Altcoin Opportunities

Market watchlist: Opportunities for ETH, PEPE, SUI, and more

We release this list at the start of every week to project and map out potential trading opportunities. Each opportunity or potential scenario can be approached differently depending on individual trading strategies.

Key points

- Focus: The watchlist is focused on key levels and scenarios to play if and when they arise.

- Market uncertainty: The market can be unpredictable, and opportunities might not always unfold as expected.

- Alignment: The watch list helps us stay aligned and focused on common goals heading into the week.

Disclaimer: This is not financial or investment advice. You are responsible for any capital-related decisions you make, and only you are accountable for the results.

Overview of the week

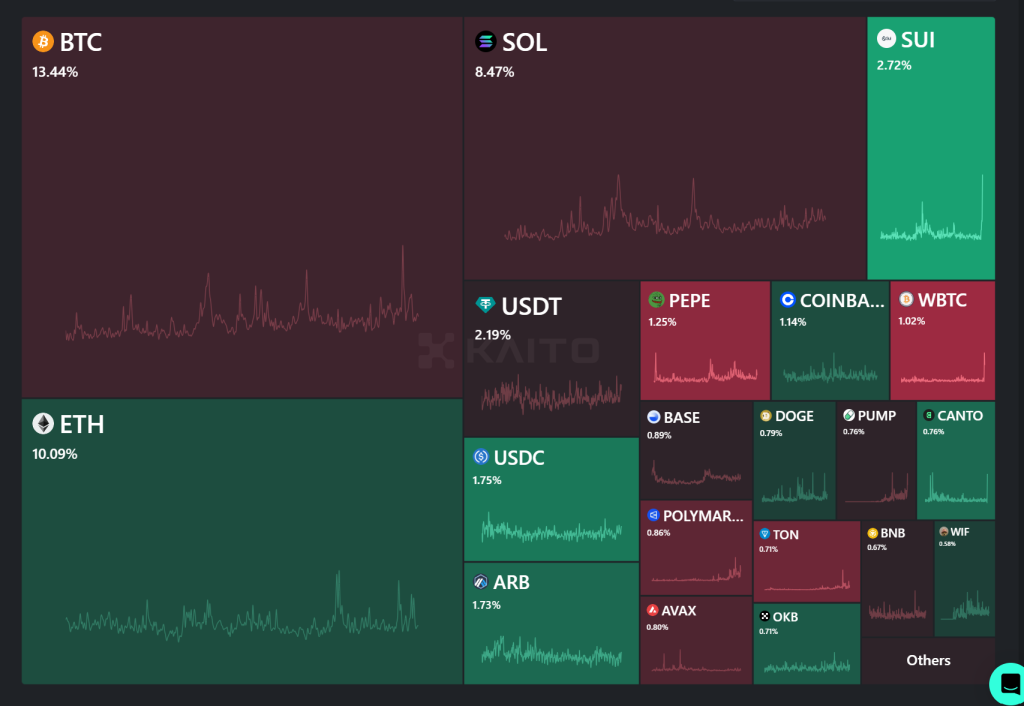

This week, we’ve seen significant movements across various assets, with Bitcoin experiencing a 30% sell-off, triggering emotional reactions across the market. However, now is not the time to panic or make hasty decisions. We’ve adopted the barbell strategy as our winning formula for this cycle, and this week, we are focusing on optimizing our strategy around specific assets to capitalize on the current market environment.We are also factoring in mindshare, looking at both narrative mindshare and individual token mindshare, where we see SUI and PEPE dominating when considering how most assets perform in terms of mindshare.

These are very interesting metrics to examine. As the saying goes, " Where attention flows, money goes," utilizing this metric is key when positioning ourselves in winning assets.

Trading levels and opportunities

Ethereum (ETH)

- Hypothesis: Ethereum is nicely positioned for a long-term swing trade. The price is currently magnetised around the 61.8% Fibonacci retracement of the recent bull market swing from the October lows to the recent highs. At the $2,200 level, we see a strong opportunity to build a position, as ETH could be undervalued at this point, especially considering its institutional interest and the ongoing competition with Solana.

- Key level: $2,200

- The play: Begin building a position within this price region. This could be done through spot buys or even using light leverage (e.g., 2x) to capitalise on this perceived undervaluation. Setting limit orders around this key level is also a viable strategy.

Pepe (PEPE)

- Hypothesis: Pepe remains one of the most attractive charts in the crypto space. The asset has shown consistent, sustainable swings to the upside and downside. We are particularly interested in the 61.8% retracement level at $0.00000593, which presents a strong buy opportunity. Given the strength of meme coins in the current market narrative, Pepe's dominance and potential for significant moves cannot be ignored.

- Key level: $0.00000593

- The play: Accumulate within the identified buy box. This could be done through spot buys or by employing a strategy similar to ETH's, using light leverage to maximise the potential upside. Given Pepe’s volatility, it’s crucial to only risk capital that you are comfortable with, but the risk-reward at this level appears favourable.

Sui (SUI)

- Hypothesis: Sui has quickly risen in prominence, capturing a significant portion of the market's mindshare. The asset has shown a strong upward move, reflecting growing demand. However, this move is likely to see a pullback, presenting a great opportunity to enter. We are looking for a retracement to around the $0.75 level, where we believe a strong buying opportunity could emerge.

- Key level: $0.75

- The play: Look to build a position around the $0.75 level. Following the initial strong move, this level is likely to act as a support zone. Before committing to this trade, it will be key to monitor the price action for signs of stabilisation.

DogWifHat (WIF)

- Hypothesis: WIF continues to be one of our top plays this cycle. The current price action suggests that WIF might be nearing a bottom within its trading range. The $1 to $2 range offers a great opportunity to accumulate, especially given our long-term conviction in this asset. This range allows for flexibility in building a position, with the potential for substantial upside as the market recovers.

- Key level: $1.00 - $2.00

- The play: DCA (Dollar-Cost Averaging) within the identified buy box. This approach will allow you to accumulate at a range of prices, reducing the risk of entering all at once. As WIF approaches these levels, staying patient and disciplined is crucial, gradually building your position.

Cryptonary’s take

Now is not the time to panic. The markets never provide smooth sailing. You must stay calm and composed and adapt your strategy to be positioned for the best opportunities.For now, we are dialled into the barbell strategy until things change.