Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro

This week sees the market not under the pressure of any highly anticipated macro data such as CPI and Labour statistics. However, this week does begin with kicking off Earnings season. Earnings have been revised down quite considerably in the last 6 weeks, meaning expectations are low. This allows for a low bar to be beat meaning Earnings may come in better than expectations. If Earnings in the majority do come in above expectations, then Equities may get a brief relief rally.This may be supported by a technical-driven oversold rally from the S&P. The S&P has created two bullish divergences, with the first being in the oversold territory – this is identified in the SPX chart included in this report, showing lower lows in price and higher lows on the RSI oscillator. An S&P rally may help highly correlated risk assets such as Crypto to follow.

The above assumes that Earnings come in above the low set expectations which may help drive the market higher. Although it must be said, with tensions between Russia and Ukraine escalating, it remains unlikely that rallies will have any significant momentum due to investors possibly remaining cautious and not willing to add significant risk.

TLDR

- Bullish divergences on the S&P may help risk assets (crypto) to get some short-term relief.

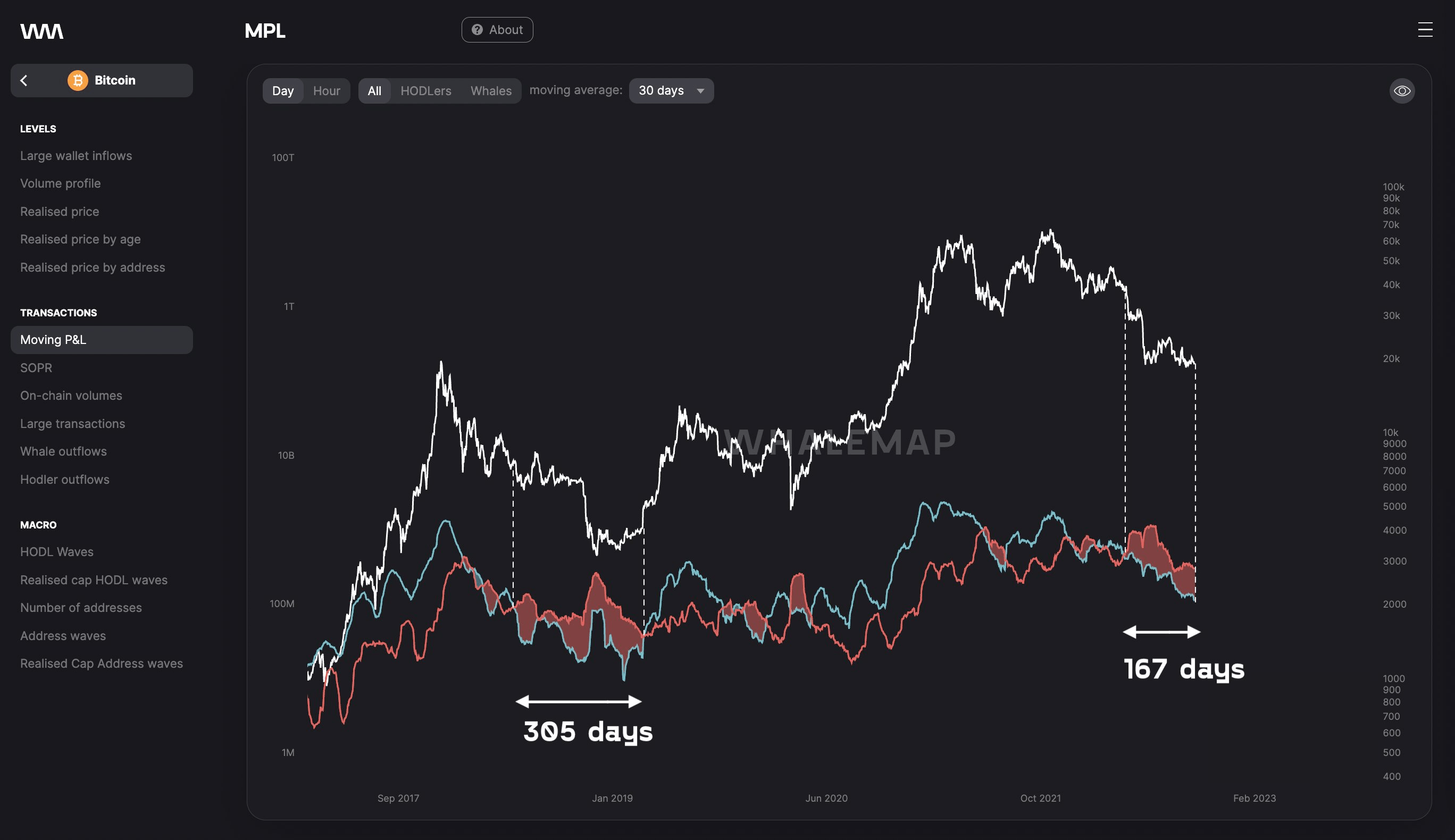

- The Moving PnL metric suggests there may be more loss-taking in the coming months before there is a bottom in the risk assets markets.

