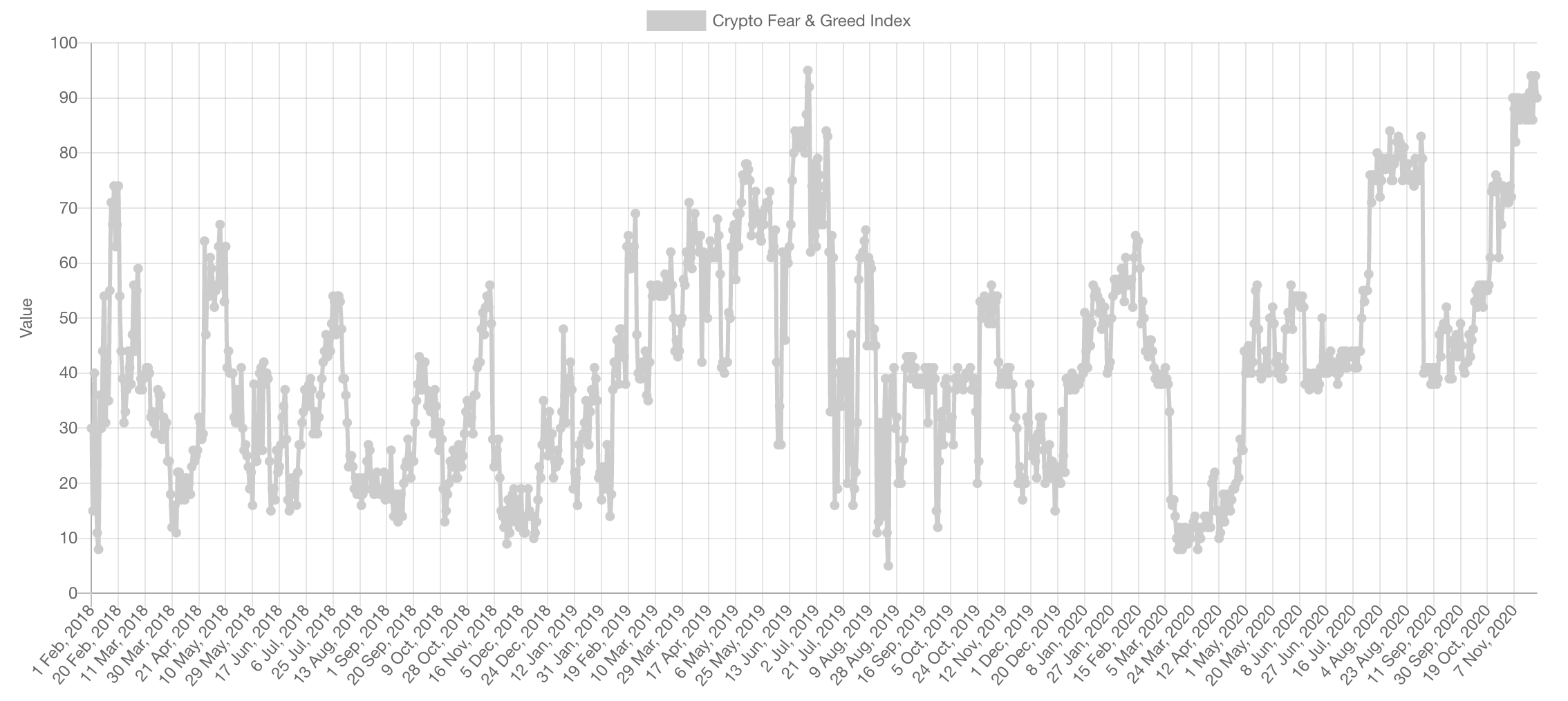

There is no going around the fact that market sentiment is at a very high level of “Extreme Greed”. It reached a level of 94 a couple days ago, the all-time high was 95 in June 2019 which indicated the top back then. This metric cannot be used to time the market but does call for caution. There is nothing stopping the market from rallying another +50% before the greed gets taken out.

