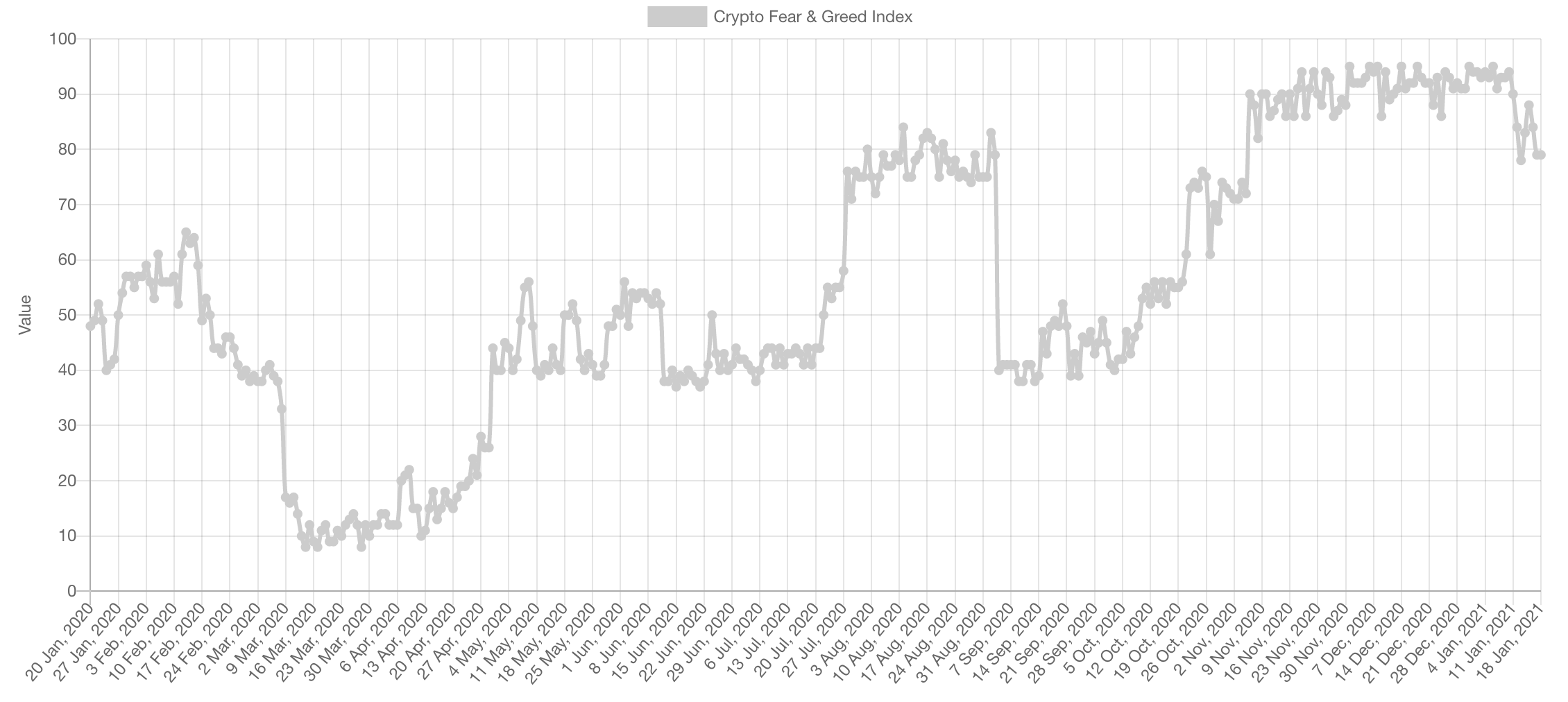

Market Sentiment

The sentiment has dropped slightly which is the result of 11 January 2021, a day mainstream media dubbed as a “Bear Market” - highly entertaining. This drop in sentiment was not only seen in the metric but on social media as well where we continuously interact with market participants. The enthusiasm about the parabolic advance decreased significantly. This is a positive sign as it gives further room for growth and longevity for the bull-cycle.

Market Indexes

Total Market Cap

The Total MCap has retraced the bigger portion of the dump, this signals significant demand. The weekly candle closure - a hammer candlestick - is bullish and tends to be followed by continuation when seen in a bullish trend; which this certainly is.

Altcoins Market Cap

First and foremost, the fractal shared back in September 2020 has played out beautifully without delays even. The Alts MCap has began surpassing a very important resistance; the resistance that crushed a lot of Alts price (for one day only, 11 Jan). Bitcoin and the Total MCap have reached and breached their 2017 highs. The Alts MCap is next on this list and it now seems prepared.

