Weekly Technicals Pro - Volume 47

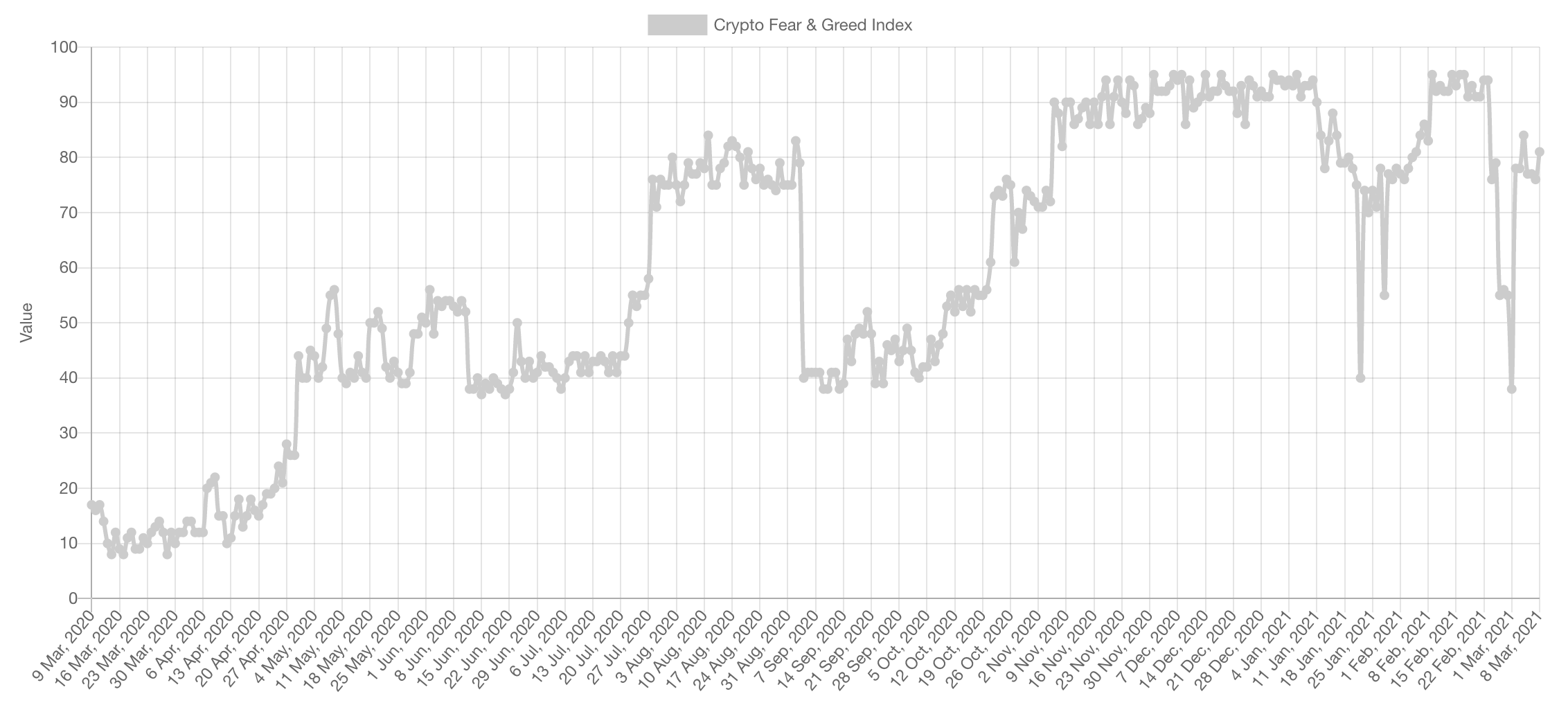

For the foreseeable future, this market is running a full on bull market. The pattern we are seeing with the Fear & Greed metric is numbers gravitating towards "Extreme Greed" and occasional downside wicks to the "Fear" zone. This is the polar opposite of what we saw during the bear market.

Market Sentiment

Market Indexes

Total Market Cap

The Total MCap has retraced about half of the dump seen late last week. There is no clear pattern yet on the Total MCap which is 60% dominated by Bitcoin. What is really interesting is the Alts MCap.

Altcoins Market Cap

The Altcoins Market Cap is giving a very obvious and extremely high R:R opportunity. Price has crossed the 2017 high and has retested it as support - it is now consolidating. Our prediction is it will break out of this consolidation relatively soon before rallying towards $1 Trillion in Alts MCap alone.

Note: This index in particular only account for the top 200 coins, so the creation of random sh*tcoins does not add to it; this makes it a reliable index.

Bitcoin

Bitcoin's price action is "ranging". It can have one of two paths:

- Break above [$52,150-$53,300] and go into price discovery again

- Break $45,000 on the daily timeframe and correct towards $40,000 and potentially $30,000 - depending on the strength of the break

Ether

ETH also have a chance to many near $1,400 - we took it and longed more ETH at $1,430 as you know. Now price closed a very slight candle above $1,720 (not convincing yet), we'll need a second consecutive close above it to prove legitimacy of the first. Once that happens, ETH will likely go into price discovery again. The reason we are bullish is not only the monetary environment - every now and then the MCap Indexes give very slight signals and they tend to have high odds of working out; this is one of them.

