Weekly Technicals Pro - Volume 51

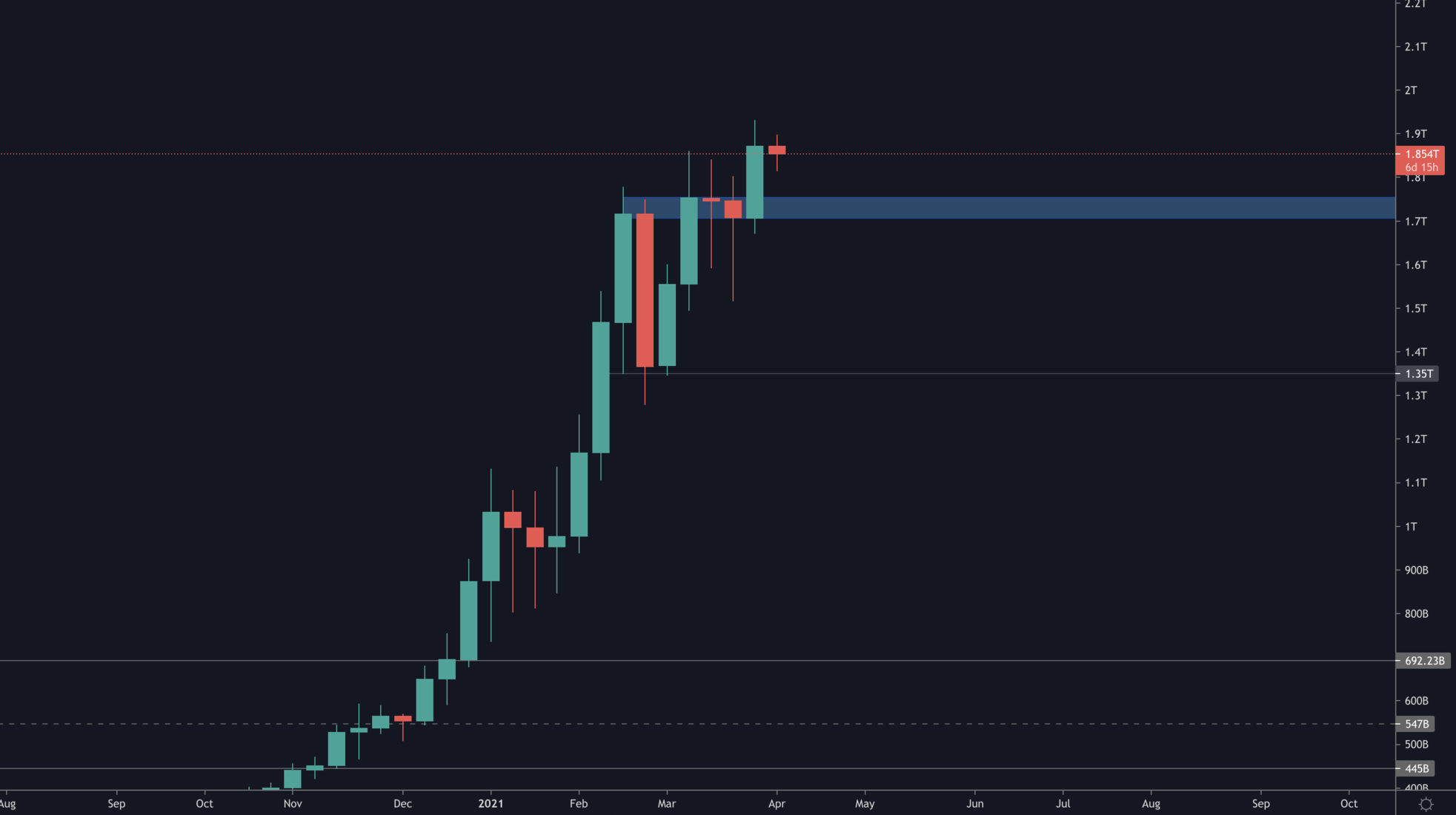

The Total MCap is continuously creating higher highs and higher lows as it approaches the $2 Trillion mark. In order for buyers to retain market power, this structure needs to be maintained. On the ground, this mean the $1.7T region (in blue) must be held as support.

