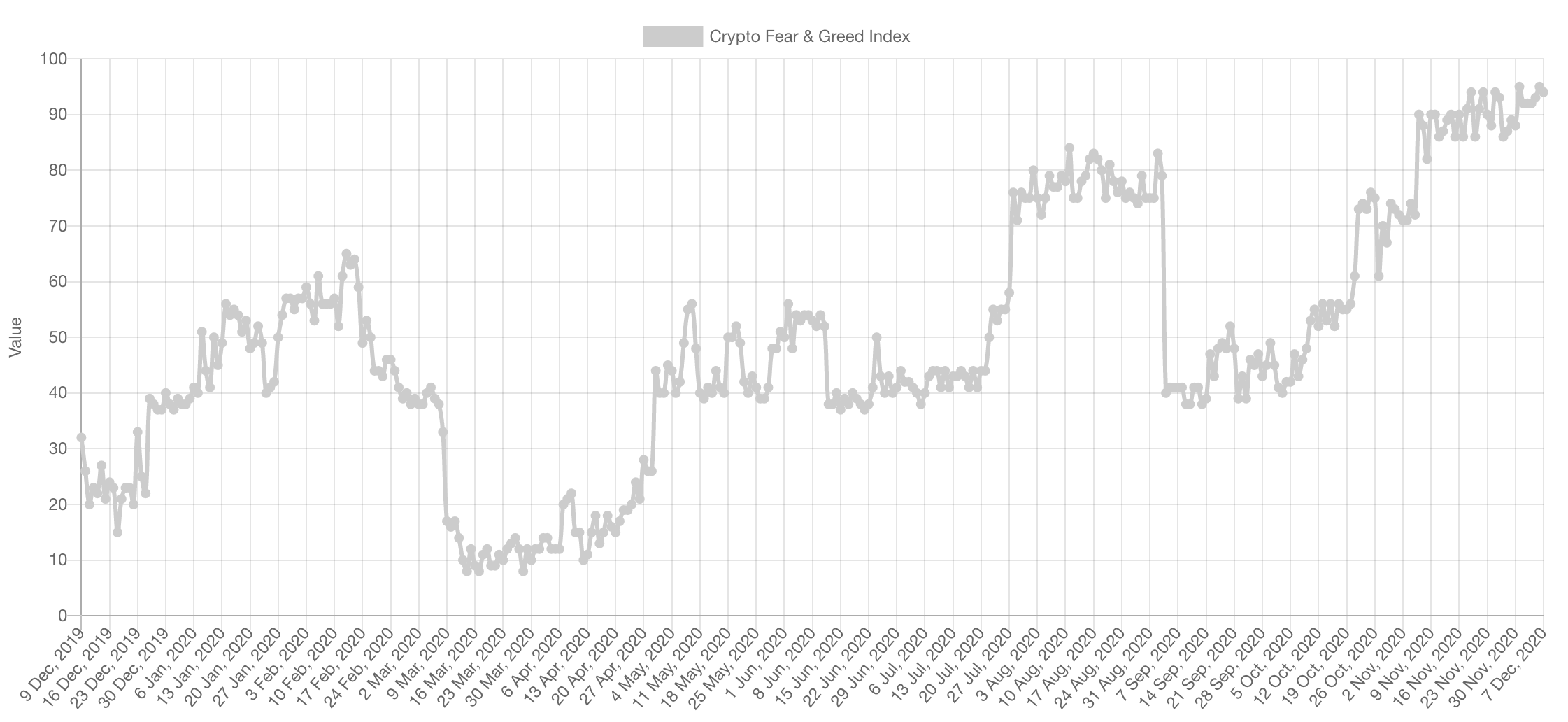

“Extreme Greed” has once again hit a very high level: 94/100. Once again, we restate that this tool cannot be used to time the market, it simply calls out for caution as at some point buyers may experience temporary exhaustion.

