Disclaimer: Not financial nor investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Macro

In the June and July FOMC meetings, it is expected that there will be rate rises by 50 basis points at each meeting before the next meeting in September. The aim of raising rates is to make the cost of borrowing money more expensive, resulting in a reduction in demand for borrowing and therefore spending decreasing, ending in inflation coming down. The next inflation print is Friday, 10th June (this Friday). It is forecasted that it will be 8.3%. Last week, the Unemployment Rate came in at 3.6%, what this effectively means is that the labour market is currently still strong and the FED has room to tighten (raise) rates into. This effectively means, that markets will continue to struggle in terms of liquidity, and it’ll be tough for Bitcoin to sustain any rallies with any meaningful momentum.TLDR

- Bitcoin finally managed to close its first green week in over 2 months, which suggests short-term upside movement might be on the cards.

- In the past few weeks, selling has been mostly driven by short-term holders.

- The Accumulation Trend Score suggests accumulation. But prior bear markets are suggesting a similar pattern of accumulation before a final last move down and accumulation increasing more heavily into the finalisation of that last leg down.

- The number of UTXOs still in a profit remains relatively high (75%), it may be the case that this needs to come down further to flush out more weak hands.

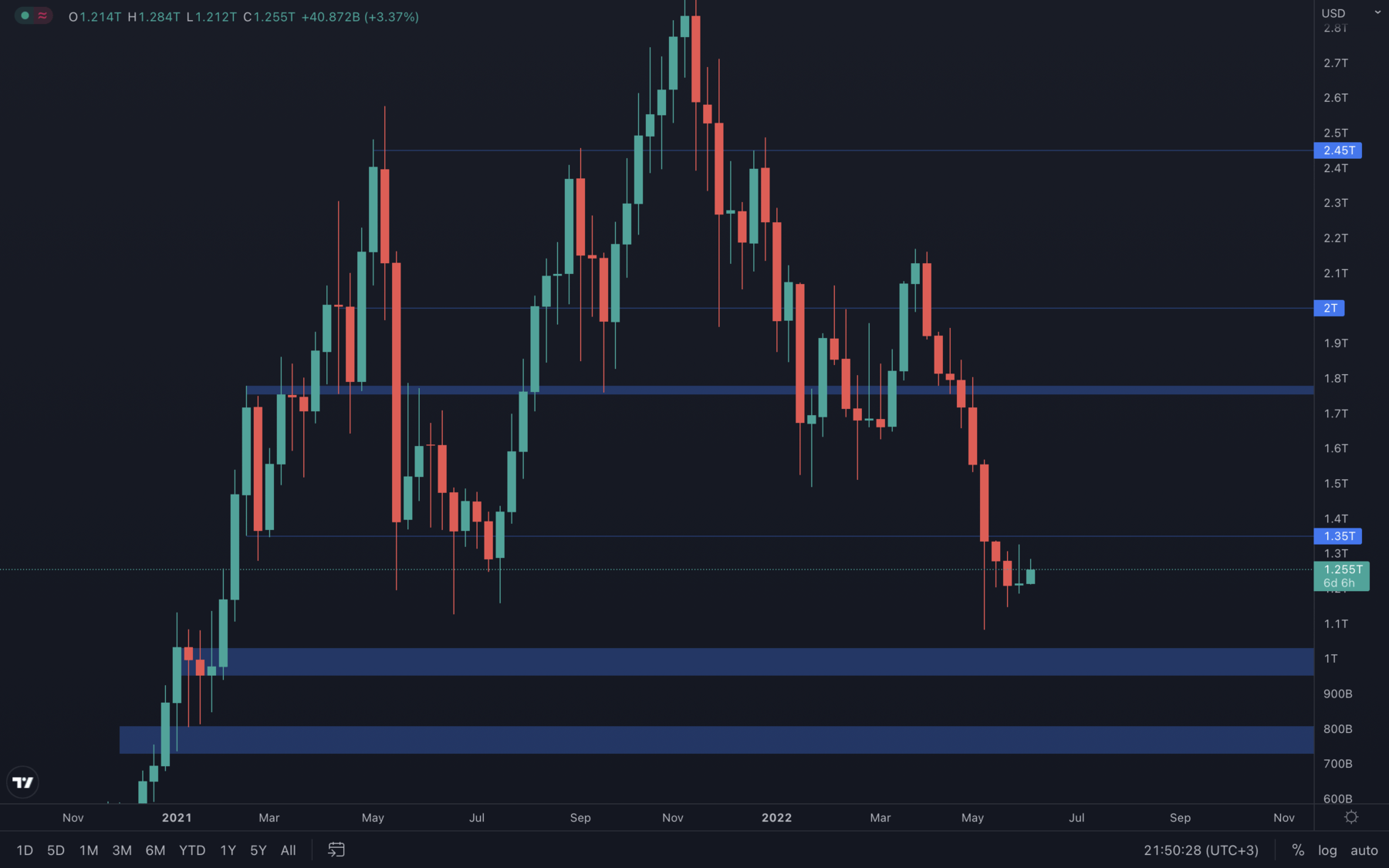

Total Market Cap

Ladies & gentlemen - the time has come. The total market cap closed green last week, the first green candle since the start of April. This only indicates one main thing - selling pressure has finally come to an exhaustion and buyers are starting to regain control over the price. Now, let's not get ahead of ourselves. Even though we are most likely going to experience a rally in the first half of June, it will be cut short due to decreased volume. Prices cannot be sustained without proper buying pressure and we have no signs of that changing anytime soon. Caution is advised, even though the odds of a short-term rally are higher in this case.

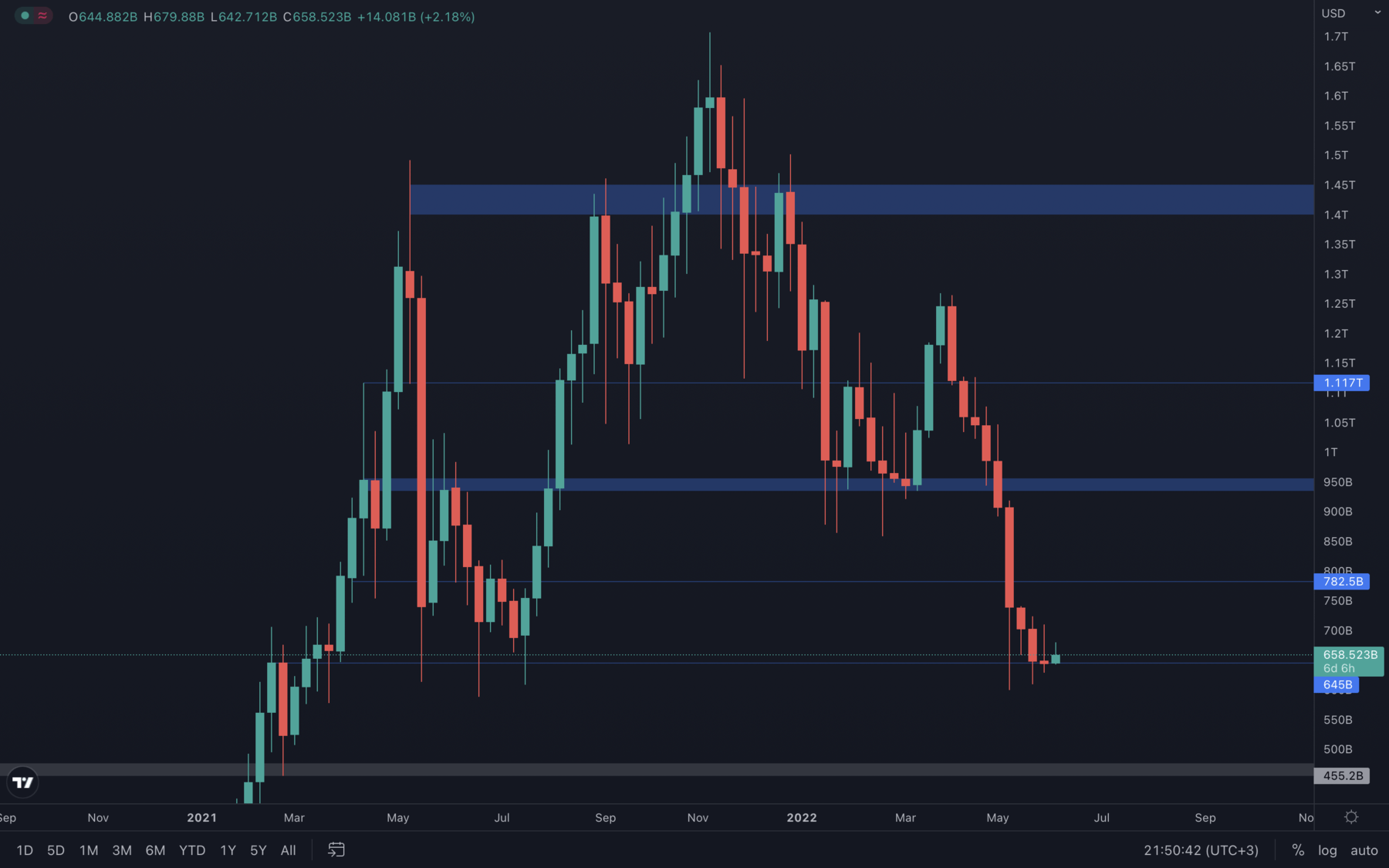

Altcoins Market Cap

The altcoin market cap managed to perfectly close above its $645B support level last week - until a weekly candle closes under $645B, we cannot expect further downside. It's safe to assume the market altcoins market will follow the Bitcoin, but not as we might think so. Bitcoin's dominance has been increasing at an incredible pace for multiple weeks, which are blocking alts from outperforming - check the BTC Dominance chart below.

The altcoin market cap managed to perfectly close above its $645B support level last week - until a weekly candle closes under $645B, we cannot expect further downside. It's safe to assume the market altcoins market will follow the Bitcoin, but not as we might think so. Bitcoin's dominance has been increasing at an incredible pace for multiple weeks, which are blocking alts from outperforming - check the BTC Dominance chart below.