Bitcoin

On the weekly timeframe, we can see Bitcoin struggling now and staying put around the $36,000 level. As you all know this is an important options’ strike price where a lot of options sellers are incentivised to suppress Bitcoin’s price to keep it under this level. This causes options to expire worthless and sellers get to keep the premiums paid. $40,000 & $52,000 are the next two largest strike prices, with the latter having significantly more volume than the former.

Bitcoin has entered a phase of consolidation. It is now ranging in this symmetrical formation of lower highs and higher lows. After a bullish advance, these tend to break to the upside. However, we must monitor the market signs here, in case of lower low, as that would create an opening for a correction. In the meantime, Bitcoin will likely keep ranging for some time here, which will be net positive for Alts (keep reading).

Ether

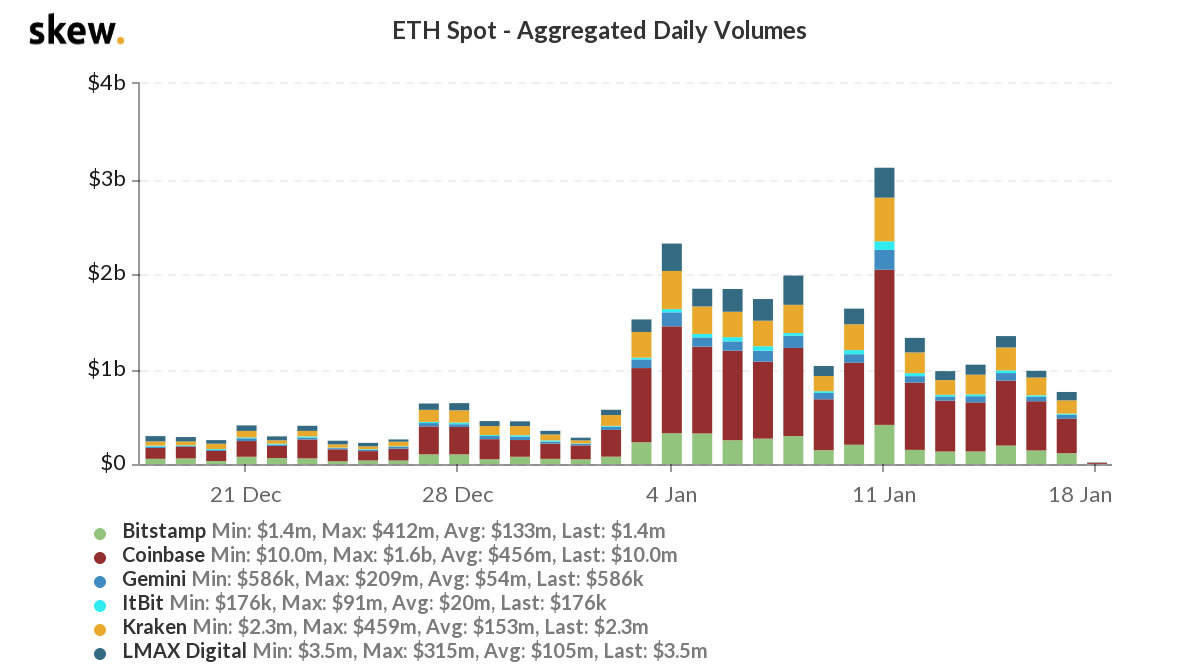

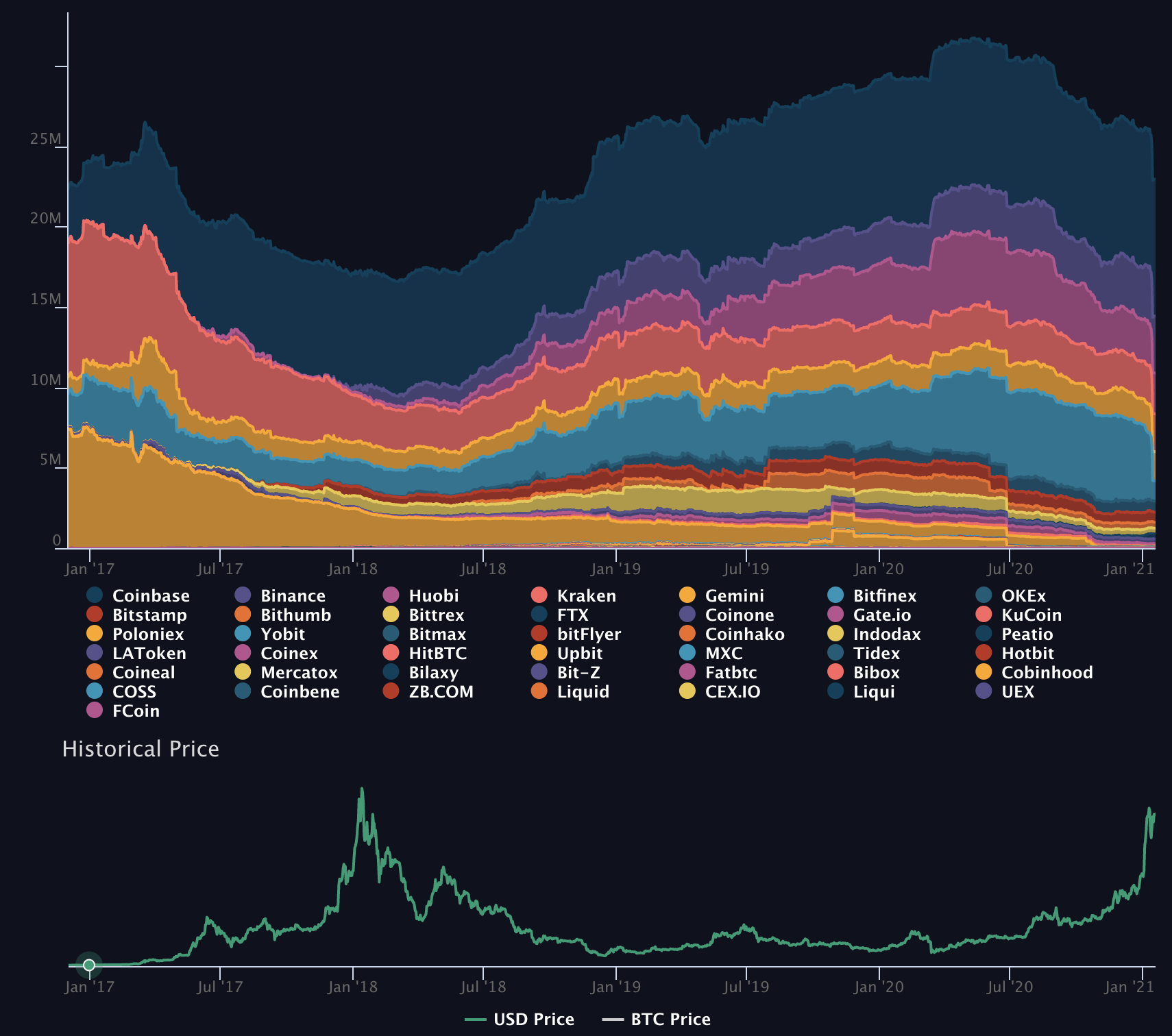

Now, we have reached ETH. Unlike previous versions of Weekly Technicals Pro, ETH itself will be a full documentary of its own with all the data we are about to present and analyse. It is at a very important spot.

From a technical perspective, ETH has closed a full weekly candle over a key level ($1,220) which has become support here. In addition, the hammer candle closure is bullish. This tells us that we are likely to see an ETH ATH by next week which is at $1,420. *This chart is from Kraken which had an extreme overshoot in 2017.

