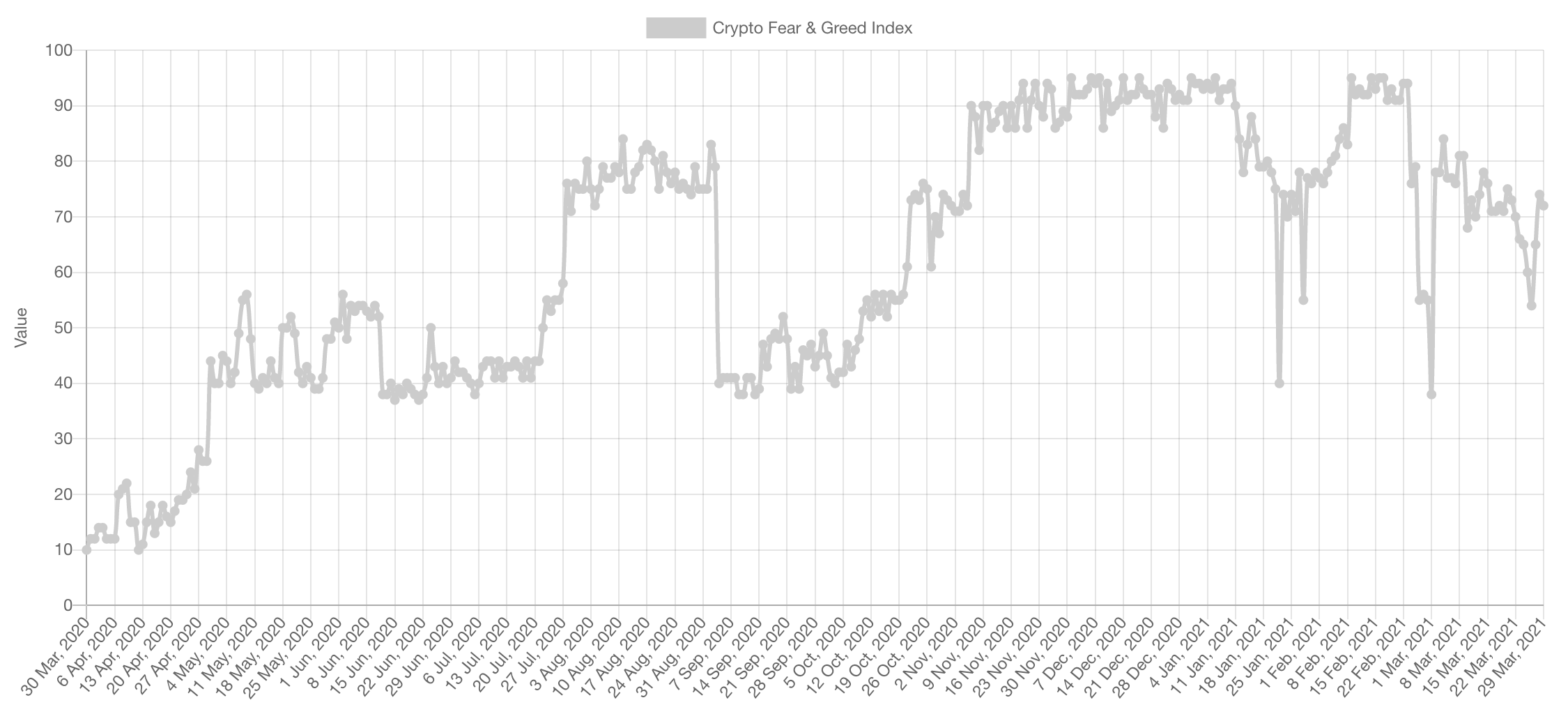

Market Sentiment

Each time sentiment falls towards the [40-50] area, crypto prices re-bounced. This is a characteristic of bull markets, one we extensively talked about in previous versions of Weekly Technicals. This quasi-reset in sentiment gives longevity for future upside legs in prices.

Market Indexes

Total Market Cap

The main aspect to take from the weekly chart of the Total MCap is the market demand. Price did close slightly under the previous $1.72T high, however that offset by the large downside wick buy up - signaling great market demand.

Altcoins Market Cap

Alts are in a very unique position at the moment. Many may be focusing on Bitcoin, however Altcoins are gearing up for significant movement it seems. If there was one breakout we wouldn't want to fade, it's this one.

Zooming into the daily timeframe, we find that the resistance is $700B. The run-up will likely start when the Alts MCap closes a daily candle above $700B.

Bitcoin

Similar to the Total Market Cap index, Bitcoin's price action on the weekly timeframe signals demand - offsetting the closure under $57,500.

This is where things heat up. Bitcoin is currently breaking out from the counter-trendline resistance that imposed itself on price since mid March. The target from here? $74,000.

Ether

BTC & ETH are walking a very similar path. ETH is breaking out from its own $1,720 resistance alongside Bitcoin. Once a daily candle closes above the aforementioned level, $2,000 would be on the cards.

Personally, our swing long from $1,430 remains open and we're still not looking to take profit under $3,000 on it.

DOT

During the market-wide dip, DOT retested its previous support of $27. From here we expect price to get back towards $40. From there however, a daily closure can help advance the asset significantly and offers a high R:R long opportunity.

