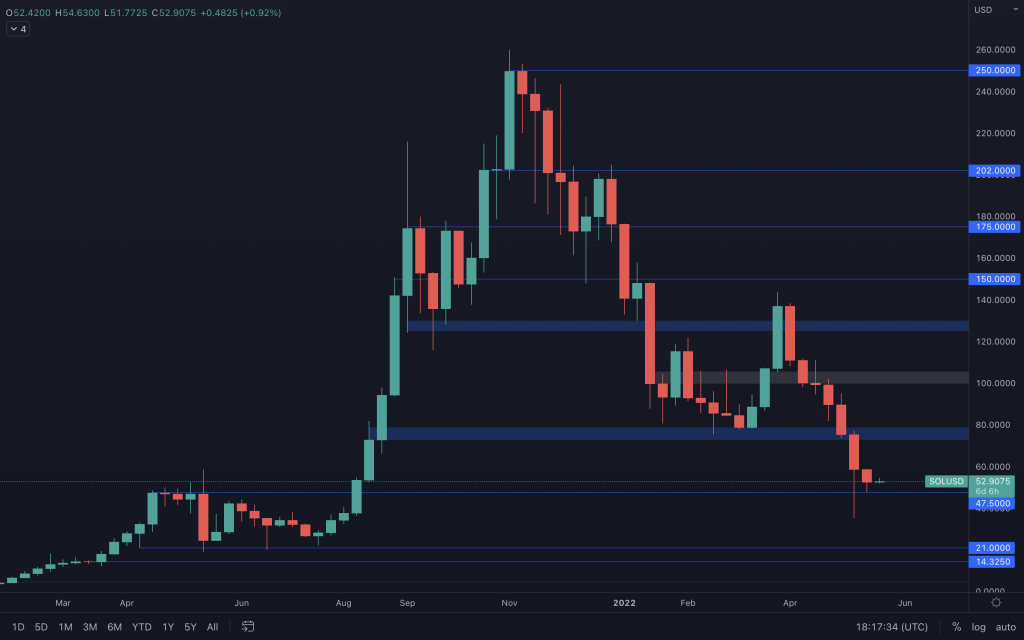

SOL

Last week, SOL tested its $47.5 support level once again and closed above it. Because we still have no weekly closure under $47.5, we cannot expect further downside, but only ranging between $47.5 and $80. Same as all other assets, SOL will follow BTC's price action - monitoring BTC is necessary.

Last week, SOL tested its $47.5 support level once again and closed above it. Because we still have no weekly closure under $47.5, we cannot expect further downside, but only ranging between $47.5 and $80. Same as all other assets, SOL will follow BTC's price action - monitoring BTC is necessary.

SRM

There are no signs of reversing here, which means SRM is due to range between $1 and $1.40. A standalone break under $1 is highly unlikely. It serves not only as a technical level but also as a psychological level, which means market participants will be looking to buy from the $1 level for short-term gains. However, BTC's price action can quickly invalidate the $1 support level and put SRM on a painful path back to $0.75.

There are no signs of reversing here, which means SRM is due to range between $1 and $1.40. A standalone break under $1 is highly unlikely. It serves not only as a technical level but also as a psychological level, which means market participants will be looking to buy from the $1 level for short-term gains. However, BTC's price action can quickly invalidate the $1 support level and put SRM on a painful path back to $0.75.

FTT

FTT wasn't able to reclaim $36 and is now on a straight path to $22.45. Either way, it's highly likely FTT will remain in the $36 - $22.45 range for some time.

FTT wasn't able to reclaim $36 and is now on a straight path to $22.45. Either way, it's highly likely FTT will remain in the $36 - $22.45 range for some time.

MINA

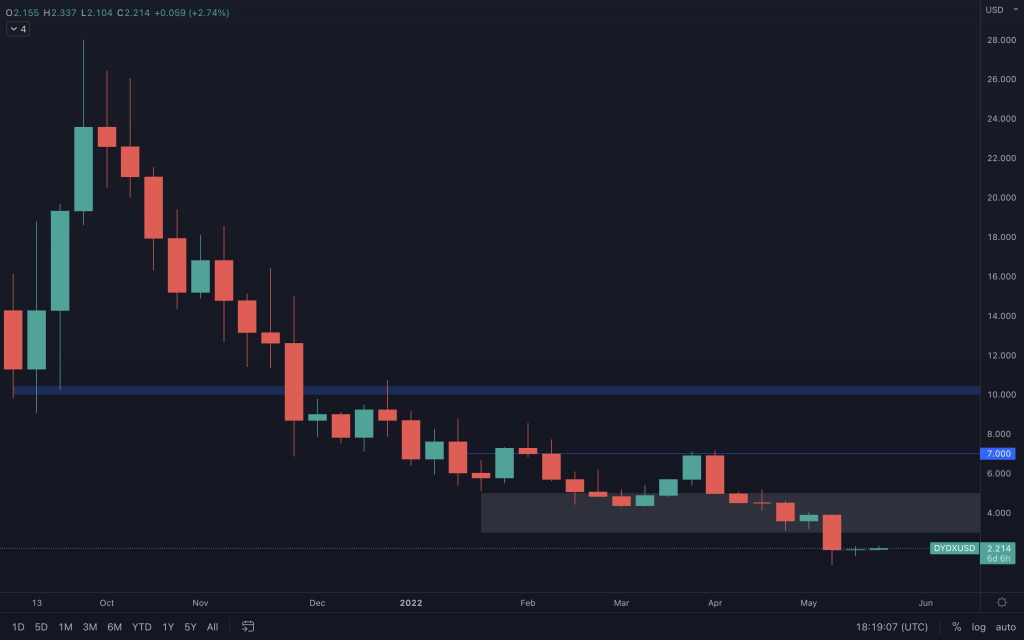

$1 psychological & technical support level continues to be the main area of interest. It's absolutely necessary for MINA to hold this support level, otherwise it's likely MINA will go on an all-time low spree, similar to dYdX.

$1 psychological & technical support level continues to be the main area of interest. It's absolutely necessary for MINA to hold this support level, otherwise it's likely MINA will go on an all-time low spree, similar to dYdX.

dYdX

Summary

It can be said that several of the metrics suggest that a macro bottom is still not in, but they suggest a local bottom may be in. With the macro uncertainties on the horizon, it will likely be difficult for all relief rallies to get any meaningful momentum. Investors would be encouraged to remain cautious until the number of uncertainties begins to come down.Ahead of the FED meeting, it's best to just stay sidelined and watch how the market progresses. The price of BTC is struggling with the $30.000 level and only after we successfully manage to reclaim it on the weekly timeframe, can we start looking for opportunities. We strongly believe there's more downside to come this year and we have enough data to back this. Always manage your risk and remember - it pays to know.