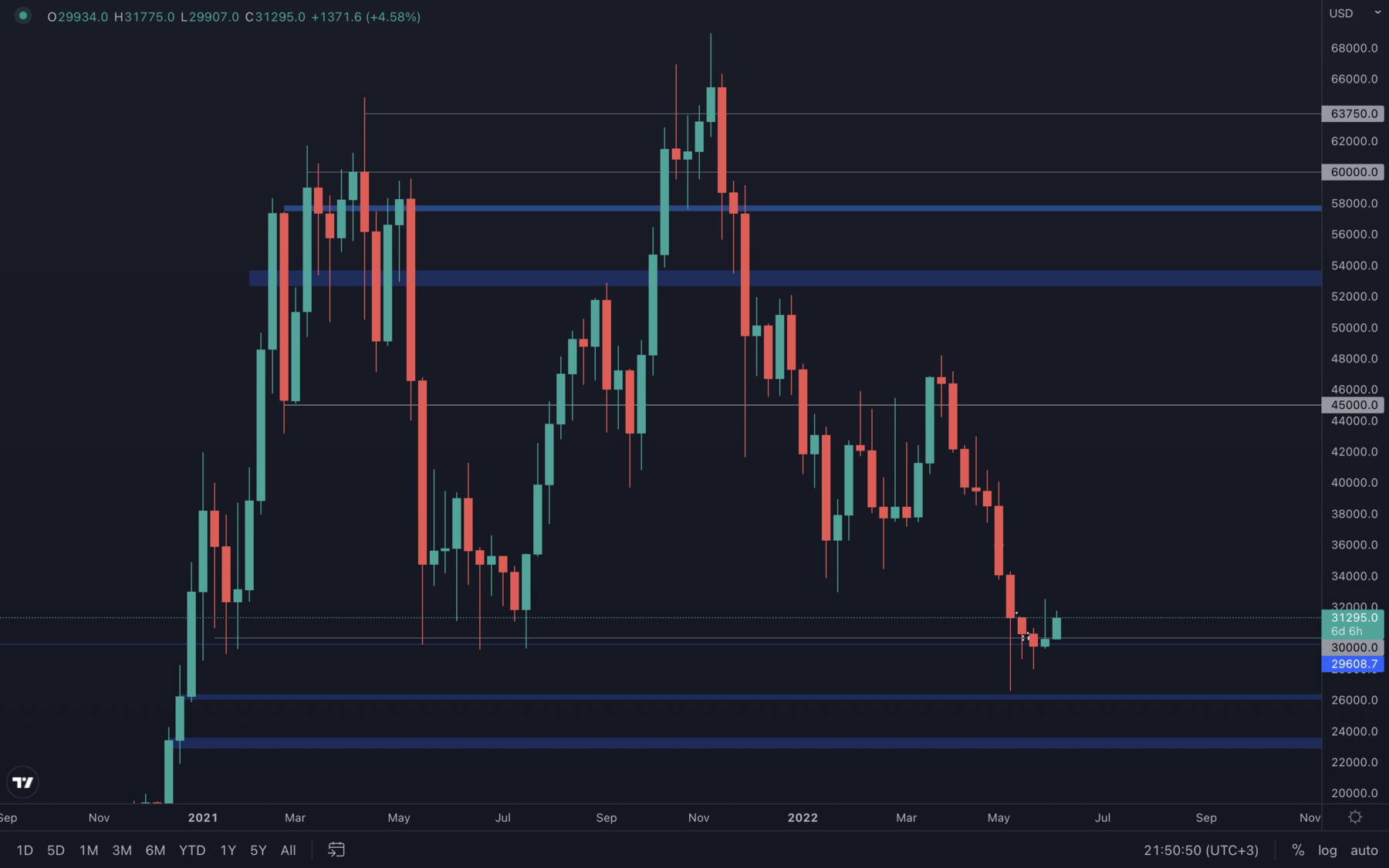

Bitcoin - Technical & On-Chain Analysis

After 9 red weeks, it is finally here - a green weekly candle. Even though last week closed just under the $30.000 psychological & technical level, price is experiencing a solid percentage move to the upside in not even 24 hours since the new weekly candle opened. As long as price doesn't drop under the $30.000 level by a weekly candle closure under it, then further downside is invalidated.

After 9 red weeks, it is finally here - a green weekly candle. Even though last week closed just under the $30.000 psychological & technical level, price is experiencing a solid percentage move to the upside in not even 24 hours since the new weekly candle opened. As long as price doesn't drop under the $30.000 level by a weekly candle closure under it, then further downside is invalidated.

As we have been mentioning for some time now, a potential relief rally is on the cards - markets always work the same, and neither selling nor buying pressure can be maintained on a constant basis. This suggests that for Bitcoin, selling pressure has slowed down for now and that there are higher odds of further upside than further downside in the short-term.

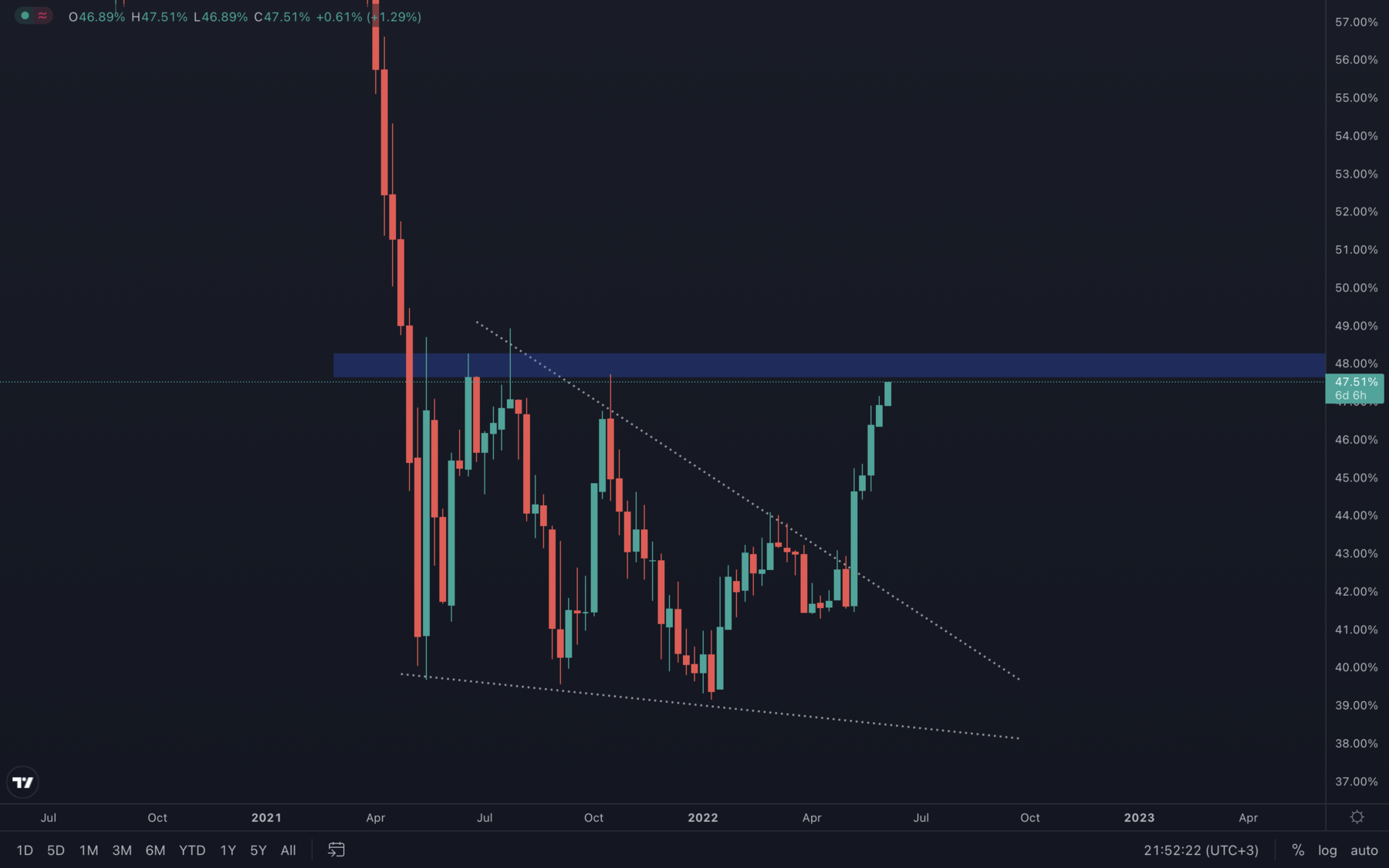

Bitcoin Dominance

Bitcoin's dominance has been increasing at an extremely fast paced in the last couple of weeks - this forced alts to underperform, and even close more bearish than Bitcoin itself. However, the dominance is slowly approaching an important technical area, which we believe will present a change in performance, as it's likely Bitcoin's dominance will start to slow down or even descend; this will result in altcoins outperforming. However, a break of this area will lead to further upside for Bitcoin, but less upside for altcoins and even the possibility of consolidation.

