Weekly Technicals Pro - Volume 44

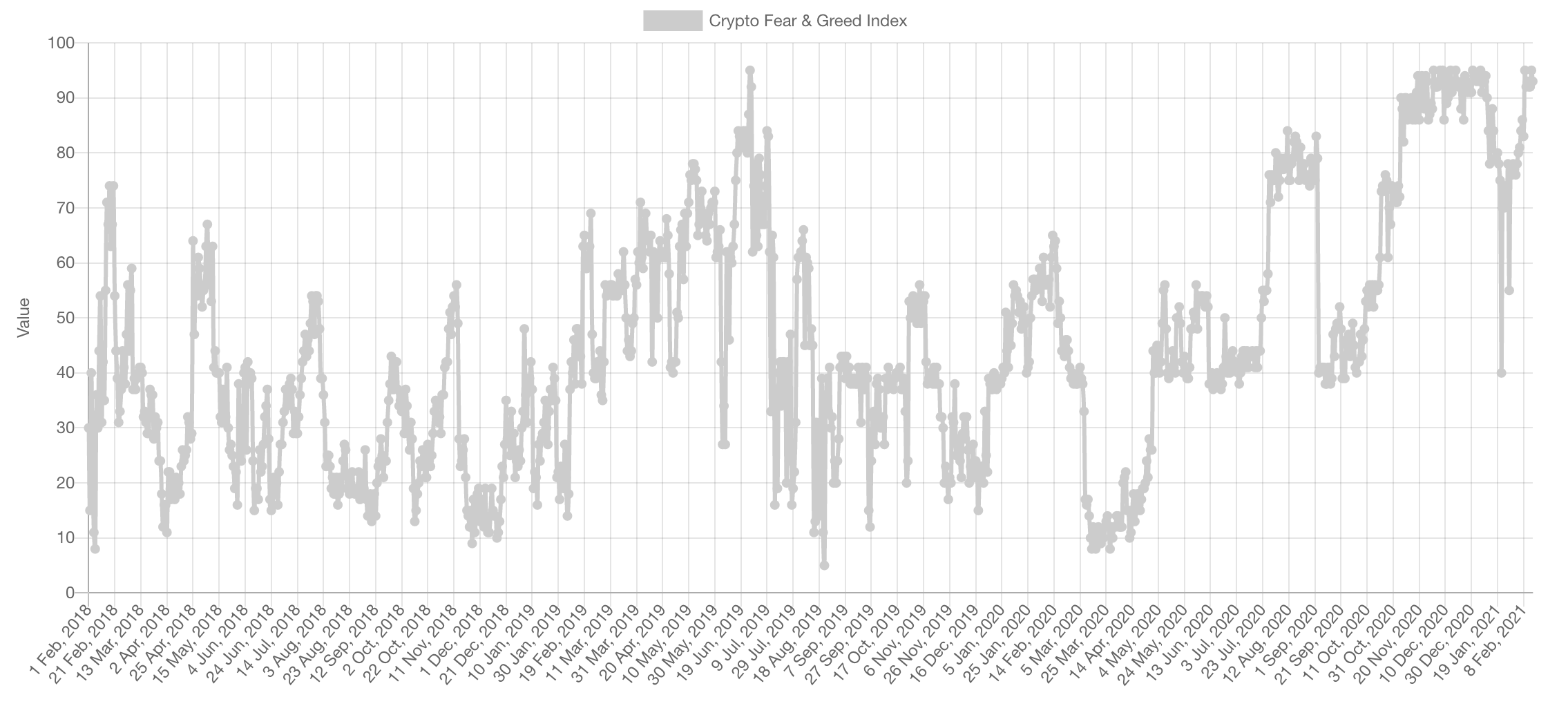

Assets have been rising almost perpetually for the past few months which of course leads to a lot of optimism from investors. This sets the overall Fear & Greed index at a very high level. In bull-markets these are not values one can rely on for timing. Take a look at the 2018 Extreme Fear values seen and how often they were registered. This metric, however, is a good self-check and a reminder that risk management should not be thrown out of the window. Here's another metric:

Market Sentiment

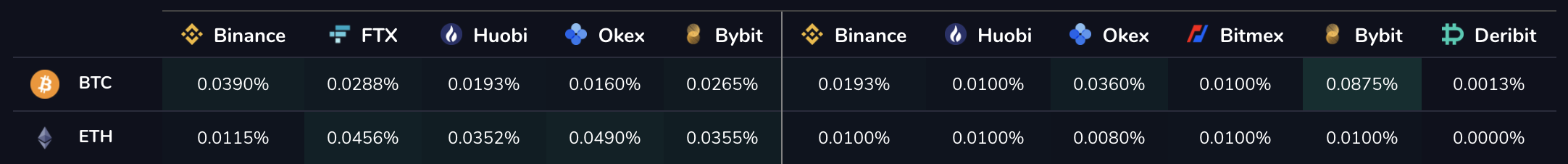

Funding rates for perpetual futures (i.e. perps) are a good indication for when too much short-term greed is in the market. Funding was created as a mechanism to keep perpetual futures contract close to spot price since they had no expiration. When most market participants are skewed long on perps the price goes over spot and it begins trading at a premium. In such a case, the funding rate is positive and the higher the premium, the higher the rate is. With positive funding the rate is paid from longs on a regular time interval to shorts. In other words, traders get paid to short the market to bring back perp and spot price together. Base funding rates are 0.01%, when they grow to 0.1-0.2% then it becomes a bit extreme and we often see a reasonable amount of shorts coming in to collect funding which liquidates the overly leveraged positions (healthy for the market).

Market Indexes

Total Market Cap

For the first time in history, the Total Cryptocurrency Market Cap reached a value of $1.5 Trillion. The weekly candle closed quite strongly and does not yet show signs of weakness which calls for a high probability of further upside continuation in the coming weeks.

Altcoins Market Cap

Full break of the 2017 ATH on the weekly timeframe. Altcoins have officially entered price discovery. It is difficult to believe that this does not end up going to much higher valuation ($1 Trillion+) after such a break.

