Below we’re going to state of three (Sentiment, Volume, Funding) objective facts and they will be analysed in the “Bitcoin” section.

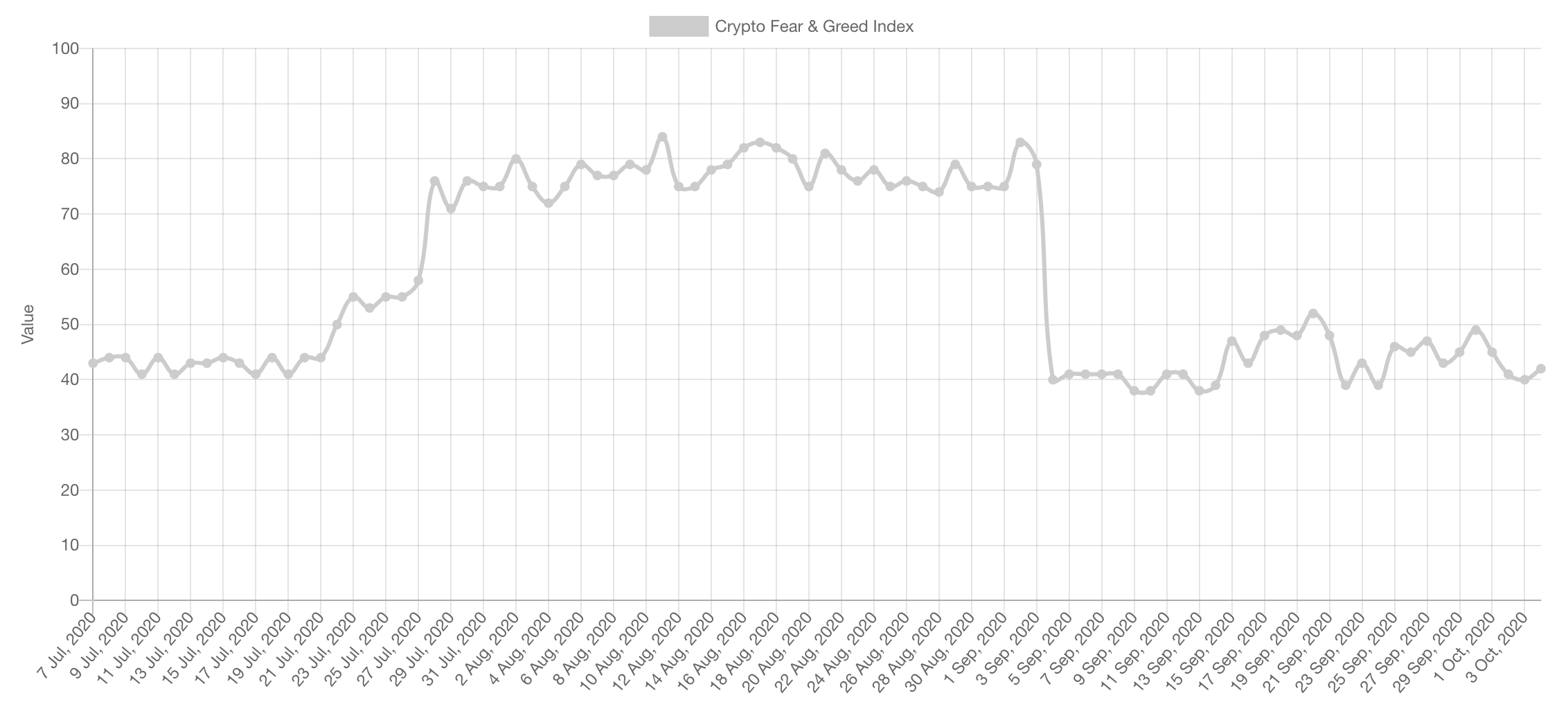

Market Sentiment

The market sentiment flipped from “Extreme Greed” to “Fear” with the flip of a switch (in a single day).

