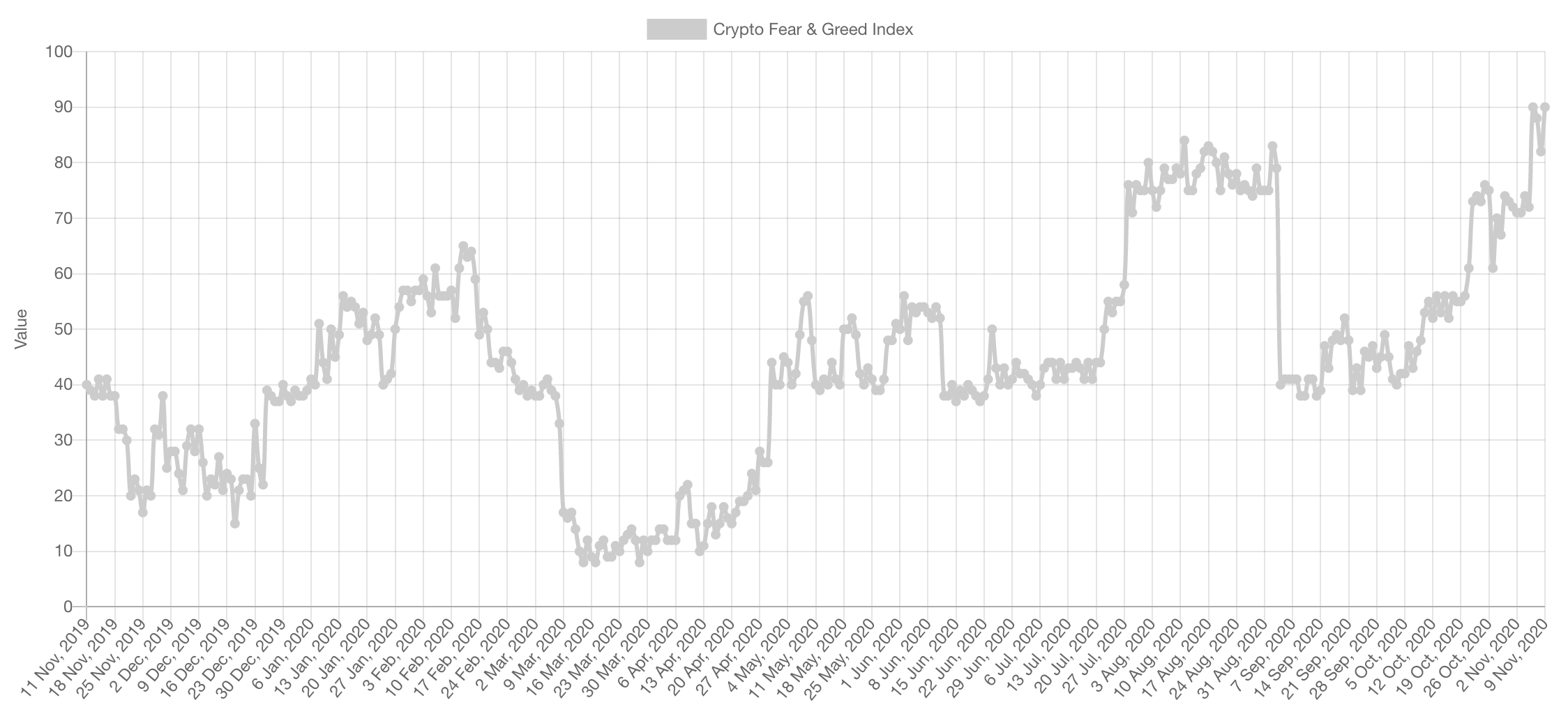

Sentiment has reached “Extreme Greed” which is understandable given that Bitcoin is trading at $15,000+. Extreme sentiments must be handled carefully because they tend to cause reversals. This information however, cannot be used to time the market. The “Extreme Greed” sentiment lasted throughout the entirety of August (an entire month).

