Weekly Technicals Pro - Volume 45

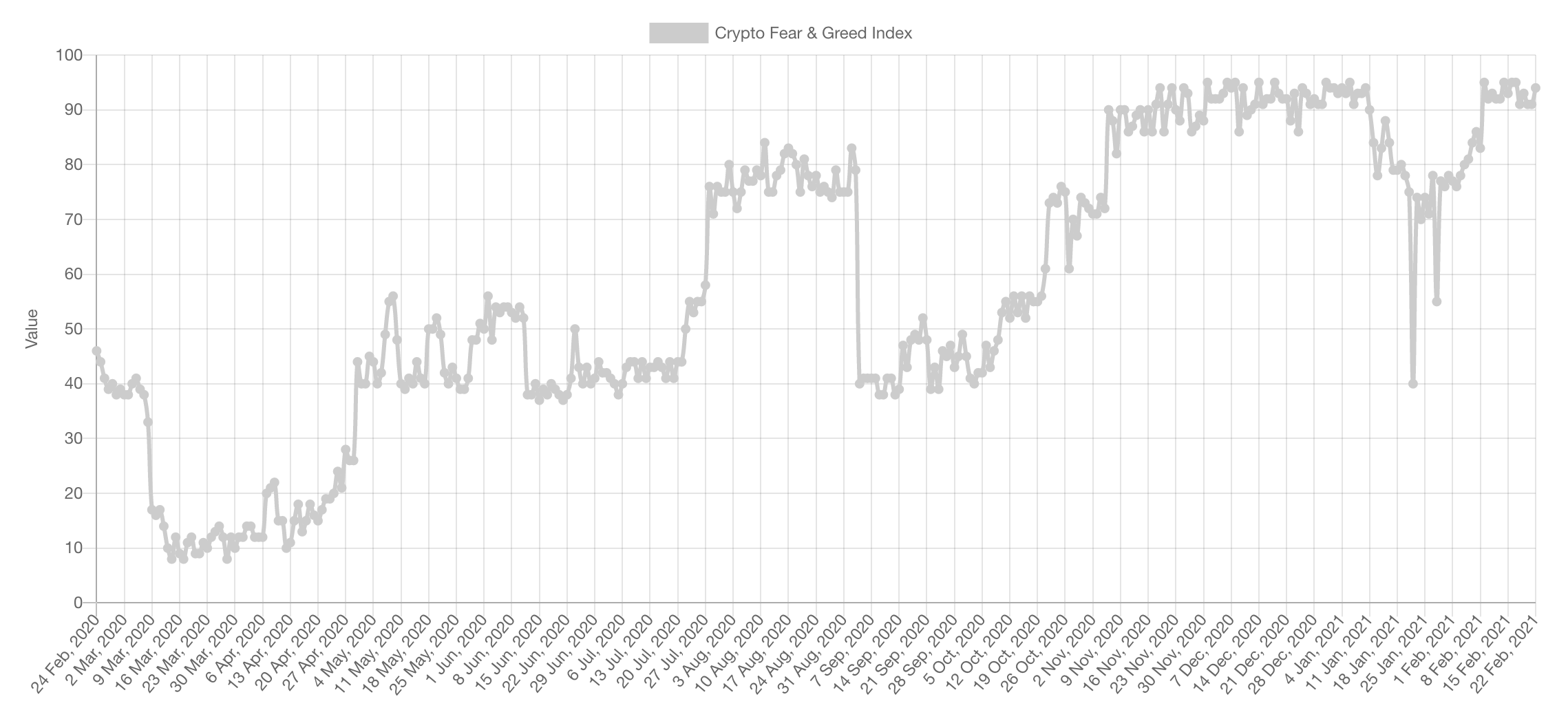

Market sentiment is at the 94 level - the level it previously peaked at. With that being said, it did remain there for quite some time and Bitcoin in particular pushed to brand new highs with it. This remains a "keeps us down to earth" metric.

Market Sentiment

As we stated last week, funding on perpetual futures is a much better metric for fear and greed in the short term. There's been a lot of over-leveraged positions liquidated over the weekend. These sort of moves give longevity to this smaller cycle. With that being said, participants are kind of sticky here and each time price moves back up they get greedy once again and funding rates show it.

Market Indexes

Total Market Cap

The Total MCap is just under $2 Trillion, not expecting this upcoming level to act as hard as a resistance as $1 Trillion did - the latter was the entry into a brand new era. Prices are not yet showing signs of weakness; with that being said, taking some profits even if it is 5-10% is a good way to lock in some profits.

Altcoins Market Cap

The Alts MCap continues on its path forward post-breakout from the 2017 high. Up until this point, Bitcoin has stolen the show. There will come a time where Altcoins gets to shine however. Timing the market is not an accurate science, however it is approaching.

