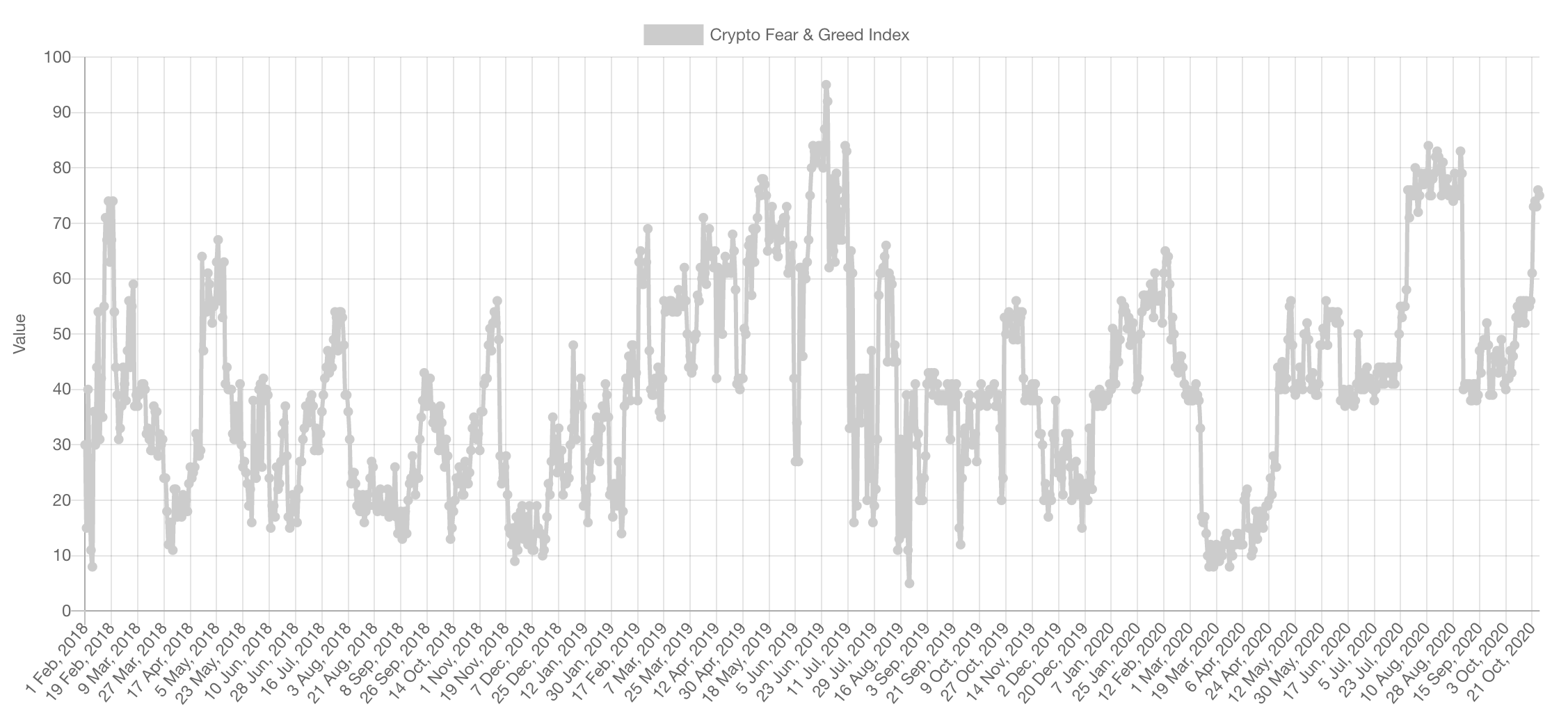

When it comes to market sentiment, it is most reliable when it reaches an "extreme". Right now, sentiment is back in the Greed zone, which is understandable after the PayPal rally. "Extreme Greed" has not been reached.