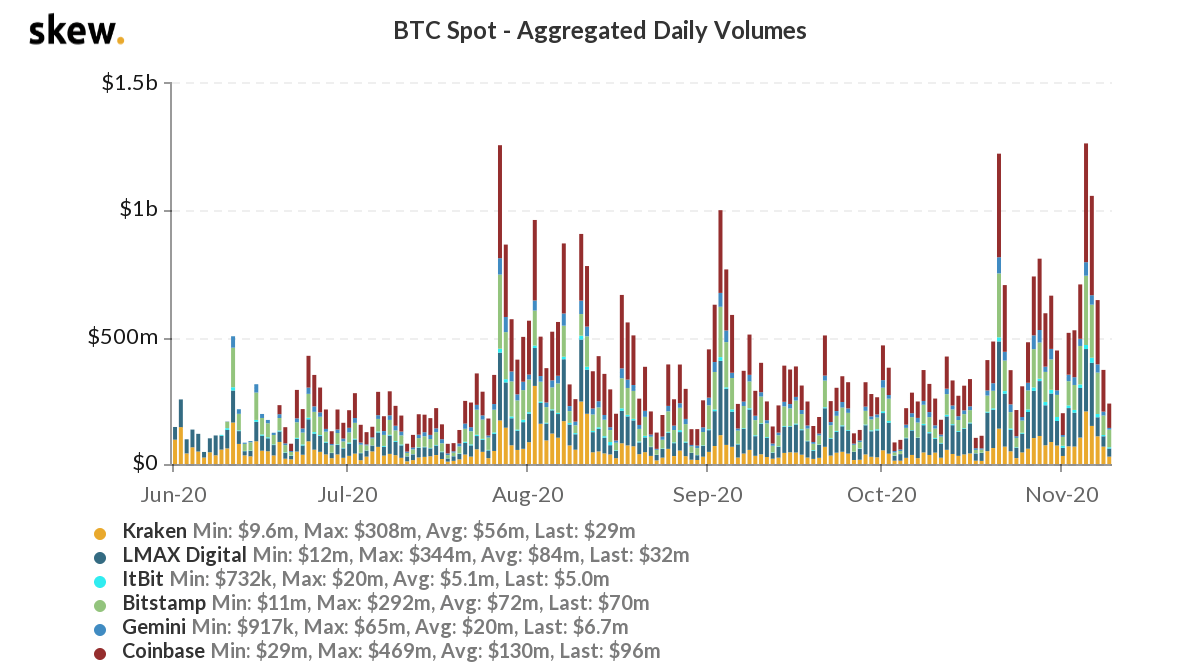

Volume

Trading volumes on Bitcoin are confirming the trend. The high volume shows conviction.

The data provider (Skew.com) still isn't showing the Ether Volume chart for some odd reason. Either way, from what we can tell, the volume of course has been increasing on ETH but there was not a major increase yet.Market Indices

Total Market Cap

The $445B target has finally been achieved, it has been our target for a while. The flip of it can bring a very interesting leg to the upside but we cannot assume so until that happens. Our guess is it will be able to cross through $445, mainly through Altcoins.

Altcoins Market Cap

This remains our most comprehensive chart, the [$110B-$120B] S/R flip is keeping us extremely bullish on Altcoins with a first target at $245B.

Bitcoin

Very few resistances stand in the way of Bitcoin’s price, all-time high is no longer very far away. The weekly timeframe toppled $13,800 which sets the next target at $17,200 and any dip to $13,800 is something we are interested in buying as they represent high R:Rs.

