Weekly Technicals Pro - Volume 41

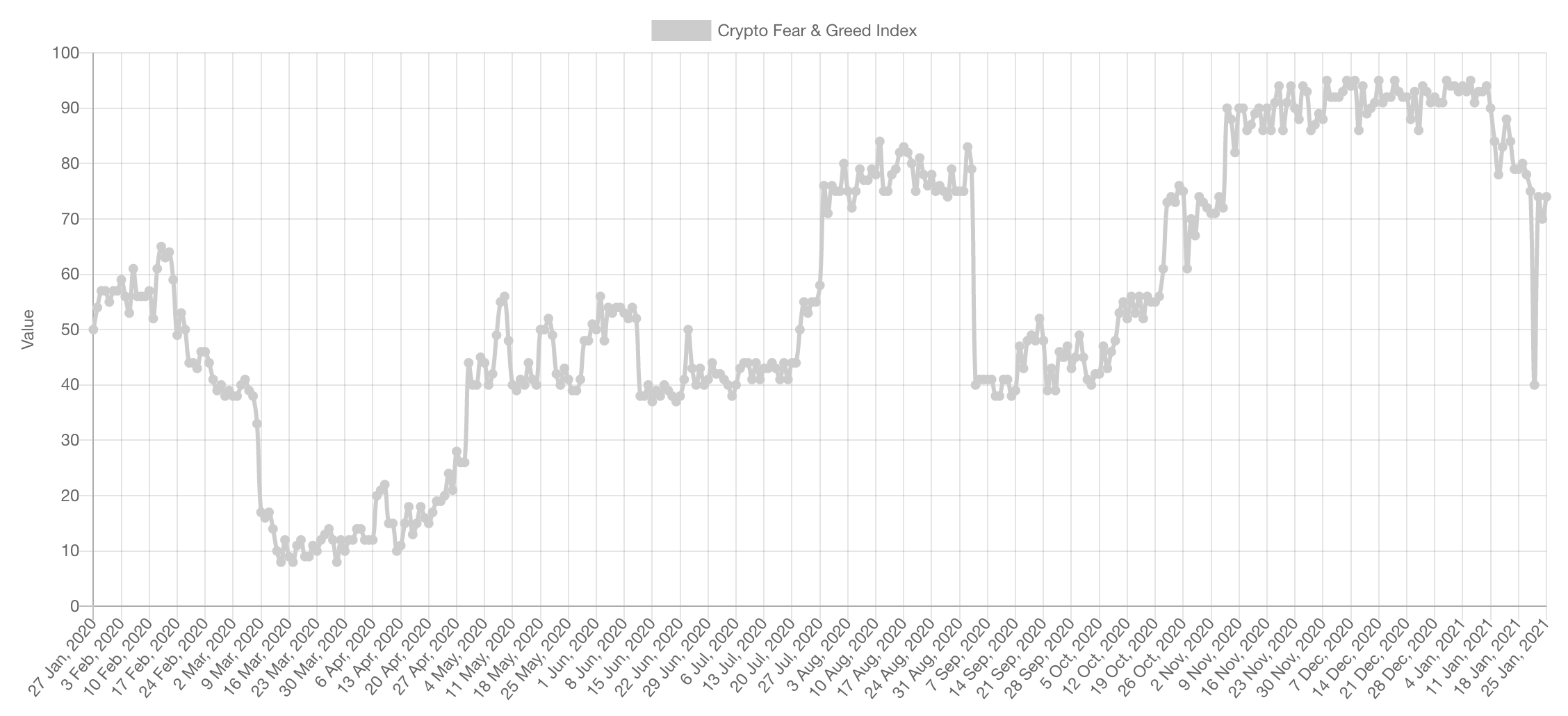

The drop in sentiment on the 21st was a textbook "buy the fear". This sort of reset was necessary and only gives longevity to the bull cycle. How bullish is this and for Bitcoin, Alts or both? That's something we'll explore below. Enjoy!

