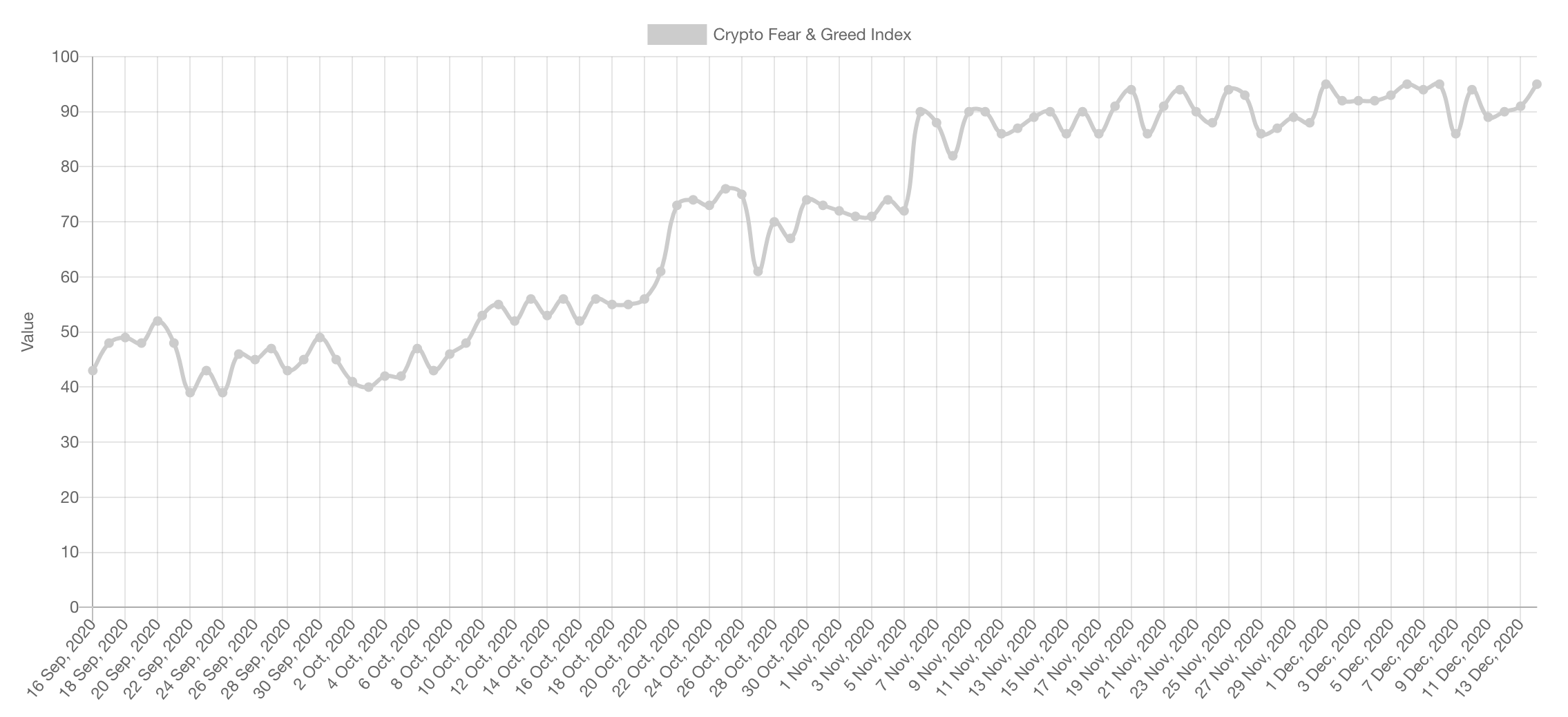

After a slight drop, the market sentiment is right back at “Extreme Greed: 95”. This is an indication that calls for caution and reminds us to not get carried away and forget about risk management. However, it cannot be used to time the market by any means. In fact, the sentiment has been in “Extreme Greed” since Bitcoin was trading at $14,000. It is similar to the RSI for example, just because it is “overbought” does not mean the market is going to stop right away, it can stay at elevated levels for weeks as we have seen here.