- Spent Outputs from some of the older wallet cohorts have seen spikes in selling in the past few weeks indicating long-term buyers are still interested in selling their coins at these levels as they potentially anticipate lower prices.

Total Market Cap

(Daily chart was used)

We used the daily chart here as we have a more interesting perspective on what's going on with the Total Market Cap index. We can see that the price is taking a swing at other resistance test here. On a larger timeframe, we've been ranging above the same support area for the last five weeks which leaves the question - have buyers really managed to save the day this time?

(Daily chart was used)

We used the daily chart here as we have a more interesting perspective on what's going on with the Total Market Cap index. We can see that the price is taking a swing at other resistance test here. On a larger timeframe, we've been ranging above the same support area for the last five weeks which leaves the question - have buyers really managed to save the day this time?

If the index successfully breaks above the resisting channel, then a $1.03T test is on the cards. Failure in breaking above will most likely lead to a nasty rejection as the price is close to squeezing itself between the support and resistance levels here. The probability of a short squeeze here (bullish event) is definitely there and will aid in pushing the index to $1.03T.

For now, it's just a waiting game - "either that or the other" scenario.

Altcoins Market Cap

(Daily chart was used)

Same thing that has been said on the Total MCap chart can be said here - the Altcoins Market Cap is ready for a move and the probabilities are equal for both at this point.

(Daily chart was used)

Same thing that has been said on the Total MCap chart can be said here - the Altcoins Market Cap is ready for a move and the probabilities are equal for both at this point.

In the case of a break above the channel, the index needs to also reclaim $550B to confirm a higher move toward $600B. If that level isn't reclaimed, then $550B can easily act as a nice spot for a rejection.

Bitcoin - Technical & On-Chain Analysis

(Daily chart was used)

Bitcoin is currently battling with this falling wedge, but it seems we have a potential rally on our hands. With the S&P 500 index at support and the DXY at resistance, the possibility of the crypto market rising is real from a technical standpoint.

(Daily chart was used)

Bitcoin is currently battling with this falling wedge, but it seems we have a potential rally on our hands. With the S&P 500 index at support and the DXY at resistance, the possibility of the crypto market rising is real from a technical standpoint.

With that said, we're going to monitor this break out carefully and wait for Bitcoin to choose a direction. A successful break above the top trend line will put $21,000 as Bitcoin's next target, which is also a solid level for sellers to step in again.

Last week, we've seen some selling pressure occur on the day the CPI data came out and although it was worse than expected, the markets have reacted negatively but then suddenly recovered and actually pushed higher. Weird times call for weird actions.

A rejection from the top trend line will push Bitcoin toward $17,500 once more.

Metric 1 – Moving PnL

The first metric we will cover today is the MPL. This visualises if investors are selling their Bitcoins at a profit or a loss and in what periods of time this investor behaviour persists.

In the below, we can try to identify where we are in today’s bear market in comparison to the 2018 bear market. In 2018, participants were loss-taking for 305 days before the general market flipped into profit-taking again as prices went higher. In the 2022 bear market, there have currently been 170 days of loss-taking from investors. If 2018 is anything to go by, this may suggest that we have more loss-taking in general ahead of us.

