Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro

This week, there are a few key macro data points that may help to move markets. The first of these released throughout the week is Big Tech Earnings. In general, Earnings have come in around estimates having previously been revised down in the prior 6 weeks, so therefore it is possible Earnings ‘beat’ expectations. However, this is unlikely to catalyse a significant rally.The standout piece of data to watch is the Core PCE data on Friday. It is expected that YoY inflation is to be 5.17%, which is an increase from the prior reading. A higher Core PCE suggests a continued aggressive FED which would cause headwinds to risk assets in the coming months. However, we and the markets will get more information on what the FED is likely to do in the coming months when FED Chair Powell speaks next Wednesday (02/11/22).

TLDR

- Core PCE is the key data point this week alongside Big Tech Earnings. Core PCE is expected to come in higher whilst Big Tech Earnings may beat the low revised expectations bar.

- All-time highs in miner difficulty has seen the cost of production for Bitcoin increase. This places a greater pressure on the inefficient miners and may force them to dump their coins.

- The Seller Exhaustion Constant shows that we’re currently seeing low volatility but not the high loss taking to match it. It may be the case that a large flush out in price sees this metric spike higher.

- Currently, investors are taking out a lot of highly leveraged derivatives trades as we see the Estimated Leverage Ratio soar.

Total Market Cap

(Daily chart was used)

The Total Market Cap index has broken above a daily resistance trend-line, closing its second candle above it last week. From a technical standpoint, there's nothing stopping the index from testing $950B - $1.03T.

(Daily chart was used)

The Total Market Cap index has broken above a daily resistance trend-line, closing its second candle above it last week. From a technical standpoint, there's nothing stopping the index from testing $950B - $1.03T.

Nothing other than the 💩 economy that will bring crypto down with it.

Altcoins Market Cap

(Daily chart was used)

Similarities continue to be present between the two indexes - the Altcoins Market Cap has also broken above a local resisting trend line and is now on a path toward $550B.

(Daily chart was used)

Similarities continue to be present between the two indexes - the Altcoins Market Cap has also broken above a local resisting trend line and is now on a path toward $550B.

