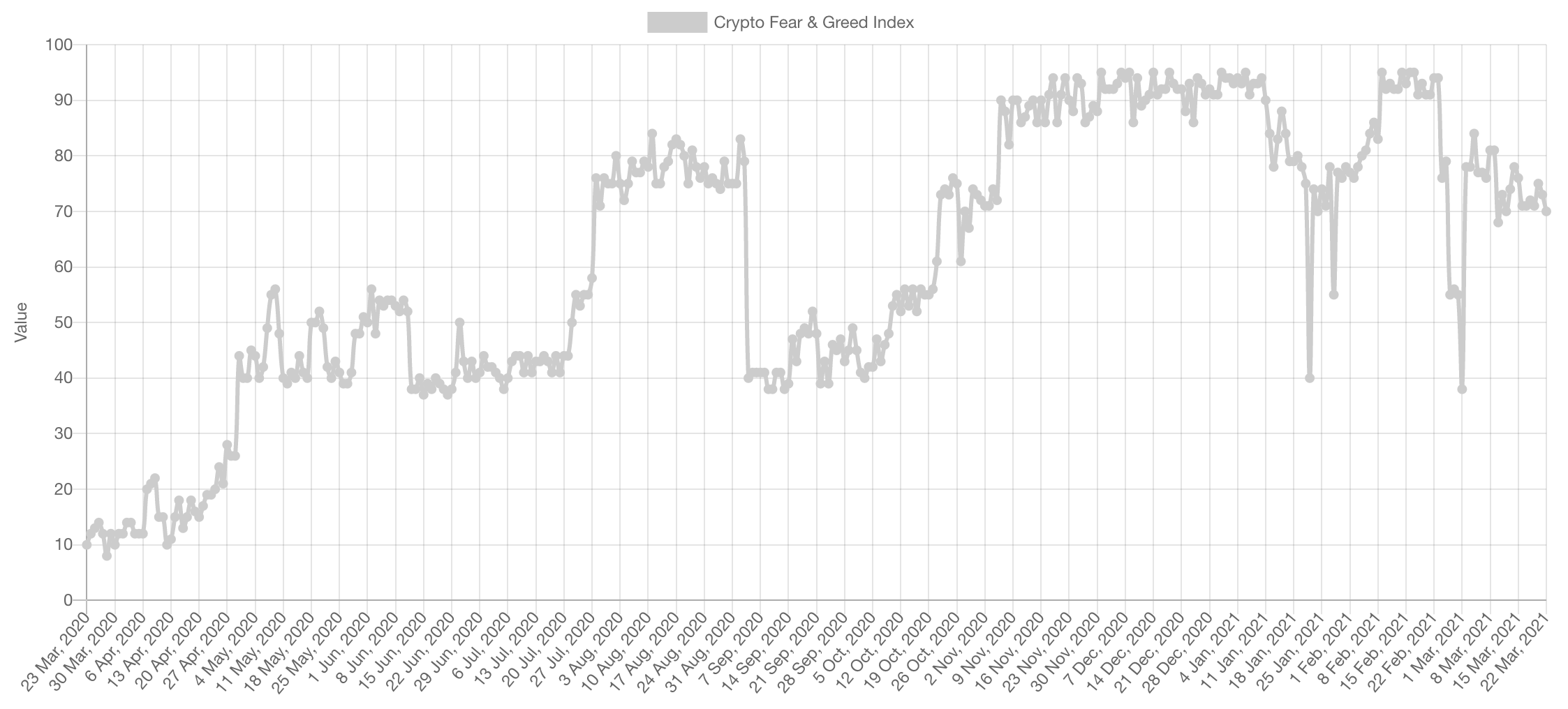

Market Sentiment

Based on our what we're seeing, newer market participants are no longer in FOMO mode and have taken a step back with some questioning the bull-run's sustainability. When you take into account the factors we'll be discussing below, the odds of them remaining sidelined while price pushes higher is increasing.

Market Indexes

Total Market Cap

Very important development today seen across both indices, and that is weekly candle closures respecting the bullish market structure.

The Total MCap's price action retraced the entire pullback seen during the week and closed a weekly candle back above $1.72T.

Altcoins Market Cap

This is the weekly chart of the Alts MCap (index for top 200 altcoins). This breakout is certainly not one we would ever consider fading, it would be the same as shorting Bitcoin from $25,000 right after the breakout. Price is consolidating and hence we must ask: when does momentum start? This is where we visit the daily chart.

The daily timeframe shows that $700B is acting as resistance for now. However, buyers continuously are helping with the creation of higher lows; which indicates a likely daily closure above $700B. Post-breakout (if/when it happens), it would open the road for an Altcoin rally.

Bitcoin

Bitcoin's price also retraced the majority of the downside registered during the week. From a technical perspective, Bitcoin's chart is filled with higher highs and higher lows. From a fundamental perspective, we're seeing more interest in institutions/corporations owning Bitcoin - with the latest stimulus package, Bitcoin's time to shine is now or never.

Ether

ETH is stalling similar to the Alts MCap. Once again, this is not a breakout we would be fading at any moment in time and our $1,430 long is still held and targeting $3,000.

Fundamentally, institutional interest in ETH has begun. ETH has three events that make it highly valuable: Layer-2, EIP1559 and ETH2.0.

DOT

DOT was consolidating in a symmetrical triangle that broke to the downside. However, as price stagnated too long around the apex of the triangle, it became clear that DOT was likely to close a daily candle above $37 and invalidate the breakdown - exactly that happened.

