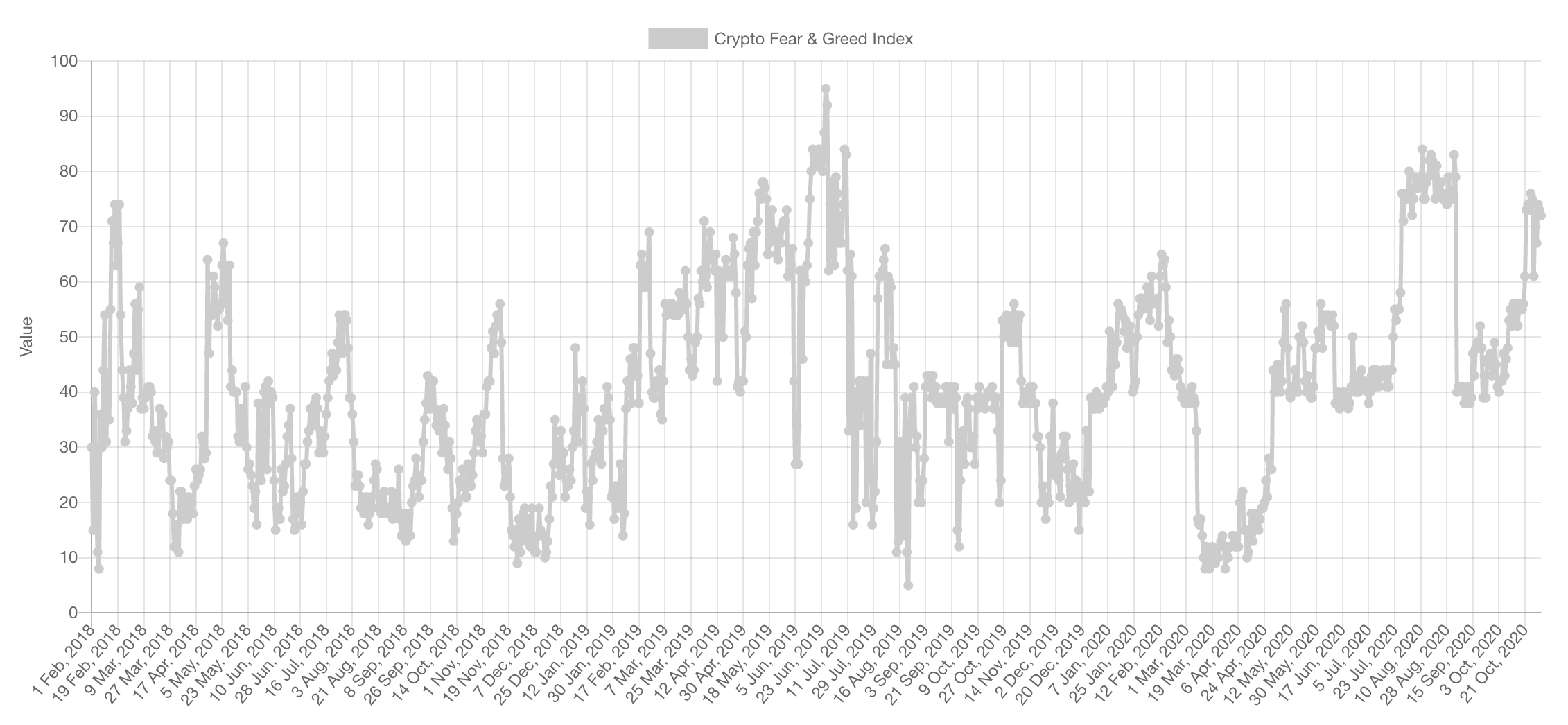

Sentiment is in the Greed zone, however it has not reached extreme points yet. Usually, extremes bring about the worry of a trend (temporary or mid-term) change.