Bitcoin - Technical & On-Chain Analysis

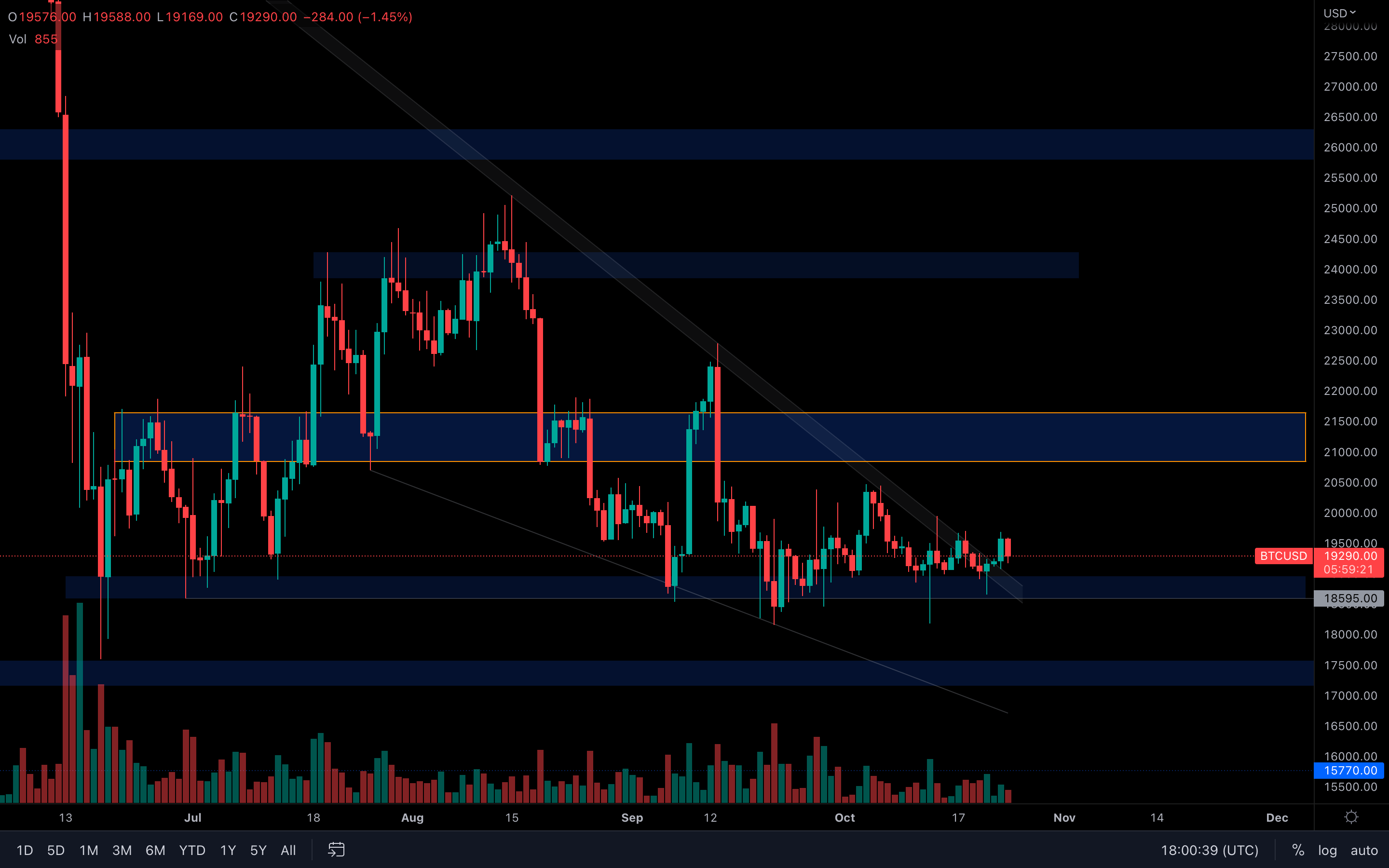

(Daily chart was used)

Yes, it's another trend line break - Bitcoin has the same price action as the two indexes we covered previously, which means the asset is also on a path toward higher levels, specifically $21,000.

(Daily chart was used)

Yes, it's another trend line break - Bitcoin has the same price action as the two indexes we covered previously, which means the asset is also on a path toward higher levels, specifically $21,000.

The only concern here would be that volume has been descending for a while. Keep that in mind when jumping into this market.

