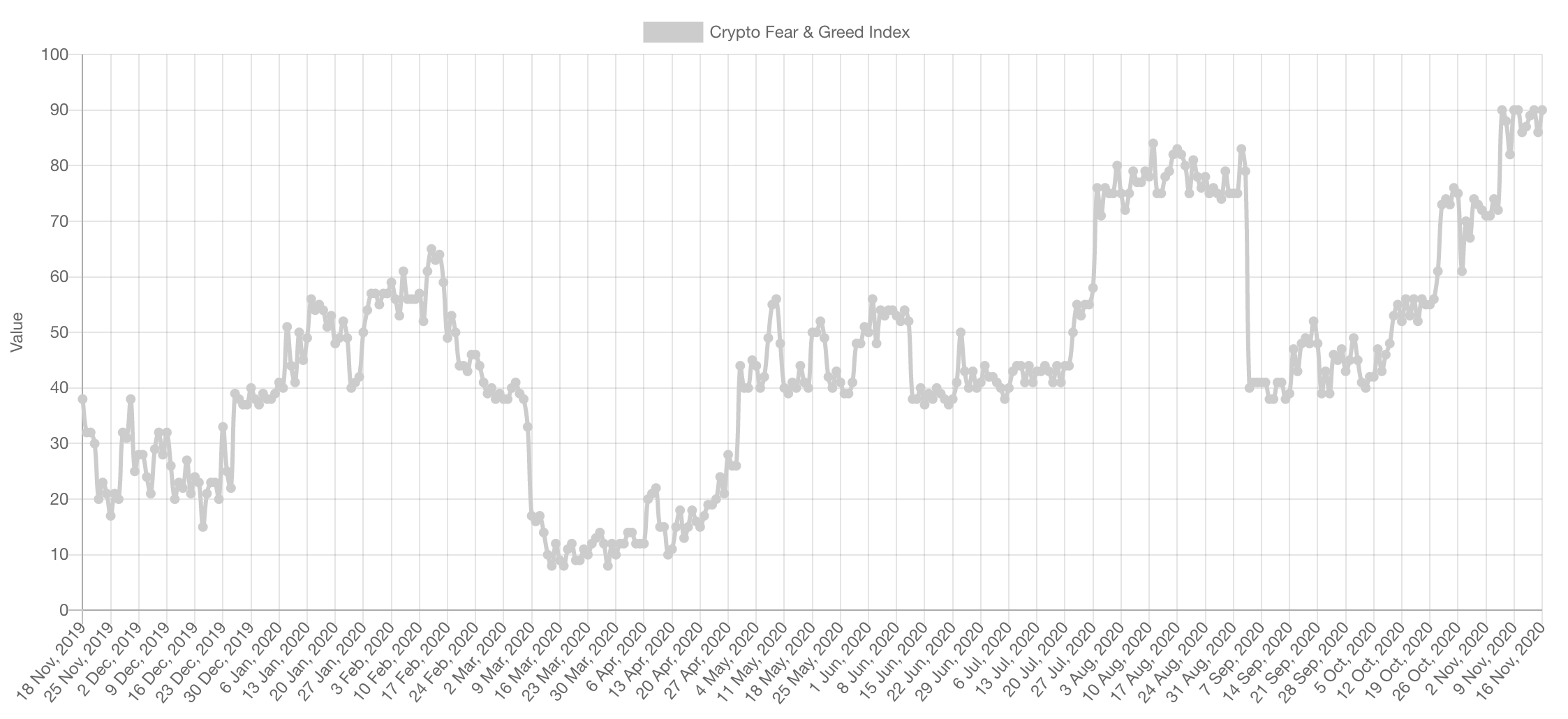

The market has been in “Extreme Greed” since November 6th, while this tends to be a bearish indication and nearing pullback/correction, it can stay at these levels for a while so it cannot be used to time the market. For example, the market remained in “Extreme Greed” throughout the entirety of August 2020.

