Disclaimer: Not financial nor investment advice. Only you are responsible for any capital-related decisions you make, and only you are accountable for the results.

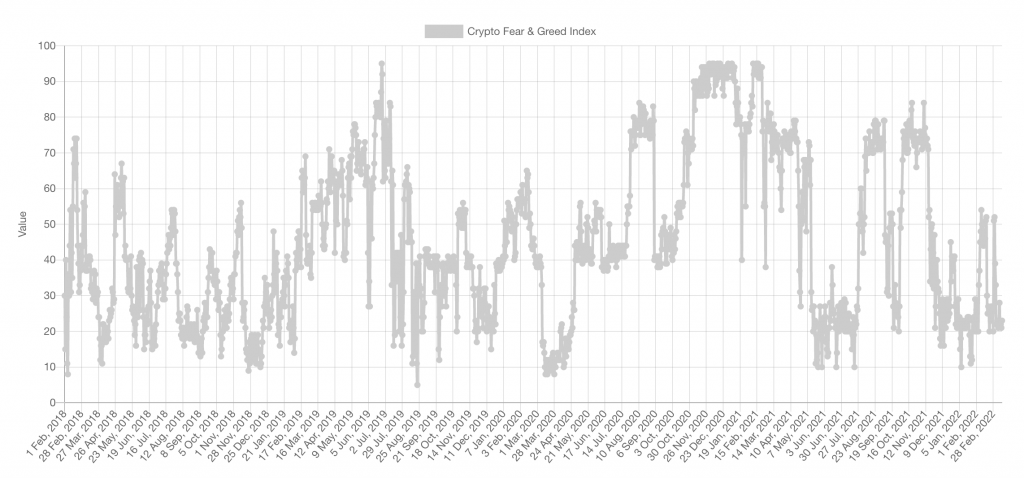

Market Sentiment

Market Indicies

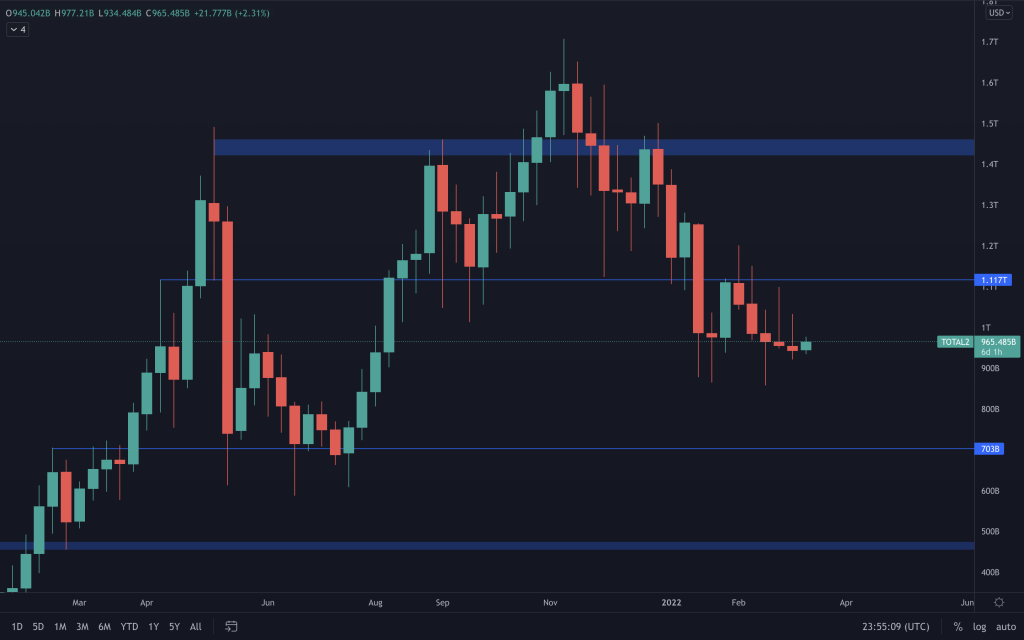

Total Market Cap

The market continues with its struggle to maintain a market cap over $1.75T for any significant period of time. Marketwide demand has stepped in as it has neared $1.5T. So should the market head in the direction of $1.35T, we can observe its reaction around that level first. Right now, many external factors are affecting the market. We have the FED's interest rate announcement coming up this week, so we could see some volatility around this announcement.

Altcoins' Market Cap

The Altcoins market cap continues with its decline and, unless that changes, support comes in around $700b

Bitcoin

Bitcoin has once again failed with a break above $40,000. Should it not get that break upwards, in terms of support, it has found demand in the middle of the $30,000-$40,000 range, and there is also has the untested $30,000 level. For upside, the safest approach would be to wait for a break of $45,000.

Ether

With five red candles in a row, ETH's bearish structure remains intact as it has continued its decline after a retest of $3,200.

DOT

Although DOT's decline has somewhat slowed, we await an indication of a reversal. Last week's candle closed without a bias, and although the daily timeframe is slowly appreciating, the overall downtrend remains.

SNX

SNX moved well early in the week but couldn't sustain it going into the weekly close, eventually closing back in the $3.60-$4.45 range. Had it been able to hold the move, it would have been a good indication of a bottom being formed.