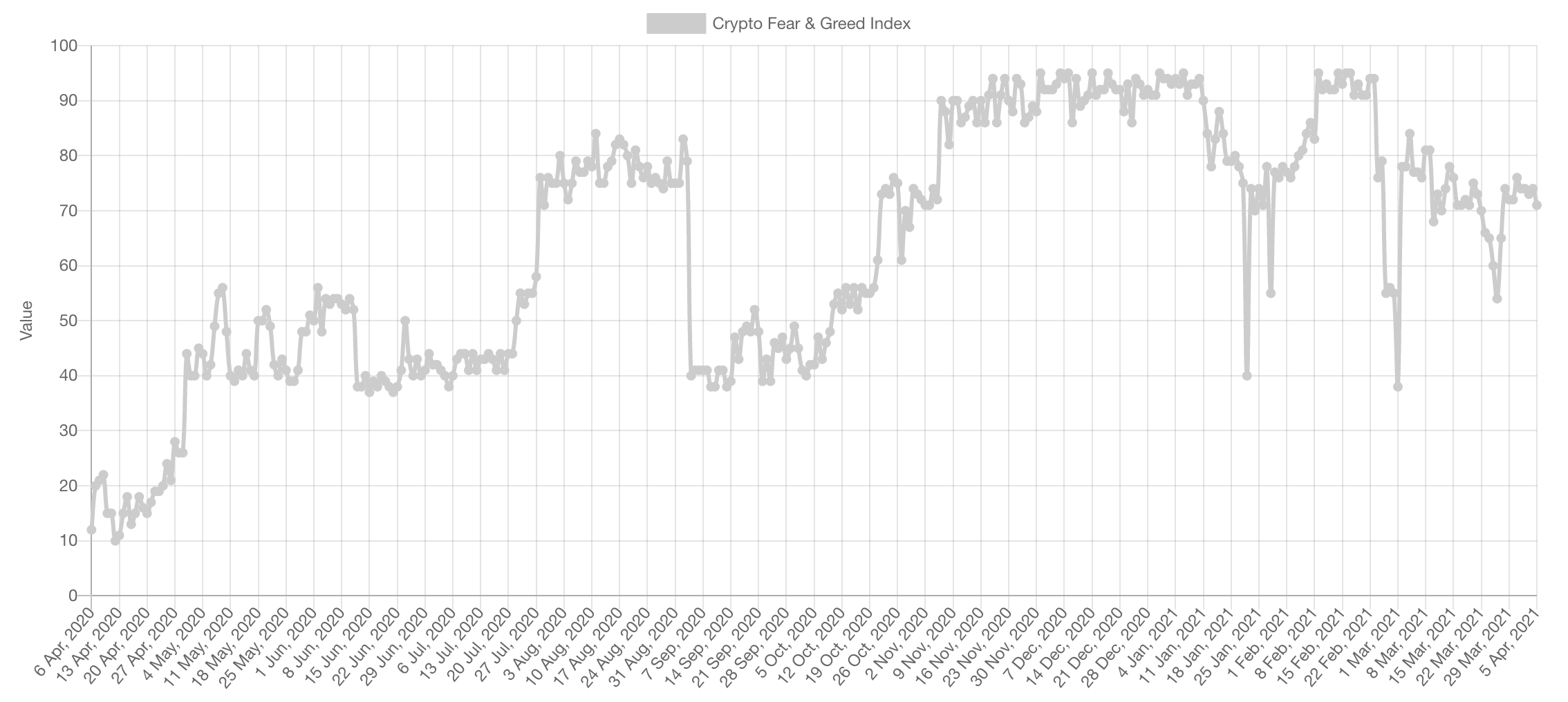

Market Sentiment

Given that many Altcoin prices are in price discovery (i.e. new All-Time High), the sentiment level is rather surprising. One would expect market participants to feel somewhat euphoric at these prices but they are not. We also see that through social media channels - no extreme greed yet. This gives longevity and room for growth for the run.

Given that many Altcoin prices are in price discovery (i.e. new All-Time High), the sentiment level is rather surprising. One would expect market participants to feel somewhat euphoric at these prices but they are not. We also see that through social media channels - no extreme greed yet. This gives longevity and room for growth for the run.

Market Indexes

Total Market Cap

Altcoins Market Cap

This is where things really got interesting. Altcoins had a massive run last week and $700B was broken on the daily timeframe. This has opened the road to further price advances with the first target being $1T in Alts MCap.

