Weekly Technicals Pro – Vol 98

The Total Market Cap failed to hold its ground after advancing earlier in the week. When news broke out regarding shelling around Europe's largest nuclear power plant, many markets moved negatively, and naturally, crypto was no exception, closing back below $1.75T. The market is obviously susceptible to these extreme developments in the world, which are out of our control. Right now, the lower highs are unbroken, and this week's candle reflects the selling pressure that has been seen across the market.

Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

Market Indicies

Total Market Cap

Altcoins' Market Cap

The Altcoins' Market Cap remains in a clear bearish trend with $703B as support below. Only a reclaim of $1.117T would invalidate further downside.

Bitcoin

Fundamentals have, unsurprisingly, played a big part over the past week. Bitcoin has strongly rejected $45,000 and closed the week below $40,000 again, leaving us with a pretty non-convincing higher-low. Looking at the daily chart, the momentum suggests further downside.

Ether

With its bearish structure unbroken, ETH closed the week looking a little worse than BTC, hinting towards another test of the lows towards $2,000. Of course, that would be invalidated by a weekly reclaim of $2,750.

DOT

The bearish structure continues. DOT is still moving down, leaving another visit to $15 highly likely. Should we see a closure below $15, $10 would be next.

SNX

As we mentioned, SNX continued to test support at $3.60 day after day, resulting in a weekly candle closure below. SNX now has $2.50 as support and would only look good if it were to close above $5.50.

RUNE

With the hype around LUNA, RUNE has seen a nice pump over the past week, closing bullish above $4.25-$4.40 but unable to close above the significant $5.70 level. Now faced with a potential change in market structure, we'll see if RUNE can first mature the potential bullish structure or reclaim $6.

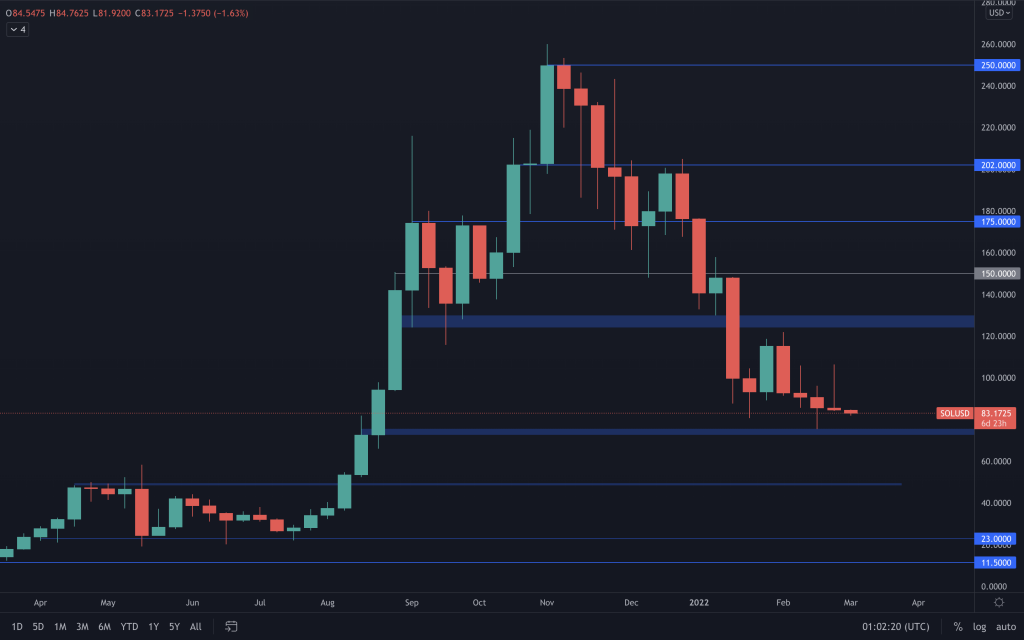

SOL

SRM

The downtrend continues, and, as we've mentioned, with another close below $2, it looks like SRM is on its way towards $1.40.

FTT

It's still moving within the never-ending $35-$50 range, and we're awaiting a breakout of this range.

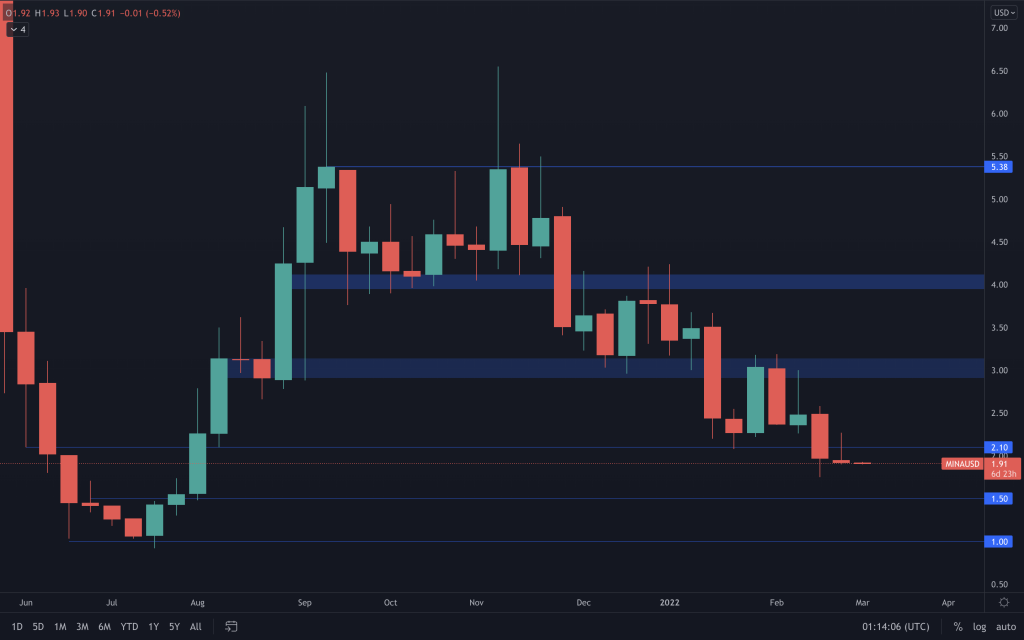

MINA

MINA's inability to reclaim the broken $2.10 support suggests that we'll see it at $1 (on the weekly timeframe). Of course, we know that there is daily support at $1.50 first, so we'd see how it reacts there first.

dYdX

dYdX is not any different to the majority of the market as it continues its downward journey. It's back in our area of interest that is $3-$5.