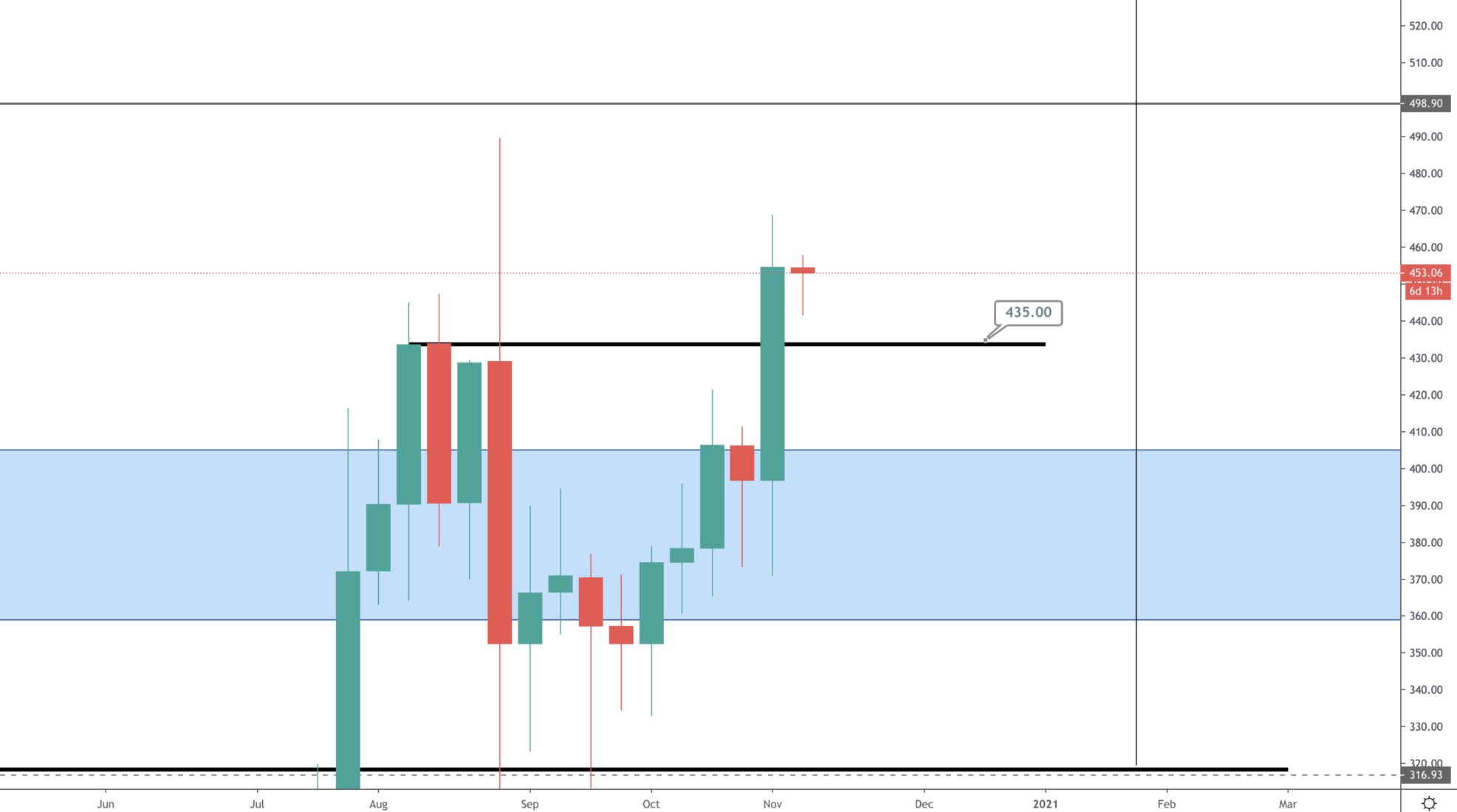

Ether

The double-bottom pattern we shared in Weekly Technicals Pro last week when price was sub-$400 is in materialising. The technical target is $550.

Digging deeper into the weekly chart, the line at $435 represent a pullback area we'd be interested in buying (in addition to what we already bought) with targets: $550 & $800.

XRP

This one has been a very slow mover, but our perspective and bias remains the same after the bearish structure break.

SXP

It was a shitcoin but it made for a great trade, this is the one we shared last week. Not trading this one anymore.

LINK

Right at resistance, but given the bullish environment keeping an eye on LINK for a break of $12.75 to long and target $17.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.