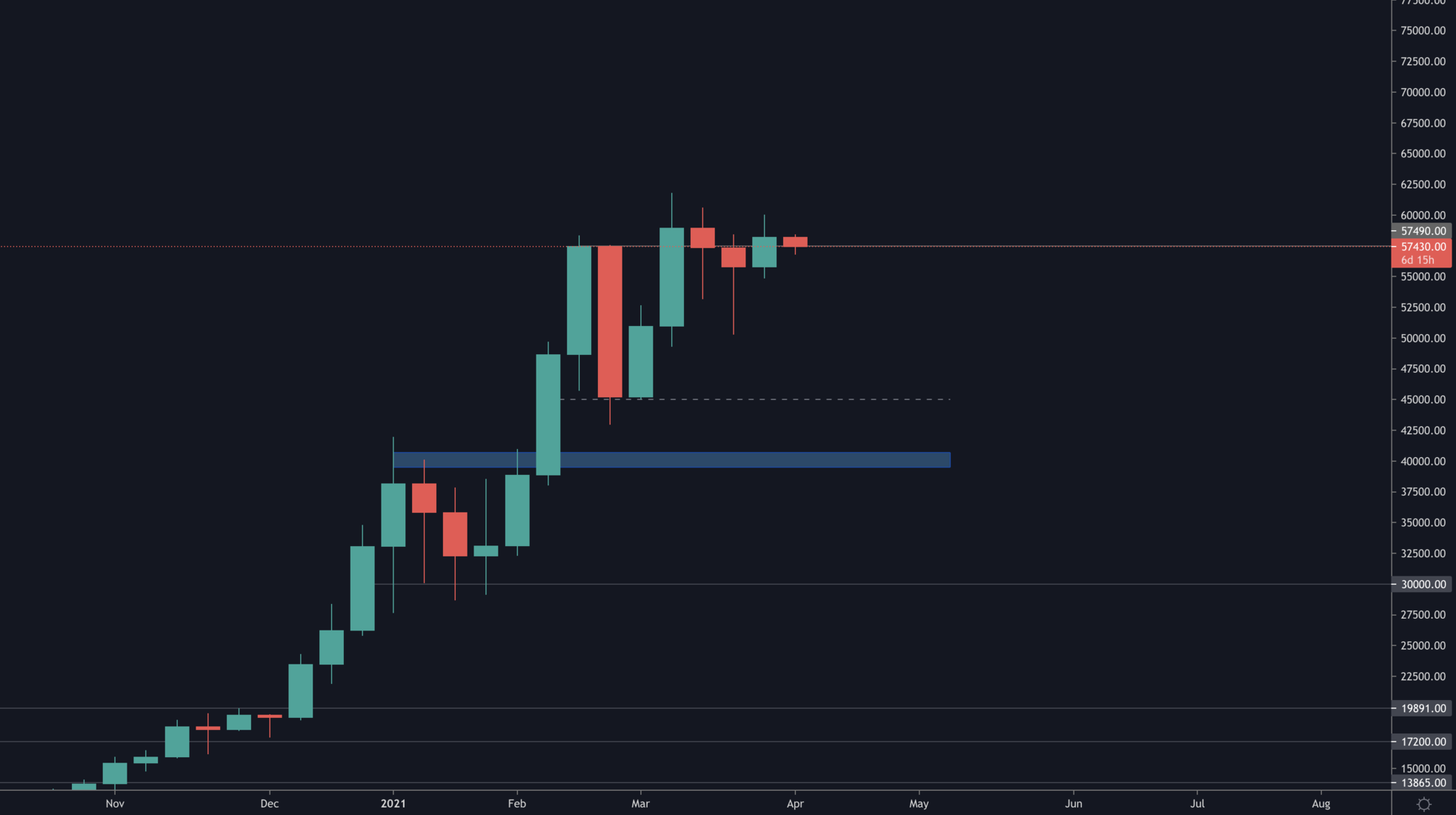

Bitcoin

Bitcoin has spent a few weeks ranging around $57,500. Now price has reclaimed that level on the weekly timeframe but the real resistance is happening on the daily timeframe at $60,000. This round psychological number is where sellers are outweighing buyers. Buyers though, are continuously bidding BTC from higher prices - creating higher lows.

This battle will end in favour of one or the other. Our bet? Buyers will outweigh sellers and take-over $60,000.

Ether

ETH has entered price discovery once again after re-entering the $2,000 region. From a technical perspective, price has turned the previous high set in February into support. That is what needs to hold - the $1,950 region (in blue).

We're still in our swing long (spot) from $1,430 and our target remains standing at $3,000.

RUNE

Spectacular price advance by RUNE last week: +70%.

RUNE has finally entered the two-digit territory with its cross of $10. The weekly candle closure has been immensely bullish with a full green candle and no upper wick. This communicates further price discovery in the coming weeks.

DOT

After revisiting support at $27, DOT has risen again towards the $40 and crossed it this time. This triggered a swing long on our end that has a very reasonable R:R (Risk:Reward ratio). The invalidation is as simple as a daily closure under $40 and our target is +50% higher at $60.

SNX

SNX has broken above the counter-trendline that was limiting price, in addition to crossing $18.25 and flipping it to support. The upcoming level is $23.60. However, given the significance of the counter-trendline break and the broader market advancement, the target is $30 (previous high).

FTT

FTT saw a V-shaped recovery. This asset has grown immensely because of the innovation and traction that FTX had. Expecting further price discovery on this one but it would first require a daily closure above $42.