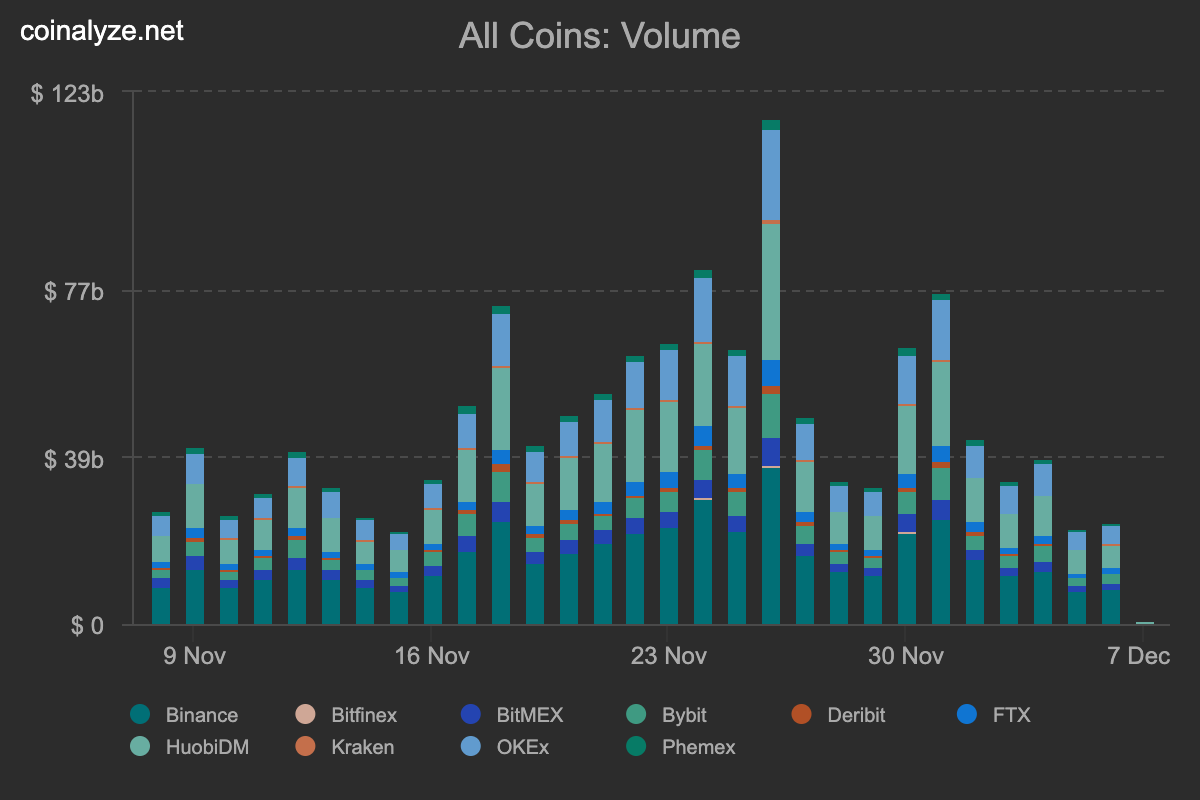

Trading Volume

The futures’ trading volume is communicating a clear message: “Calm before the storm”; continuous lower highs as the dust settles after a large move. Before a secondary increase in trading volume, it’ll likely witness a stagnation stage as we saw before the run-up on Bitcoin back when it was trading near $10,000.

Funding

For those unfamiliar, funding is what maintains the peg between “Perpetual Futures” (perps) and the price of the underlying as these contracts do not expire.

- Negative Funding (because the market is skewed short) = shorts pay longs

- Positive Funding (because the market is skewed long) = longs pay shorts

Whenever the figures over-extend to one side, it indicates exhaustion of the buyers/sellers. It is a more precise indication of sentiment than “Fear & Greed”.

These figures are not extreme by any means and most are at the standard rate of the exchange (typically 0.01%). XRP is surprisingly negative, meaning there’s big capital behind shorts on FTX, Huobi and Okex. This gives it more room to rally to the upside in the next few days than BTC and ETH.

Market Index

Total Market Cap

$535B represents the highest monthly closure in 2017, which has been crossed a few days ago. This is the main monthly support for December, over which price shall remain on that timeframe for further upside.

Altcoins Market Cap

Alts have been on a rip for a good few weeks, consolidation is not out of the question nor the ordinary. In fact it drives indecision amongst many who end up questioning their investments (some exit too). Our target of $245B remains underway, been our target since the September correction; now up +72%.

Bitcoin

Bitcoin is facing stiff resistance: its own all-time high (~$20,000); a great problem to have. Given the strength of this rally and most importantly the institutional capital flow backing it, it is no secret that we consider “dips for adding”. Bitcoin has perfectly pierced through $13,800 and $17,200. Now the latter has turned into support.

$19,900 is the determining factor here, a cross above and it is uncharted territory; finally.

Ether

However this plays (dip from here and rally or straight rally), we are still believers in “$800 ETH EOY”. This asset remains under-appreciated and under-recognised for its potential.

XRP

After the higher low which created this entire rally, XRP created a MUCH higher high. From here, we’ve discussed in Pro Discord how price has been trading in a determined tight range. The breakout from it will give the next indication as to whether $0.79 comes next or $0.47.

Given the catalyst incoming (airdrop), our educated guess would be an upside break within the next few days.

ALTPERP

We are currently observing the following trading setup on the “ALTPERP” index on FTX which tracks a basket of the largest Alts. We are awaiting a break of the counter-trendline to position ourselves in a long targeting $1,180.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.