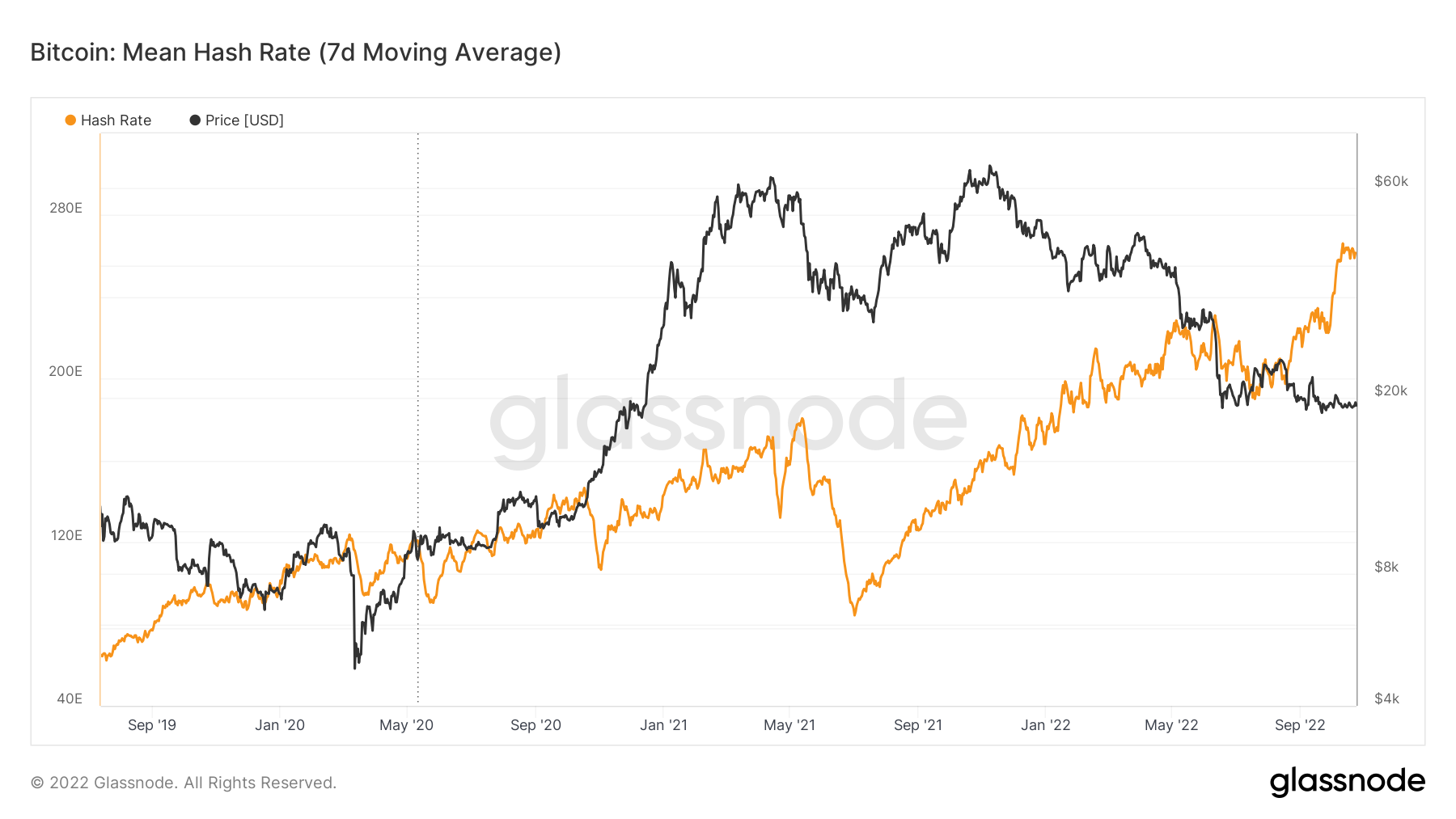

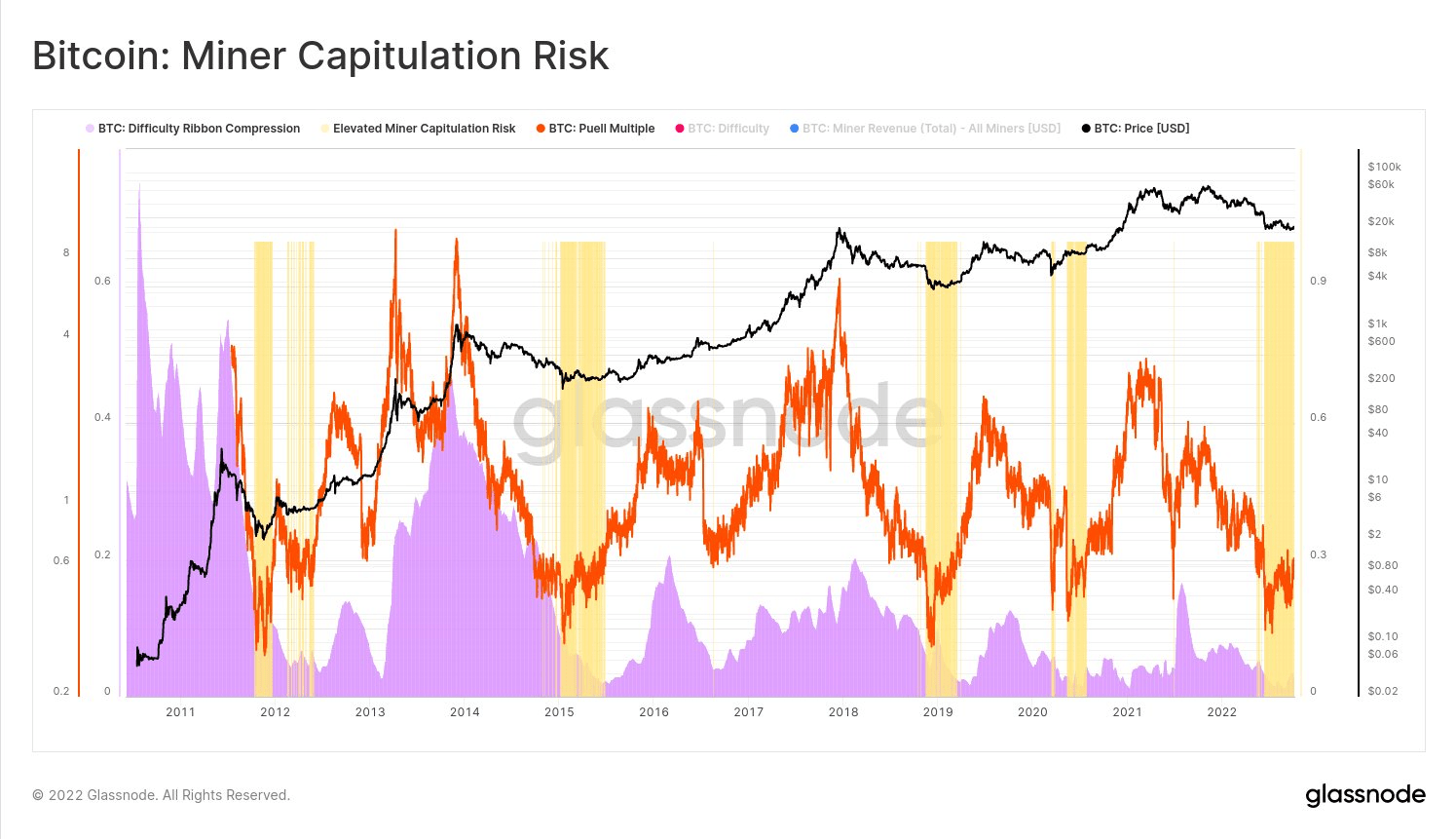

Metric 1 – Difficulty and Hash Rate

The first set of metrics we will cover today is the mining metrics. In the past few weeks, ‘Difficulty’ has reached all-time highs - this means the costs to produce/mine a Bitcoin has increased considerably. The most efficient miners are believed to be operating at a production cost of around $12,000, while average miners are working at a production cost of $17,000. Inefficient miners are seeing their costs of mining a single Bitcoin be north of $20,000. As new mining rigs have come online, the competition to mine Bitcoin has increased dramatically, putting more and more pressure on inefficient miners. We can track the Pull Multiple and the Difficulty Ribbon Compression to see when both of these metrics are low, the risk of Miner capitulation increases. We can see from the second chart below that both of these overlapping metrics are at a low point and may indicate that a Miner capitulation is near. This may be emphasised as investors remain risk-off due to the macro conditions; hence miners may have more months of this to absorb.

Bitcoin – Difficulty (zoomed in)

Bitcoin – Risk of Miner Capitulation (zoomed out)

Bitcoin – Risk of Miner Capitulation (zoomed out)