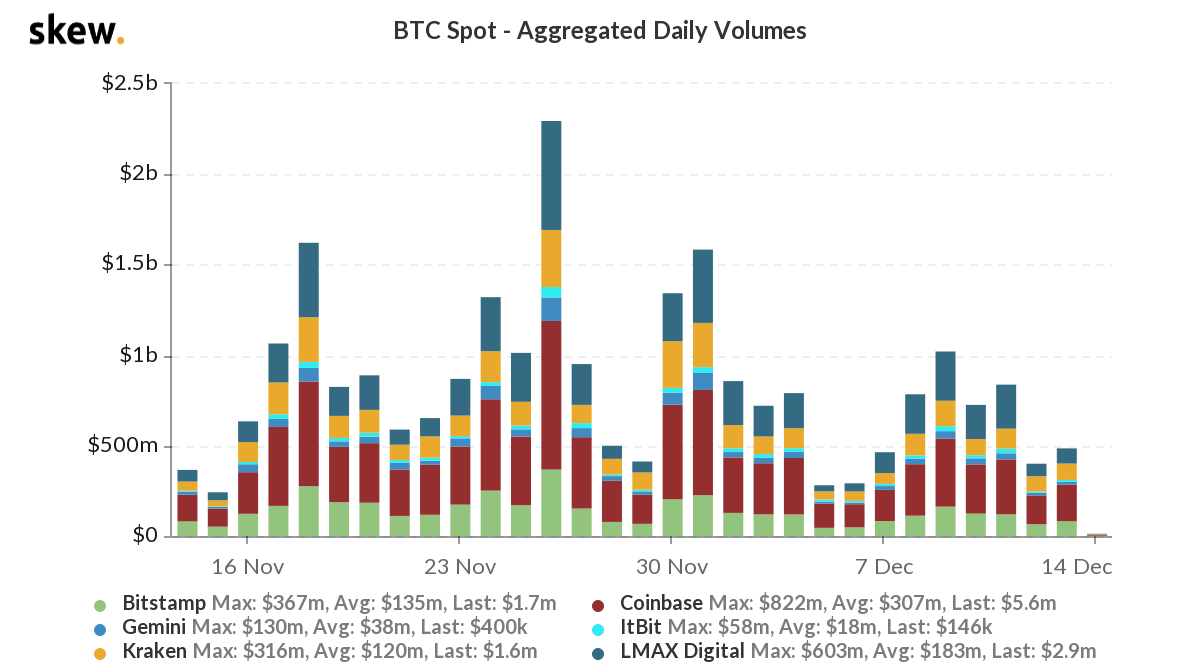

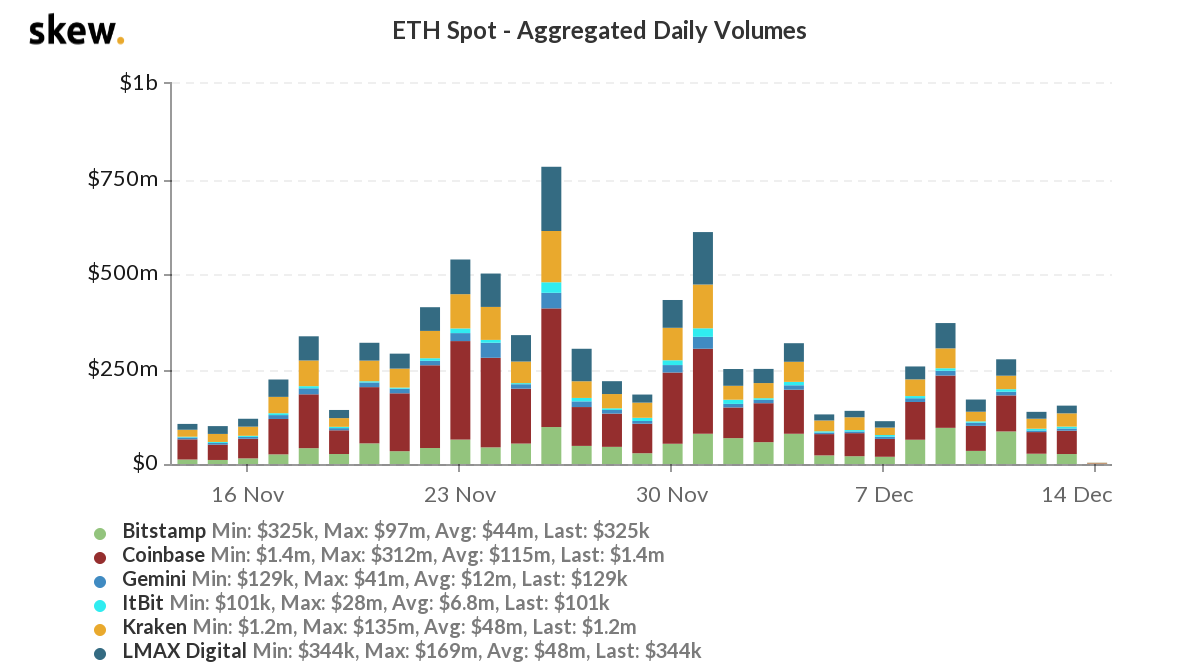

Trading Volume

Bitcoin’s trading volume continues its downtrend after a very voluminous run, however this (as we’ve seen in the past) is a sign of the calm before the storm. The direction of that storm is something we’ll discuss below.

ETH’s trading volume is no different than BTC’s and is also showing signs of an upcoming “storm”. Will it be to the upside? Downside? Let’s see below.

Market Index

Total Market Cap

This week’s candle closed with a signals that bulls are here to stay, the deep bottom wick a show of demand. The market has closed two weekly candles above $547B which signals that there is a high probability of continuation and a test of ATH.

Altcoins MCap

During the September crash, we rationally focused on the fact of the [$110B-$120B] liquidity area flip from resistance into support. We expected price to repeat a specific fractal with some degree of precision this time around. The fractal has been followed perfectly until now. Our next target remains at $245B for Altcoins.

BTC

Bitcoin’s price is knocking at the “All-Time High” door and this week’s candle closed in favour of upside continuation. The level to look at is $19,800, this is where price has failed. Crossing it will signal the start of a new price discovery.

ETH

ETH is showing strength; similar to BTC. The creation of continuous Higher Highs and Higher Lows is a promising sign for 2021. In regards to this year, our target remains $800 EOY.

If we dig deeper into the 4H timeframe we see that price crossed a counter-trendline that was limiting growth. Now the target sits at $620 for this move; that level will then need to be crossed for an $800 attempt.

XRP

XRP has exited the [$0.585-$0.64] range, retested it and remains on its way to $0.47; nearly there. XRP is moving differently since it pulled a much larger rally which is why it can afford to have some more downside (barely). Target for the dip is $0.47 and the first target for the rip is $0.79.

SNX

SNX pulled a 100%+ move from the bottom is a very short period of time. Price found support at $4.15 and is on its way towards $5.50 once again. The latter is the gate, once open a test of ATH becomes very likely.

ALTPERP

This setup was shared last week but it is only now that the counter-trendline has been crossed. The target is $1,115 with a very simple invalidation: going under the trendline once again.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.