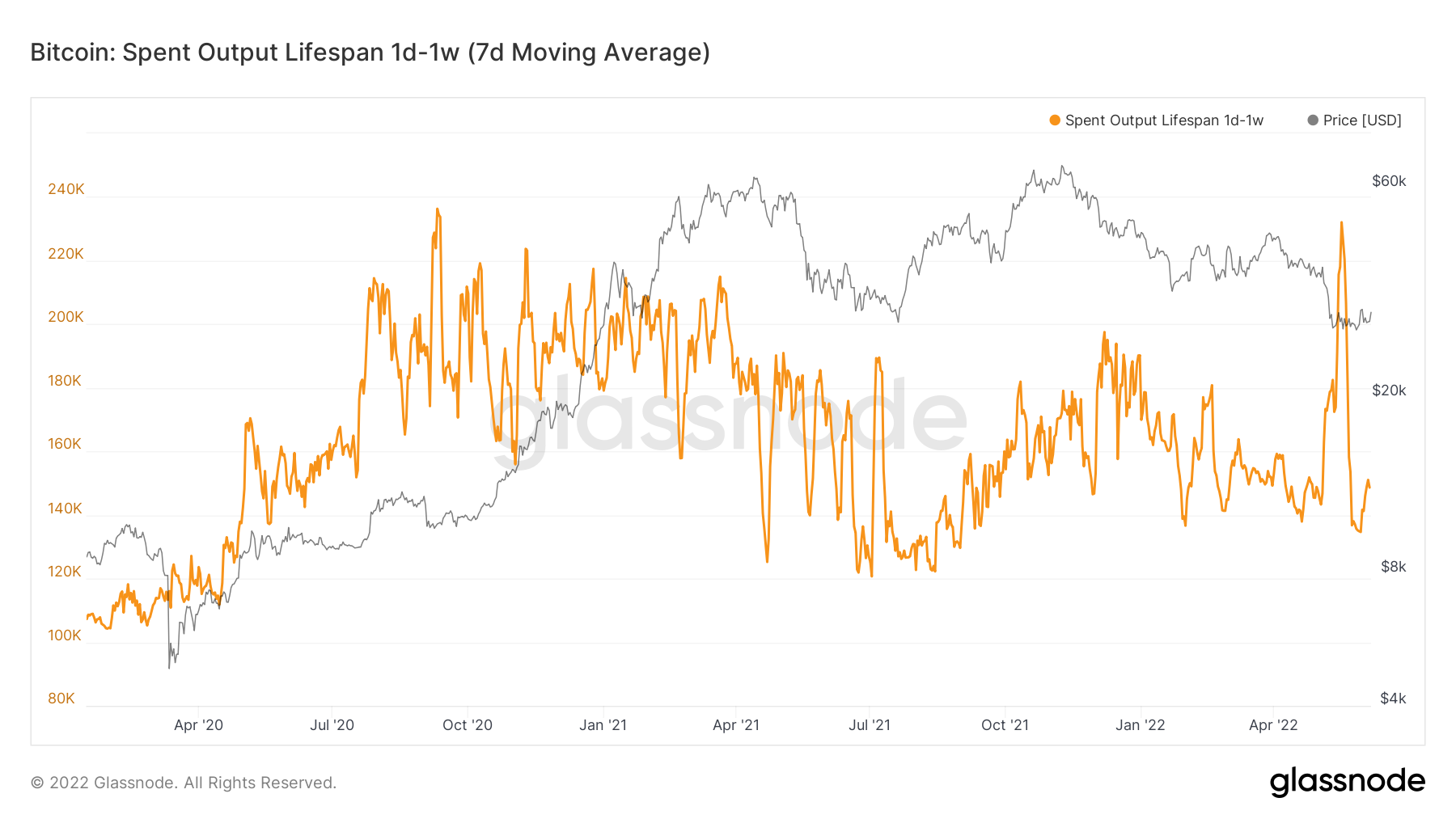

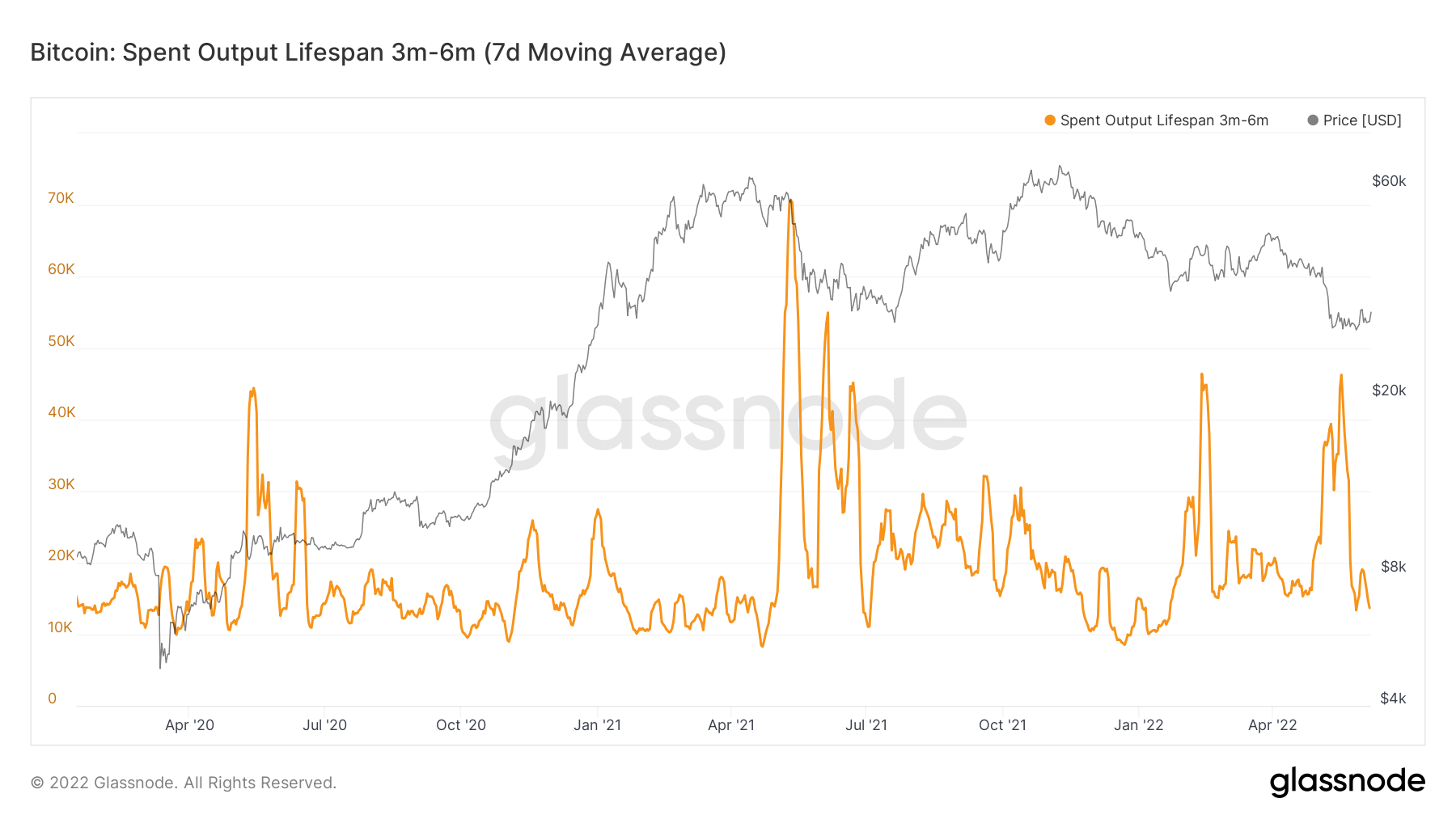

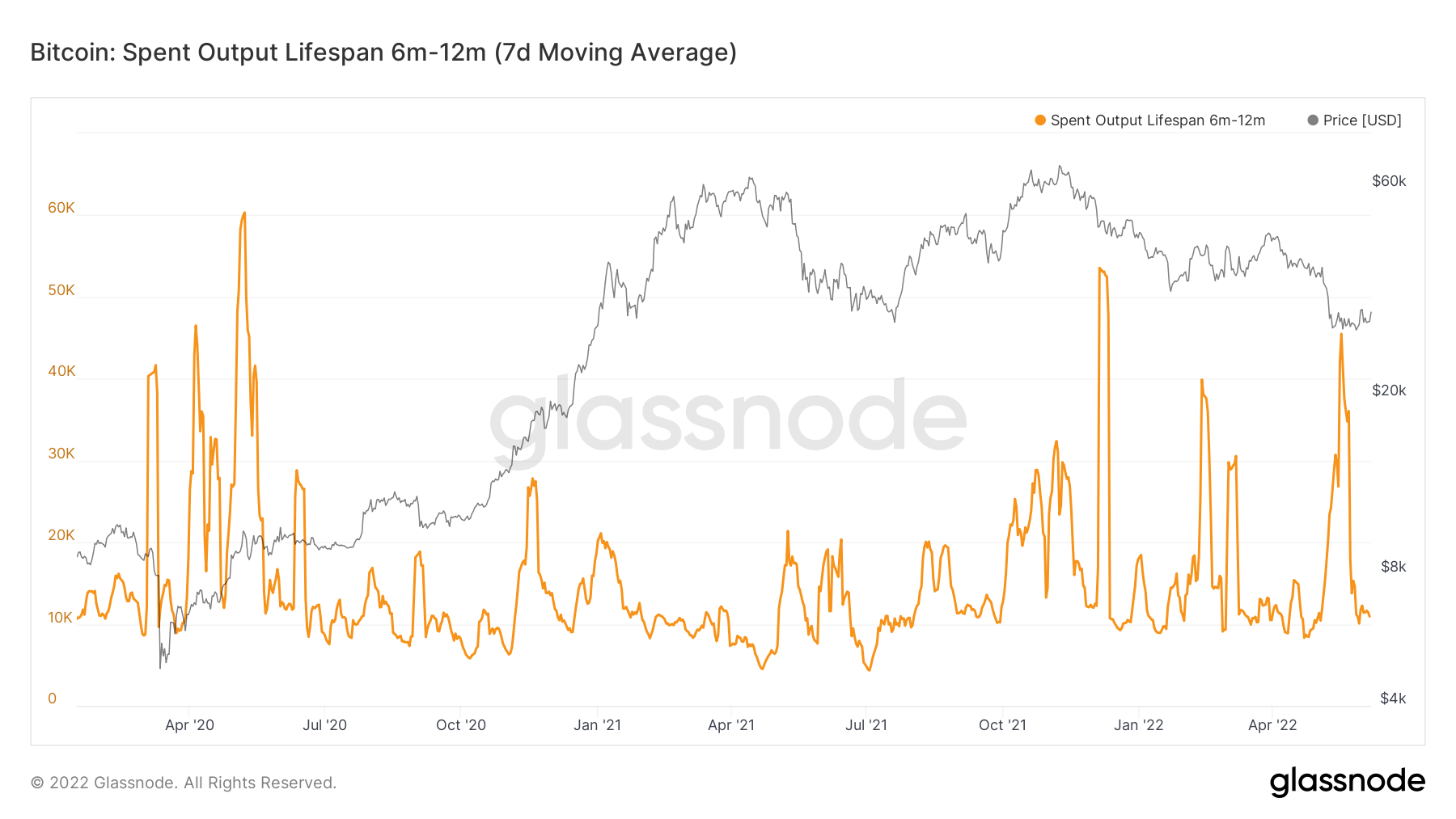

Metric 1 – Spent OutputsIn the last few weeks, we have seen crypto sell-off and then stabilise. Following the sell-off, Bitcoin remained range-bound between $28,700 and $31,300. In this period, there was a lot of short and mid-term selling taking place as we can see from the charts below.