SNX

SNX has a counter-trendline resistance. From a technical perspective, when this is crossed, SNX will have room to grow back towards its ATH. Of course it would not be a straight line and levels such as $23.60 will likely resist price - however it would be temporary.

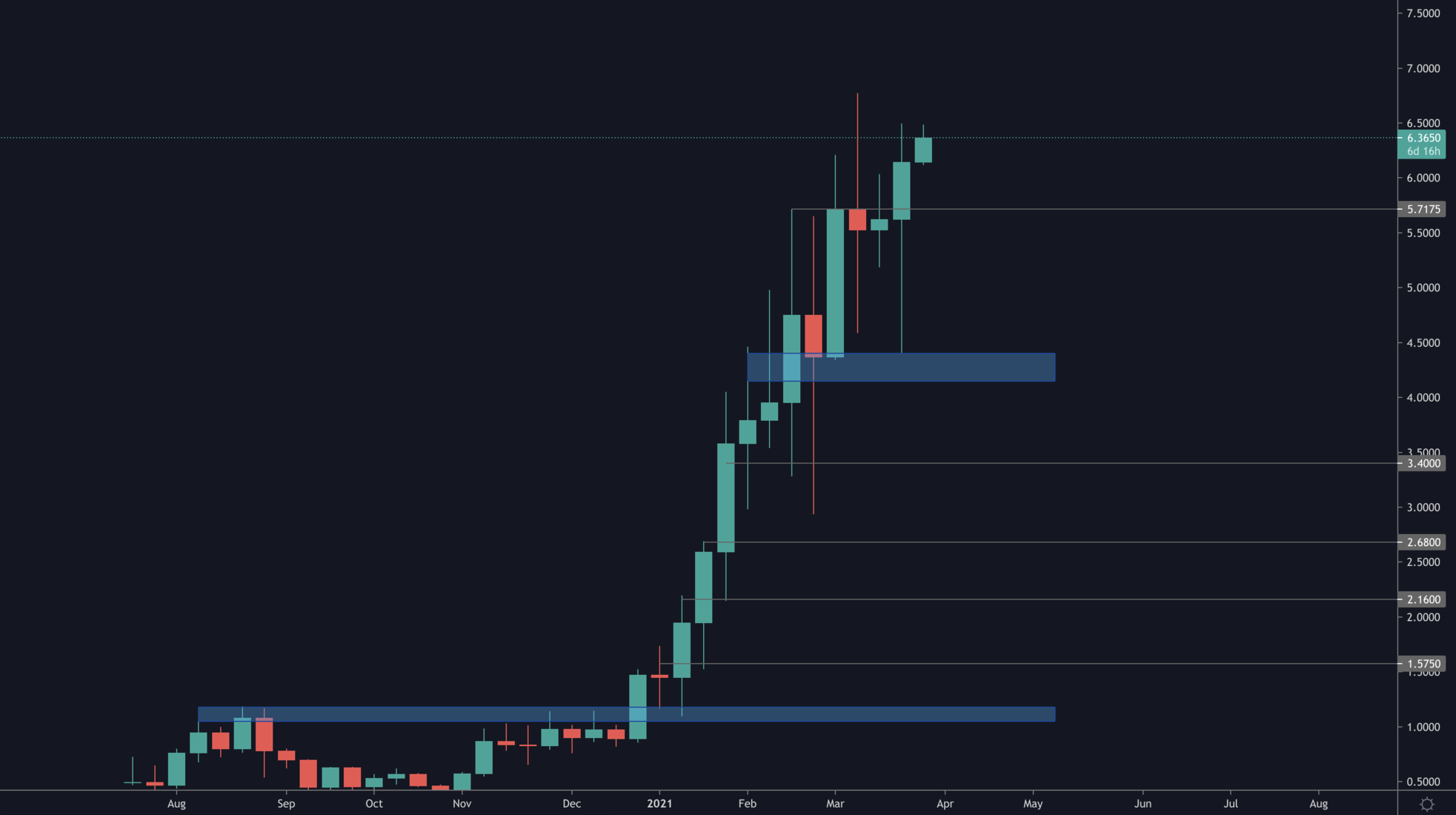

RUNE

This DeFi token showed us the market is demanding it big time. You can see this communicated by the chart through the weekly candle. How a sharp dip turned into a bullish green candle. RUNE's only resistance is $6.40 on the daily timeframe, a closure above it will send it back into price discovery and towards the two digits territory.

SRM

SRM reclaimed $4.54 on the daily timeframe (shared in Discord Pro at the time) and is now heading towards $6.45.

FTT

After a reclaim of $35.60, FTT is now rallying back towards $38.50. From there, a daily reclaim of that level would send it back into price discovery. The main benefit exchange tokens have is the immense transactional volume on those exchanges. Our target for taking some profits off our investments remains $100.

SOL

After weeks of ranging in the same region with price being crushed by $16 sellers, SOL is finally back on the road of price discovery. Right now it is retesting the previous high on the 4H timeframe. The next levels are all round psychological numbers, $30 is the next one.

XRP

XRP is creating higher highs and higher lows on the daily timeframe which denominates a bullish market structure. Technically speaking, the next target would be $0.79. (We are not trading XRP due to its sensitivity to news - we're still holding our 5% investment in it however).