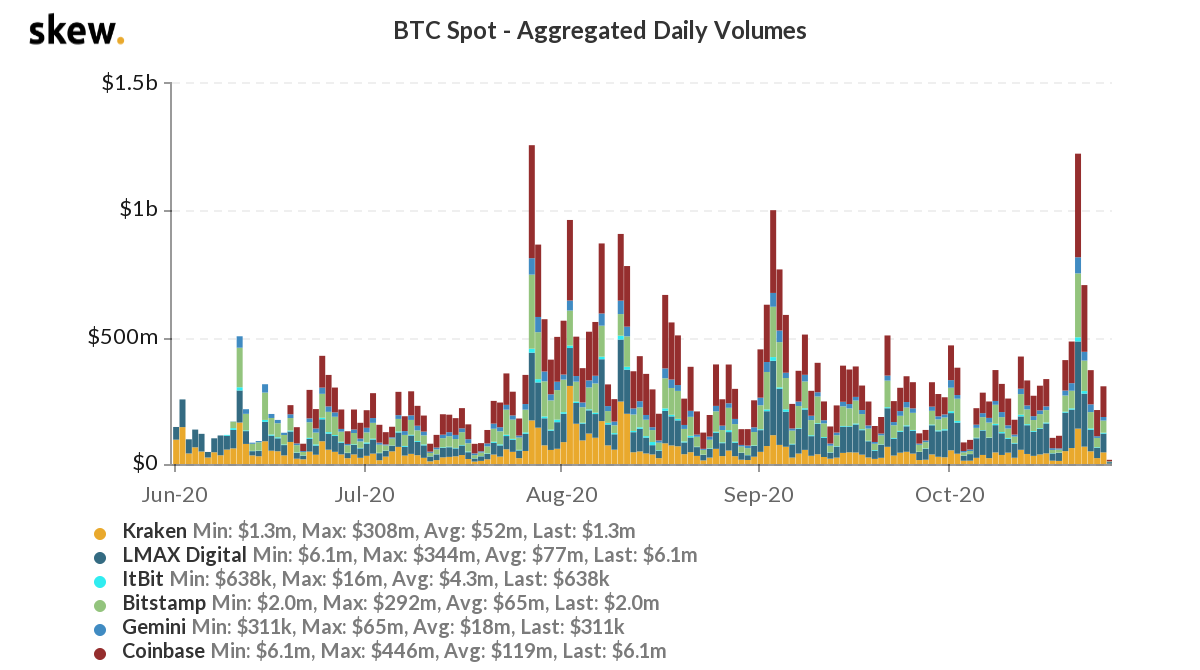

Trading Volumes

As expected, Bitcoin's trading volume sky-rocketed after the period of stalling which signaled that the ranging was coming to an end.

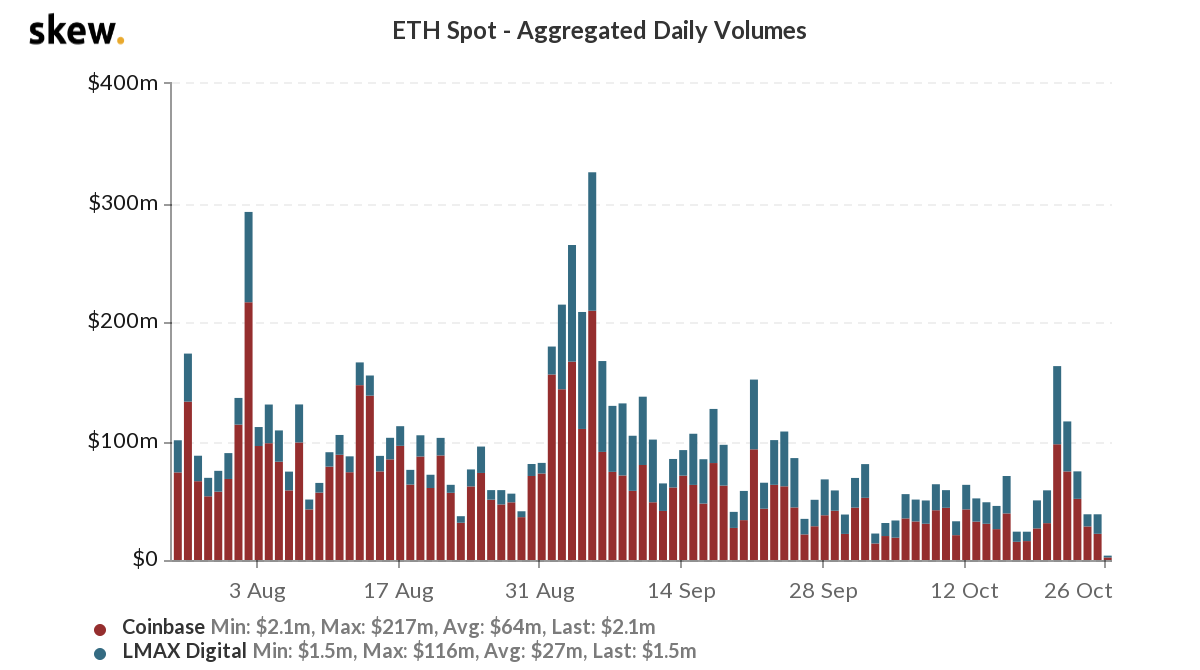

The increase in trading volume was seen in ETH as well but not of the same magnitude. When paired with its price action, it may mean that top volume is still on the way.

Market Indices

Total Market Cap

$325B area held as support as intended and price is now climbing higher towards $445B which is the next target we have our eyes on.

Altcoins Market Cap

This is a self-explanatory chart which seems to still be on track. Our bet remains "mad bull" as long as price remains above $110B. One of the best R:R in a long time.

Bitcoin

Massive rally after the S/R flip mentioned in previous WTs. Right now, price is approaching resistance (2019 top) which requires certain caution until it is breached which we believe eventually will happen as this is the start of a new bullish cycle.

Ether

$360 reclaimed and $405 was reached and breached. Daily candles have respected that level highly which sets the stage for a potential run towards $500, especially interesting with the volume chart and analysis mentioned above.

XRP

The monthly XRP chart is undeniably bullish. There are many resistances overhead but the train may be ready to start departing soon, at least for a small rally which is what we are betting on for now.

RSR

RSR has outperformed the market and done very well in the past few days. It is now coming into strong resistance. If breached, the roads to ATHs are open.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.