Bitcoin – Spent Outputs 1D – 1W

Bitcoin – Spent Outputs 3M – 6M

Bitcoin – Spent Outputs 3M – 6M

Bitcoin – Spent Outputs 6M – 1Y

Bitcoin – Spent Outputs 6M – 1Y

Metric 2 – Accumulation Trend Score

A new metric we’re looking at today is the Accumulation Trend Score. This is an indicator that reflects the relative size of entities that are actively accumulating coins. A score closer to 1 indicates that larger entities are accumulating, and a value closer to 0 indicates they are distributing or not accumulating. We can see from the below graph that we’re in a dark purple zone now (value closer to 1 – accumulation), however, we have seen periods like this in the past where this has happened. What has then followed is one final flush out in price where price has halved. It now also looks as if this could be shaping up to happen again, maybe prices don’t half, but one final flush out could be on the cards.

Bitcoin – Accumulation Trend Score

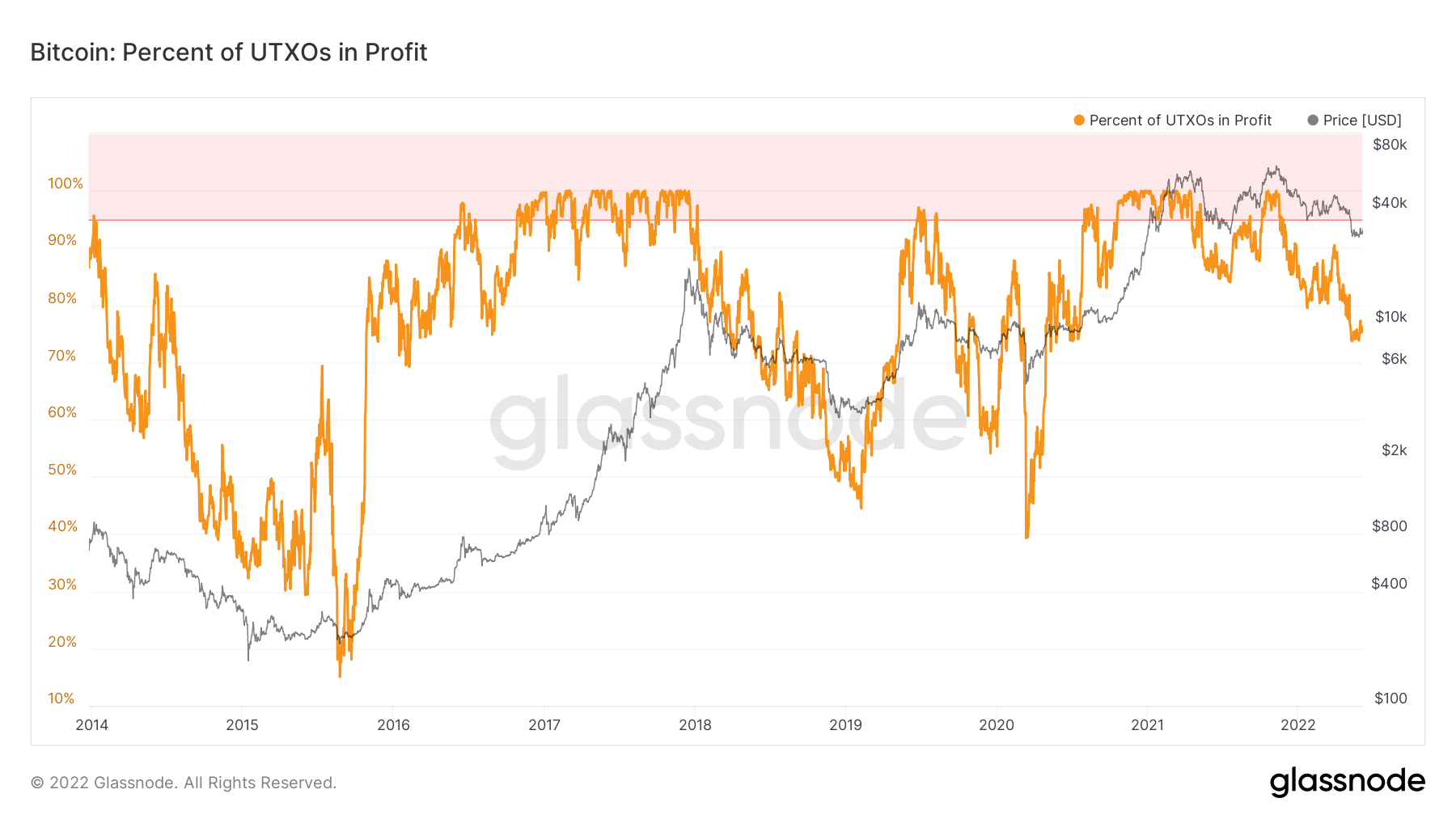

Metric 3 – Percent UTXOs in Profit

If we zoom out all the way back to 2014, we can see that the percentage of UTXOs that remain in profit is still relatively high. This may be the reason why we have not seen a capitulation event, as this would likely come as a significant portion of investors fall into unrealised losses and capitulate, plunging others into the same situation. However, right now we remain relatively high, with 75.7% of investors in a profit. If we look back to 2018, the market had roughly 60 – 70% of UTXOs in profit and it remained in this range for approximately 6 months before it capitulated lower. The result was that only 44.7% of UTXOs were in profit when Bitcoin crashed to $3,000. It may be possible we see something like this again, maybe somewhere with an end result of 50%.

Bitcoin – Percent UTXOs in Profit

Metric 3 – Percent UTXOs in Profit

If we zoom out all the way back to 2014, we can see that the percentage of UTXOs that remain in profit is still relatively high. This may be the reason why we have not seen a capitulation event, as this would likely come as a significant portion of investors fall into unrealised losses and capitulate, plunging others into the same situation. However, right now we remain relatively high, with 75.7% of investors in a profit. If we look back to 2018, the market had roughly 60 – 70% of UTXOs in profit and it remained in this range for approximately 6 months before it capitulated lower. The result was that only 44.7% of UTXOs were in profit when Bitcoin crashed to $3,000. It may be possible we see something like this again, maybe somewhere with an end result of 50%.

Bitcoin – Percent UTXOs in Profit

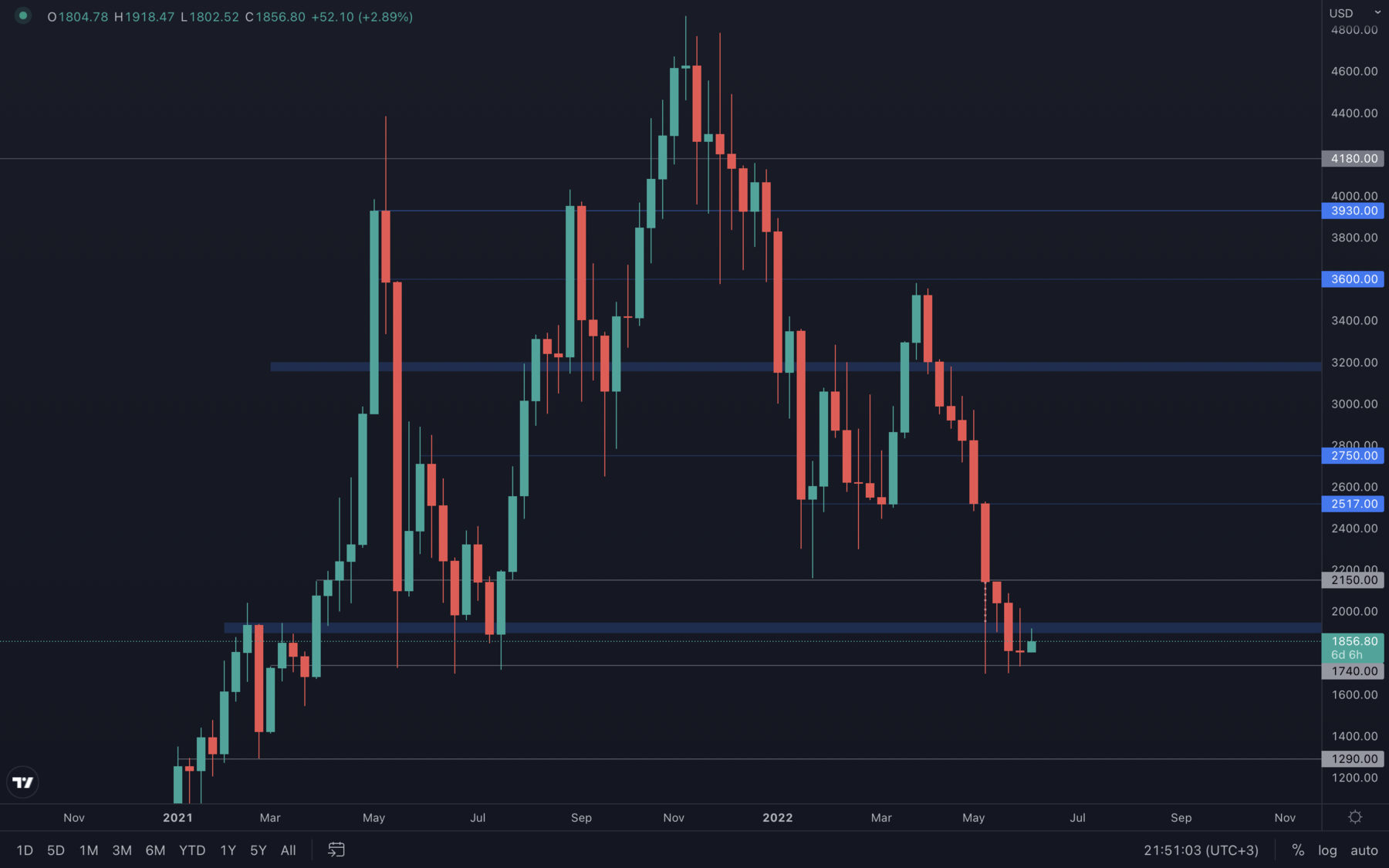

Ether

As we've already seen, Bitcoin's dominance has increased in the past few weeks, which is why ETH is having a hard time reclaiming key levels. Price is just under the $1900-$1950 lower timeframe resistance area and most importantly, under its $2000 key level. Reclaiming $2000 is necessary in order to confirm further upside - until then, Ether is still at risk, but will most likely follow Bitcoin's price action which will move its price without any other technical reason involved.