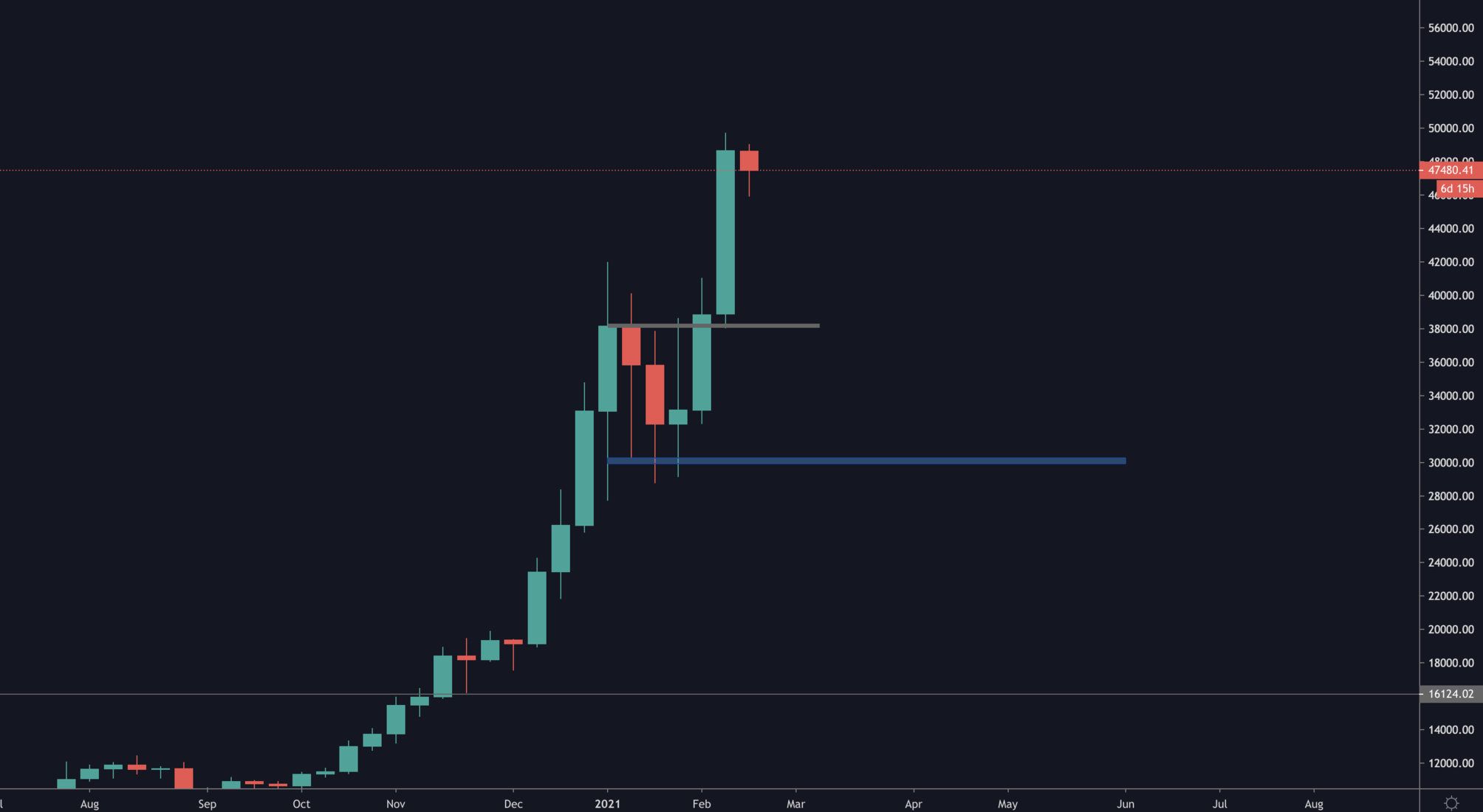

Bitcoin

Last week, posted just in time was the new weekly high which set a novel target of $52,000 for Bitcoin. Tesla's news about purchasing 42,000 BTCs pushed the market in that direction far quicker than we anticipated. This sets the tone for further upside in the mid-term but the short-term is offering a slight reset.

Similar to ETH (shared in Discord Pro), a rising wedge has been formed and broken out of. Technically speaking the target is $43,000 on this pattern formation. This would represent two things:

- Retest of the previous high

- Turns the crowd bearish; gives a lot of longevity to the market

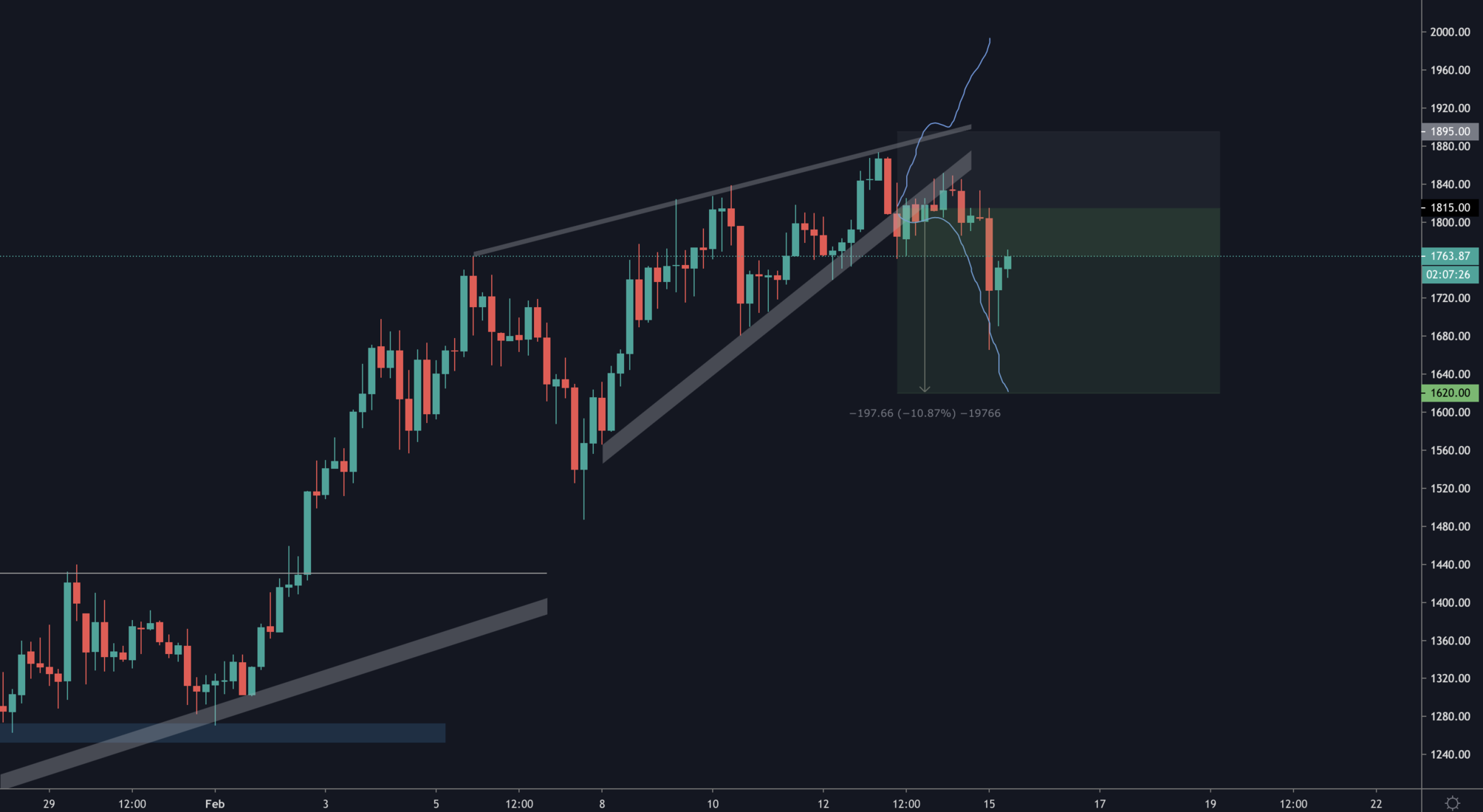

Ether

The hedge short we've taken on ETH (shared in Discord Pro) is protecting some of our fiat value. We're taking profit at $1,620 and will use those extra profits to buy more ETH.

Keeping a zoomed out view of the market and reminding oneself that not too long ago ETH was trading under $500, gives a reality check. It also puts the current smaller price action into perspective.

ETH/BTC barely closed under 0.03725. In addition, the Alts MCap has just crossed ATH; this sort of alignment is one we're willing to give a second chance as the potential reward is way too high to ignore. Still bullish on this pairing as the break was not convincing. We'll revisit the pairing upon the next weekly candle closure.

DOT

An asset that delivered 900% already. A consolidation is possible here and will create some sort of pattern formation which gives insight as to what comes next for traders. For us investors, we do not focus on this short-term price fluctuations, our target of $20 has been crushed too early to the point that we had to increase it to $100 where we'll certainly take at least a small percentage of profit off DOT.