Moving PnL – Whalemap

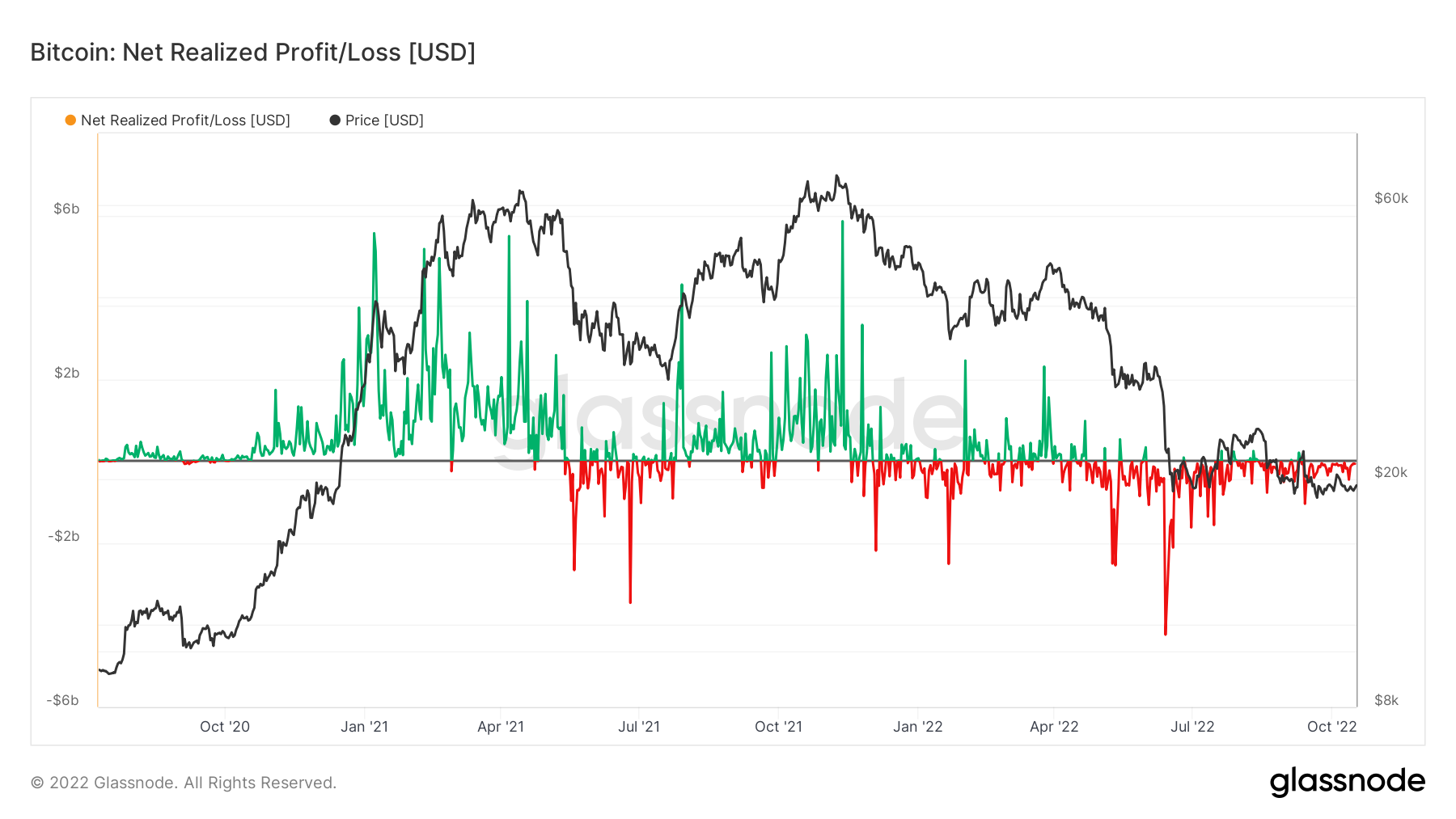

Metric 2 – Net Realised Profit/Loss

The Net Realised Profit/Loss is one of the best metrics for assessing whether the market is in profit/loss taking and how the sentiment is or isn’t likely to continue. We know from the above Moving PnL chart from Whalemap, that the market is currently loss-taking, but the Net Realised Profit/Loss enables to identify what the sentiment is and how likely this is to continue.

We can see in the below graph that there continue to be red spikes (loss-taking) and that the black horizontal 0 line continues to act as resistance. This essentially means that as price approaches investors’ break-even levels, investors are selling into these levels as they don’t anticipate higher prices for them to sell into at a profit. With the market being as bearish as it is currently, this does set up the potential for a technical-led rally, but until we see the bearish sentiment change, it’s likely look-taking and selling into break-even levels is likely to continue. The key thing to watch on this metric will be to see the black horizontal 0 line flip from resistance into support and we begin to see small green spikes.

