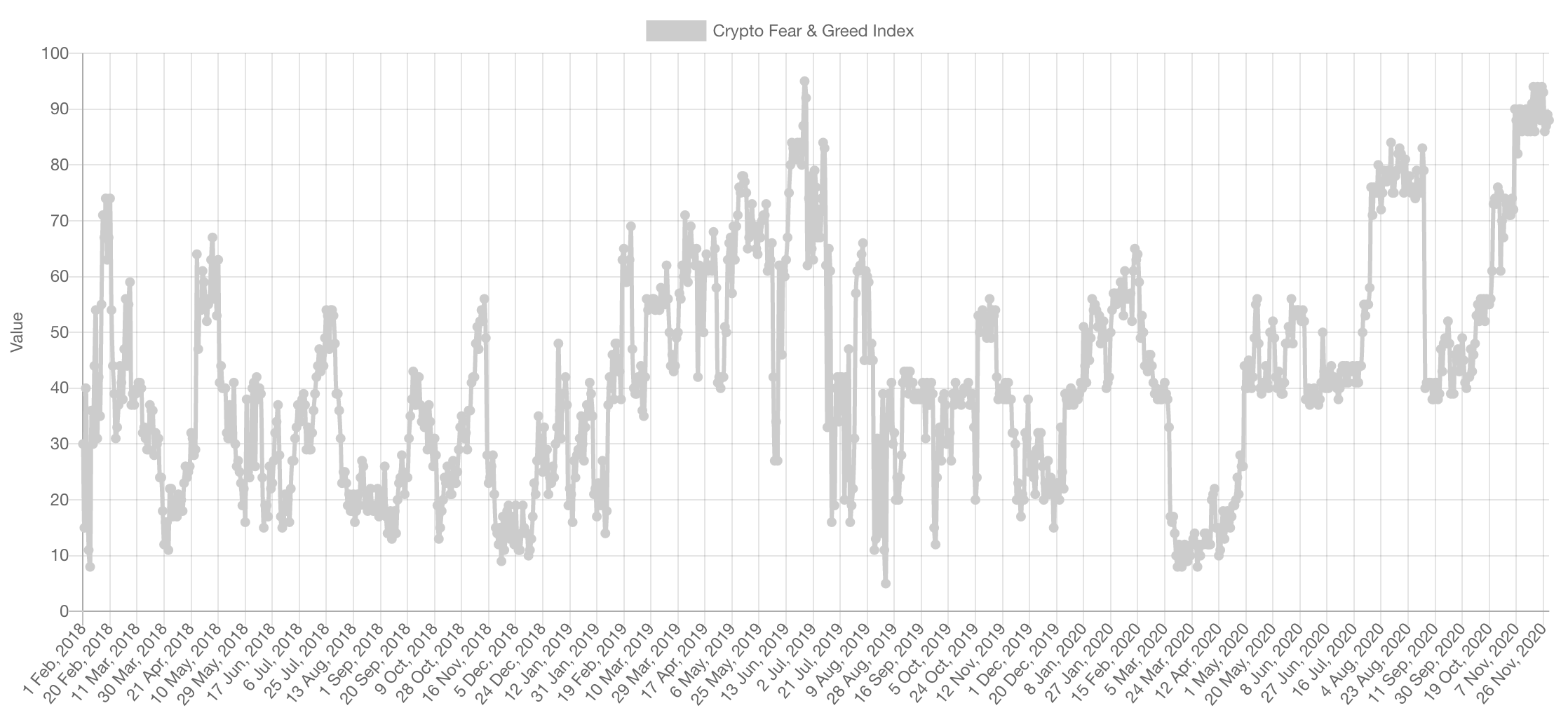

Sentiment remains in “Extreme Greed” despite the recent retracement. There is not sentiment data from the 2017 bull-run to make comparisons, but this indicator has remained in the Greed zone since Bitcoin was trading at $14,000. As stated before, it cannot be used to time the market but does call for caution.