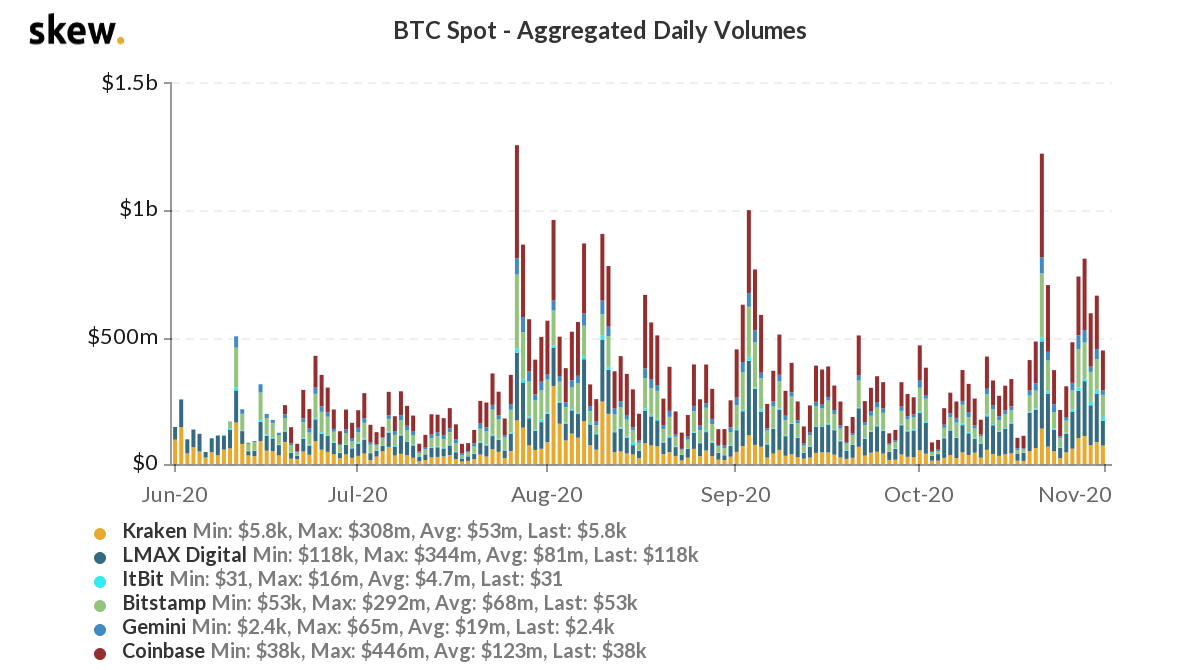

Trading Volumes

Starting off with Bitcoin's volume, the latest move had large volume backing it which is necessary to prove that it was organic and not manipulated. Ether's volume is more interesting because it has not yet had its "breakout" like Bitcoin did, and that's purely talking about volume. Unfortunately, we cannot show the chart because we get our data from Skew.com and for some odd reason only the ETH volume chart is blank today.

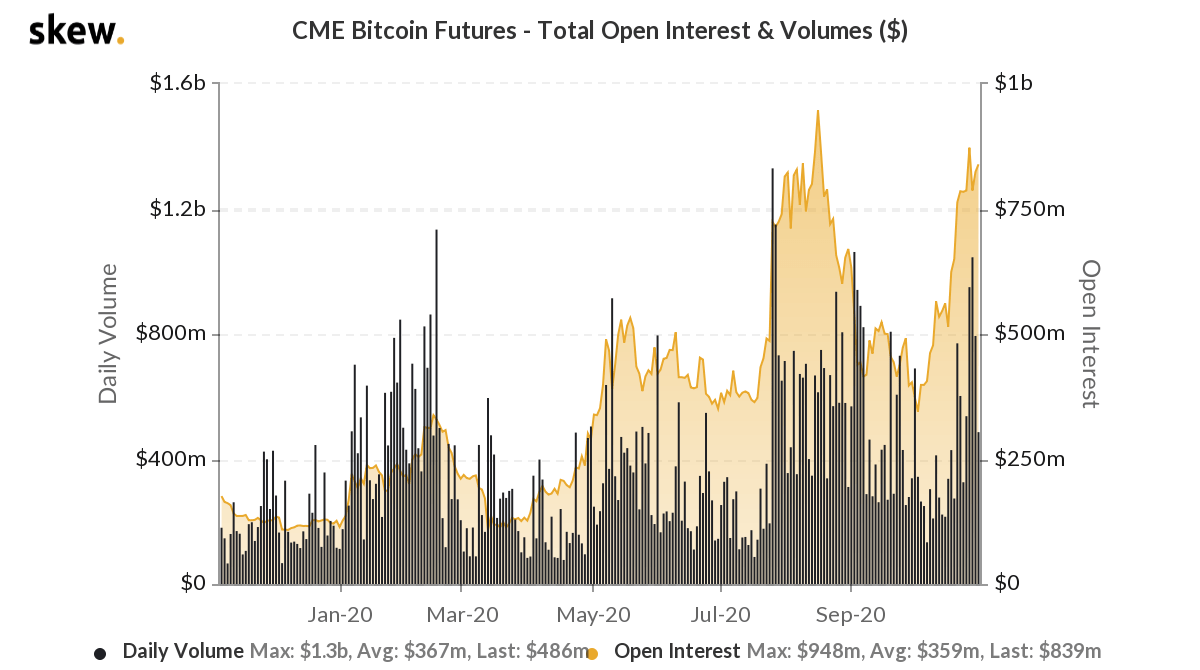

Going onto the institutional side, the open interest and volumes on CME BTC Futures have been rising dramatically. We expect the open interest will soon reach a new ATH on the CME.