As we've already seen, Bitcoin's dominance has increased in the past few weeks, which is why ETH is having a hard time reclaiming key levels. Price is just under the $1900-$1950 lower timeframe resistance area and most importantly, under its $2000 key level. Reclaiming $2000 is necessary in order to confirm further upside - until then, Ether is still at risk, but will most likely follow Bitcoin's price action which will move its price without any other technical reason involved.

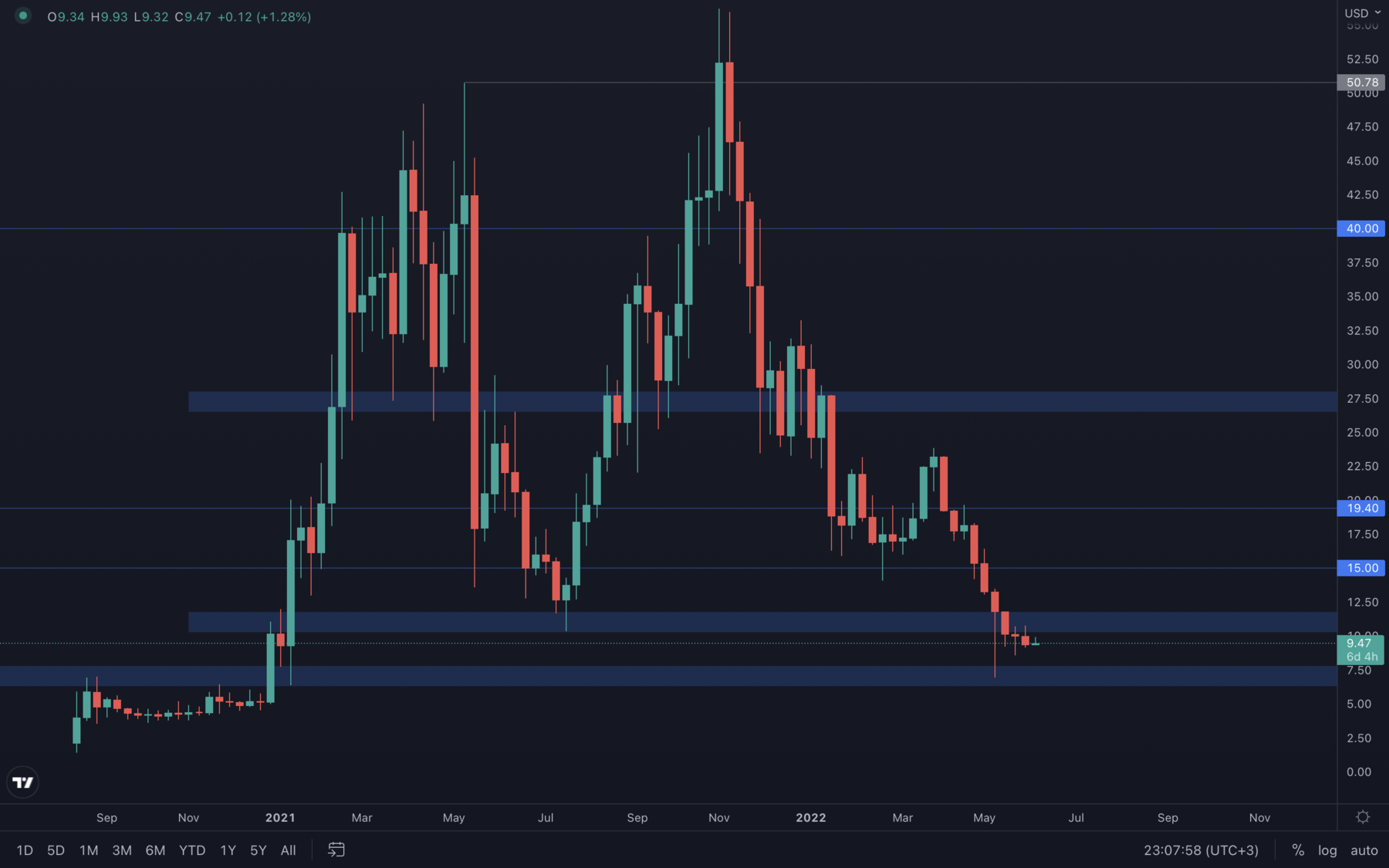

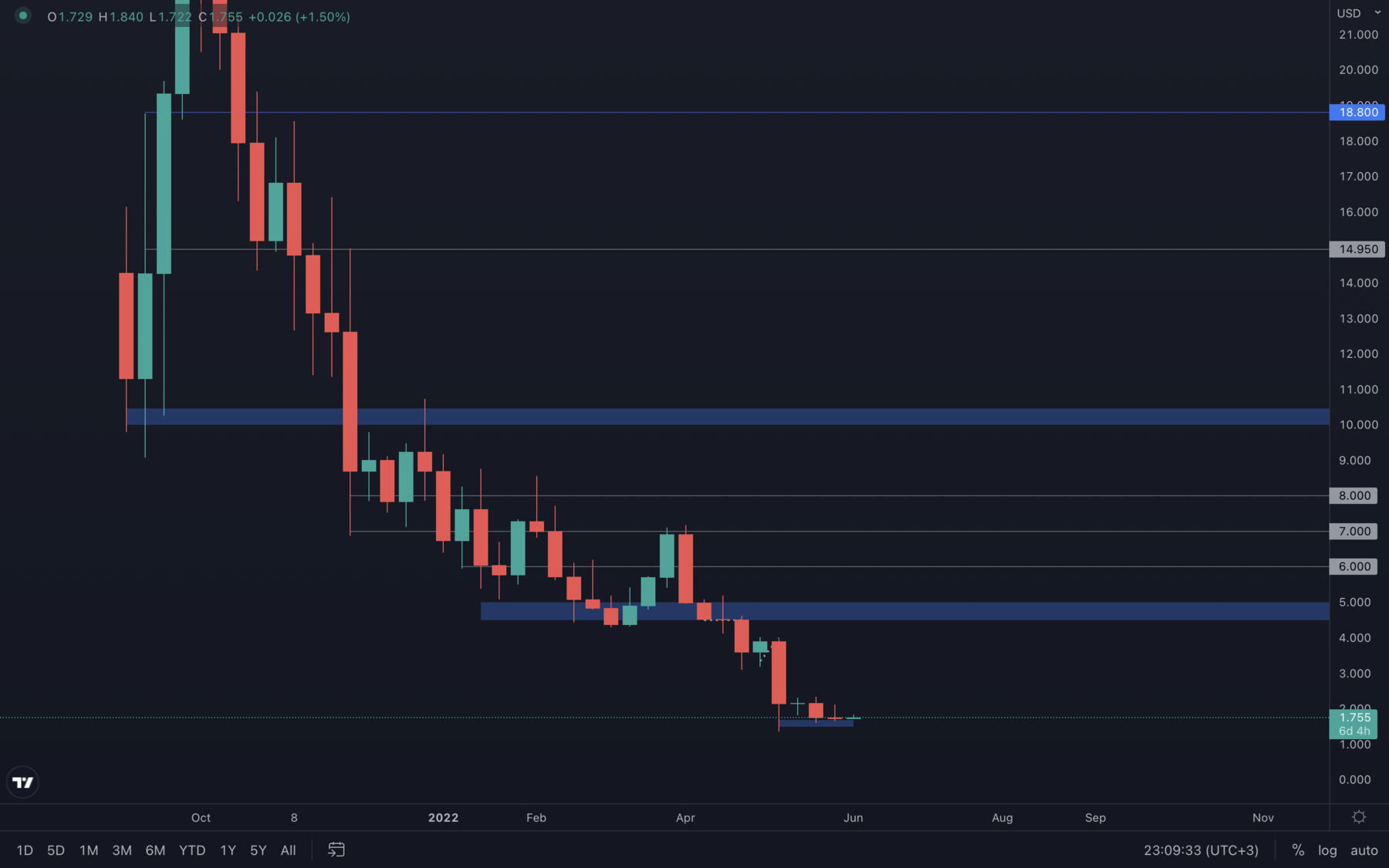

DOT

DOT isn't showing any bullish signs for now. Last week was closed below under the $10 support level, which suggests DOT might visit $7.50 in the near future.

DOT isn't showing any bullish signs for now. Last week was closed below under the $10 support level, which suggests DOT might visit $7.50 in the near future.

