Weekly Technicals Pro - Volume 46

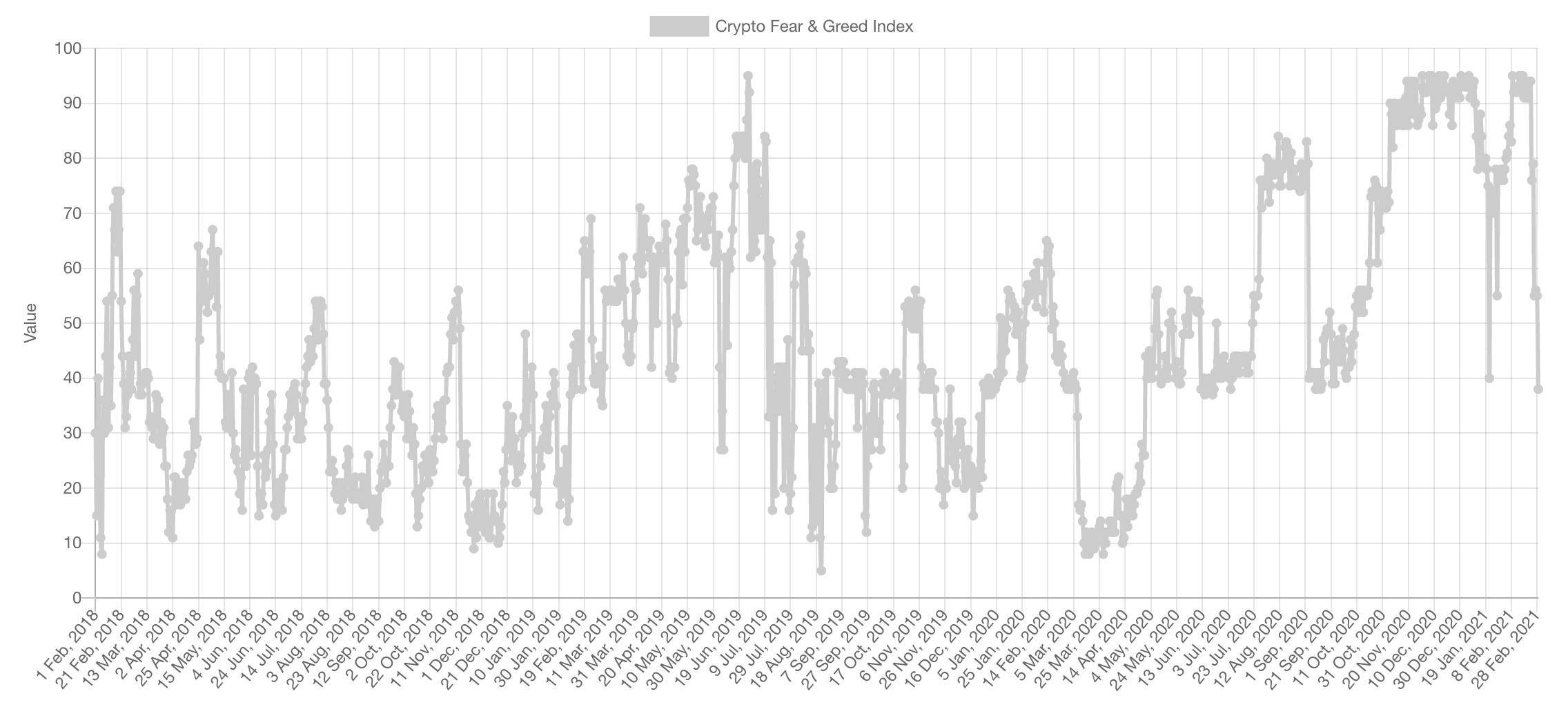

We have seen this latest shift in sentiment from "Greed" to "Fear" happen extremely quickly as the latest sell-off began. The question always is: "Has anything changed fundamentally to cause to indicate that this was the top?". Our answer is no.

Market Sentiment

We do not have data from the 2017 bull market. However, we are seeing a quasi-symmetrical resemblance to the bear market sentiment tendency to spike from Fear into Greed and quickly go back down. In this bull-market, it seems to be the opposite which supports price recovery soon.

