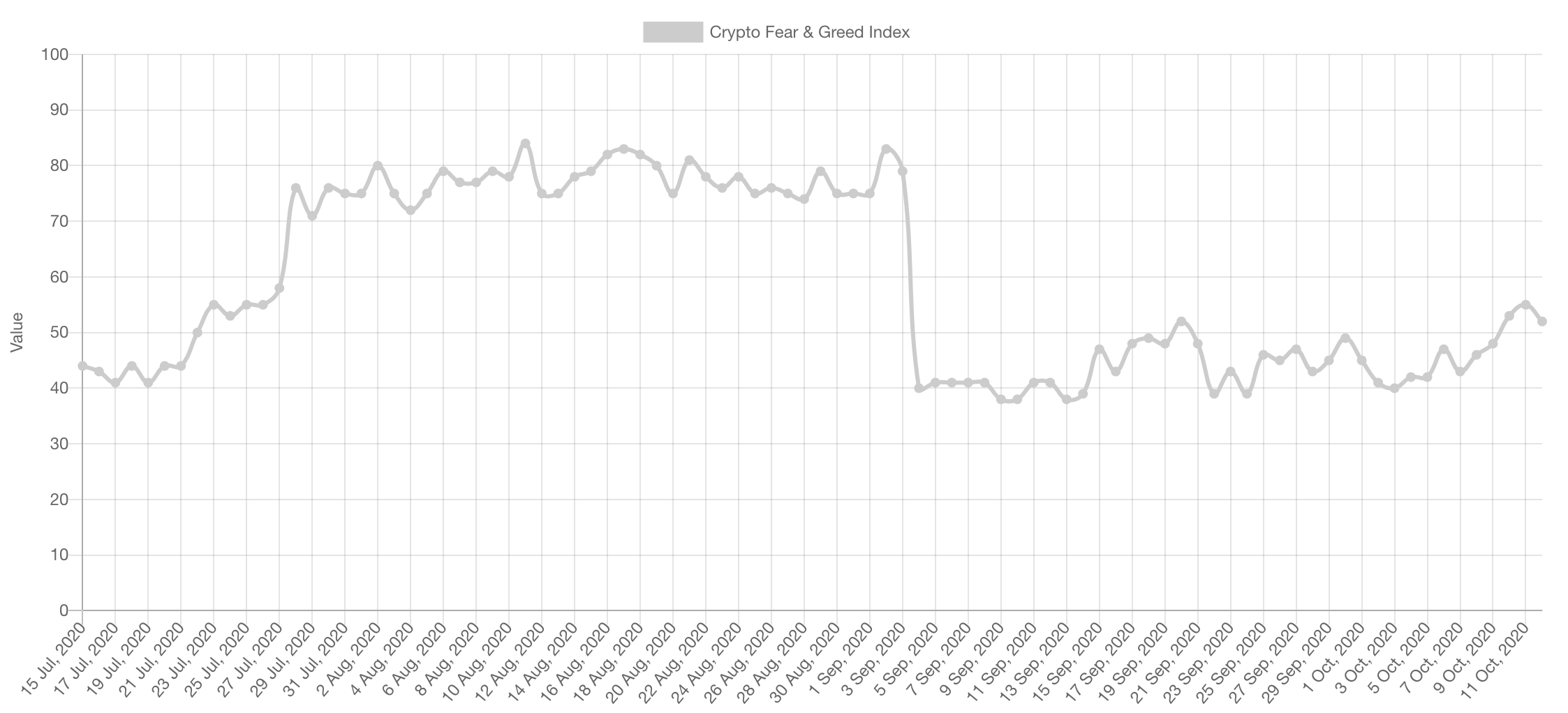

The sentiment has been stable in between the [Fear/Neutral] region as traders are uncertain of what the market may do next.