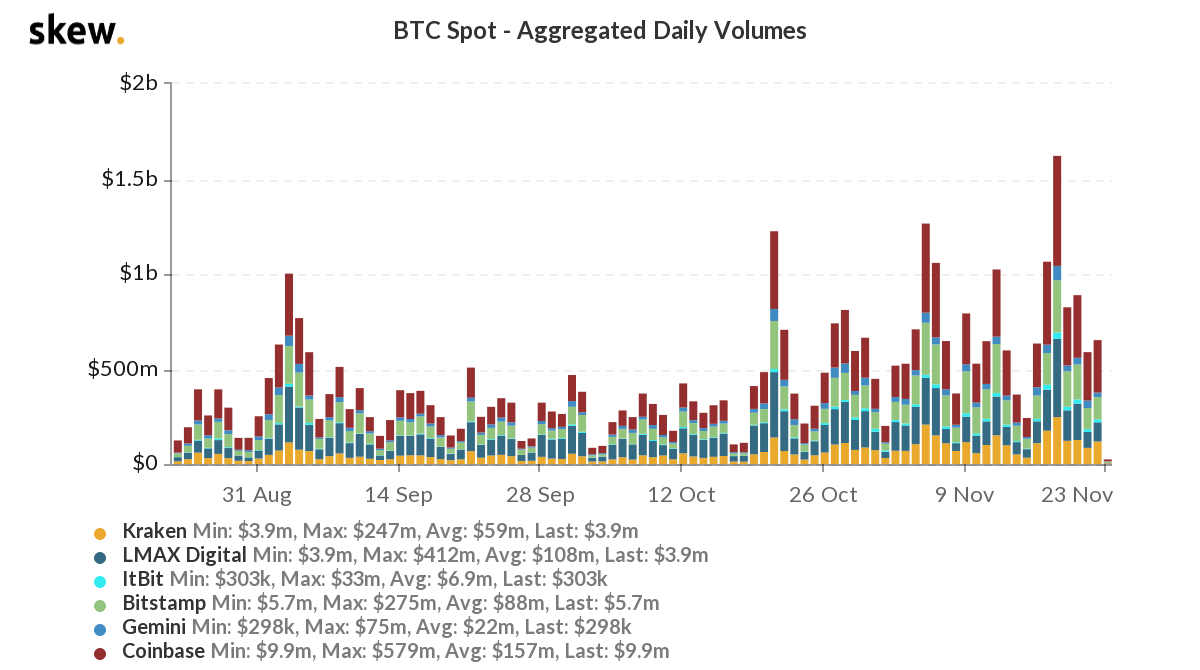

Trading Volume

Bitcoin has been ranging, giving room for Alts, which explains the recent reset in volume. They remain high and healthy but are of course lower than what got Bitcoin to rally $5,000 straight.

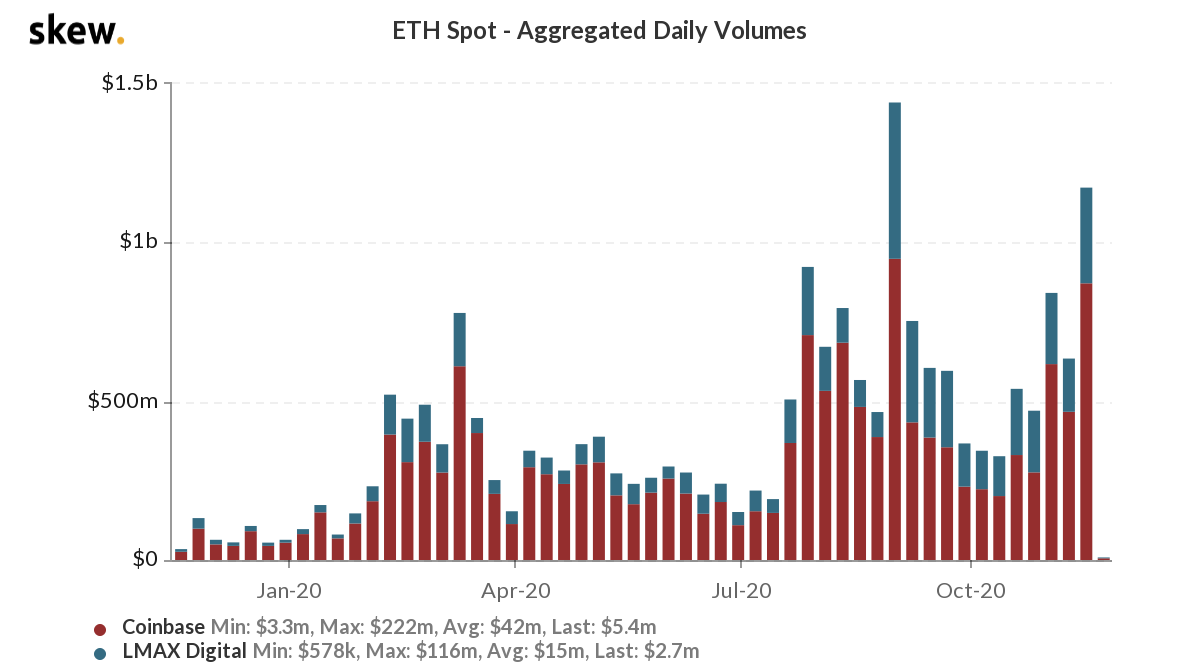

ETH’s trading volume is picking up momentum. It is likely however that trading volumes hit new highs like we’ve seen with Bitcoin during the 5k push.

Indices

Total Market Cap

The retests of $325B was a legendary one and the opportunity of a lifetime. Since that retests (of course covered in Weekly Technicals) the total market cap rallied by over 60% non-stop. Right now, it is right under resistance, which is the last one before the open road for all of crypto.

Altcoins Market Cap

Alts’ retest of [$110B-$120B] liquidity area was one of the most profitable dips we have bought with plenty of conviction. This remains the most straightforward chart with “no caption needed”. Next level: $245B.

Bitcoin

Bitcoin, the main contender of this rally that opened up new doors for all of crypto, remains in a relentless rally looking to challenge all-time highs. $17,200 was the support area that held price this week and is sending it on it’s way to the previous all-time high.

Ether

Double-bottom pattern, target achieved at $550 (70%+ rally). $550 was a target and an intermediary level, the real test will be $800 which we are still awaiting by end of year.

XRP

The “accelerated mover” pulled a very quick +50% rally, the entry on this trade was marvelous.

Let’s discuss for a minute what caused this rally on a Saturday. First, XRP’s been trading in a very tight range for 60 straight days which means a lot of over-leveraged positions were opened hoping to be right. There was an increase in demand on Saturday which explains the direction but not the magnitude of the move. You see, all the leveraged shorts began getting liquidated one after the other, pushing the market higher and higher very quickly. Remember the cascading liquidation on March 12th? Yeah the same happened but to the other side. Big move induced what? A lot of “too confident” leveraged longs, what happened then? When price imminently reached a resistance level ($0.47) some early longs were taking profit pushing the price down slightly, the over leveraged top longer began getting liquidated and that pushed price to wick excessively.

Where to next? The battle is with $0.47 which crushed prices in 2019, once taken over the next stop is $0.79.

ALGO

Quiet for a while, ALGO quietly reclaimed a level ($0.30) which sets the next target just under $0.50 as long as that level holds.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.