Metric 2 – Seller Exhaustion Constant

Metric 2 – Seller Exhaustion Constant

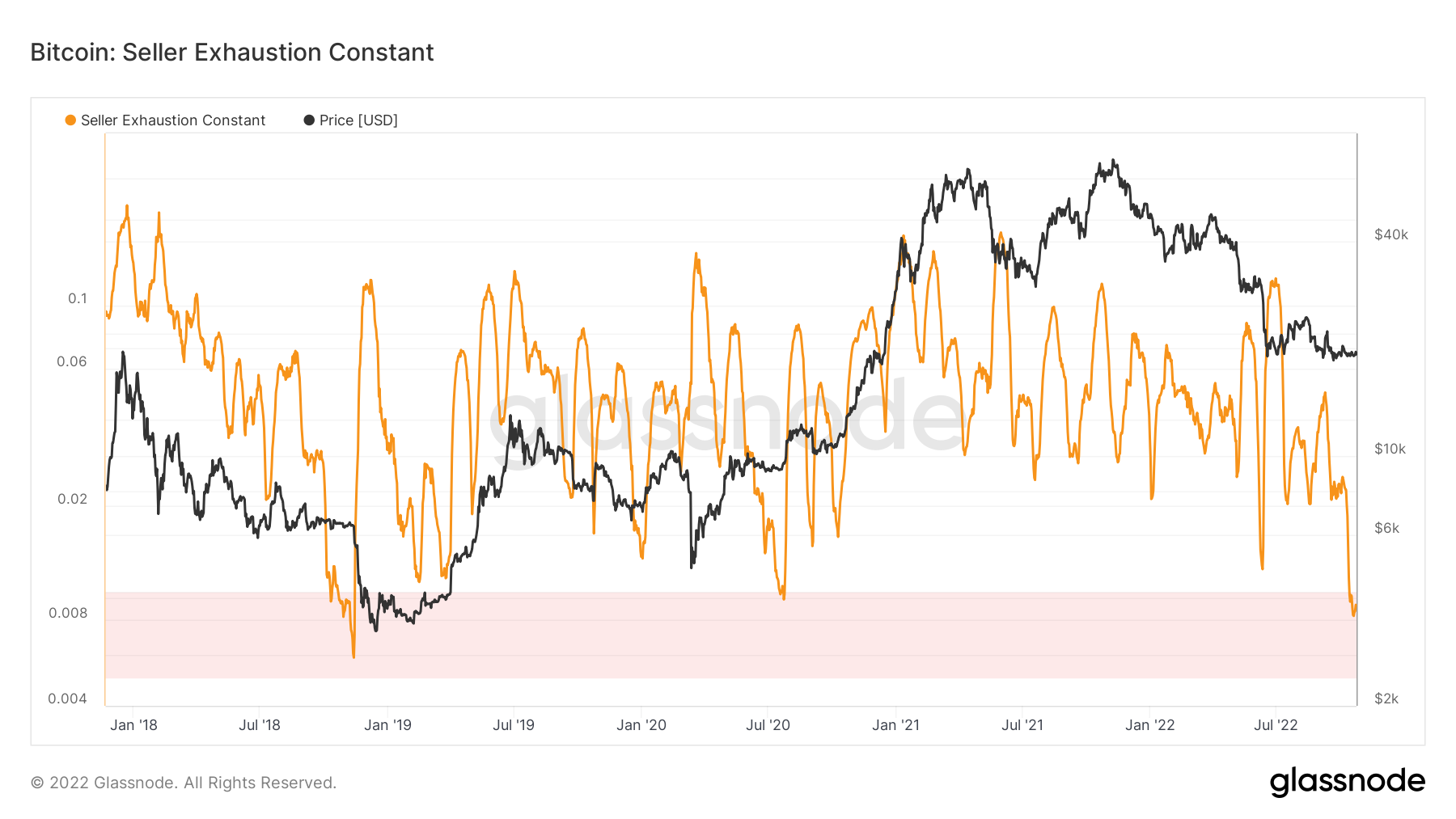

The second metric in today’s report is the Seller Exhaustion Constant. This detects when low volatility and high losses occur. Both of these together have historically indicated lower risk bottoms. At this moment, we have low volatility, but losses are not heightened compared to the past. We can see below that this metric spiked to its lowest in the December 2018 crash. We’re currently around this level, and it may be possible, with Chair Powell speaking next Wednesday, that volatility is on the horizon, pushing this metric lower and spiking off the bottom. An aggressively hawkish Powell potentially indicating another 100 – 125 basis points of rate rises, on top of the 75 bps expected on November 2nd (next Wednesday), could see markets have this spike in volatility and loss-taking. A significant move down may also see more inefficient miners off-load their existing supply, potentially seeing the median efficient miners sell some of their coins.

