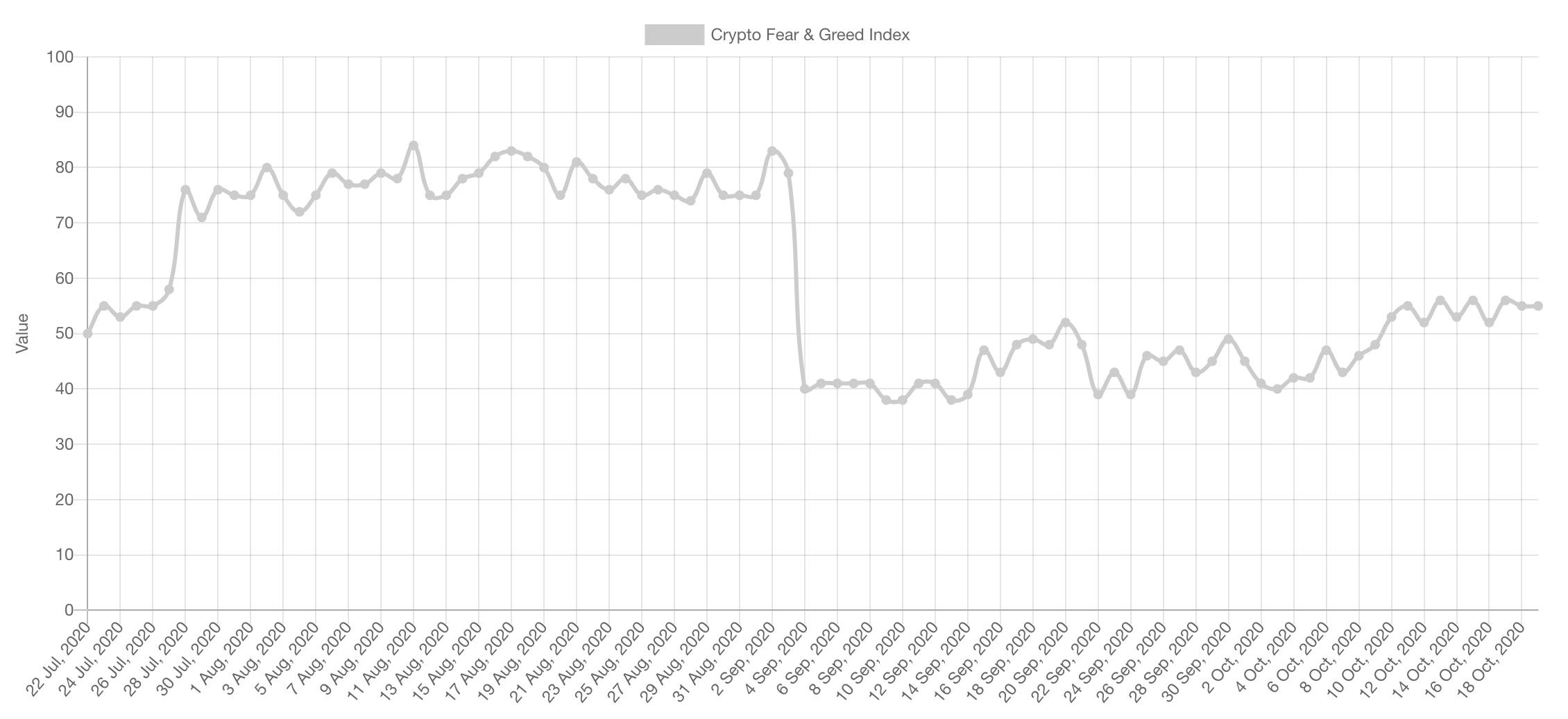

As always, we shall start by reviewing the current market sentiment. The latter has been stalling but has reached the low levels of "Greed" for the first time in weeks. Typically though, the worry in regards to sentiment starts when an extremity is reached such as "Extreme Fear" or "Extreme Greed" as was the case in late August 2020. Very worthwhile to note that Bitcoin has remained stable in the face of loads of bearish news, mainly coming from exchanges (BitMEX & OKex).