SOL

Massive price advance on SOL and the best is yet to come. Solana-based DeFi will be coming soon and that will directly benefit SOL. We're holding SOL until three digits (i.e. $100).

SRM

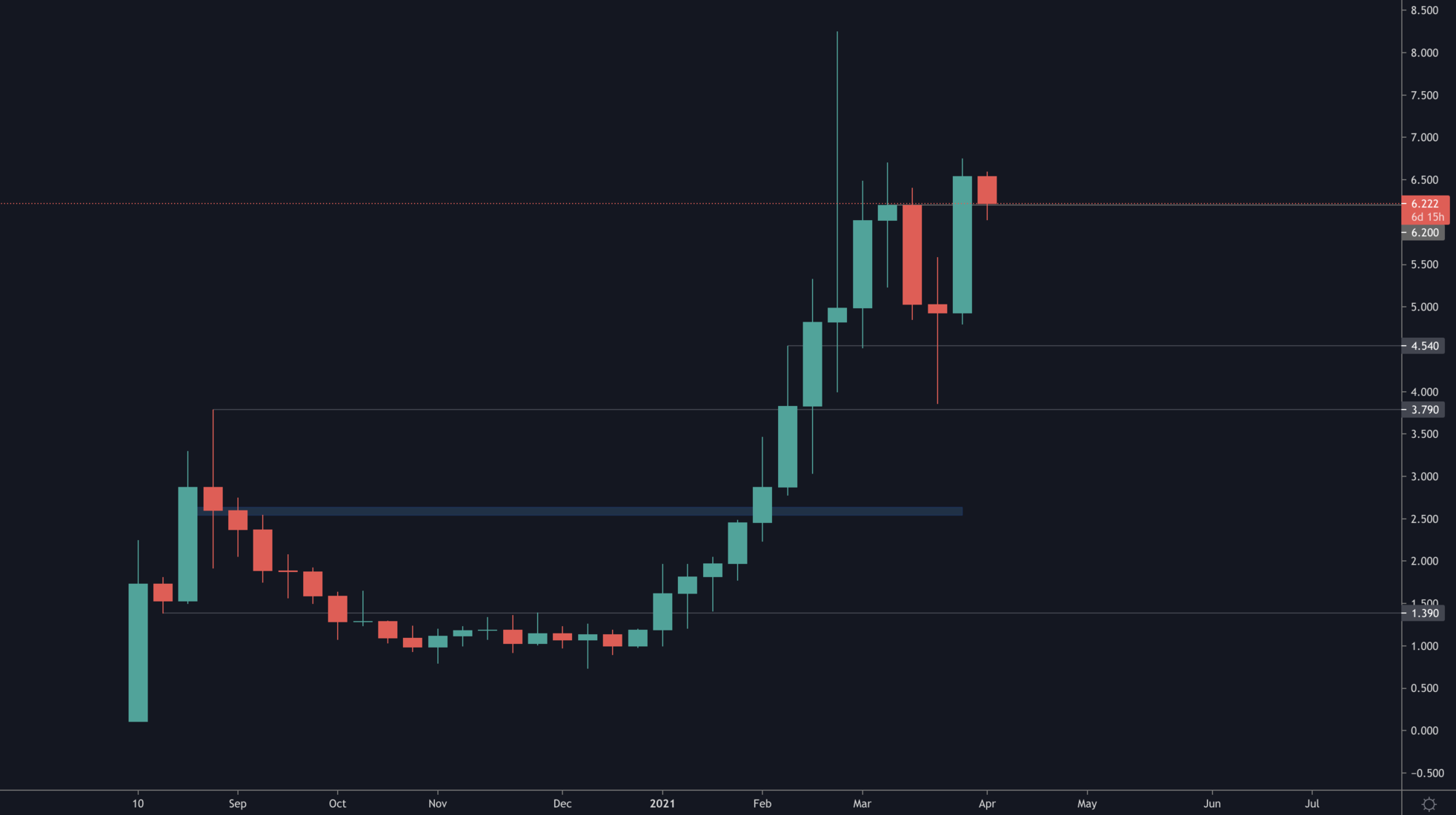

On the weekly timeframe, SRM just created a new closure high above $6.20. This re-enforces our bias towards SRM becoming a blue-chip asset in the Solana ecosystem as it is the backbone of all trading.

XRP

Since the flip of $0.50 - which invalidated downside to $0.30s - XRP has been creating HHs & HLs. This leads it towards $0.79 as a first level. From a technical perspective (once again), XRP is quite bullish here with this market structure. However, we won't be trading it because of price over-sensitivity to news. Also, potential upside on DeFi (especially upcoming Solana-based DeFi) is higher - without the news sensitivity.

With that being said, we're glad to see this price increase as it directly benefits our portfolio.