Net Realised Profit/Loss

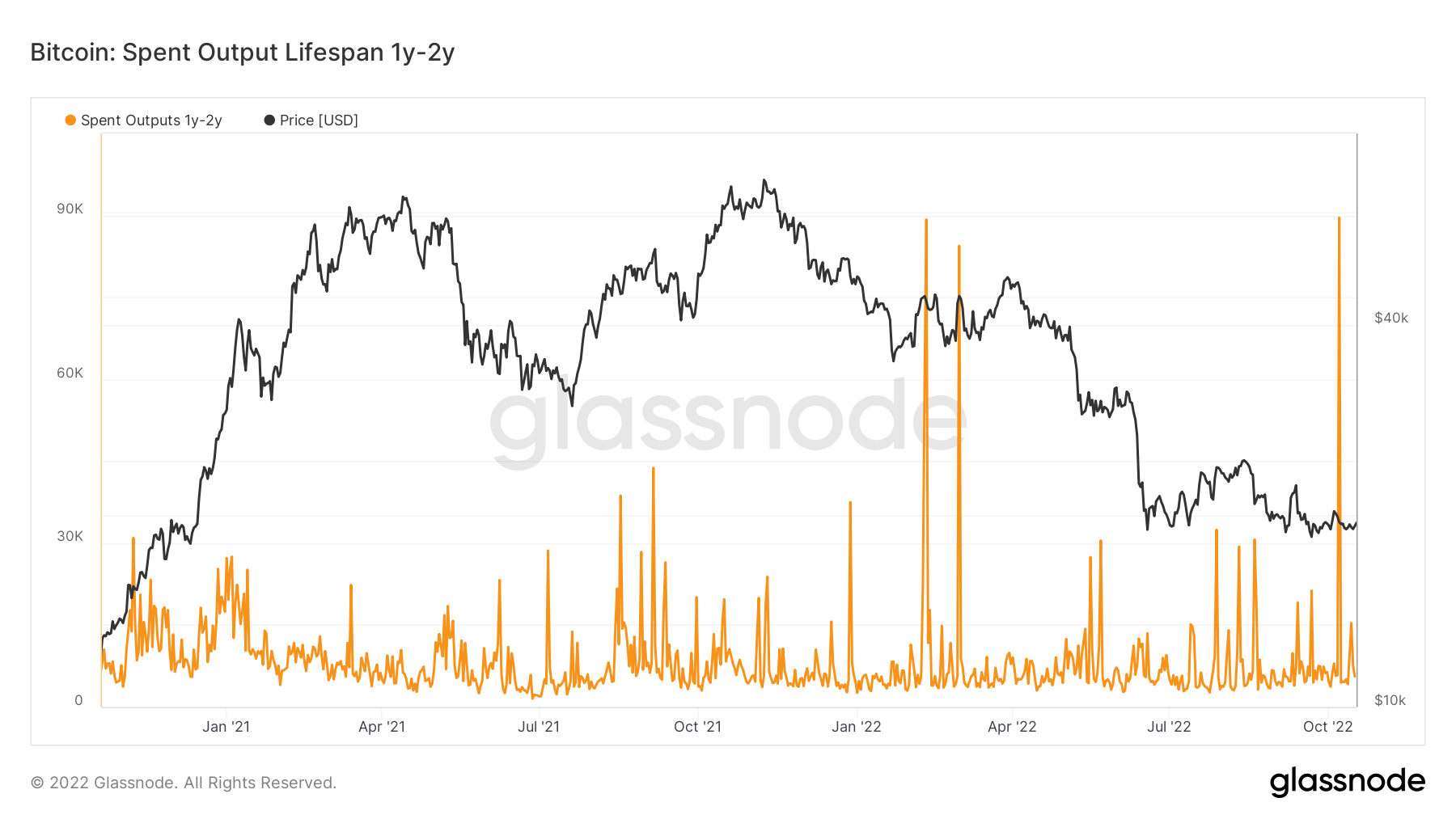

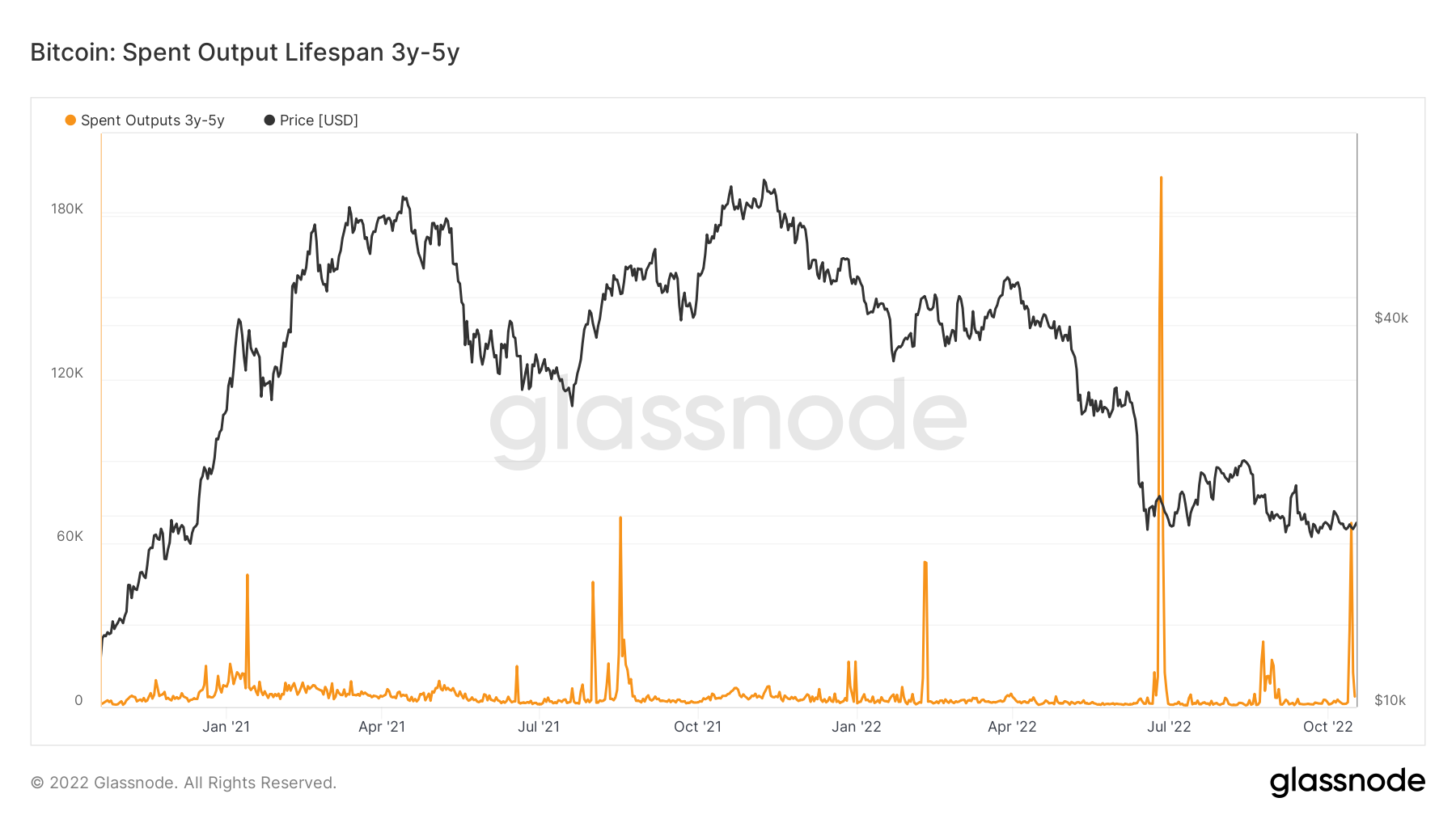

Metric 3 – Spent Outputs

The third metric we will cover today is Spent Outputs. In the past week, there have been some significant spikes on the Spent Outputs metric showing that older coins have been spent and a large amount of them was spent. In this context, spent means that these coins were moved and likely sold on-chain.

In looking at the Spent Outputs were coins that were last moved less than 1 year ago, there are little to no spikes, indicating that short-term holders had not sold a significant number of coins in the past weeks. However, if we look at the Spent Outputs aged 1 – 2 Years, 3 – 5 Years, and 5 – 7 Years, we can see that there are large spikes on these metrics – indicating that coins were Spent that hadn’t been spent 1, 3 and 5 Years prior to that.

Bitcoin – Spent Outputs 1 – 2 Years

Bitcoin – Spent Outputs 3 – 5 Years

Bitcoin – Spent Outputs 5 – 7 Years

What does the above tell us?

What does the above tell us?

The above tells us that investors who have held coins for many years are still looking at the current price levels as good levels to sell into i.e., they are expecting lower prices to re-accumulate at and are happy to sell some of their supply at the current prices as they believe they may be able to buy their supply back at a later date for less USD than what they’re getting now to sell their coins.

