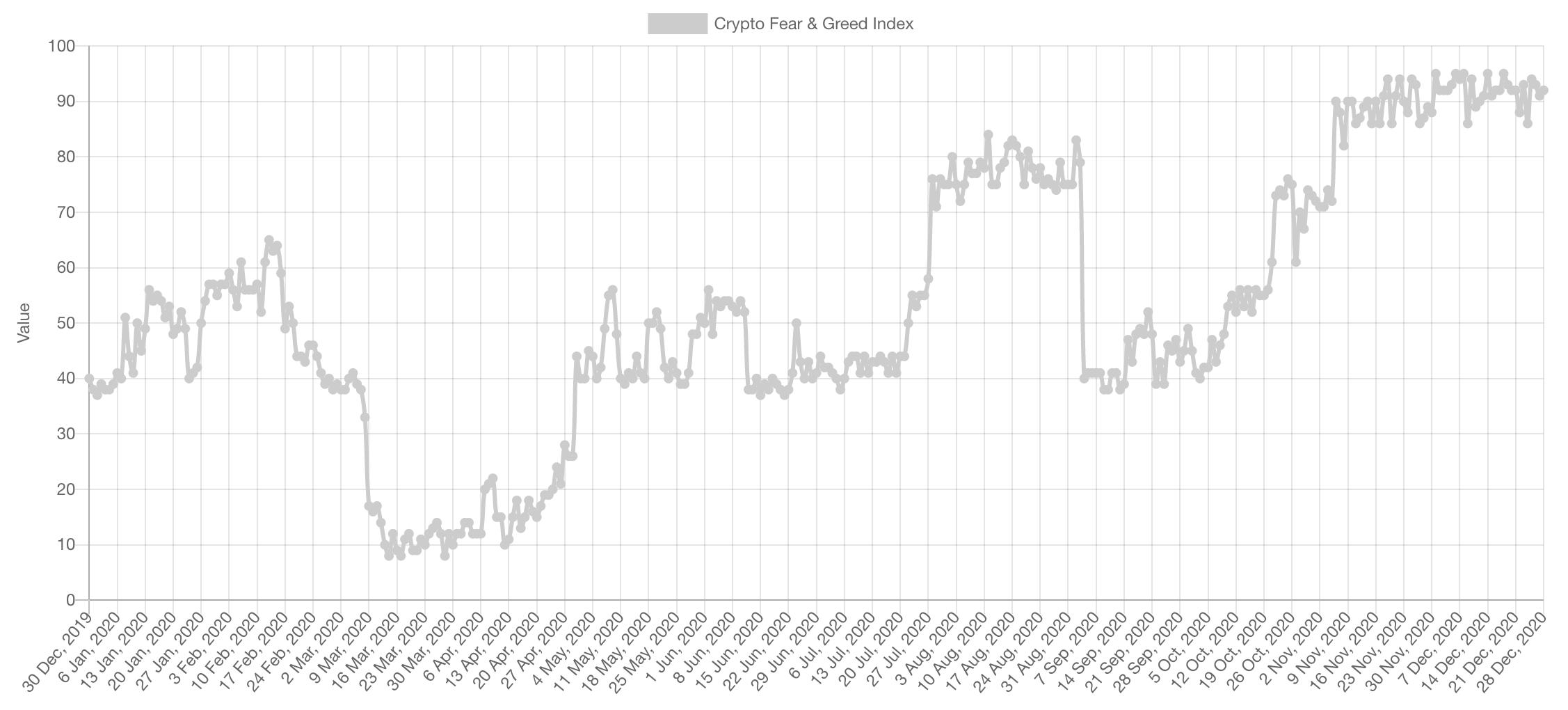

The sentiment has been in “Extreme Greed” for a long time, this is a good reminder to never throw out risk management out of the window as the tides can always shift in the short/mid-term before further upside continuation. This metric cannot be used to time the market in any way, the greed levels have been the same while Bitcoin doubled in price.