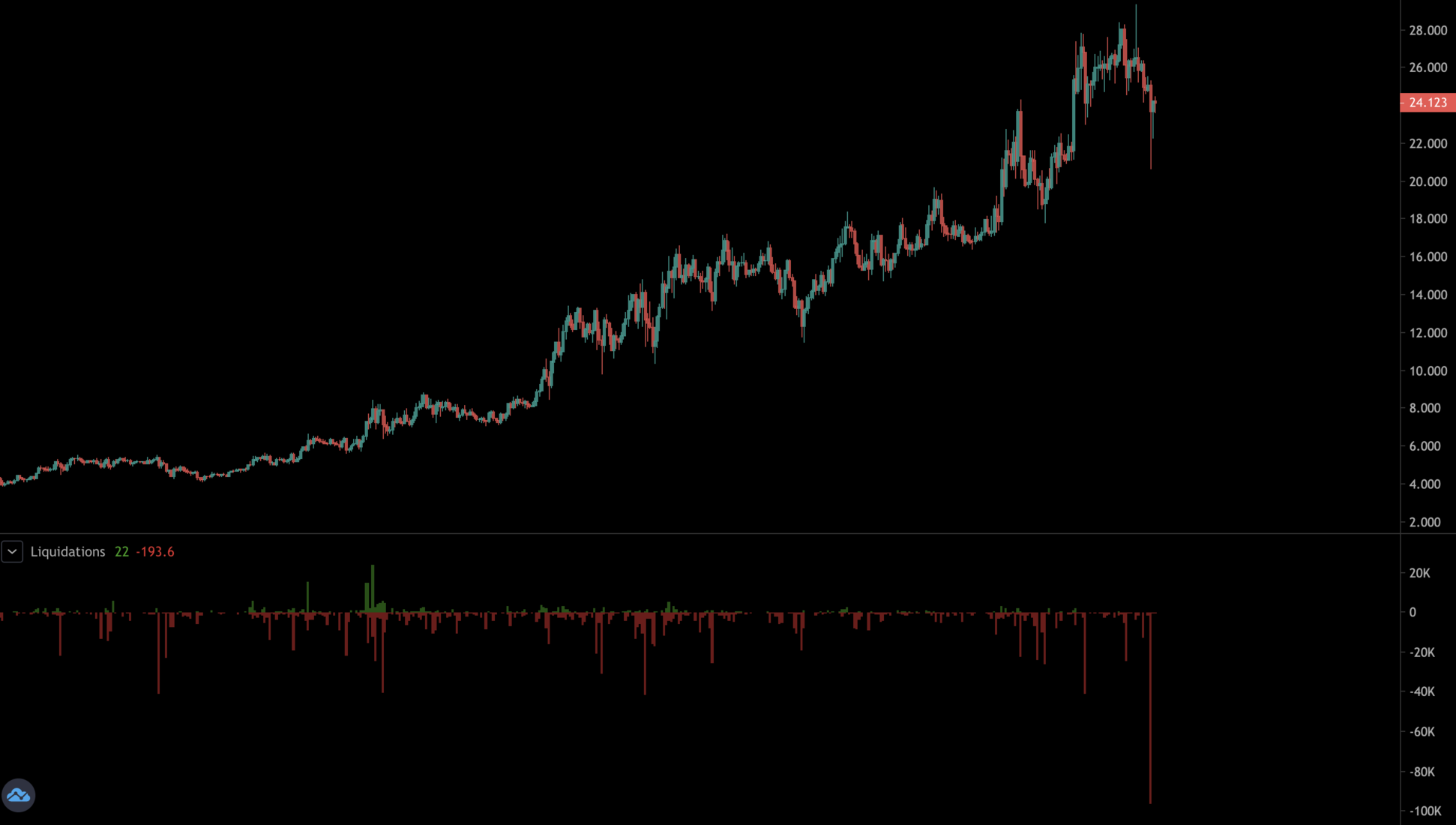

SNX

Humongous wick on SNX which was driven by cascading liquidations as there were too many leveraged positions on this asset. As you can see below, there has not been that many liquidations since December.

A daily candle closure over $23.60 maintains the bull momentum but a closure under it (would be caused by BTC & ETH) would likely lead towards $18.25.