Bitcoin – Seller Exhaustion Constant

Metric 3 – Estimated Leverage Ratio

Metric 3 – Estimated Leverage Ratio

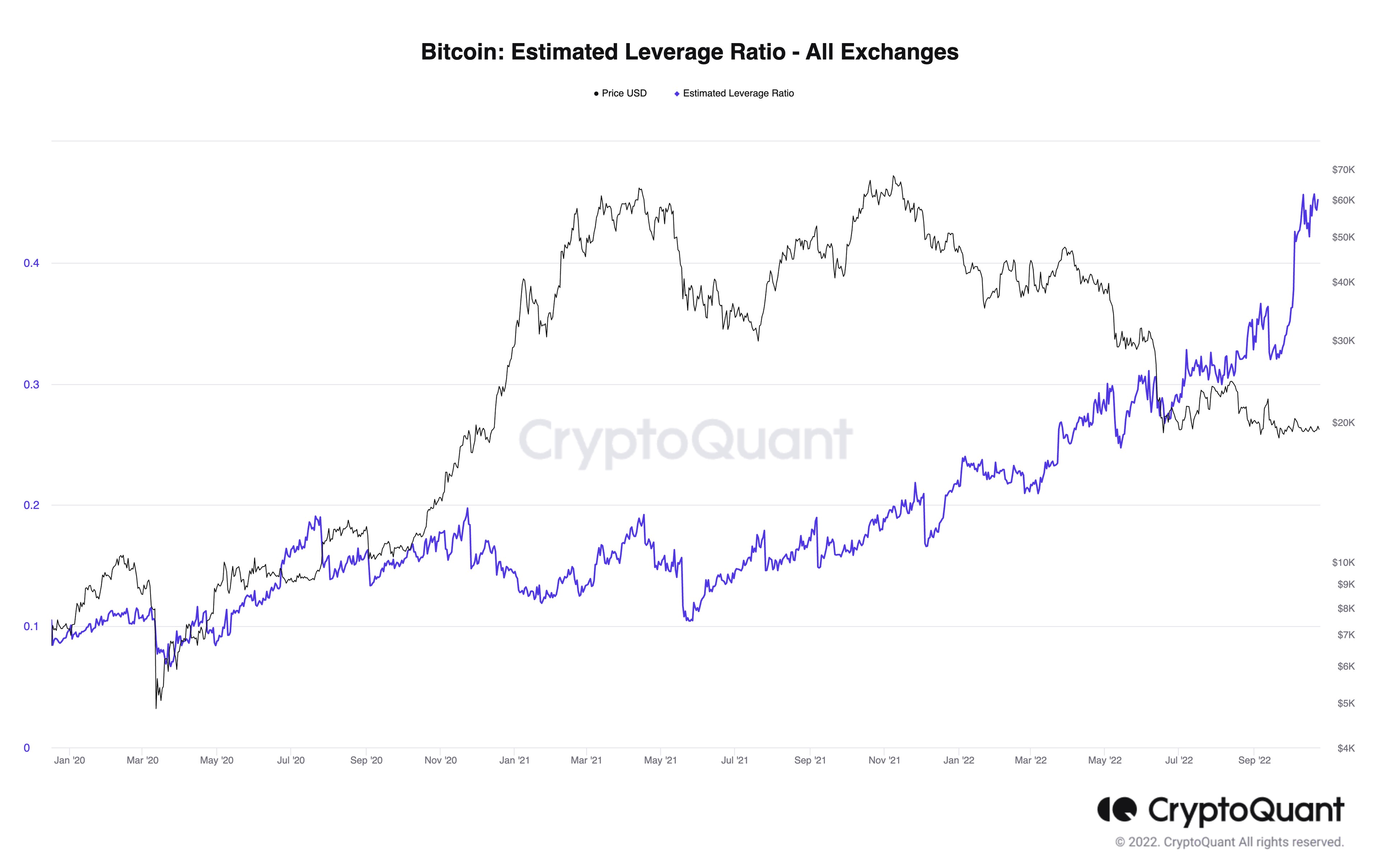

The Estimated Leverage Ratio is the Exchange’s Open Interest divided by the coins in reserve. This shows us how much leverage is being used compared to the existing Exchanges balance. We can see in the below graph that this metric has spiked higher in the past few weeks, indicating that more investors are placing high-leverage trades. When the market sees a high leverage ratio, the market tends to flush this leverage out in a significant move.