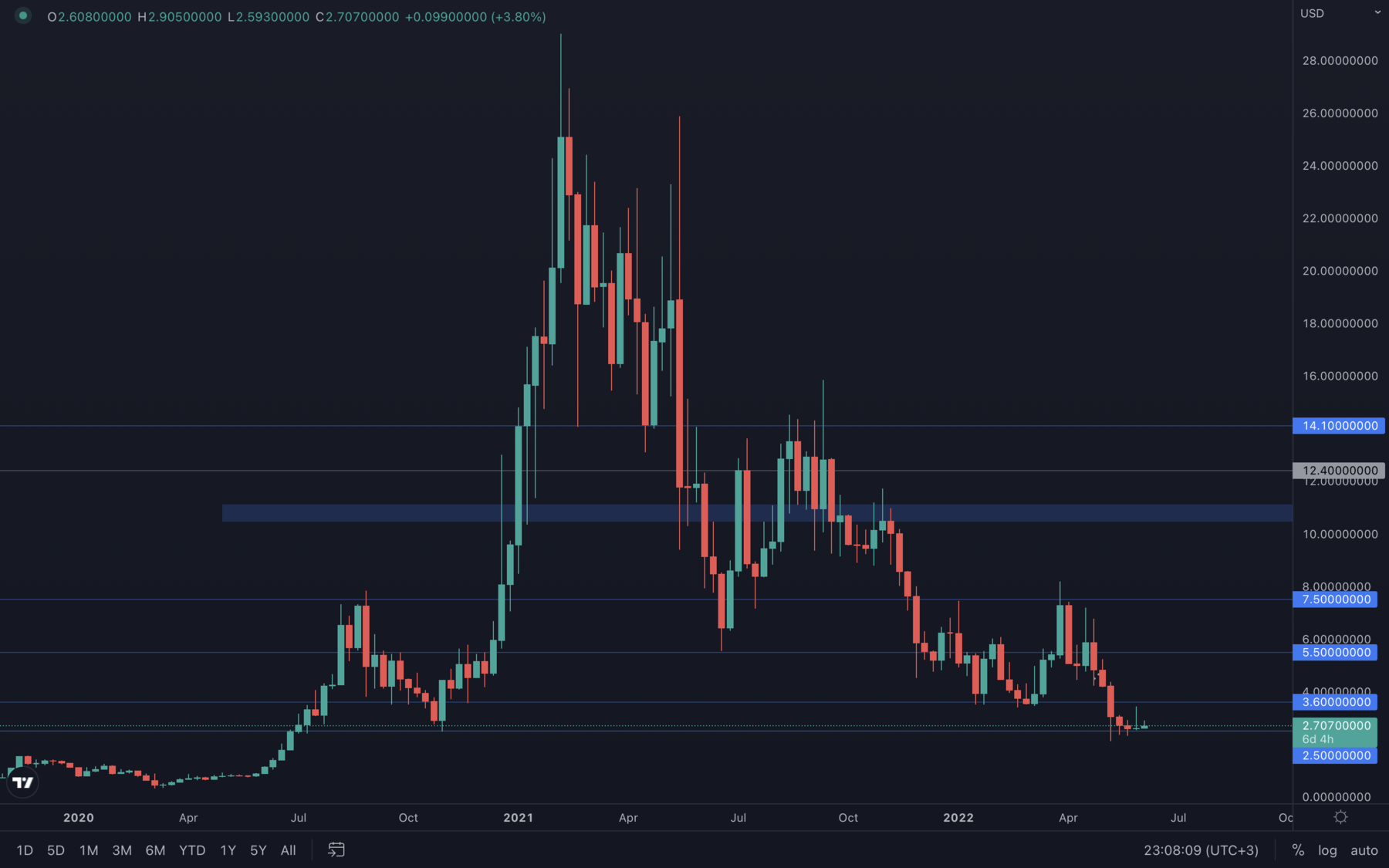

SNX

SNX is having a strong early week rise, stronger than most assets in the list - this indicates increased demand. Because price was able to hold the $2.5 support level perfectly, we can now expect SNX to test the $3.6 and $4.45 resistance levels in the coming weeks.

SNX is having a strong early week rise, stronger than most assets in the list - this indicates increased demand. Because price was able to hold the $2.5 support level perfectly, we can now expect SNX to test the $3.6 and $4.45 resistance levels in the coming weeks.

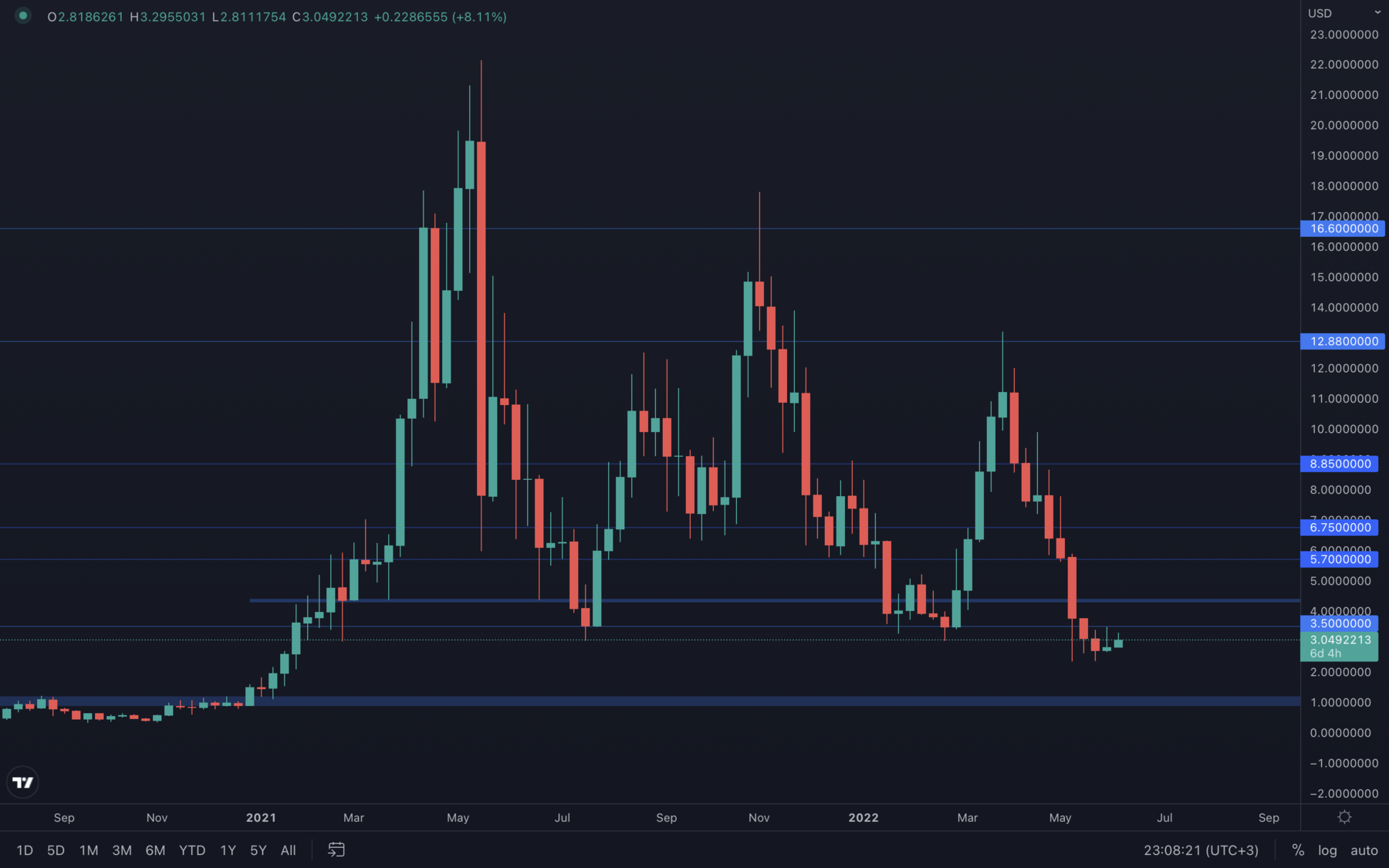

RUNE

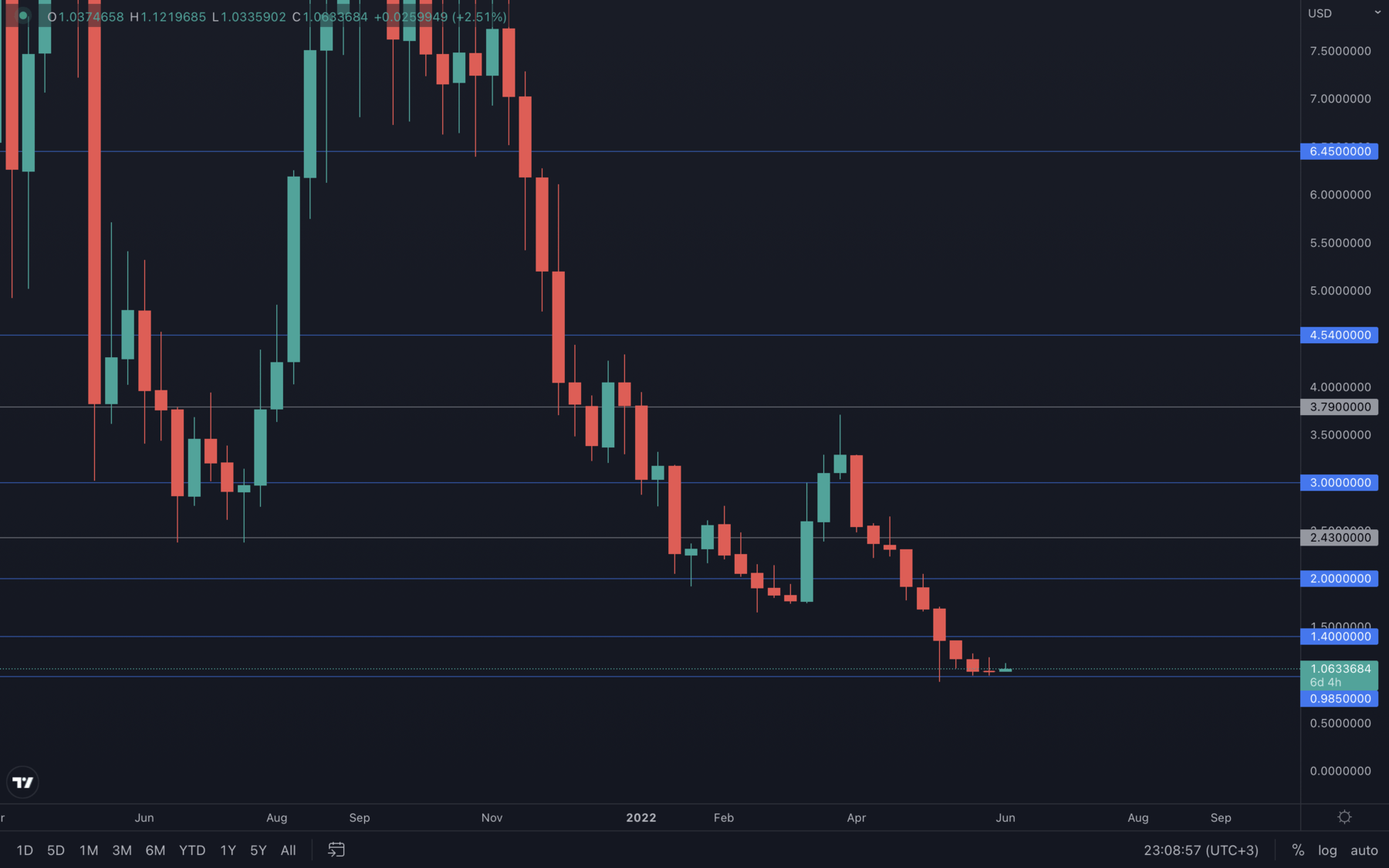

Same as the other altcoins, RUNE is likely going to follow Bitcoin's price action, but it's under the $3.5 resistance level. This presents a risk, as only a weekly closure above $3.5 can confirm further upside.