DOT

DOT is consolidating in a symmetrical triangle, we'll need to see the direction of the breakout. Based on ST history and overall bullishness on Alts, an upside break is more likely.

RUNE

The asset that saw the most demand in these past two weeks (noticeable by the wick buy-ups). RUNE is creating HHs & HLs consistently, there's a good chance of a large green candle soon. Our target for this investment is $90 but for if we were trading it and swing longed $4.20 we'd be TPing and $10.

SNX

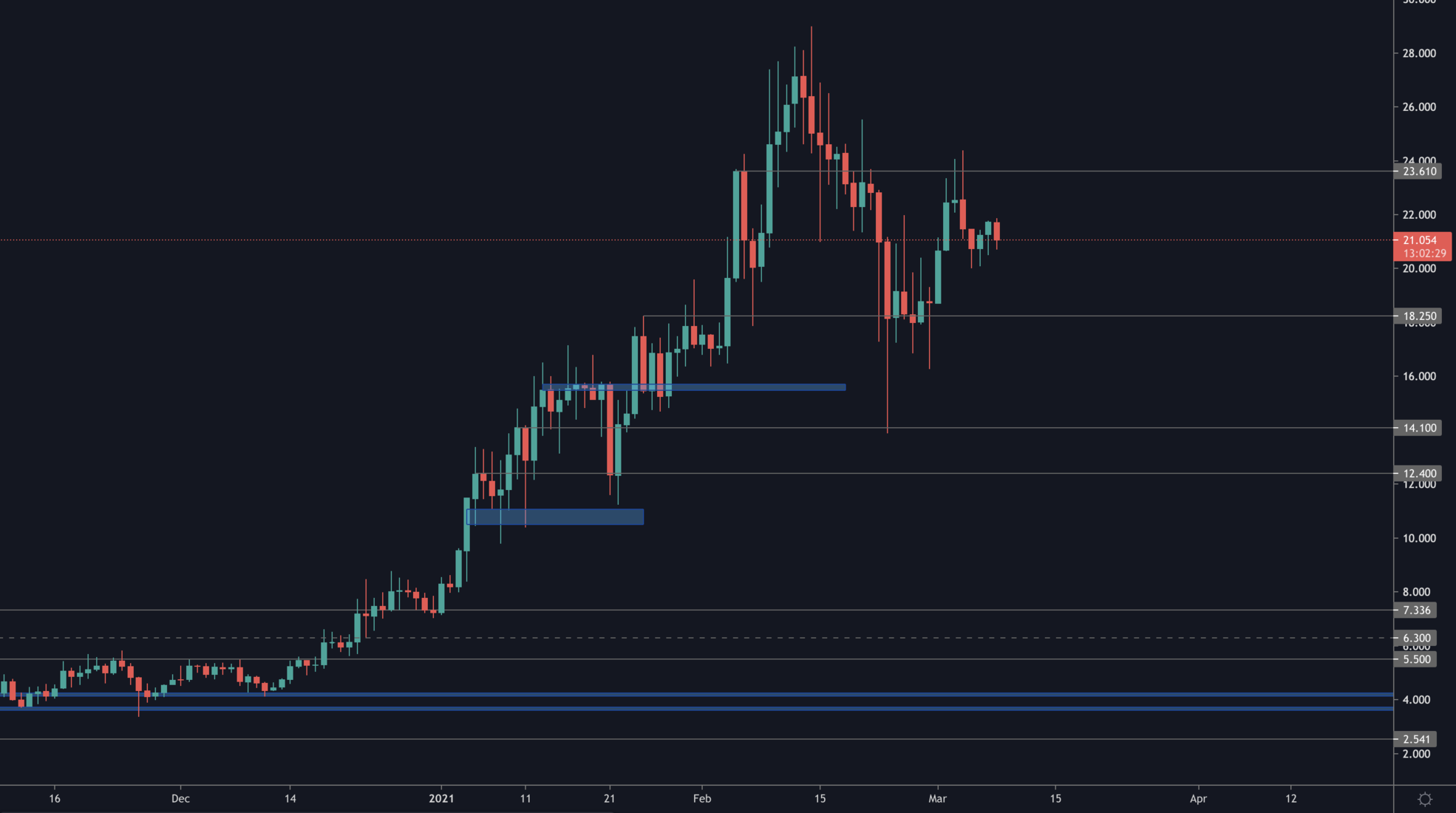

SNX perfectly went from $18.25 towards $23.60. Price has not yet broken the latter and it is what we're monitoring for further upside.

FTT

FTT requires one daily closure above $31.20 to rocket higher into price discovery. Exchange tokens have been doing tremendously well mainly because of the unprecedented transactional volume they're processing.

SRM

Despite the rather bearish weekly candle last week, SRM still was able to advance. What happens often in price discovery is large resting asks get triggered which pushes price down as people take profit, of course whenever price goes down there's a group panic selling (i.e. weak hands) and that leads to more downside. This is why we often see such wicks (albeit this one was extreme) during price discovery.

SOL

SOL dropped $0.20 shy of $11.70 and reclaimed the blue block. Given the latest reclaim, it's likely we now see a test of $14.20 and a reclaim of it as well.