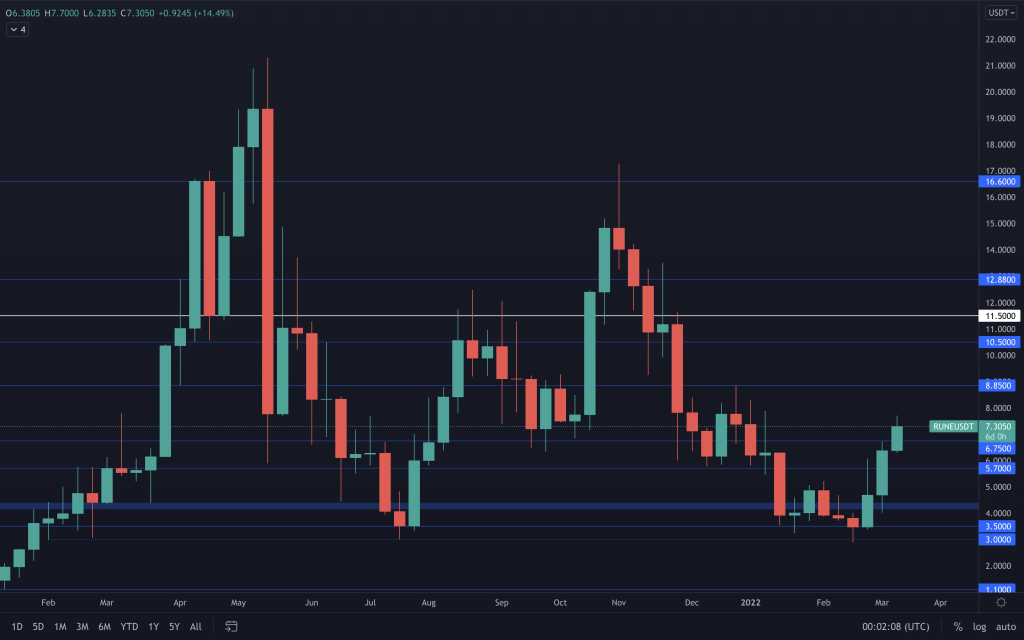

RUNE

Since touching the $3 liquidity level, RUNE has performed exceptionally well, moving out of the 'danger zone' that could have seen it go down as low as $1. The weekly candle closed above $5.70, but it doesn't look like RUNE is quite yet done. The next level in sight is $8.85.

SOL

SOL is still within its range ($75-$125) but is now coming very close to the bottom once again. Any break of $75 could mean that we see a $50 SOL.

SRM

SRM continues to look poor as it heads towards $1.40.

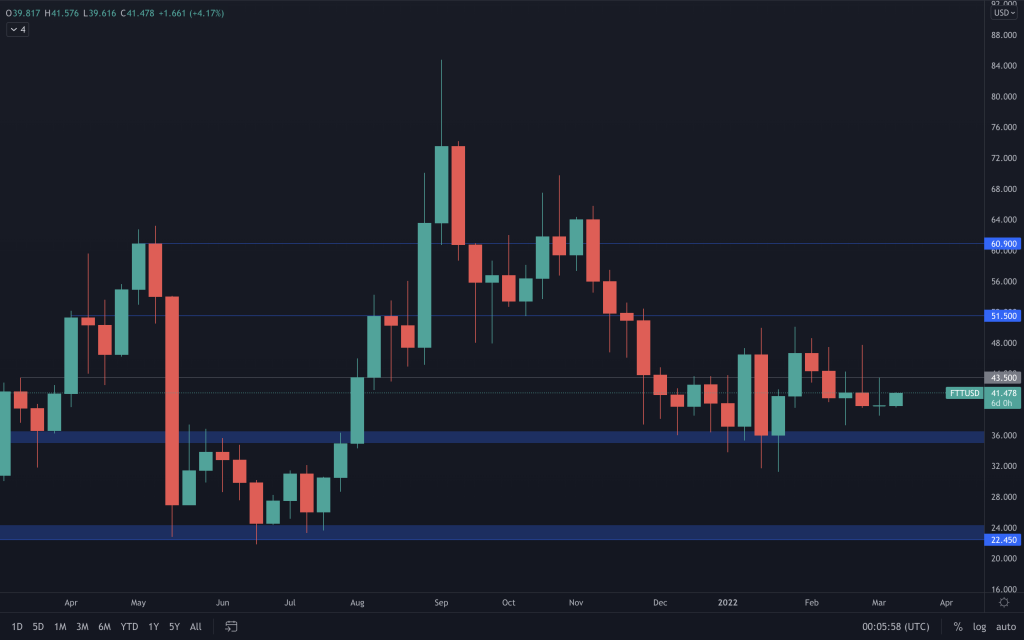

FTT

FTT is still closing in the lower half of its range ($35-$50) after failing to reclaim the intermediate resistance after three attempts. A breakout of this range will give us an indication of FTT's next move.

MINA

A $1.50 MINA, or even a $1 MINA, remains a possibility as it continues to decline.

dYdX

With its bearish structure intact, dYdX continues to move down in price.