Weekly Technicals Pro - Volume 52

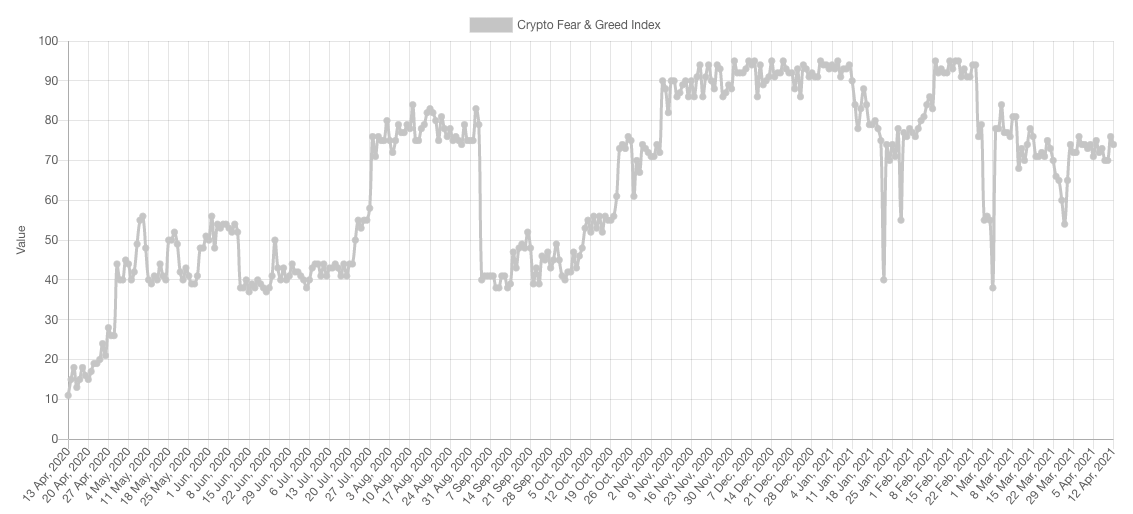

Despite the major advances we are seeing in crypto prices, sentiment has not reached high levels of Greed yet. In fact, we can tell you right off the bat that many are in denial and awaiting a bear market. What often happens is that these people change their minds at higher prices and buy. That is where worry begins as we begin reaching levels where we are out of buyers - we are nowhere near yet.

Market Sentiment

Market Indexes

Total Market Cap

The Total MCap has tackled the $2 Trillion mark. The first Trillion took more than a decade, the second one took about three months. We're targeting $5 Trillion for the year and the market pace is starting to accelerate - meaning we'll likely see it sooner than anticipated.

The market is not showing any signs of weakness right now - people's current worry is more psychological than factual. The market structure is still bullish, higher highs are still being created. Until the trend bends, we assume upside continuation to our target.

Altcoins Market Cap

This is it. Market is approaching $1T for Altcoins. This is the breakout we continuously mentioned that we would never want to fade. $1T target is 11% away now.

Bitcoin

Bitcoin has created a new weekly candle closure high. The $60,000 level that sellers were protecting has been pierced into and now it's a buyers' market. This market structure tells us there are considerably high odds of $74,000 being achieved this month.

Ether

A chart cannot get cleaner than that. First we had a weekly break of the 2017 high ($1,420) which was then retested very neatly. Now we have seen a break of $1,935, which is the latest weekly high, with a perfect retest this week.

This bullish price action will lead ETH to becoming a "too expensive" asset which it is already starting to become. We remain in our swing long from $1,430 and our target remains unchanged at $3,000.

DOT

There is a tendency amongst analysts to over-complicate a chart when in reality it is as simple as: Higher Highs & Higher Lows = Bullish.

$40 is now support and the upcoming level of interest if $60.

FTT

Pierced through $50 after this recent monumental rise. There is a common saying in the world of investing "Hold on to your winners" which we certainly are applying with FTT.

Of course, this is applicable until the market becomes too manic with out-of-this-world valuations.

SOL

SOL is rising purely on the anticipation of SOL SZN and this is completely reasonable given the hype being built around that sector. When we first entered SOL on the dip to $10, we had our eyes set on $30 as a target. As price advanced, we realised this is too conservative of a valuation because SOL SZN has not started and we were at $20+ and SOL was still not in the Top 10 by MCap List. Therefore, we had to run another analysis and are now targeting $100 on this short-term investment.

Price action perfectly retested support at $25.50 - giving late entrants a chance which many buyers have taken. SOL requires a daily candle closure above $30 to continue its ascent.

SRM

Also in anticipation of SOL SZN, SRM has been on the rise again and it actually registered a brand new ATH! The resistance in place is $8.25 as of this moment. A daily closure above it will bring forward another upside leg that gets SRM into the double-digit territory.

OXY

The latest piece of the Solana ecosystem puzzle. OXY has turned $3.20 from resistance into now support which sets the next target at $4.

SNX

The older DeFi projects, such as Synthetix and AAVE, are in an interesting spot right now: attention is elsewhere.

However, these projects hold a lot of intrinsic value, in addition to their price action having just turned bullish (higher low). It seems like many will be FOMOing into these after they go parabolic again. Which is why we are holding a hefty position in both. The first target for SNX is $30, followed by our $60 20X target.

RUNE

Massive price advance in the previous weeks. $10 was a territory we were highly awaiting for and now this has turned into support! Currently, RUNE is in retest-mode with support at $10.35 and an upcoming psychological level of $15.

XRP

XRP is now at prices not seen for over three years. Support now sits at $1.25 and the next levels of interest are $2 & $3. We have begun taking partial profits on the way up on XRP and we'll be taking off more as we approach the two aforementioned levels. A piece of news regarding a potential settlement agreement can be very beneficial in the short-term and Brad may have hinted towards that with this tweet.

Today was a good day.

— Brad Garlinghouse (@bgarlinghouse) April 6, 2021