Market Sentiment

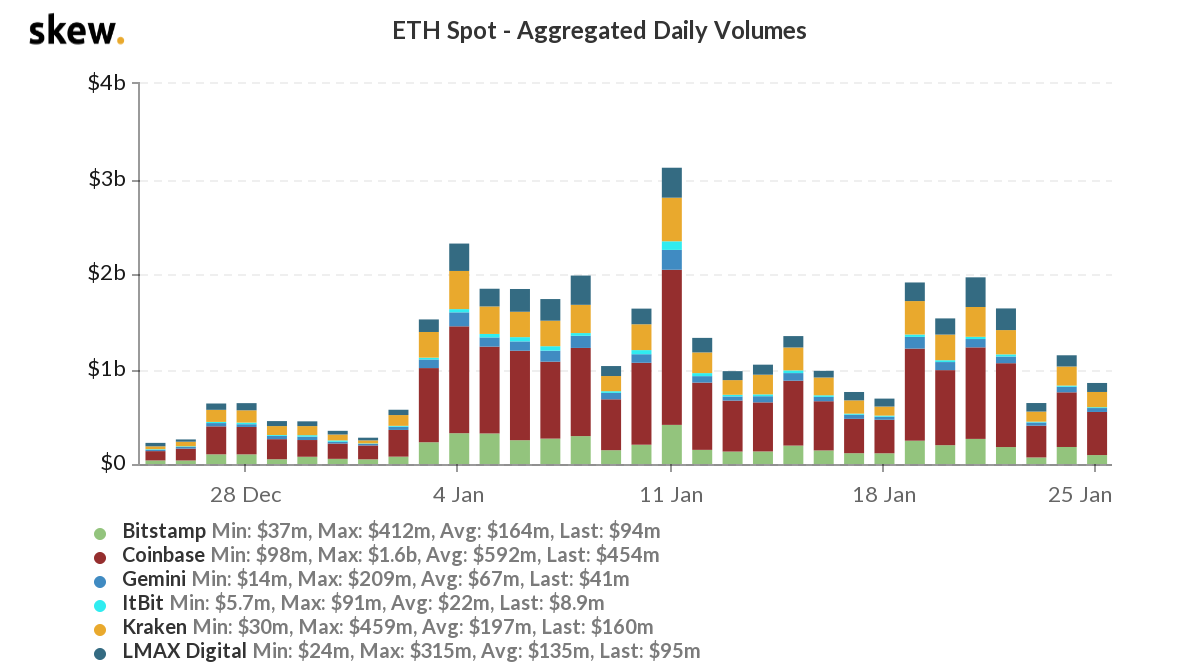

Trading Volume

Despite ETH rallying higher continuously, the volume has been consistently dropping for the past two weeks. This occurs before a big move, which way? Keep an eye for the ETH section below.

Market Indices

Total Market Cap

The Total MCap has been mainly stalling, which is normal given the fact that Bitcoin makes up 2/3 of this index and it is stagnant now. The weekly candles show demand but the $1T level has proven as a psychological level up until this point. Expecting further consolidation in the coming week.

Altcoins Market Cap

This is where the action is. The fractal we shared back in September is simply the greatest fractal of all time. Price has now flipped the $330B area from resistance to support. This communicates that are a run to the ATH is very likely incoming.

Bitcoin

Bitcoin, as mentioned in two Pro Breakdown videos, has flipped [$32,000-$33,000] from support to resistance after having broken the supporting trendline. This is bearish. This is why we have taken a hedge on our holdings which is ending up being the perfect hedge, why? Because if Alts are to run, Bitcoin will very likely remain stagnant which means we benefit from all the gains, if Bitcoin falls and brings down the rest of the market with it, our profit on the short makes up from our losses which gives us buying fuel. This is a bull-run after all, and dips are for buying.

Ether

The most interesting section.

First and foremost, bears decimated here. Weekly candle highs are being turned from resistance to support. The latest one happened with $1,360 which indicates further upcoming upside. How much upside? $2,000. Why? Read this.

This is ETH/BTC, the single most important chart in all of crypto today. ETH has broken out of 0.0425 which is a very important development given that it has been under it for 3 years. The first target is 0.058, with a BTC price of $33,000 that is a $1,914 ETH.

DOT

500% DELIVERED. DOT remains in a bullish market structure of higher highs and higher lows, the red line indicates very simply our expectation here. Given that ETH season seems to have begun.

SNX

SNX continuously showed strong demand applied to it. If ETH season is real, it feels like $60 SNX may happen much sooner than we anticipated.

XRP

Disappointing price action. XRP needs to break above $0.30 or under $0.25 to give further communication as to where it is headed next.