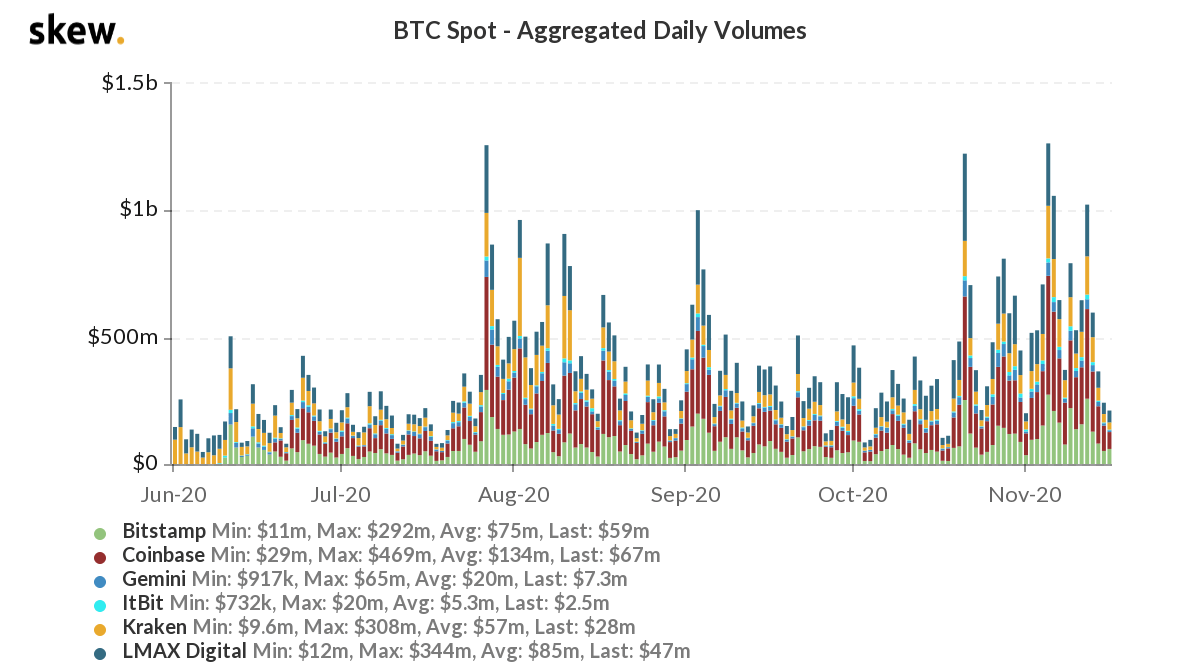

Trading Volume

Bitcoin has been trading with very large volumes, indicating of course an organic movement supported by a big portion of the capital in this market.

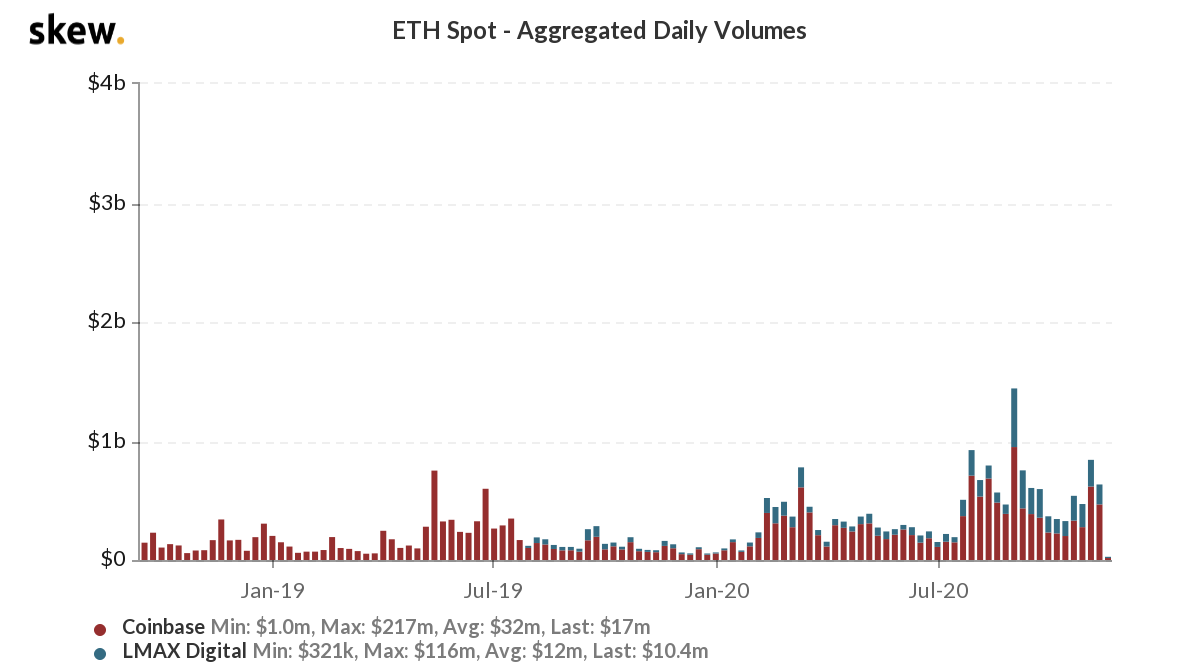

The Ether volume data is finally available by Skew. As you can see while there was an increase in volume it was not that significant (yet).

Indices

Total Market Cap

The Total MCap has now crossed $445B on the weekly timeframe, a second candle closure above this level would confirm the break. There are resistances overhead of course but they are somewhat of smaller magnitude than the ones market already went through. All-time highs are no longer a far away dream.

Altcoins Market Cap

The Alts MCap, as we have repeatedly stated is something we are majorly bullish on after the [$110B-$120B] bullish breakout. Unless that changes, our stance will remain the same and so will our first target of $265B.

Bitcoin

Bitcoin has been a raging bull ever since that bullish S/R flip in the $11,000s that we shared in Weekly Technicals Pro. Price action is still registering higher highs and higher lows, it seems that a significant slowdown won’t happen before $17,000.

Ether

The $435 pullback last week was the perfect spot to add to our position (mentioned in Weekly Technicals Pro). This market is also registering higher highs and higher lows but at a slower pace.

IMPORTANT: Tomorrow is a crucial day for ETH. More than $1 Billion worth of ETH gets released from Uniswap pools, the UNI liquidity mining program ends November 17th. The question is where will that money go? Will it be sold? Will it be put in ETH2.0 staking? DeFi?While we can only make educated guesses, the smart place for this money to go is into DeFi as there are good yield rates to take advantage from. If this is correct then DeFi will have yet another boost.

XRP

Probably one of the slowest trades but it is slowly working in our favour which is always good. Our bias remains the same.

COMP

Compound is a solid project, its token COMP however has underperformed compared to the rest of DeFi. As long as price does not break below $118 on the daily, it could be set for a +30% run.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.