Now DOT is dealing with the $40 resistance, in conjunction with the Alts MCap $700B resistance. A daily closure over $40 will open up the door towards $100.

SNX

SNX held $18.25 perfectly on the daily timeframe. The next level is $23.60 and crossing it will be crucial for upside continuation. The way we're trading it (in addition to our long term investment in SNX) is by having longed 50% of our desired position size at $18.25 and we'll be adding the second portion if/when SNX's price closes a daily candle above $23.60. Our target is to hold this trade into price discovery.

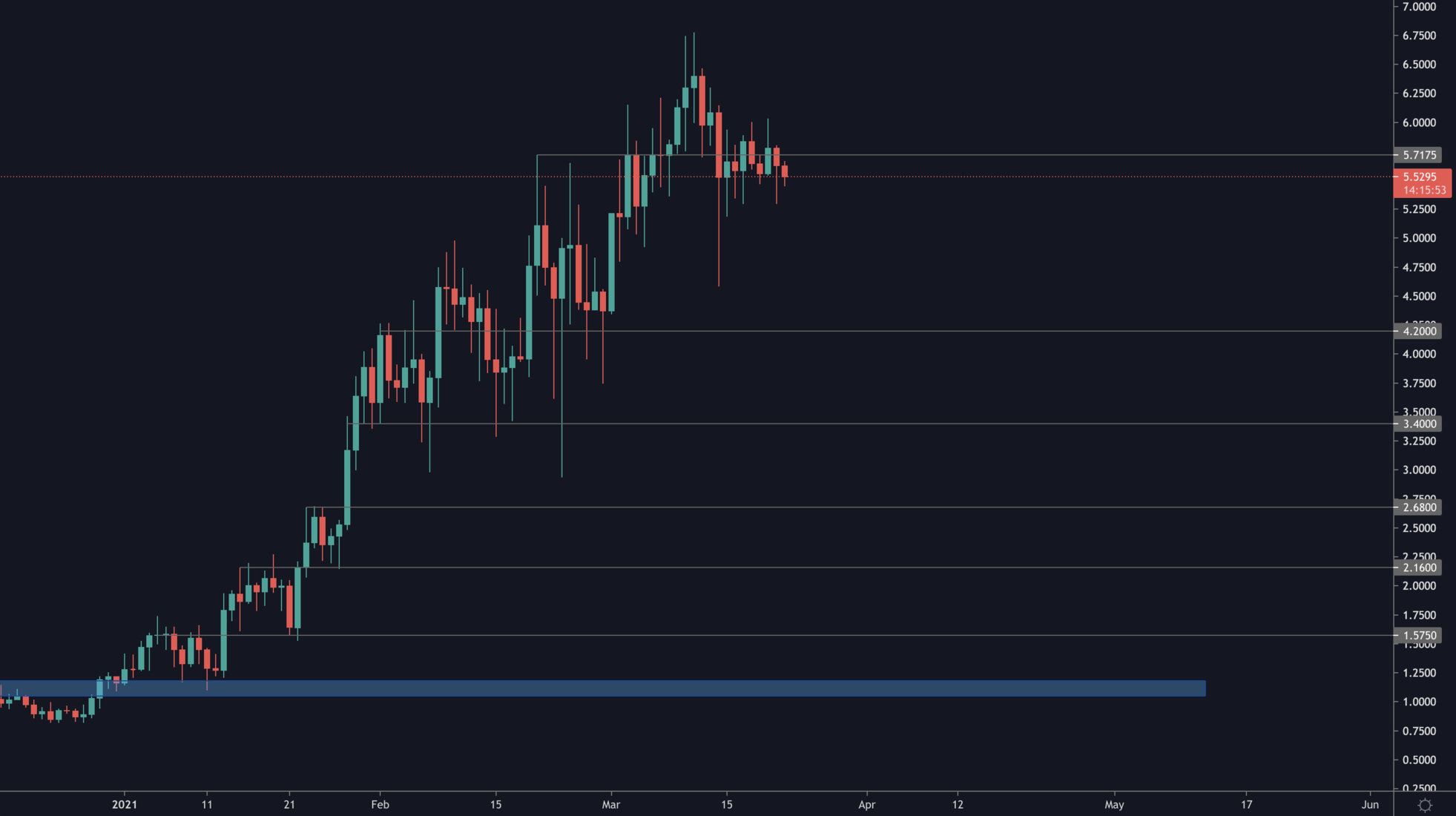

RUNE

RUNE, similar to most Alts, is ranging as price dances around $5.72. For that reason we had stated that in order for a $5.72 breakout confirmation to happen, price would need to close two consecutive daily candles above it - which is yet to happen.

SRM

SRM's price action in terms of trading is a simple "no-go" for us as indecision is reigning over that chart. Our approach is very simple: HODL our investment from sub-$1 with the same $20 target.

SOL

The SOL falling wedge was a roller-coaster ride. As price corrected after getting $0.05 shy from target, we adapted to the change and took 50% profit at $14.20 and the remainder at $15 - that trade is done and closed.

We still hold some SOL (which we bought much earlier at $10) as we anticipate that ecosystem to grow, especially in terms of DeFi and user growth.

XRP

XRP's price action saved itself from a lot of downside by closing a daily candle above $0.50. Now it will likely join Altcoins in their rally with a first target of $0.79.

We're personally not trading XRP, we still have a small proportion of our portfolio invested in it but there's too much uncertainty around it and it is too news-sensitive for us to swing trade.

Disclaimer: NOT FINANCIAL NOR INVESTMENT ADVICE. Only you are responsible for any capital-related decisions you make and only you are accountable for the results.