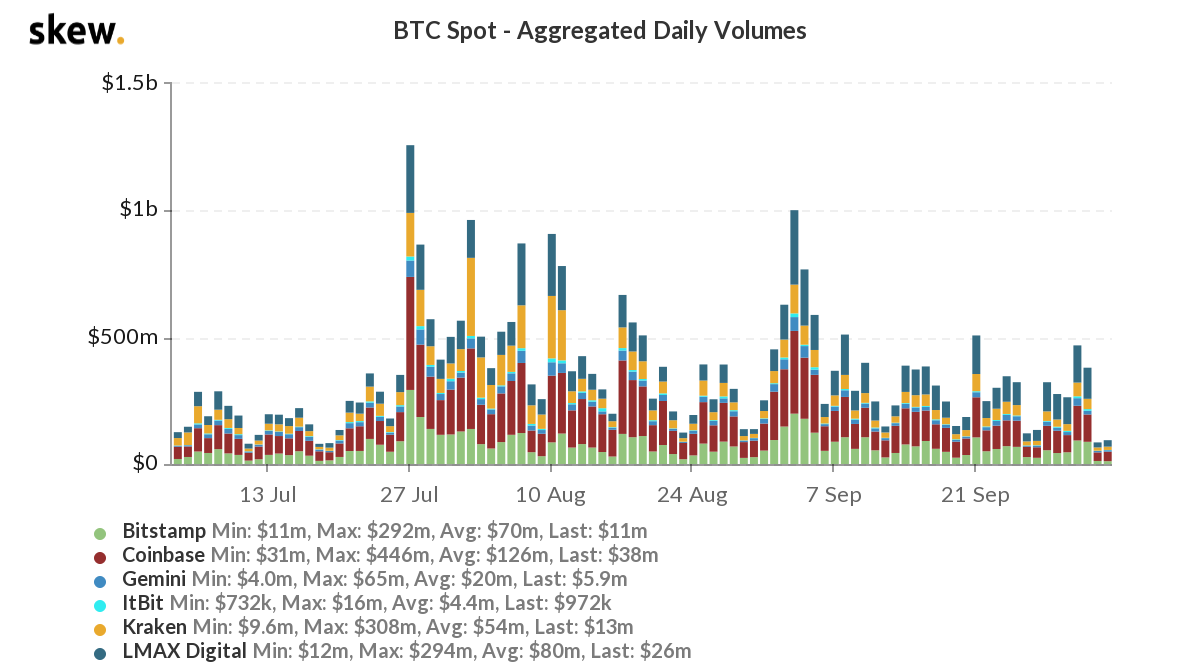

Trading Volume

The trading volume keeps making lower highs which is what happens in a period of “calm before the storm” but that also is leading to one of the quietest periods in Bitcoin moves which has been especially profitable for MOVE shorts (you can ask us more about it in Discord!).

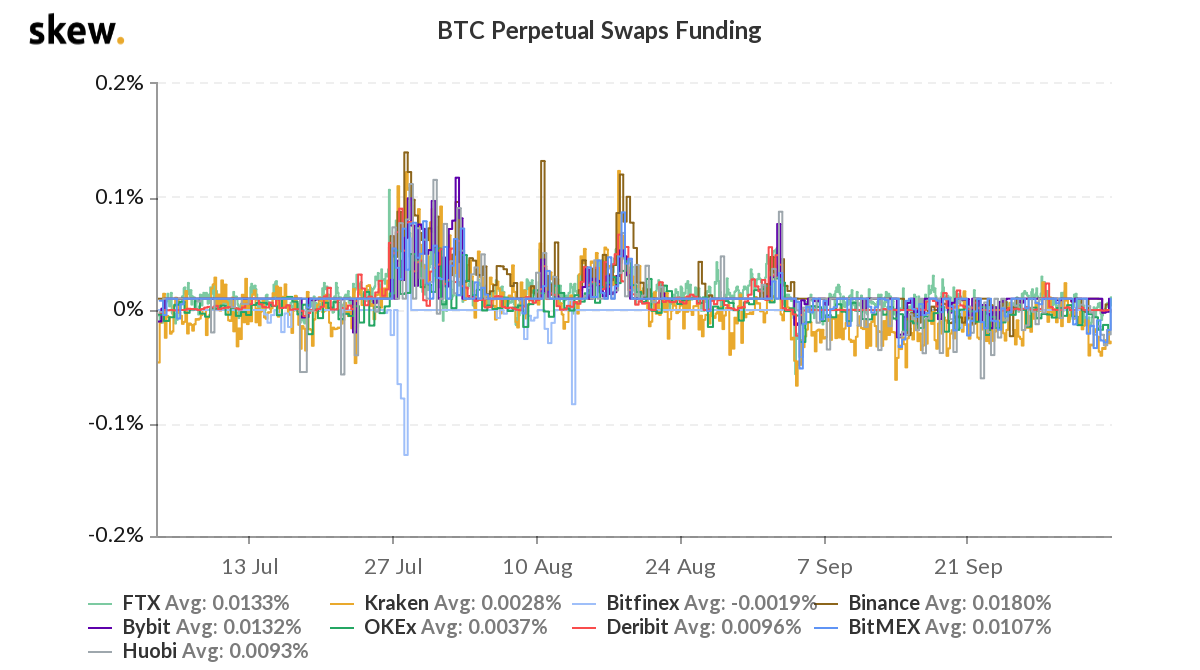

Funding

The funding on perpetual futures represents where the people are leaning. In normal conditions, the future trades at a premium to spot which leads to positive funding where longs pay shorts. Now we have an abnormal situation where funding is negative and shorts are paying longs. In other words, people are getting paid to long Bitcoin.

Market Indices

Total Market Cap

The Total MCap has been ranging and frankly this is applying to the majority of the market where movement has been boring. But after this boring period of consolidation we are expecting further upside. Price is at support and our target of $450B remains valid till now.

Altcoins MCap

To summarise, perhaps you should watch this YouTube video again as nothing has changed whatsoever.