Metric 4 – Addresses

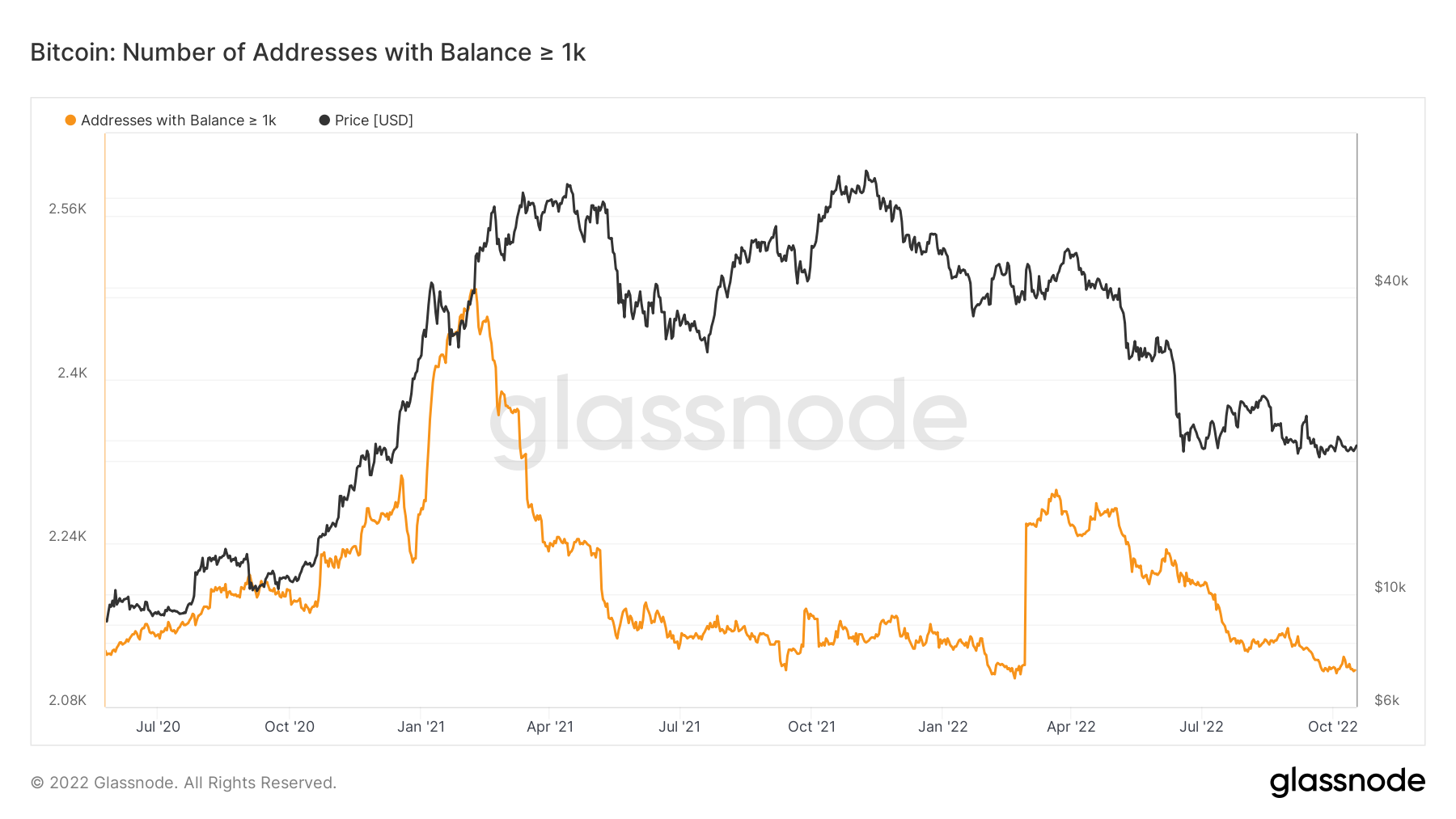

The last metric we will cover is the Addresses metric. From previous reports, we know that historically Wallet Addresses holding greater than 1,000 BTC have been the most profitable. As we dig further into that metric, we can see that this wallet cohort is still decreasing in the total number of wallets. This tells us that this cohort has still not risked-on (accumulated more BTC), potentially indicating that they still do not think the bottom is yet to be in.