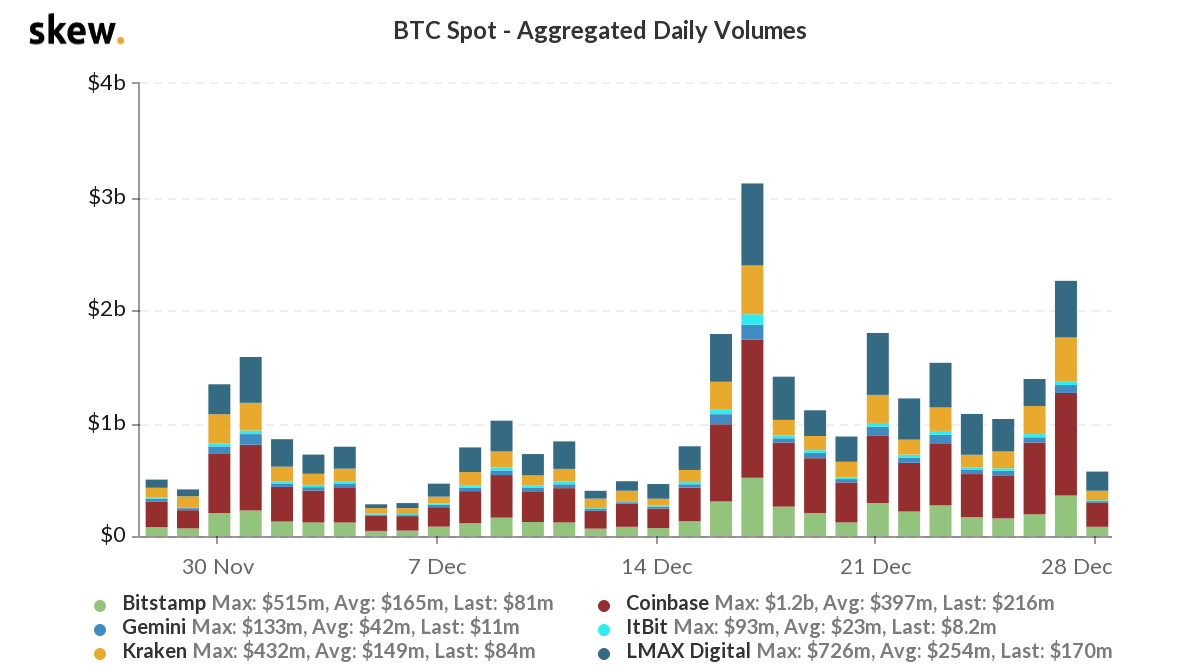

Trading Volume

Bitcoin’s trading volume remains relatively high which must confirm the trend for it to remain intact - and it is.

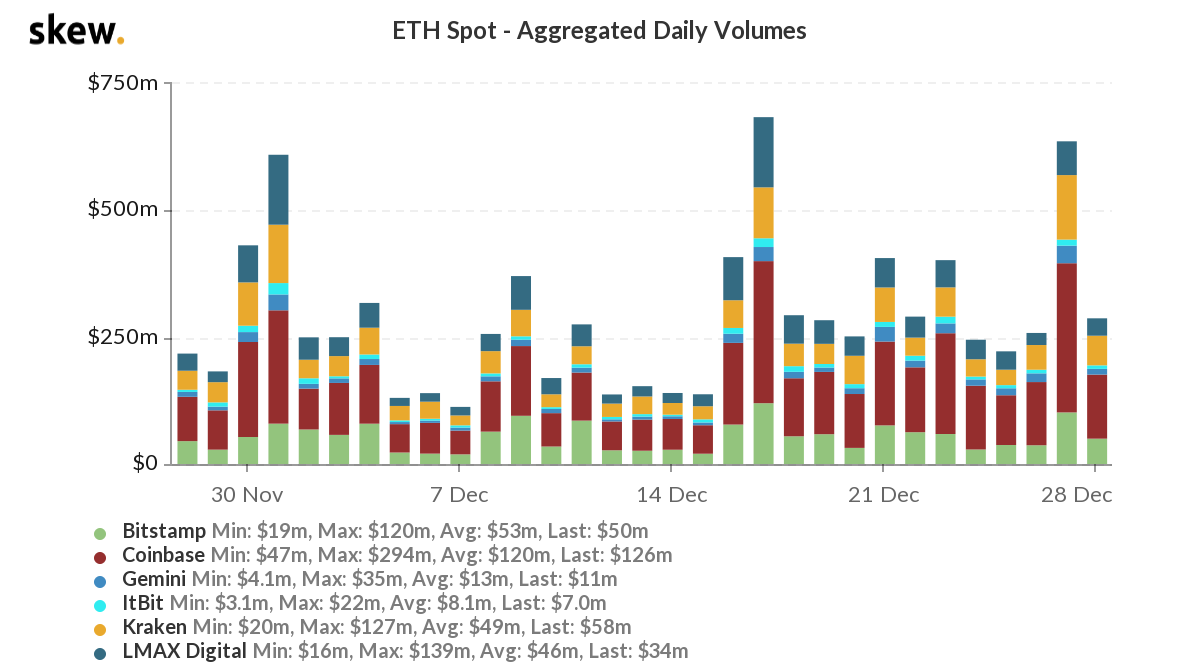

The same can be said about Ether’s trading volumes. However, we are expecting them to increase further when institutional investors begin announcing stakes in ETH.

Market Indices

Total Market Cap

The Total MCap is making major advances and its chart is beginning to mimic that of Bitcoin (we fully expect that). It is just under ATH, it also crossed $692B on the weekly and flipped it to support - similar to how it flipped $547B from resistance to support. The first target has become (after ATH cross), $1 Trillion.

Altcoins Market Cap

The Alts MCap is catching up. Our target of $245B which we’ve been targeting ever since price action was at $120B is getting much closer. This chart will also mimic the Total MCap’s and Bitcoin’s.

Bitcoin

Ever since that S/R flip of $10,000, followed by subtly flipping $11,200, Bitcoin has not stopped for anyone. Bears got slaughtered as price did not even look back on those levels. Price is in price discovery and holding on strong, the yearly chart is looking increasingly bullish with the upcoming close in a few days. Two important upcoming levels are $30,000 (psychological) and $36,000 (popular options strike price). The latter holds more weight as options sellers are incentivised to suppress price under it. Just like what happened at $24,000 with the 25 Dec expiries (explained in Discord Pro). Once they expired, the suppression was gone and Bitcoin jumped by over $4,000 in a few short days.

Ether

$100 -> $360 ✅

$320 -> $550 ✅

$500 -> $800 (In progress…)

XRP

This weekly close under $0.30 is quite bearish. The uncertainty of exchange delistings is too great, multiple market makers (whom keep XRP liquid) stopped trading it. The risk is too high to ignore, which is why we have reduced our position size in half on it, especially when there are so many more appealing opportunities with higher potential upside in DeFi.

SNX

SNX has been on a rip, it stopped for no one, looked out for no one and just went straight to ATH and beyond. The last development was the flip of $7.50 from resistance to support. Price has officially entered price discovery. Upcoming levels are psychological round numbers - Target 1: $60.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.