Bitcoin – Estimated Leverage Ratio

Metric 4 – Percent UTXO’s in Profit

Metric 4 – Percent UTXO’s in Profit

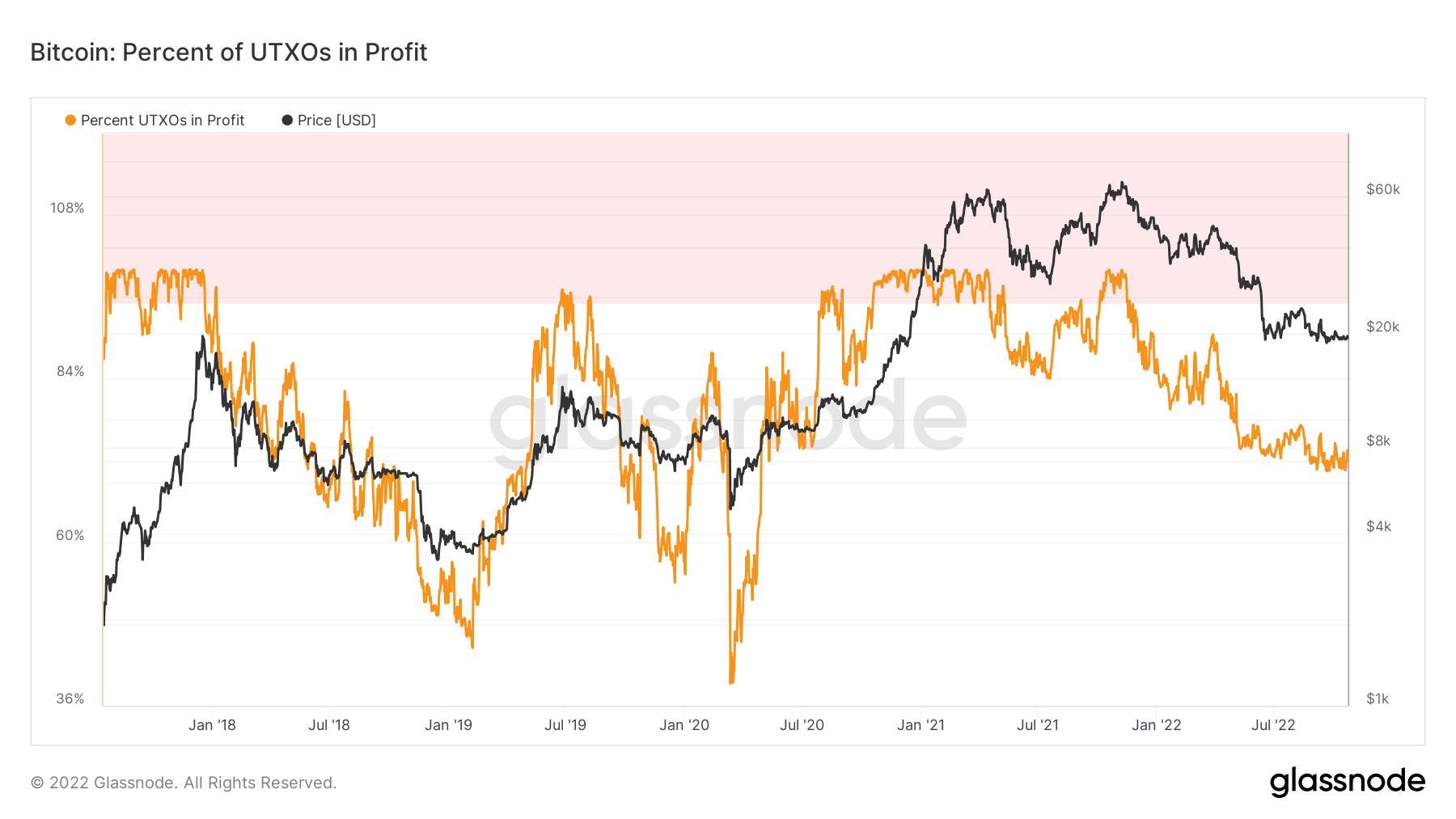

The Percent UTXO’s in Profit shows the percentage of Bitcoin supply (unspent transactions) that remains in a profit. Currently, this metric is in the low 70 percent. But, if we look back at the prior bear market, this metric mainly was range-bound between 60 and 70 percent. This may indicate to us that this metric has a further downside.

Bitcoin – Percent UTXO’s in Profit

S&P 500 Index

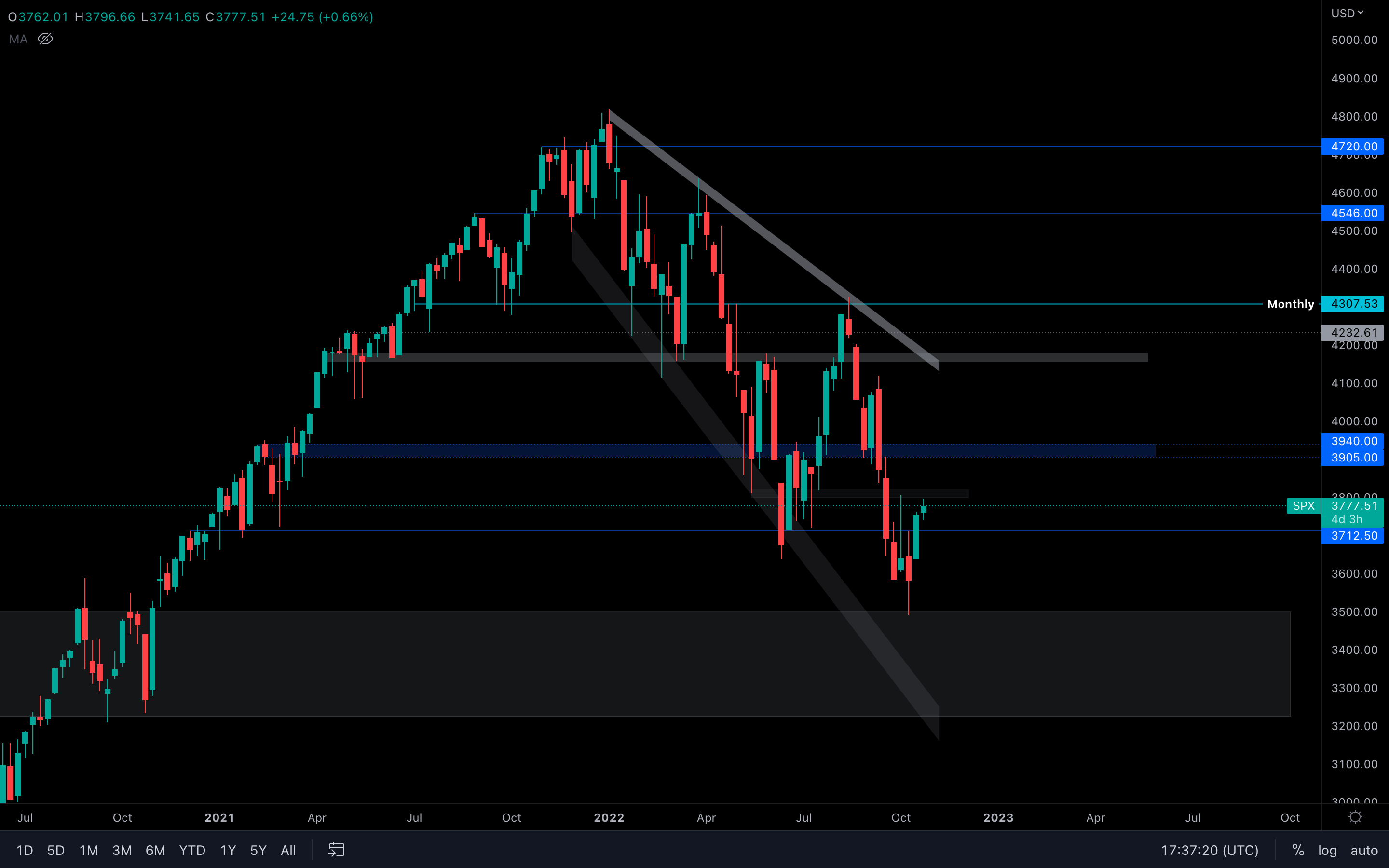

Last week, we mentioned that $3700 needs to be broken in order for the S&P 500 Index to rise higher. That level has been broken last week after we closed a candle above it. However, there is another obstacle in the index's path - $3800.