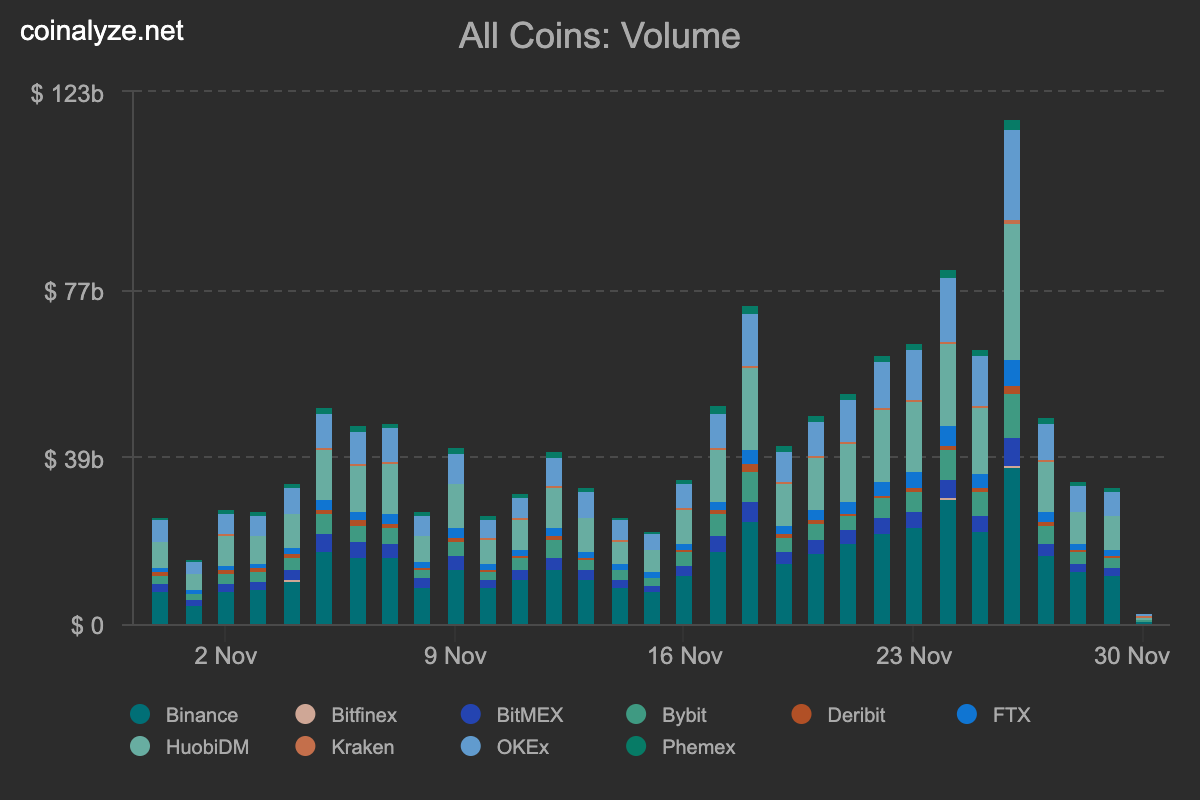

Trading Volume

Trading volume has dramatically decreased one the days the market was pulling back. According to Dow Theory, volume must confirm the trend. Worry would be raised by increased trading volume on a downside move as that could indicate a change in trend which has not occurred here.

Market Indices

Total Market Cap

$547B has been the main resistance stopping growth, it is the last resistance before the all-time high. A cross above this level can be the next step in pushing this market into the Trillions.

Altcoins Market Cap

The faster movers have begun moving and we are not expecting them to stop now. This chart and our bet is materialising day by day.

Bitcoin

The push down was immediately bought up, maintaining a bullish outlook on the weekly timeframe. This will help push Bitcoin higher into the next level: all-time high. This is specifically possible with the major institutional flood of capital.

Ether

After a perfect double-bottom trade with a $550 target. ETH went ahead and retested the $500 key level off of which it bounced. We remain believers that it can reach $800 by end of year.

XRP

A massive rally on XRP, and price is very fairly taking a break (it earned it). XRP is now ranging, a close above $0.64 will lead back to $0.79. On the other side, a break of $0.585 would lead back to $0.47. Until then, XRP is likely to maintain this range.

SNX

$4.15 support was respected by the daily candles. This is now shaping up to be a second rally to $5.50. If Bitcoin takes a small break, SNX could get there very quickly as attention shifts to DeFi.

LINK

We’ve actually shared and taken this trade a couple weeks back, it was shared in Weekly Technicals Pro. The target was immaculately achieved and price is now looking to test back that $17 level again.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.