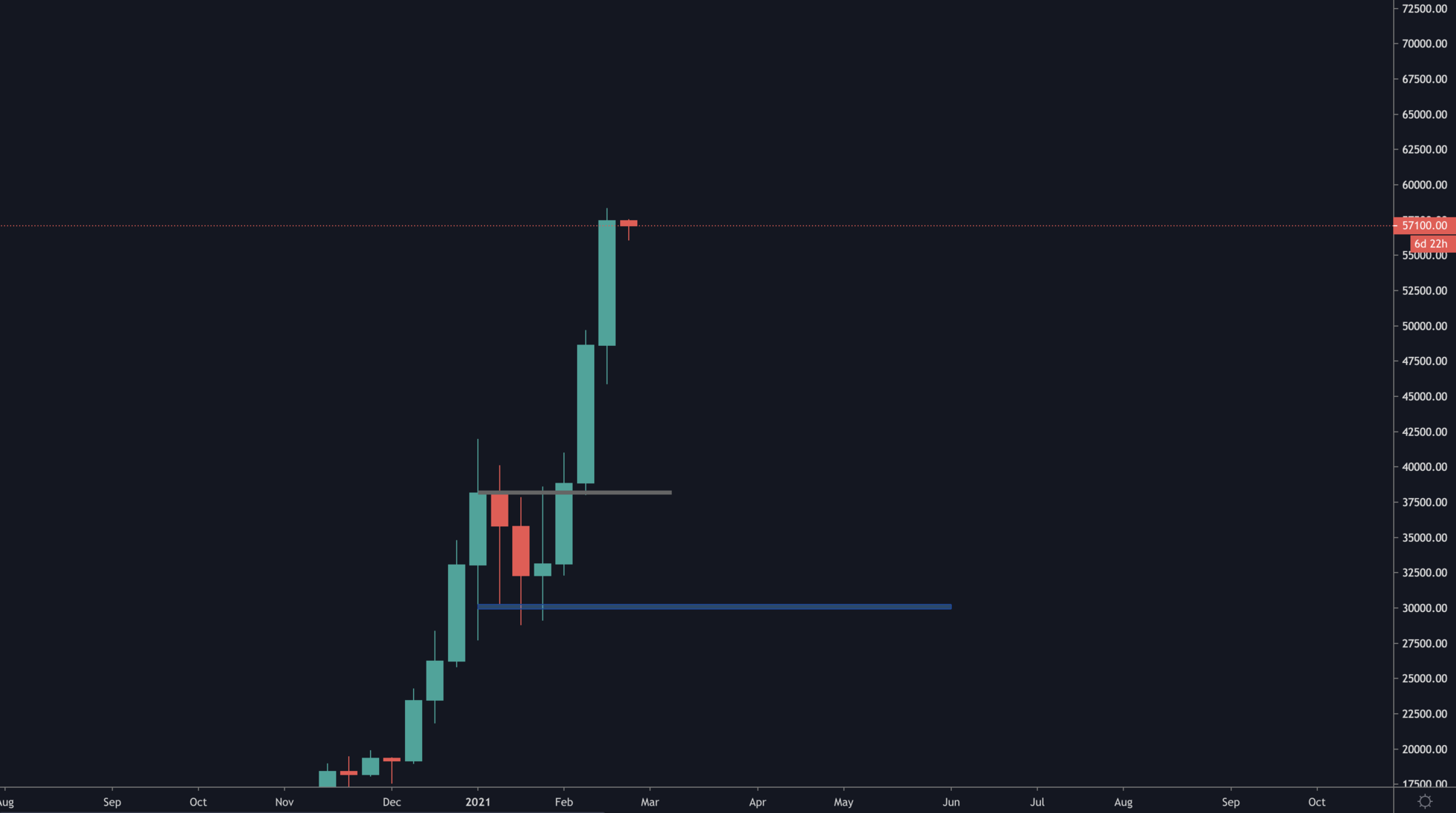

Bitcoin

After the break and retest of the weekly high a couple weeks ago (mentioned in WT 43), Bitcoin went and crushed the $52,000 target and is now headed towards $64,000. Signs of irrational exuberance are beginning to show on Bitcoin. It's important to note that this remains a bull-market and hence the dips that come will be dips we personally capitalise on.

Ether

This week, ETH was able to reach $2,000 for the first time in its history and it oddly feels like a lot of people don't care or are not paying enough attention. Almost similar to how many dismissed the $20,000 BTC break.

While ETH is growing in fiat terms, which is great, its breakout against BTC has failed and is now put on hold until 0.03725 is reclaimed.

DOT

Over 1,000% delivered on DOT. A unique asset with a unique performance. There not yet signs of weakness in the bullish market strcuture built by DOT over the past few months. The next key level is $50.

XRP

XRP is starting to show some signs of life here and there. Namely the creation of higher highs and higher lows in recent weeks as well as the flip of $0.47 from resistance into support. This, from a technical perspective, calls for a run towards $0.79.

SNX

SNX has flipped $23.60 from support into resistance - this indicates a likely route to $18.25. It gets invalidated by a daily closure above $23.60.

Of course, we are not selling anything a penny under $60.

RUNE

Creation of a new high and a new support level, similar to the pattern DOT was having a few weeks back. The bullish trend is intact on RUNE.

SRM

From accumulation break to ATH and now into a brand new ATH. SRM's bullish trend is as intact as RUNE's. The maintenance of higher highs and higher lows will be important for further upside.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.