Same as the other altcoins, RUNE is likely going to follow Bitcoin's price action, but it's under the $3.5 resistance level. This presents a risk, as only a weekly closure above $3.5 can confirm further upside.

SOL

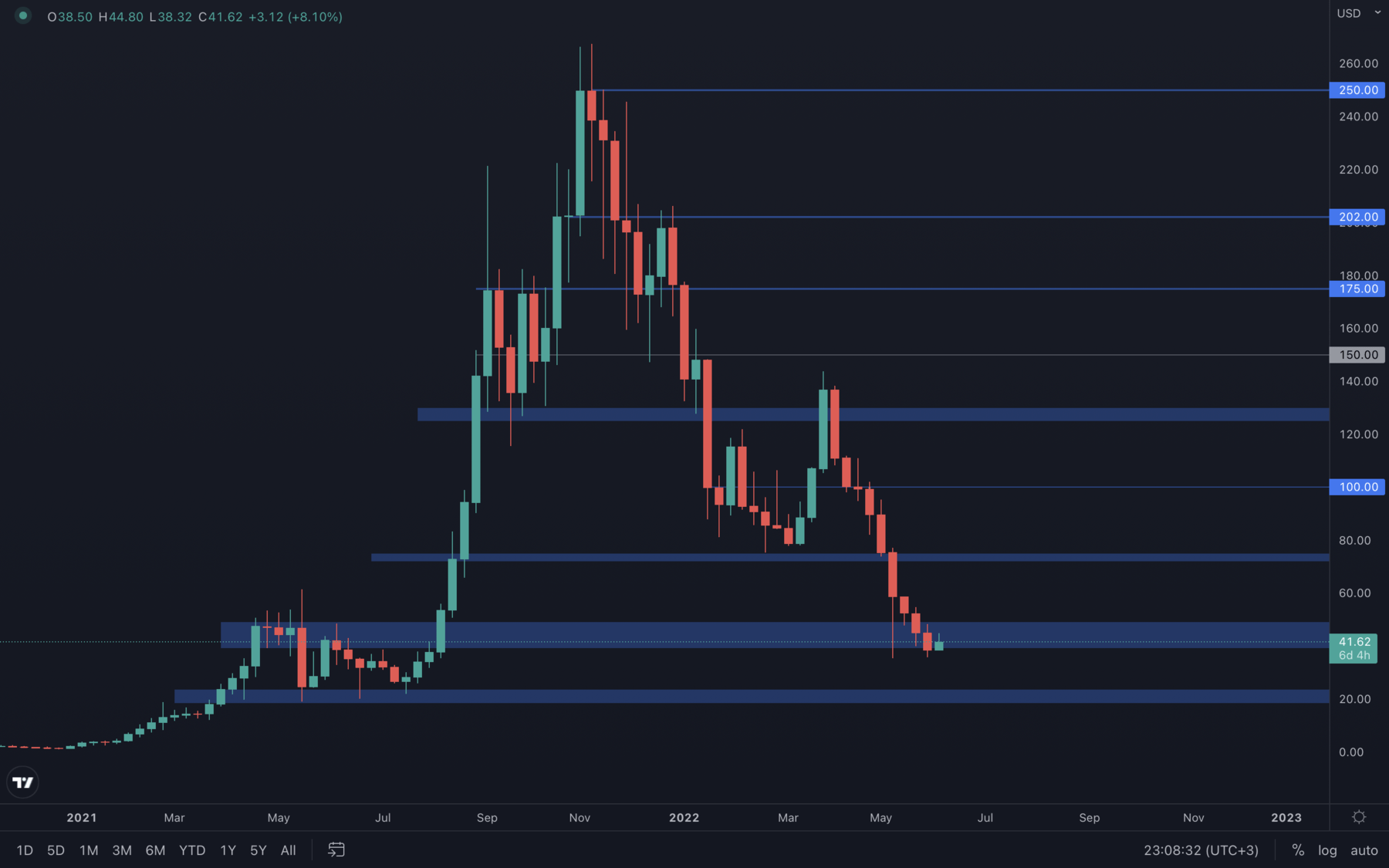

SOL managed to close above its $40 support area. Until this level is invalidated by a weekly closure under it, SOL is due to rise with the rest of the market.

SOL managed to close above its $40 support area. Until this level is invalidated by a weekly closure under it, SOL is due to rise with the rest of the market.

SRM

SRM has been holding its $1 psychological & technical support level for four straight weeks. Only a weekly closure under $1 will indicate further downside, but until then, expect SRM to rise in the next couple of weeks.

SRM has been holding its $1 psychological & technical support level for four straight weeks. Only a weekly closure under $1 will indicate further downside, but until then, expect SRM to rise in the next couple of weeks.

FTT

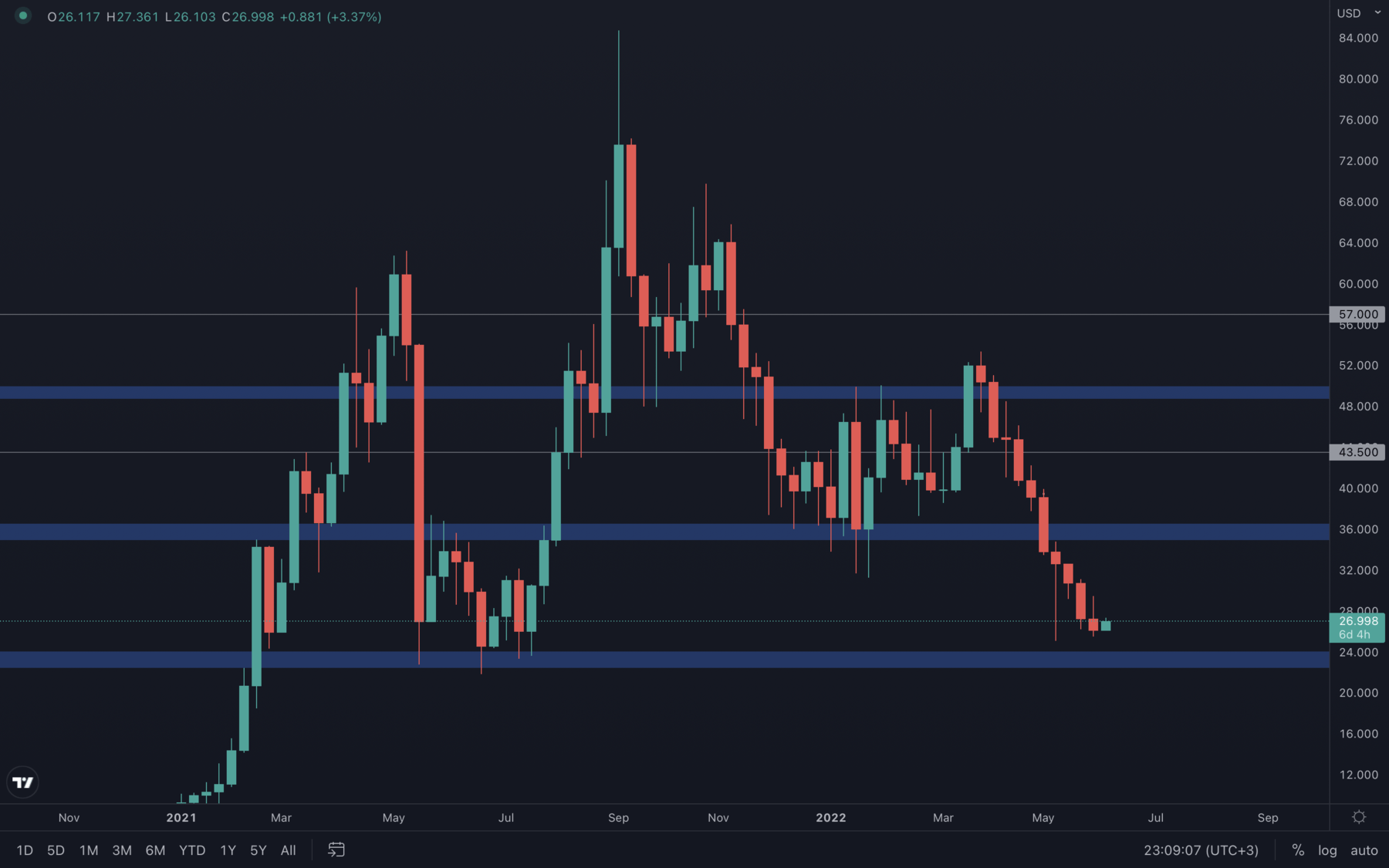

FTT is slowly approaching the bottom of the $36-$24 range and unlike many assets in the list, it does not show any signs for further upside due to last week's candle closure. A $24 support test is possible, an area where FTT is likely going to start performing well if the rest of the market, especially Bitcoin manage to maintain their upside movement.

FTT is slowly approaching the bottom of the $36-$24 range and unlike many assets in the list, it does not show any signs for further upside due to last week's candle closure. A $24 support test is possible, an area where FTT is likely going to start performing well if the rest of the market, especially Bitcoin manage to maintain their upside movement.