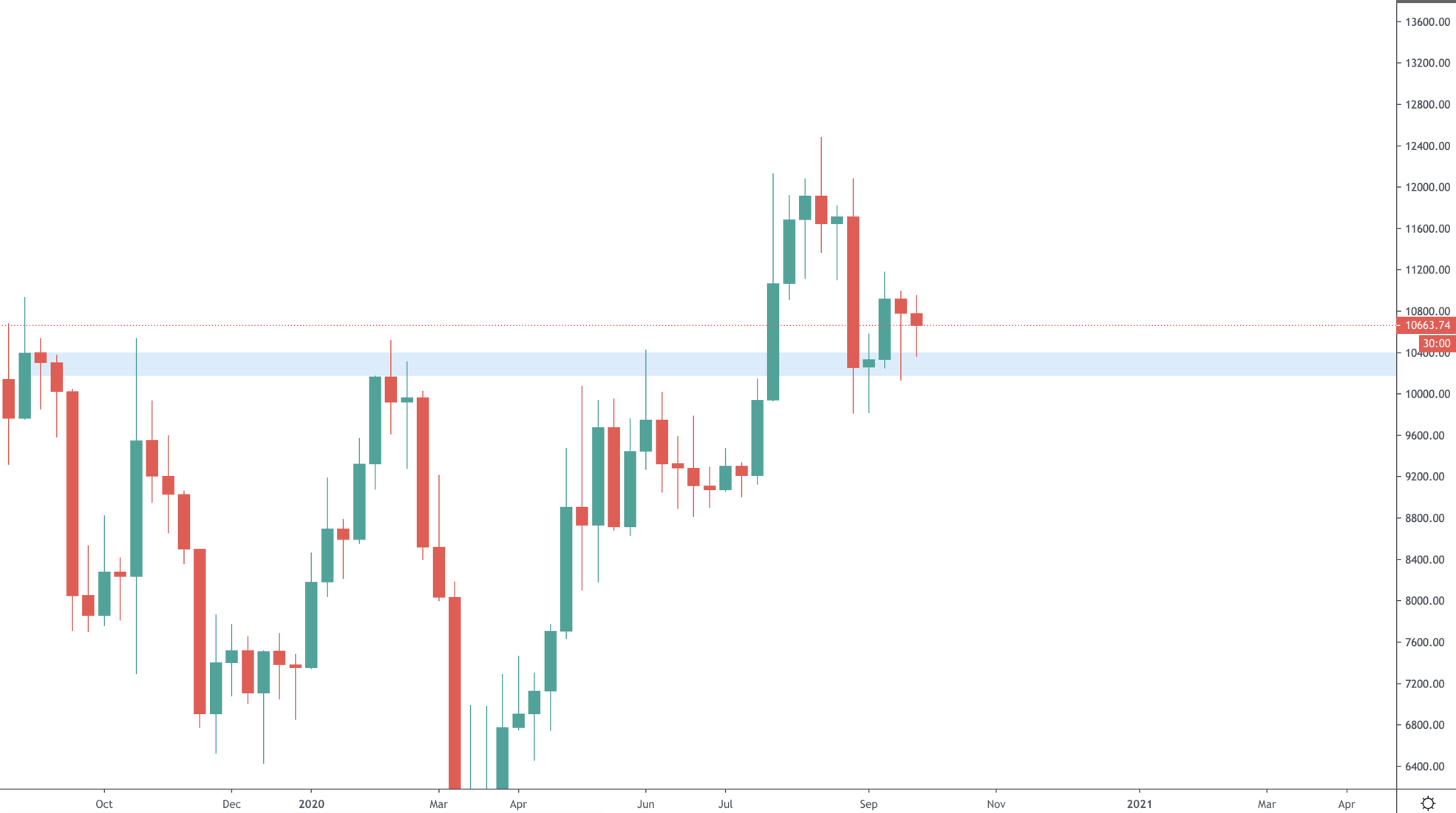

Bitcoin

This is where things get interesting. First the monthly timeframe. As you can see price has flipped a monthly level from resistance to support with the next monthly level sitting near $14,000.

Going to the weekly, we can see a very similar trend where this move has simply been a flip of a resistance to support till now. Where do the factors mentioned at the start of this WT come in? Imagine that Bitcoin is flipping S/R in a bullish manner, sitting at over $10,000 for one of the longest periods to date and sentiment is still fearful and funding is negative. Trading is about taking educated guesses, and our educated guess is “Numbers go up”.

Ether

Not much movement from ETH right now. It must regain $360 back for further upside, though all of the other charts support a bullish bias.

XRP

After breaking out of the incredibly long downward channel, XRP has been ranging and retesting it. Yesterday, there was some volume on the asset which has pushed us to take a small trade on it and give it a chance to shine.

XMR

There has been an impressive demand for privacy recently which is pushing XMR through upside moves that not other asset is experiencing. The next level of resistance, which is our next target is $115 but it seems that this asset has a much farther way to run beyond that. Of course, we are taking it one level at a time.

SRM

While fractals are not strong evidence, this NEO superposition on SRM has been working very well and we don’t think that will change soon. This upside predicted move is very likely to now happen as price is at support.