With the exception of 11 Jan, Ether’s trading volume has been trending down. This is what precedes a big move - the calm before the storm. The technical aspect indicates this big move will be to the upside.

Last but more certainly not least, ETH has been flying off the shelves. Over $3.8 BILLION worth of ETH has been taken off exchanges in the past 7 days alone. This is reducing the supply which should positively reflect on price soon.

TLDR: ETH is very likely to reach ATH by next week.

DOT

After the creation of subtle higher highs and higher lows, DOT exploded vertically. Our target of $20 is less than $3 away now.

Since our buy-in of $3, DOT has increased by close to 500%!

SNX

The subtle higher highs and higher lows we talked about on DOT? We are witnessing the same structure on SNX, we believe the resulting move will be the same as well.

SRM

Since the breakout from $1.40; signaling the end of the accumulation phase, SRM has become highly bullish. This is a bull-market and therefore we cannot limit movements by conservativeness. The first price we’ll be looking at for SRM to reach will be its ATH of $3.79. Of course it will not be a straight arrow up.

FTT

FTT has respected support well and has finally crossed the $10 resistance. This has opened up the doors for a run to $15.

XRP

Delistings will be happening over the coming days for the most part (each exchange has a different date). "IF" price does not react negatively - drop - on those days, a relief rally will likely be incoming on XRP; to $0.47.

Disclaimer: None of the above constitutes financial advice or any sort of recommendation. These are purely opinions.