Market Indexes

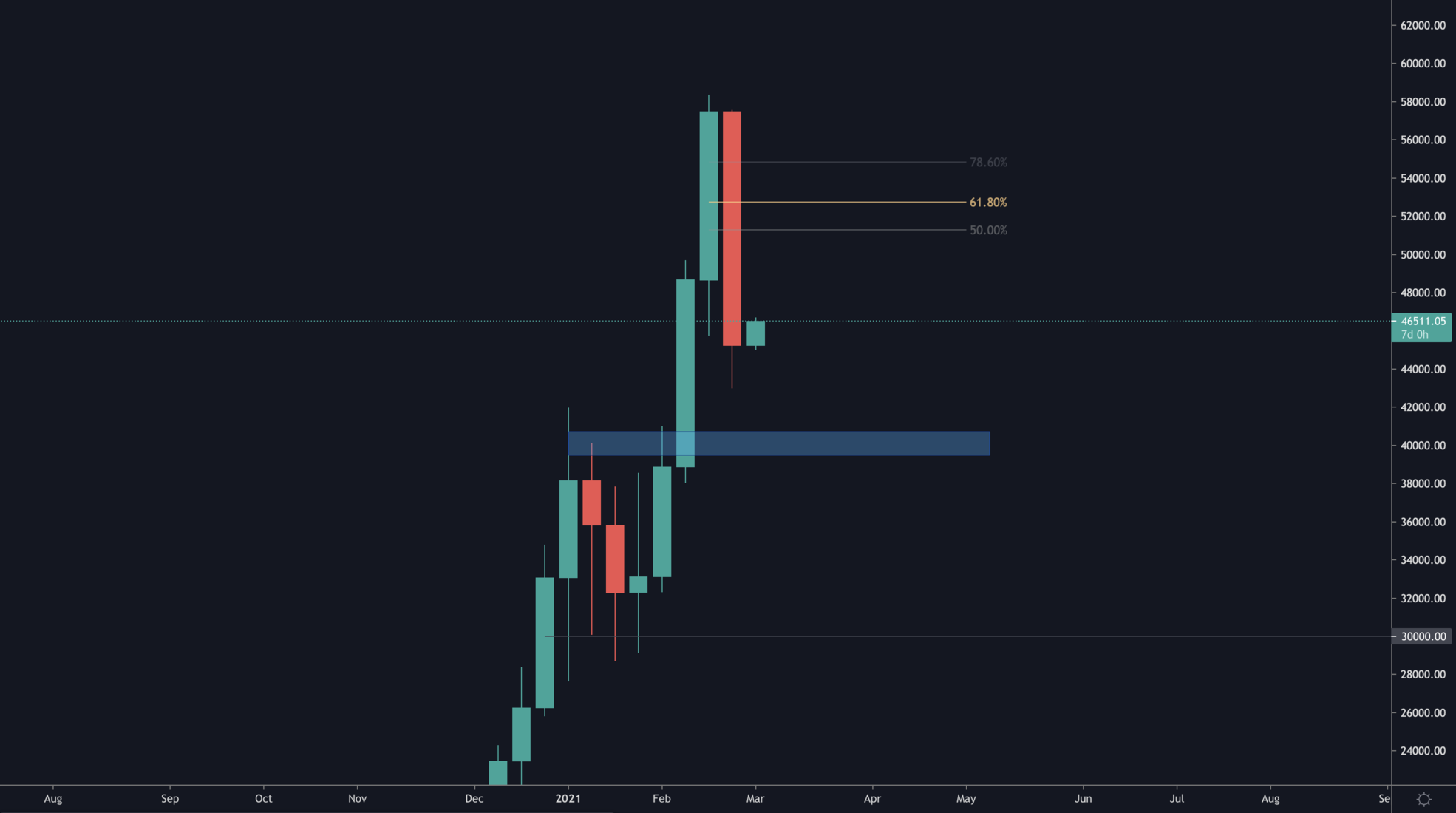

Total Market Cap

The monthly closure for the month of February is in, the market discovered significant new ground during that month. The monthly candle is not bearish per se as it closed approximately a half body, which is reasonable in price discovery as prices hit new walls.

From a monthly perspective, the bull run remains alive and well.