Addresses w Balance > 1,000 BTC

Note: The large spike on Feb 28th, was not a misprint but it was not an organic increase in wallets from users. This generated new wallets from Exchanges, this was confirmed by the data provider, Glassnode.

S&P 500 Index

In last week's report, we made sure to mention that a bullish divergence has been formed on the S&P 500' RSI and we believed that this divergence was ultimately going to be invalidated entirely due to an uncertain macro environment and overall bad market conditions. However, that statement might not be entirely true now.

In last week's report, we made sure to mention that a bullish divergence has been formed on the S&P 500' RSI and we believed that this divergence was ultimately going to be invalidated entirely due to an uncertain macro environment and overall bad market conditions. However, that statement might not be entirely true now.

The index seems to have formed a perfect divergence and the RSI can be seen starting to rise, which might suggest that this bullish signal alone can be a warning sign that the SPX will experience a small rally.

However, an obstacle is in the way - the ~$3700 resistance level. Unless the index successfully reclaims that level, preferably on the weekly timeframe, then further upside remains skeptical. The $3800 level can also act as resistance if $3700 is broken and reclaimed. If we were to put this situation in a single sentence, it would be something like:

Too many obstacles on a zig-zag path.

Great things take time. Don't expect from this anything more than a simple short-lived rally until the world comes to its senses and the macro picture starts an actual healing process.

Ether - Technical Analysis

We've seen some volatility last week and from a technical standpoint ETH has formed a new low. However, we have to link ETH to the rest of the market since external influence still remains (Bitcoin & S&P 500). What that means is because both the S&P 500 and Bitcoin are showing bullish signals, we can only assume that ETH will follow in their steps.

We've seen some volatility last week and from a technical standpoint ETH has formed a new low. However, we have to link ETH to the rest of the market since external influence still remains (Bitcoin & S&P 500). What that means is because both the S&P 500 and Bitcoin are showing bullish signals, we can only assume that ETH will follow in their steps.

🟩 $1400 stands as resistance for now and a weekly reclaim of this level will lead to a $1740 in the next weeks.

🟥 Failure in reclaiming $1400 and ETH is back on the path toward $1000.

DOT

(Daily chart was used)

Another falling wedge can be seen for DOT, with the price also currently sitting at the top trend line. Big difference here is that the asset is already above the trend line, which suggests we can now expect higher prices.

(Daily chart was used)

Another falling wedge can be seen for DOT, with the price also currently sitting at the top trend line. Big difference here is that the asset is already above the trend line, which suggests we can now expect higher prices.

We've highlighted DOT's next targets, ideal for profit-taking in case of a rally. $7 is the first target DOT needs to break above to properly confirm a rally toward $8 - $8.50. A rejection on the other hand will lead to a fast decline in DOT's value and will most likely form new lows.

SNX

Surprise - it's another falling wedge! 😱

Surprise - it's another falling wedge! 😱

SNX is still inside the falling wedge we've been monitoring for a while, but we already knew that. Something that really surprised me here was that the asset managed to close green last week, even with all the selling pressure that occurred which pushed its price below the $2 level.

This indicates that buyers are present and ready to push prices higher if the rest of the market plays along. For now, waiting for a break above $2.50 is recommended if we were to expect higher prices, such as $3.50.

RUNE

(Daily chart was used)

RUNE registered a miniature bullish engulfing candle yesterday, which is why its price is also rising today. The asset is still inside a descending channel, which makes the situation a bit more difficult as others are either at support or about to break resistance - instead, RUNE is in the middle of this channel.

(Daily chart was used)

RUNE registered a miniature bullish engulfing candle yesterday, which is why its price is also rising today. The asset is still inside a descending channel, which makes the situation a bit more difficult as others are either at support or about to break resistance - instead, RUNE is in the middle of this channel.

Assuming the rest of the market performs well, we should see RUNE test the channel's top trend line in the coming days.

On another note, RUNE is at support on the weekly timeframe, which further boosts the possibility of rising, maybe even closing green this week.

SOL

(Daily chart was used)

SOL has lost its local support area after the CPI data came out and is now about to retest the same area. Failure in reclaming $30.5 will push SOL to another $29 test, but since a rejection can occur in the $30.5 - $32.5 area, a daily lower high will be marked which will eventually lead to sub $29 in the near future.