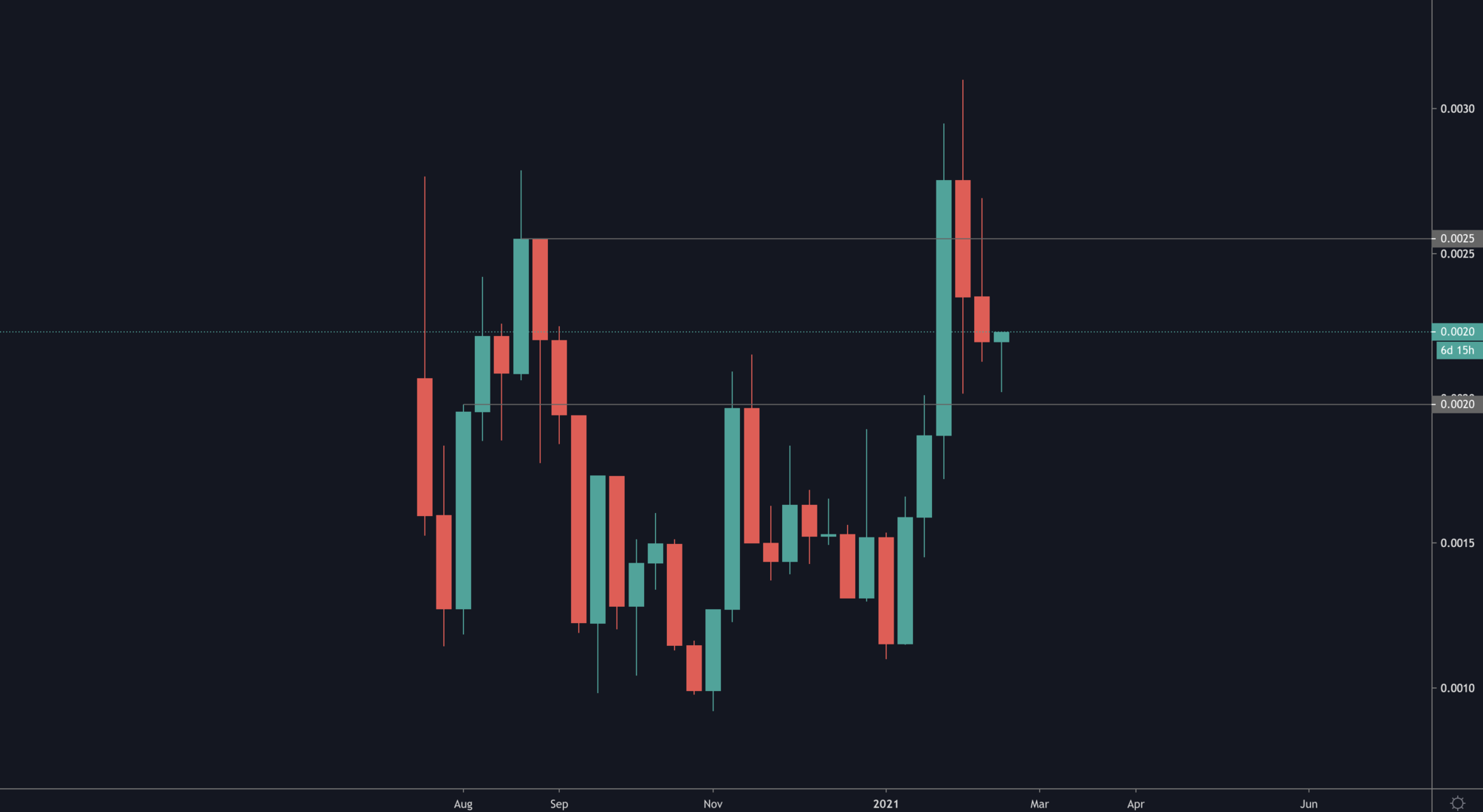

Above is the SNX/ETH pairing which still favours outperformance from SNX against ETH.

RUNE

The daily candle closure under $4.20 called for a retrace towards the next level which in this case was $3.40. For traders, a breakout either way will show short-term direction; right now it is in no mans land. For us investors, we do not pay attention to short-term price fluctuations and the reason behind our investment is not price, it's THIS.

RUNE/ETH is almost at support (0.002) which can then give space for RUNE to outperform ETH.

SRM

SRM price action has been textbook since the start of 2021 with the accumulation breakout. It has broken above the previous ATH of $3.79 as well. The downside wick is due to liquidations, mainly coming from Binance after checking the data (poorer liquidation engine).

This is exactly why our newest SRM long; post ATH break had to be on low leverage, the market simply does not allow positions with over 5x leverage to survive in such a market environment with that much volatility. We're awaiting the daily closure, a closure above and we'll maintain the position, a closure below and we'll close the trade.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.