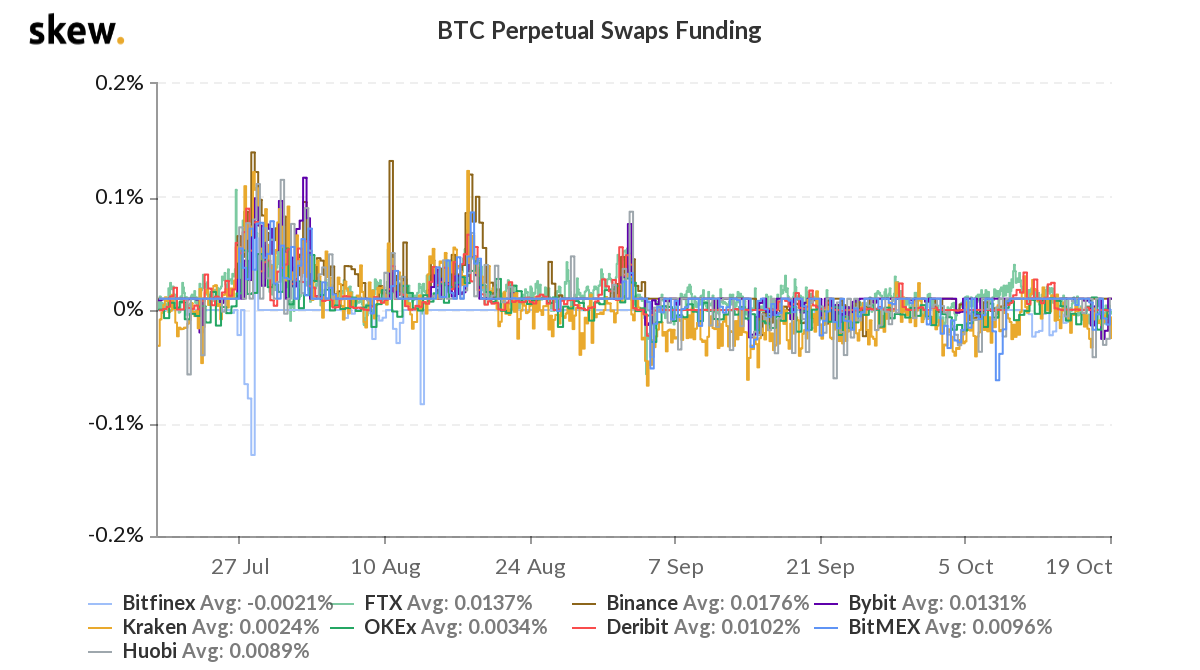

Funding Rate

Funding, as explained in a previous WT, shows which party is paying the other. Are traders being paid to long or short the market? Until now, traders are being paid (negative funding) to long Bitcoin.