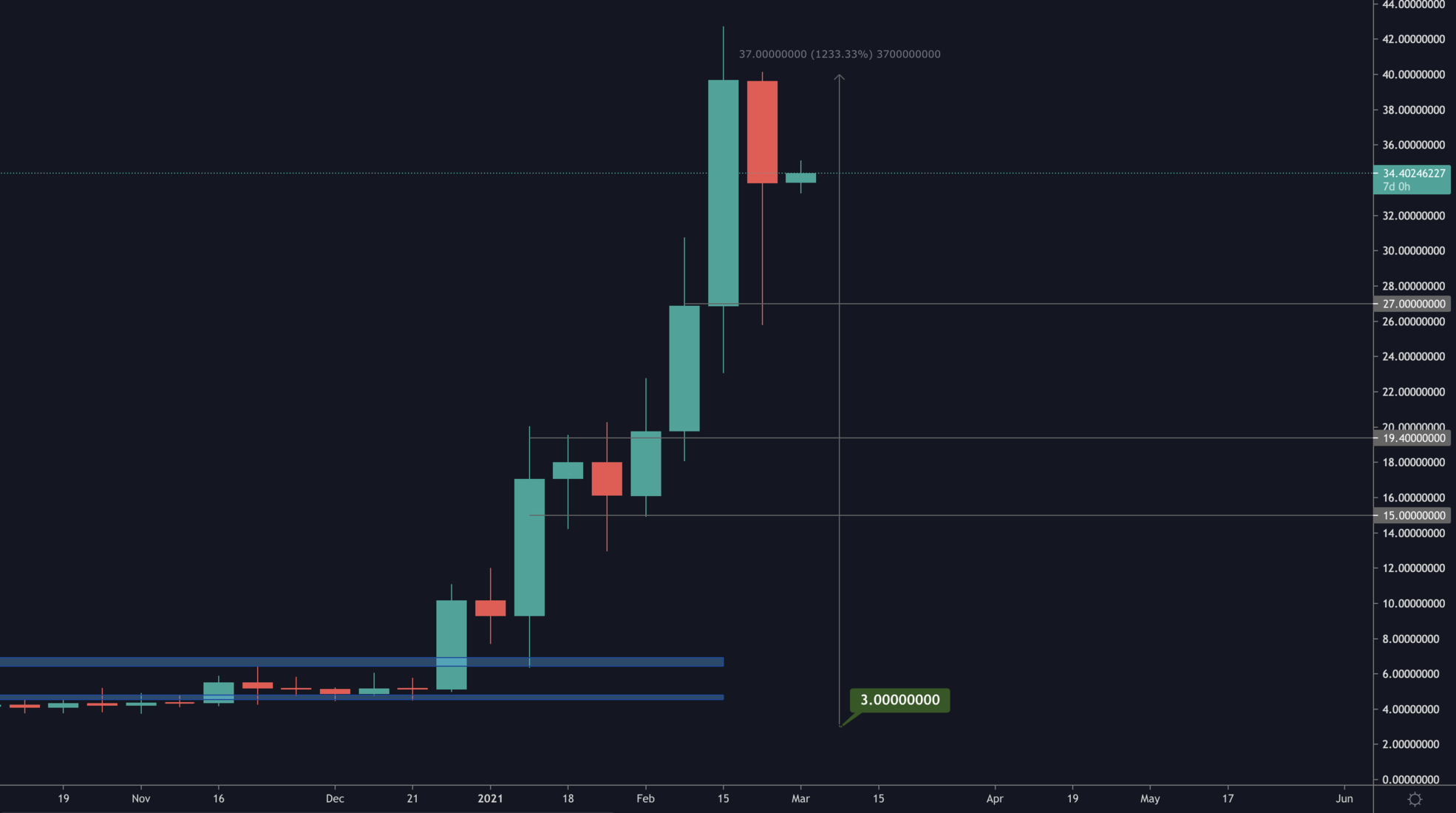

Altcoins' Market Cap

The latest weekly candle closure has closed as a retest of the 2017 high - which is bullish. The only worrying aspect is the bearish engulfing candle. However, support precedes candlestick analysis.

Bitcoin

February 2021 is the month Bitcoin's price action hit $50,000. Let's dig deeper in timeframes for more information.

The weekly candle closed as a bearish engulfing one. Using the Fibonacci retracement tool. Price is likely to hit the 61.80% retracement.

The daily candle closed perfectly above the $45,000 support. Unless the latter breaks, we remain bullish on Bitcoin.

A falling wedge has formed, from which price is breaking out. The target would be $51,500 for this pattern formation.