MINA

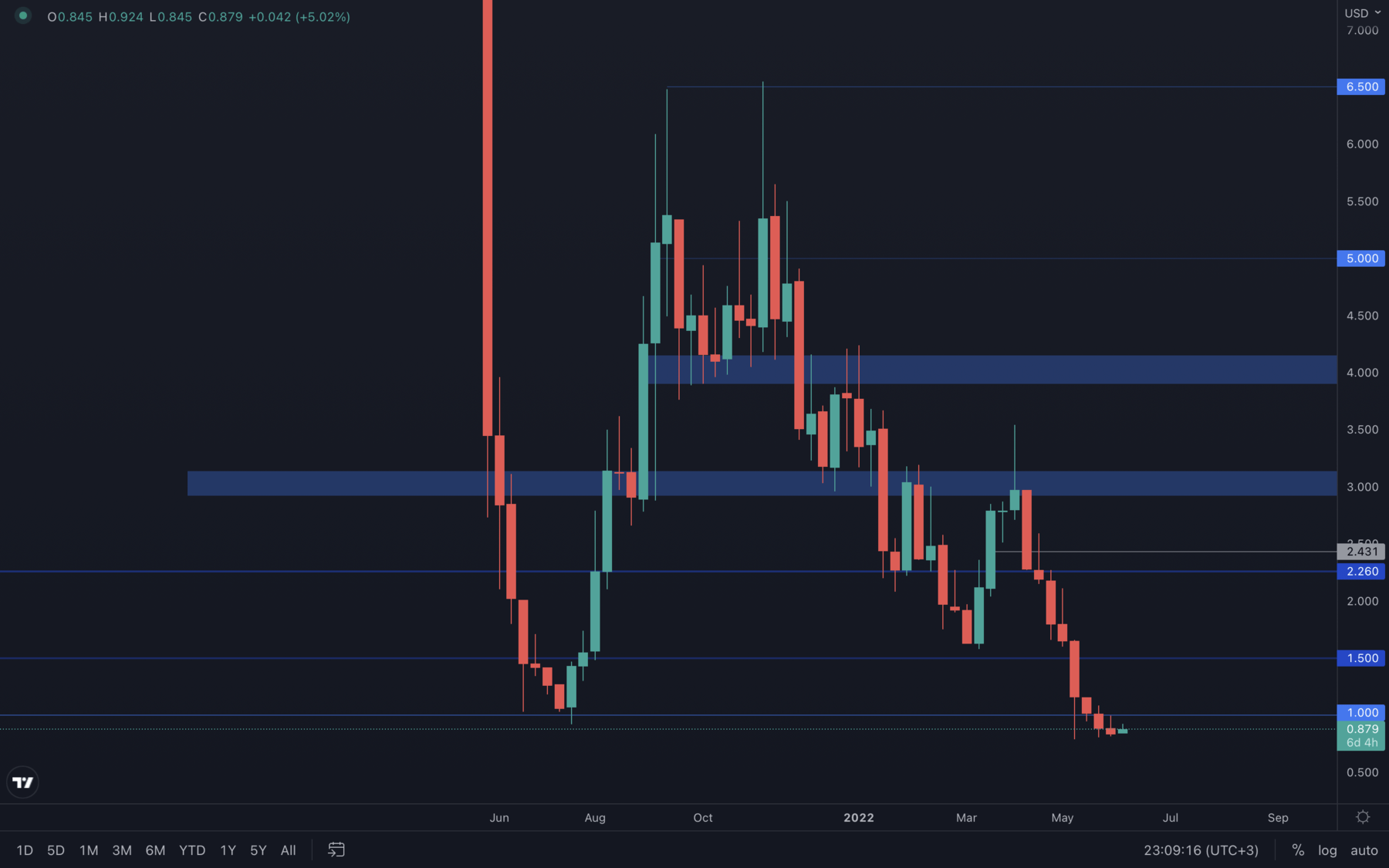

After losing its $1 psychological & technical support level, MINA hasn't been able to reclaim it for two weeks now. Only a reclaim of $1 will suggest further upside - until then, MINA is likely going to form lower & lower weekly closures due to decreased demand.

After losing its $1 psychological & technical support level, MINA hasn't been able to reclaim it for two weeks now. Only a reclaim of $1 will suggest further upside - until then, MINA is likely going to form lower & lower weekly closures due to decreased demand.

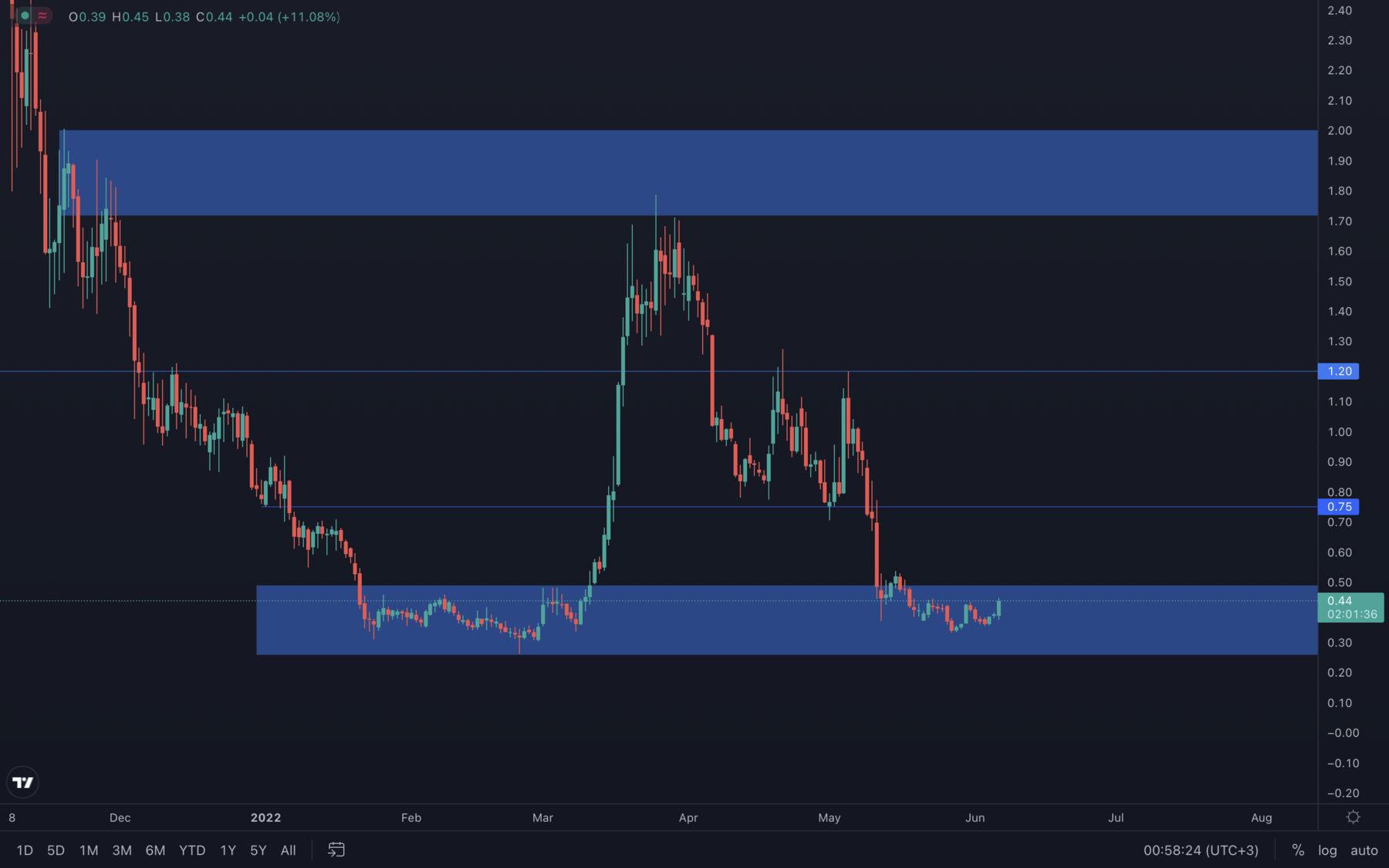

dYdX

dYdX has been ranging between $2 and $1.5 for a few weeks, which is why only a weekly closure under $1.5 or above $2 will indicate where dYdX is going next. As we know, a $2 reclaim has higher odds of happening due to the possibility of the rest of the market experiencing a potential relief rally soon. There has been an interesting technical update on THOR - price is now in the $0.5 - $0.25 range, which we've seen as being an extremely good accumulation area in the past. Unless Bitcoin aggressively falls under $30k once again, it's highly likely THOR will consolidate in this range and will break out in the near future, aiming for a $0.75 resistance test. This scenario is only valid if Bitcoin will not experience any sudden sell-offs.

THOR

(Daily chart was used)

As the market progresses and Bitcoin is starting to show signs of bullishness, THOR is looking for a potential $0.5 break that will make $0.75 the next target. A weekly reclaim above $0.50 and a healthy short-term market can easily push THOR to its $0.75 resistance level, especially since RUNE and THOR are correlated, and we know RUNE to be a top outperformer in almost every upside movement - this will push THOR's price to $0.75 at a rapid pace, but the risks still remain the same. There isn't enough volume and demand in the market to really sustain significant upside momentum, which is why trading or investing with extreme precaution is advised now more than ever, as traders or investors can easily get caught in the market's indecisiveness, even if we might have multiple signs pointing to a relief rally in the not-too-distant future.

Summary

In summarising this report, it can be said that the market still remains cautious ahead of further FED tightening. If previous bear markets are to go by, it may the case that we get a further leg down before the weakest hands are flushed out and smart money begins dollar-cost averaging back in.Until then, we cannot ignore a green weekly closure on Bitcoin under any circumstances. This alone suggests selling pressure has finally exhausted and buyers are regaining control over the price - however, this will not last. We haven't seen any significant volume to back further upside, which means it's highly likely a potential rally will be followed by another aggressive drop to previous lows, which will completely invalidate any upside potential. As always, we recommend reducing exposure and preparing for any foreseeable outcome.