Last week, we mentioned that $3700 needs to be broken in order for the S&P 500 Index to rise higher. That level has been broken last week after we closed a candle above it. However, there is another obstacle in the index's path - $3800.

If/when $3800 is broken, $3940 will follow. Until that happens, the SPX is at risk at getting rejected.

Ether - Technical Analysis

Ether has been steadily rising for the past few weeks and has now encountered resistance at the $1350 - $1400 area. Failure in breaking above $1400 will mark a weekly lower high which will push the asset toward June lows.

Ether has been steadily rising for the past few weeks and has now encountered resistance at the $1350 - $1400 area. Failure in breaking above $1400 will mark a weekly lower high which will push the asset toward June lows.

I'd rather wait for a direction to be confirmed until making any decisions.

DOT

(Daily chart was used)

DOT was unable to stay above the wedge last week and has fallen inside it once again. Following that event, the asset has closed a candle above it, but the volume remains at miniscule levels.

(Daily chart was used)

DOT was unable to stay above the wedge last week and has fallen inside it once again. Following that event, the asset has closed a candle above it, but the volume remains at miniscule levels.

I'd say there's a 10% chance of DOT actually rising above $7 here, because of economical reasons and bad market conditions (i.e low volume). Not something you'd want to trade.

SNX

Clear rejection after testing the top trend line of this wedge - SNX is now on a path to $2. However, prices can still be influenced by a both good-performing SPX and Bitcoin, so no guarantees (as it has always been in crypto).

Clear rejection after testing the top trend line of this wedge - SNX is now on a path to $2. However, prices can still be influenced by a both good-performing SPX and Bitcoin, so no guarantees (as it has always been in crypto).

RUNE

RUNE is struggling to stay above $1.40 and as a result, more and more orders will get filled. Eventually, if this continues, the level will be lost.

RUNE is struggling to stay above $1.40 and as a result, more and more orders will get filled. Eventually, if this continues, the level will be lost.

For now, the asset still hasn't closed under $1.40 which means there's still a chance of rising from here. However, another thing to note is that RUNE's volume has been descending for multiple months, not something you'd want to see when looking for potential bullish momentum.

SOL

After closing under the $30.5 - $32.75 local supporting area, SOL continued to descend and is now sitting just under the $29 daily support level.

After closing under the $30.5 - $32.75 local supporting area, SOL continued to descend and is now sitting just under the $29 daily support level.

When looking at the weekly chart, we're not seeing any bullish signals - no bullish candles, no bullish market structure, no bullish trend, the entire chart screams "I'm bearish". For that reason, so are we. SOL will most likely continue to descend toward $21 in Q4.

SRM

We've mentioned in past reports that a loss of $0.74 will confirm a downside price discovery for SRM. That happened.

We've mentioned in past reports that a loss of $0.74 will confirm a downside price discovery for SRM. That happened.

What happened next? SRM formed another all-time low. Expect the same thing to happen again.

FTT

FTT is at a decisive point - its price is sitting just above the bottom part of its current support area ($22.45 - $24), but also just under a local resisting trend line.

FTT is at a decisive point - its price is sitting just above the bottom part of its current support area ($22.45 - $24), but also just under a local resisting trend line.

Uncertain chart, we need more data to pick a side. What we should watch carefully is either a loss of $22.45 via weekly closure under, or a break of the resisting trend line (weekly closure above).

MINA

(Daily chart was used)

The asset has seen a nice upswing last week, rising above the local channel MINA is currently trading inside of. However, that still wasn't enough as sellers have pushed its price back down with little to no effort.

(Daily chart was used)

The asset has seen a nice upswing last week, rising above the local channel MINA is currently trading inside of. However, that still wasn't enough as sellers have pushed its price back down with little to no effort.

Yesterday, a bearish candle has been formed right into resistance - strong selling pressure. Today, that pressure continues to unfold and will likely continue to do so until $0.50 is tested this week.

dYdX

Finally, some green!

Finally, some green!

dYdX is one of the lucky few that has seen green candles over the last few weeks. However, it is currently at risk as its price has reached the $1.50 resistance area. A lower high can form here, which will keep the market structure intact and invalidate the entire $1.29 - $1.50 move that occured over the last three weeks.

Only a reclaim above $1.60 will be considered a bullish signal - until then, we can only assume that dYdX will head lower.