(Daily chart was used)

SOL has lost its local support area after the CPI data came out and is now about to retest the same area. Failure in reclaming $30.5 will push SOL to another $29 test, but since a rejection can occur in the $30.5 - $32.5 area, a daily lower high will be marked which will eventually lead to sub $29 in the near future.

We're gonna have to wait for a price progression throughout the week to understand what SOL's up to next.

Note: A new low has been formed on the weekly timeframe. This is an obvious sign that SOL's market structure is not going to shift anytime soon, which means bearishness will resume.

SRM

Declining resumes, as SRM forms a bearish engulfing candle on the weekly timeframe which also marks an all-time low. There's no denying that this asset has performed poor over the last few months and will most likely continue to do so. The only thing we can do here is watch certain levels and react to any changes.

Declining resumes, as SRM forms a bearish engulfing candle on the weekly timeframe which also marks an all-time low. There's no denying that this asset has performed poor over the last few months and will most likely continue to do so. The only thing we can do here is watch certain levels and react to any changes.

SRM is currently testing $0.74, which was the previous major support area before it was lost last week. Failure in reclaming $0.74 this week will be the start of a downside price discovery for the asset. If the level is successfully reclaimed, then we could witness ranging above the level until an external factor pushes SRM into choosing a direction (i.e. important piece of news, important event, etc).

FTT

Last week, FTT experienced selling pressure similar to how all assets have experienced, but the accuracy at which FTT has seen buyers step in has to be mentioned. The asset has came down to $22.45, the bottom part of a major support area which suggests that this level had enough buy orders to hold the price above it.

Last week, FTT experienced selling pressure similar to how all assets have experienced, but the accuracy at which FTT has seen buyers step in has to be mentioned. The asset has came down to $22.45, the bottom part of a major support area which suggests that this level had enough buy orders to hold the price above it.

Buyers quickly stepped in and pushed FTT back to the top part of its current support area ($24). The asset is now battling with this level on lower timeframes. For now, it does look like we're going to see a bit more upside, but the overall market structure remains bearish with lower highs formed on a constant basis. On a larger scale, nothing's changed. We are likely going to see lower prices than this.

MINA

(Daily chart was used)

Strong performance from MINA - the asset has seen a solid surge in its price today, rising over 10% in less than 3 hours which quickly pushed the price to the top trend line of this descending channel. What we're witnessing now is sell orders getting filled, this is the reason why MINA was unable to continue rising and head to new highs.

(Daily chart was used)

Strong performance from MINA - the asset has seen a solid surge in its price today, rising over 10% in less than 3 hours which quickly pushed the price to the top trend line of this descending channel. What we're witnessing now is sell orders getting filled, this is the reason why MINA was unable to continue rising and head to new highs.

However, let's not get ahead of ourselves. MINA has had a strong performance over the last three days, but the asset is still inside the channel. Until we have a clear break above or under the channel, MINA will continue to range between the two trend lines.

Obviously, with the asset's latest performance, we can only assume that a break above the channel will occur soon.

dYdX

(Weekly chart was used)

dYdX encountered a small issue in rising further, as the $1.50 - $1.65 acts as a weekly resistance level. As with any other chart, we have to look objectively here - dYdX has been forming constant lower highs for about a year now. What we're witnessing now is a potential lower high on the weekly timeframe, with the previous one registered at $1.65.

(Weekly chart was used)

dYdX encountered a small issue in rising further, as the $1.50 - $1.65 acts as a weekly resistance level. As with any other chart, we have to look objectively here - dYdX has been forming constant lower highs for about a year now. What we're witnessing now is a potential lower high on the weekly timeframe, with the previous one registered at $1.65.

dYdX is at risk of forming a weekly lower high here, and unless buyers step in and reclaim $1.65 on the larger timeframes, then we could be seeing $1 in the coming weeks.

Summary

Much of the on-chain data suggests that investor sentiment is still deeply negative with investors grateful to be able to sell their coins into break-even levels. We’re also seeing that the large BTC holders have not yet fully risked-on and have also looked to sell into the $20,000 level as we have seen the spike in Coin Days Destroyed from some of the older coins.It may be possible that in the short-term, the S&P may help to drive a relief rally due to bullish divergences from oversold levels. This may result in other highly correlated risk assets (Crypto) having a similar rally. However, with Core Inflation at a 40-year high and the escalating tensions between Russia and Ukraine, it is unlikely we see a rally that gets any meaningful momentum, and rallies may be short-lived.