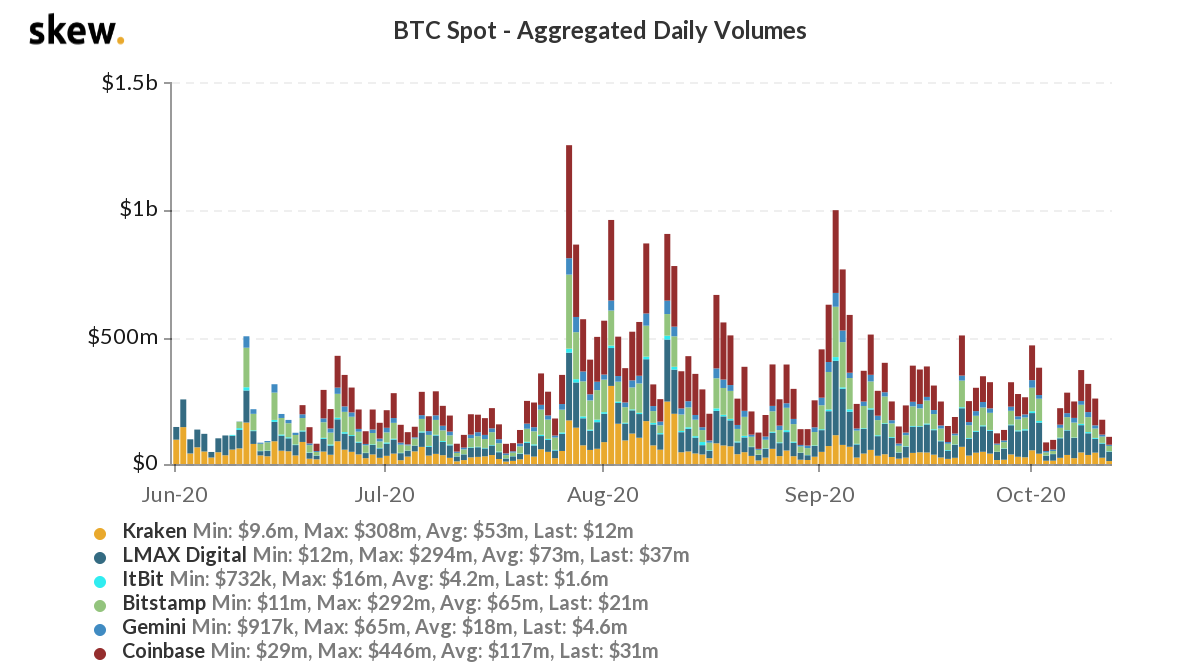

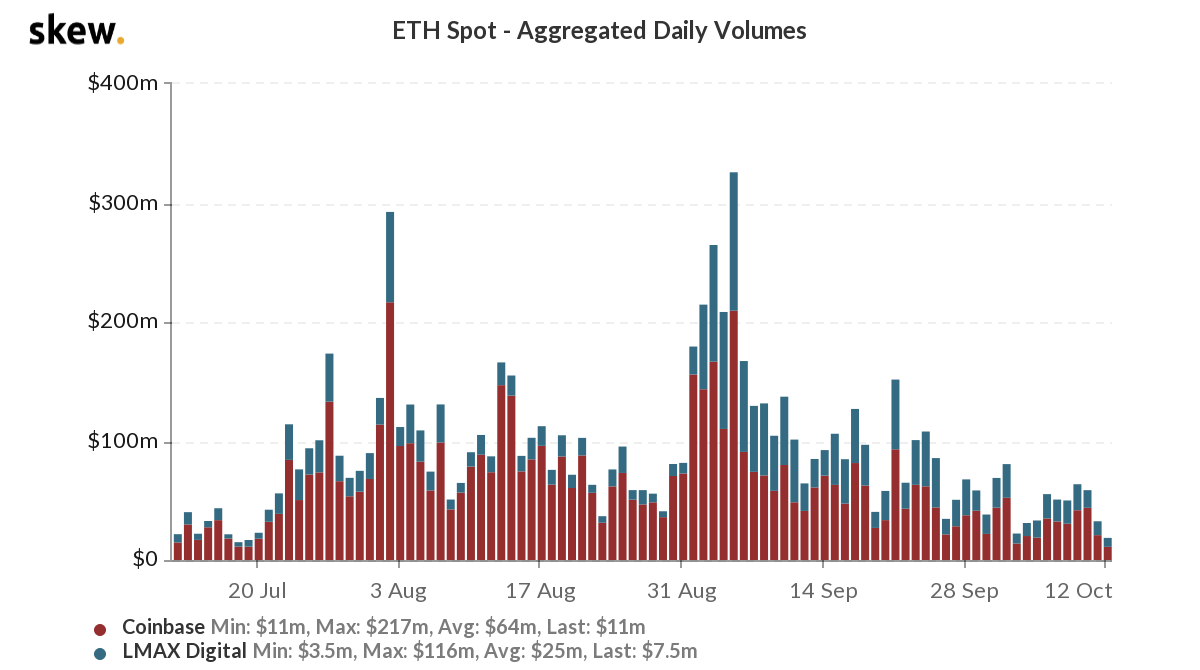

Volumes

The trading volume on Bitcoin has been in a consistent decline over the past few weeks which only indicates that this is “the calm before the storm”.

This is the same for Ether trading volumes.

Market Indices

Total Market Cap

Given the consistent decrease in trading volume, there is little to be said about the very short-term direction of the overall market as ranging and pullbacks remain possible. The mid and long-term perspective are highly bullish according to the charts as price is flipping resistances into supports and registering consistent higher highs and higher lows.

Altcoins Market Cap

Once again, our bet on Alts has not changed and we remain bullish for anything above $110B on the weekly timeframe; highly bullish that is. This is the easiest to explain chart: two levels, one goal. This recent flip is highly bullish in our eyes and consolidation above it was expected before another leg up.

Bitcoin

As shared last week in the Pro version of Weekly Technicals, Bitcoin not only flipped the monthly level from resistance to support but also did the same on the weekly timeframe.

Bitcoin managed to flip another S/R on lower timeframes which we shared in Discord, this now acts as support and losing the level can lead to further downside which will induce fear in the market as well as a potential third dip near $110B for Alts (IF the support is lost).

ETH

ETH has reclaimed $360 which sets the stage once again for a test of $405. Another bullish leg up is highly possible but only once the market experiences a surge in volume during a bullish leg, which may be soon but not yet (volume chart above).

Monero

Monero has done very well since the ascending triangle was identified. Price broke out and reached the target very quickly. Fundamentally, there is a very high need for privacy coins it seems as blockchains don't actually offer privacy with the extreme high level of traceability.

XRP

The chart setup we've taken that we shared last week remains valid for us and we are still in that trade with small size given the broader market environment (stalling).

This setup was shared a few days ago in Discord as price has corrected by a massive degree and is coming into the first area of strong support. We expect it to bounce just like LINK and YFI have. Could be an 80% play here.

DOT

DOT is also in a falling wedge formation, broken out and with a bullish divergence on the RSI. Invalidation is a mere return inside of the wedge which makes it a good R:R trade for us.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.