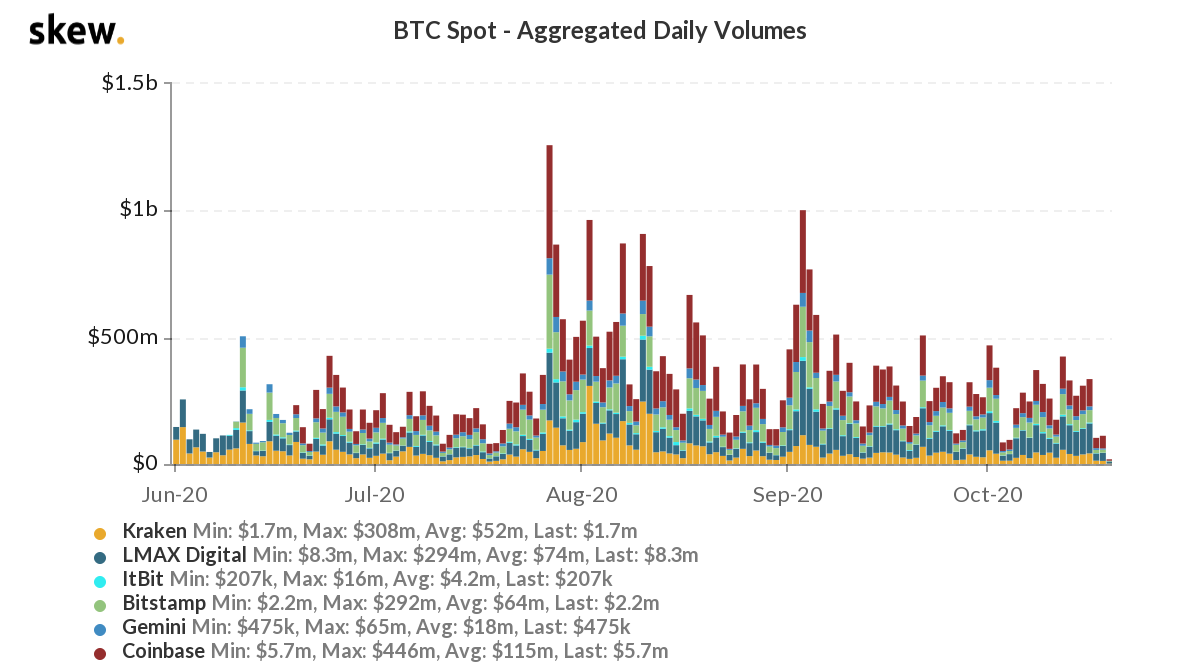

Trading Volumes

First, the Bitcoin trading volume. After creating lower highs and lower lows and generally drawing a decreasing volume image, we're seeing a sort of stability in trading volume. This of course is what's leading to the recent boring price action, but also means a large move (increase in trading volume) is getting a lot closer. Perhaps as close as within the next two weeks.

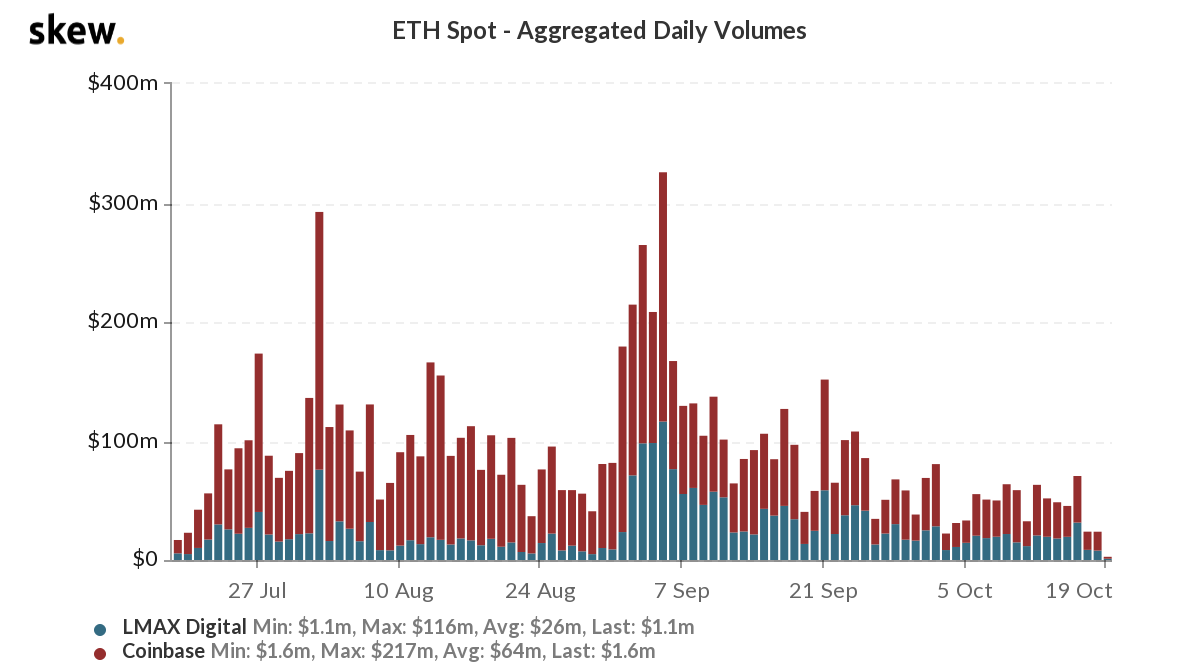

It is always smart to check different data points to ensure the conclusion is based on only one set of data and subject to high degree of potential error, which is why we're also taking a look at Ether's trading volume which turns out to be in the same state as Bitcoin's.

Market Indices

Total Market Cap

With the little price action that took place in the last week, not much has changed since the last WT. Price remains relatively close to support which maintains a higher R:R for swing longs than shorts.

Altcoins Market Cap

The consolidation can take as long as it wants and more dips into the [$110B-$120B] are welcomed with open arms. Unless that level breaks, we remain very well positioned on the long side of the market awaiting something of the sort.

Bitcoin

Price remains above the recently flipped S/R. As long as the latter remains true, $14,000 is on the menu.

ETH

Looking at the monthly chart, a very important area has been flipped for support as we extensively covered. This represents a breakout from accumulation.

RSR

The spot trade shared as RSR over-corrected and reached a level of support, remains valid and is well in profit (20%+). We remain targeting the $0.014-$0.0152 zone.

XRP

XRP's price action has been very "boring" with minimal movement. However, the breakout and retest from the large descending channel remains valid which is why we remain positioned in the same trade shared a couple weeks ago.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.