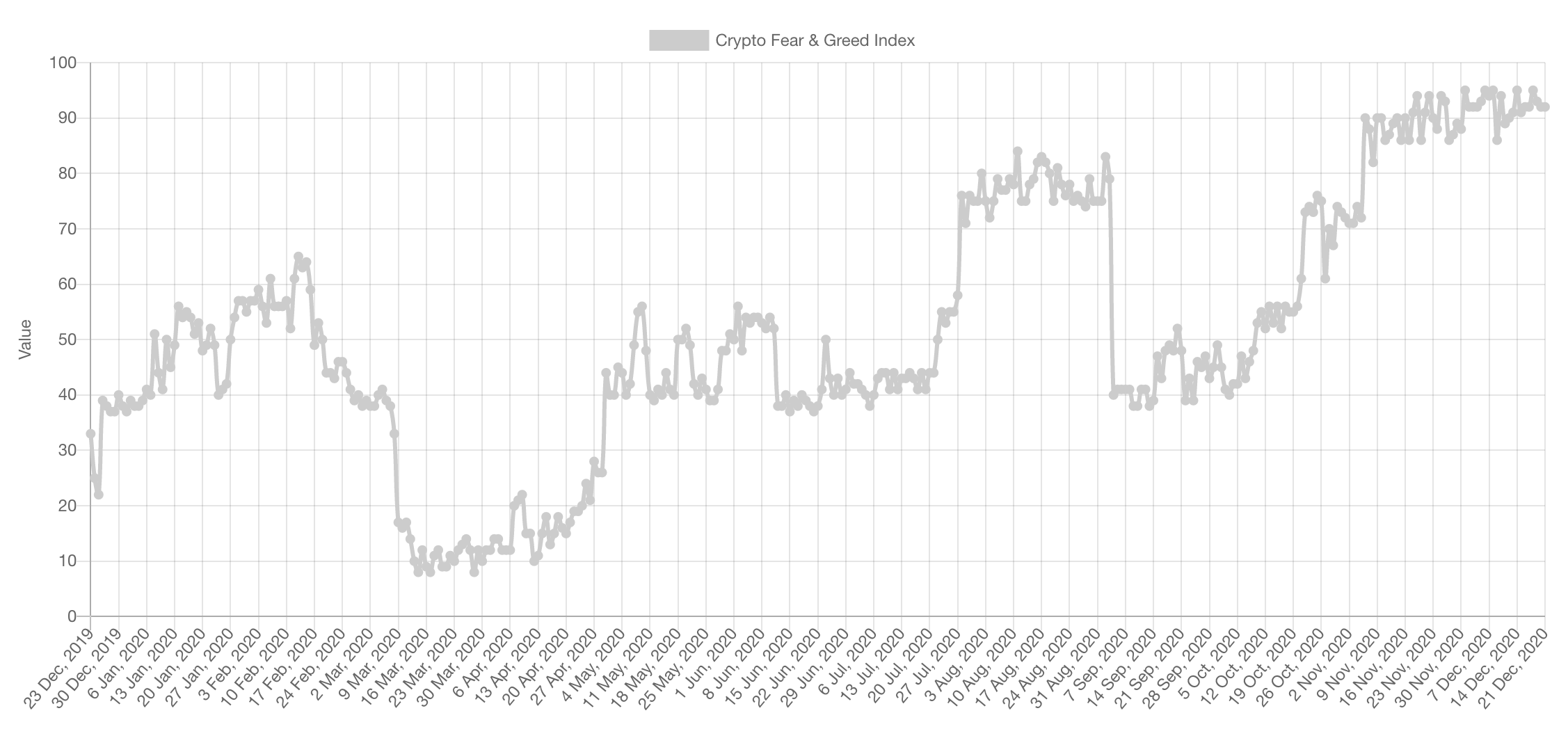

According to the “Fear & Greed Index”, the market is in extreme greed mode. As mentioned numerous times in previous versions of Weekly Technicals, this metric cannot be used to time the market. It has been at this level since Bitcoin was trading at $14,000. What this metric does call for is caution and it acts as a reminder to not forget about risk management at any point in time.

