Weekly Technicals Pro - Vol 97

The most notable observation on this chart is the reduction in Open Interest. It had moved sideways within the blue box for the best part of two and a half months but eventually dropped lower on a day that price increased. This was the day that Russia announced a 'military operation' in Ukraine. This is usually viewed as a bearish development, but it's fair to assume that the drop in O.I was due to market participants de-risking from the market at a time of increased uncertainty.

Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market Sentiment

Market Indicies

Total Market Cap

The Total Market Cap has, so far, failed to reclaim $1.75T or create a weekly higher low. With the liquid developments regarding the Russia/Ukraine war, we can't deny that it brings an increased risk of volatility to market movements. As we have mentioned in our last Multi-Format Thursday, should the index head lower, we view $1.15T-$1.35T as a 'high-value' area. Let's not forget the monthly close tonight, which will give us a more reliable indication of the market overall.

Bitcoin

The possibility of a higher-low to compliment the higher-high is still there even though Bitcoin has failed to form it this week. As price has dipped towards the low-mid $30ks once more, we began to see buyers stepping in at a higher price, which is the basis of the formation of a higher low. The comments from the FED about needing more than four interest rate hikes negatively affected Bitcoin, even though there wasn't any further detail provided. Then, on the announcement of Russia's military operation, Bitcoin unexpectedly pumped $4,000 almost instantly. Pumped, during the announcement of a war!? As the weekly candle was drawing to a close, Russia stated that its nuclear arms were moving to a heightened state of alert. Although not immediate, the market did react with a move to the downside. We can look at this two ways. The war is still affecting the markets, thus bringing volatility. Or, as we see announcements made, Bitcoin is now having a delayed reaction, building up resilience to updates from the conflict and, over time, decreasing its influence, meaning that a lot of the fear of the worst (excluding the unlikely event of an actual nuclear war, of course) could be already priced in. So, in short, even though the weekly candle closed red, it wasn't overly bearish, and the potential change to the structure through forming a higher-low is not yet void. Again, with it only being one day later, we look towards what the monthly candle close has in store for Bitcoin.

Ether

Ether closed the weekly candle as a Doji, which is the most neutral candle that you can get as it shows that the price has failed to make an advance in either direction, but it can also suggest a slow down in the downside momentum. The possibility of a higher-low remains intact. It doesn't indicate the next move, but, like Bitcoin, it has the challenge of overcoming overhead resistance. This resistance for ETH is $2,750. Should it move up from here, resulting in a higher low, ETH would only truly change its structure should it trade above $3,200. Regarding downside, similarly to Bitcoin's $30,000 level, around $1,740 is what we believe to be a 'high-value' level for ETH.

DOT

DOT has seen some demand around the $15 level, but this candle close doesn't indicate that we're about to see a change in structure quite yet, as DOT remains bearish on all timeframes. This will likely be the case until the majors show strength, at which point we'll be looking for DOT to alter its structure and turn bullish.

SNX

The momentum continues to remain to the downside for SNX, and we are looking out for signs to suggest otherwise. Lose $3.60, and we would likely see $2.50 arrive rather quickly.

RUNE

RUNE wicked to the $3 liquidity level for the first time since July '21, where it has seen demand once again. If RUNE is to reverse, $3 is a logical level for that to happen. But, of course, that relies heavily on the majors' performance. A downside argument is supported by the fact that RUNE didn't manage to close out the week above $3.50, formed a lower-low and yesterday's daily candle was a bearish engulfing candle. But a short remains risky given the subtle change in Bitcoin's market structure that we highlighted to you in early February.

SOL

SOL perfectly touched the top of its support at around $75 last week. It doesn't signal an immediate reversal as a lower-low was created in the process. At present, SOL trading above $125 would hint towards bullishness.

SRM

It's a similar situation for SRM. At present, a reclaim of $2.88 on the weekly timeframe would be the level to suggest a momentum shift. Right now, with the weekly closure below $2, the downside risk remains.

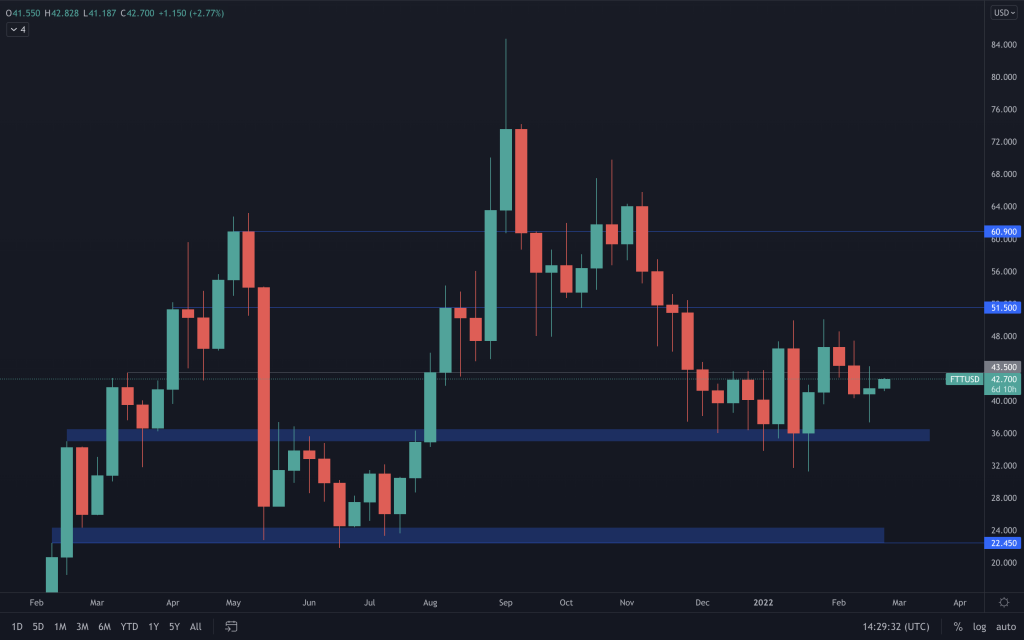

FTT

We've seen a higher low on FTT for the first time since the beginning of December, suggesting a momentum shift. FTT has held its ground reasonably well given the downside that the rest of the market has seen, and, should the market be able to turn around, we'd likely see FTT outperform the majority of alts.

MINA

MINA has closed below $2.10 and, in keeping with its bearish structure, suggests that further downside is on the cards. This can currently be invalidated with a reclaim of $3.

dYdX

Another chart depicting the same, for now. We're keeping our eyes out for a market structure change, but at this time, there's no reason to rule out more downside.