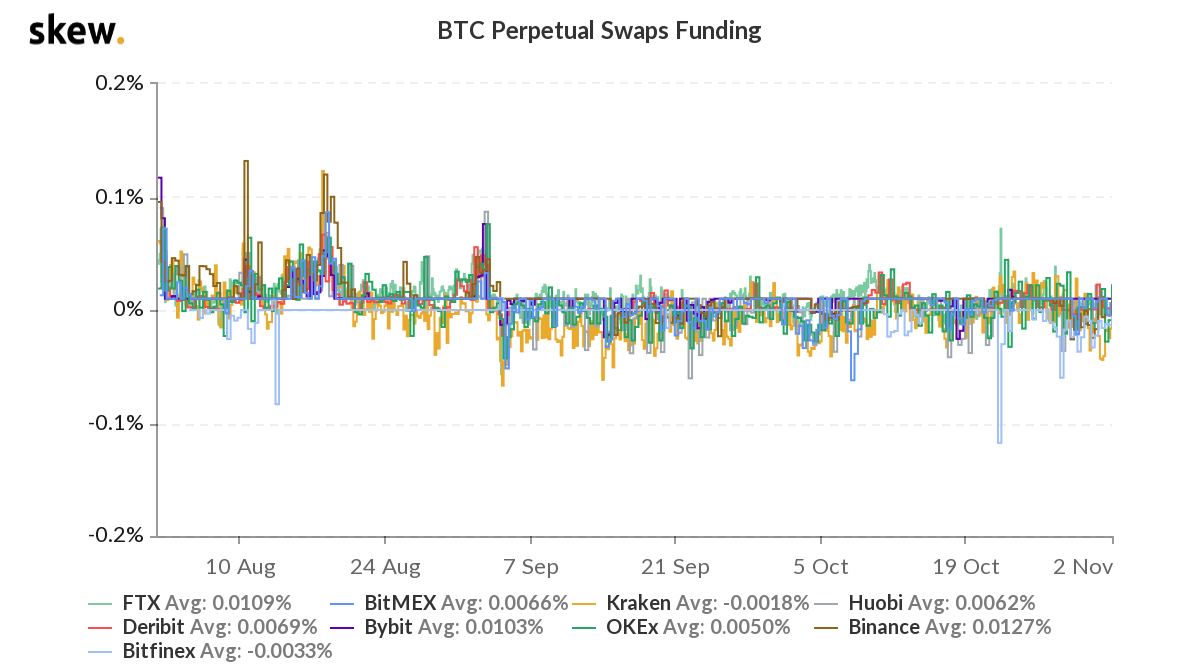

Funding

Very odd, but futures traders are STILL getting paid to long Bitcoin (negative funding) which is one of the reasons we view Bitcoin to be a lot healthier here at $14,000 than it was in 2017 or 2019.

Market Indices

Total Market Cap

Price retested weekly support as shared countless times and is now heading towards $445B.

Altcoins Market Cap

Still the most self-explanatory chart and the chart we are very bullish on. For as long as Alts remain over $110B, we remain "mega-bull".

Bitcoin

Both the weekly and monthly candles closed right under resistance which calls for a potential pullback into the $12,500 area. As long as Bitcoin does so without sharp moves or stays almost flat, Altcoins may have a good run soon.

Ether

Two charts, quick and effective.

First: Notice the recent higher lows and higher highs which may put an end to this consolidation and propel ETH to $500 first.

Second: ETH has completed a double-bottom pattern with a very clean retest, the target is as shown ~$550. We'll examine if and when price gets there but we suspect price to run much higher. Yes, $800EOY remains our target.

SXP (Swipe)

SXP is a shitcoin, sorry to break the news. This is a pure technical play. Buy volume has showed for the first time since October and price is hitting the last area of support. Unless broken, SXP has a chance at a 30%+ rally which we're putting a bit of money on.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.