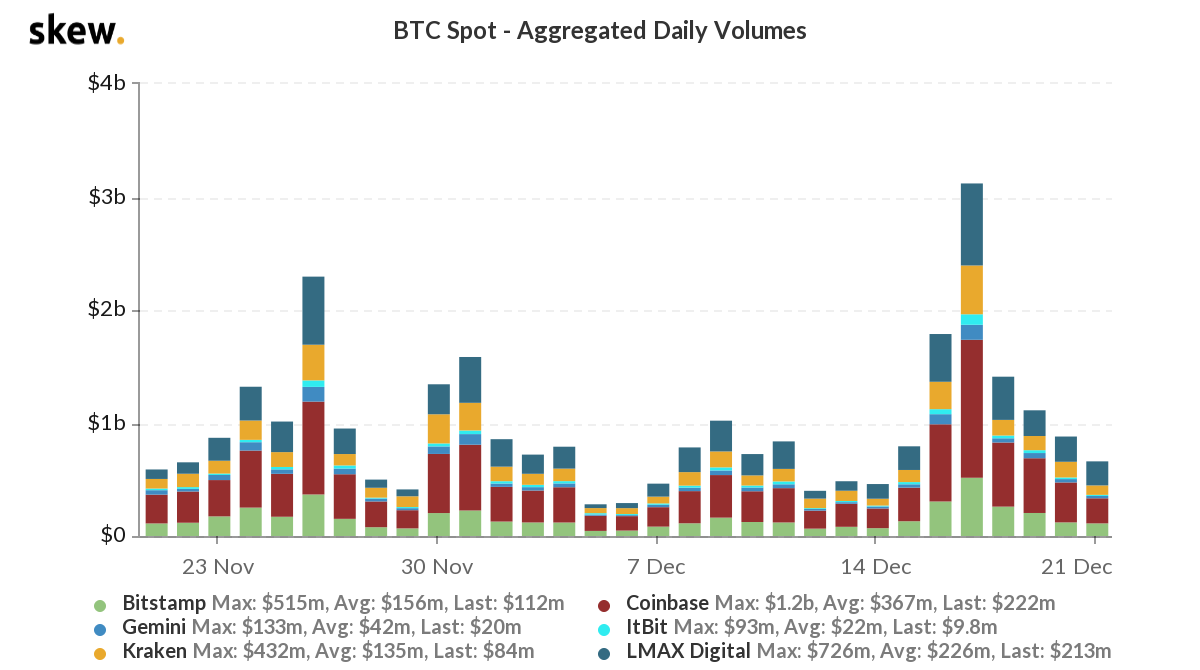

Trading Volumes

As stated last week, the continuous decline in volume signaled “calm before the storm” and exactly that happened as Bitcoin hit $3 Billion in trading volume on the 16th of December.

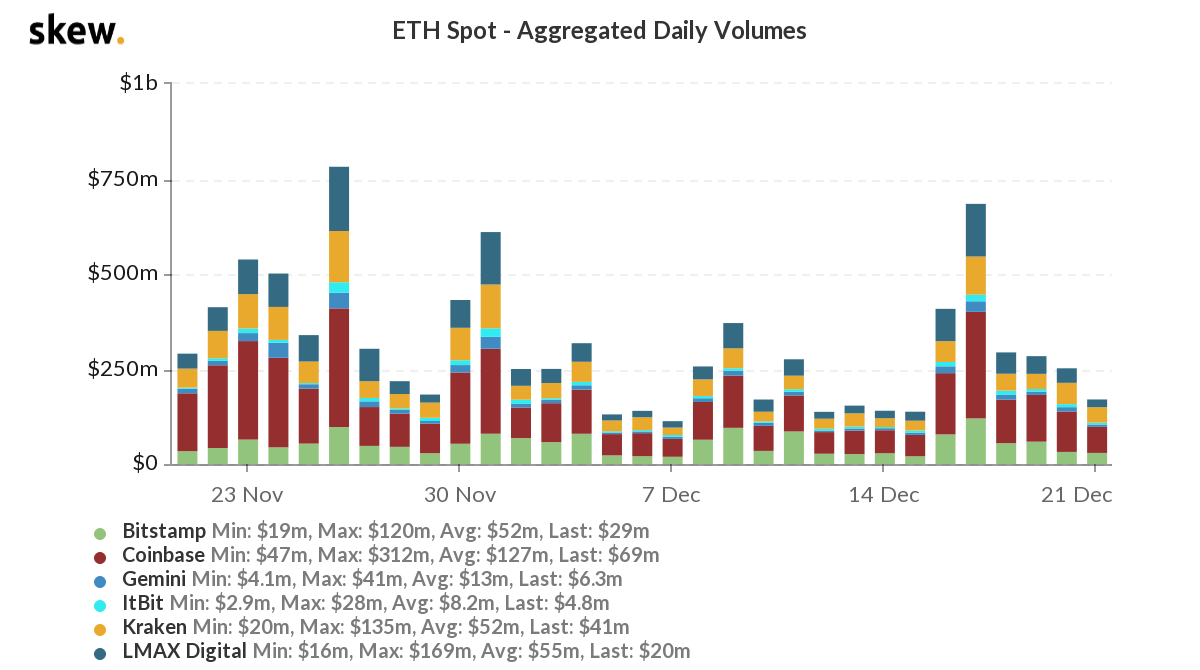

The same is applicable to ETH’s trading volume. However, we know what is incoming over the next few months after learning about this.

Crypto Index

Total Market Cap

Last week, we pointed it out the subtle $547B flip from resistance to support and the daily weekly candle closures above it. This clearly pointed towards a highly probable rise towards the all-time high and now the Total Market cap is en route to do just that.

Altcoins Market Cap

The Alts MCap followed this fractal perfectly until now. We are still targeting $245B. Once that is done we’d be looking at a cross of that key level, if it happens it’ll bring a high likelihood of an ATH attack.

Bitcoin

The weekly flip from resistance to support mentioned in Discord Pro has brought forward a brand new ATH and a massively bullish candle. Even more bullish will be the yearly candle closure which will signal a very interesting 2021; especially when you combine the fundamental factors.

ETH

ETH is an undervalued gem and people don’t seem to yet grasp how big this ecosystem is. From a technical perspective, price has been creating higher highs and higher lows. Our end of year target remains unchanged and sits at $800.

XRP

$0.47 was a meticulous second buy-in. However, if bulls want to win this they need to start moving. Losing $0.47 would be detrimental. Zooming out a little bit, previous rallies in 2018/19 all ended up retracing, is this any different? Prices were creating lower highs and lower lows (bearish market structure), this has changed since the higher low at $0.25.

SNX

SNX finally managed to cross over $5.50. It has now become a support level with the next target sitting at the previous all-time high $7.40. Beyond that only stands price discovery.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.