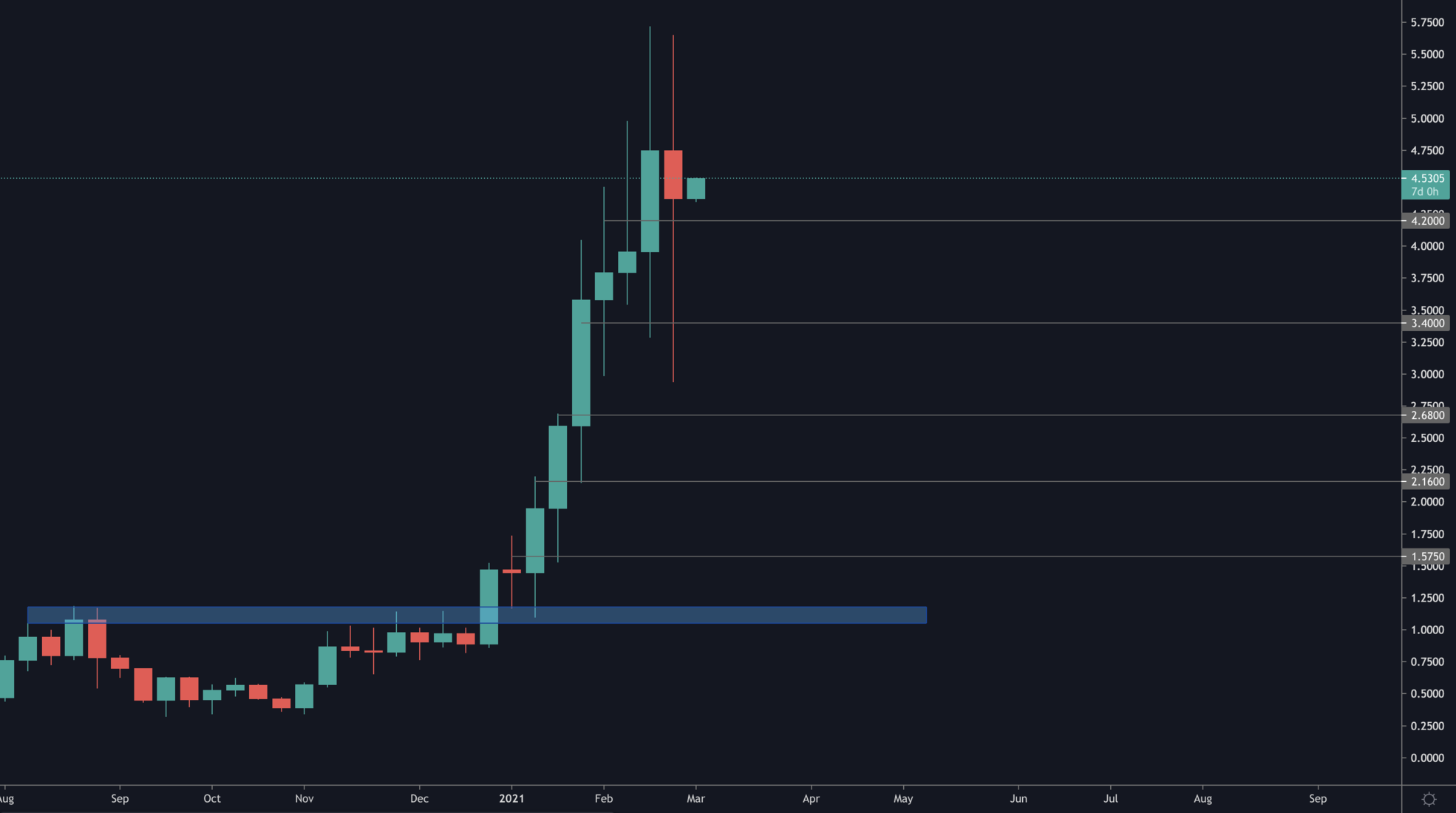

Ether

The monthly candle on ETH closed rather bearish as it retraced most of the upside movement seen in Feb. However, in order for that bearish candlestick to translate into actual downside, more would have to happen as support is protecting price. Let's explore.

Both the weekly and daily timeframes maintained ETH's price action above support, this also means we will be maintaining our latest ETH swing trade open until further notice.

DOT

DOT found support at $27 and opened up a rally which is likely to maintain its momentum until $42. From there, we'll need to monitor the market for a break of that level for further price discovery.

SNX

SNX's price wicked as low at $14.10, mainly because price wicked deeper than intended from leverage unwinding. The weekly candle closed above the $18.25 level of support which means price is likely to grind back up.

RUNE

RUNE has seen very significant demand on every single dip recently. This helped price maintain candle closures over $4.20 which is also bullish, like DOT and SNX.

SRM

For as long as SRM maintains the $3.79 breakout as valid, we'll be maintaining our full position in it until $20.

SOL

Despite all the blood seen in the markets, our SOL position remains in profit even though we bought in a few days ago only. We will be selling 20% of our position at $14.21 and another 20% at $15.41 as price action may be indicating that we'll only see a deadcat bounce. We'll maintain the rest until either $30 or invalidation by the creation of a lower high.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.