Weekly Technicals Pro - Volume 54

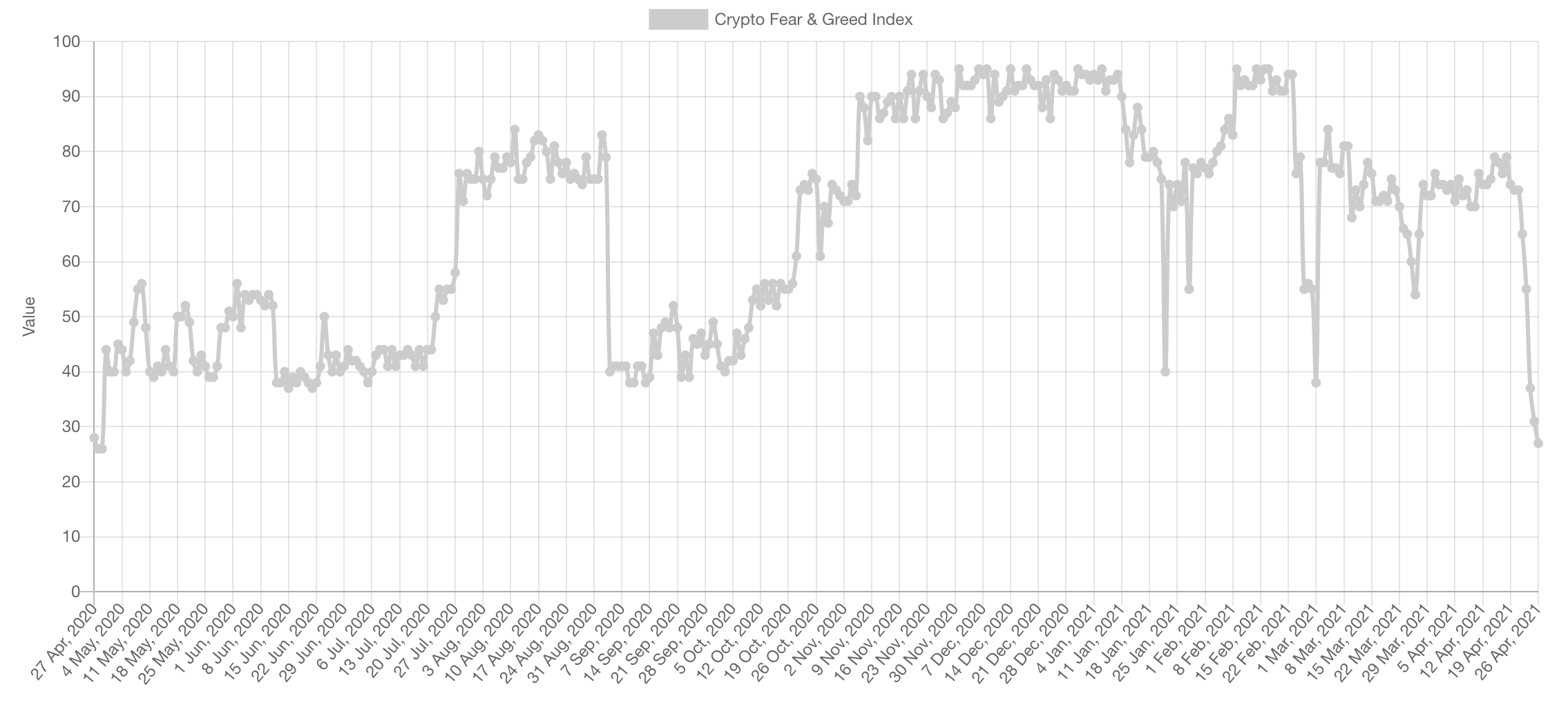

Bitcoin is trading at $50,000 and Ether is trading above $2,400, yet the market sentiment is Fear. During bull markets, we see the Fear & Greed index gravitate towards the upper bound which is Greed & Extreme Greed with unfrequent wicks down to Fear - the polar opposite of bear market sentiment movements.

Market Sentiment

Market Indexes

Total Market Cap

The Total Market Cap traded at support; the previous weekly high set which stands at $1.7T. There are two high odd scenarios we see happening:

- $1.7T holds as support and prices grind up towards $5T+.

- $1.7T breaks, $1.35T (-20%) provides support and prices continue their ascent towards $5T+.

Altcoins Market Cap

The Alts Market Cap is continuing its ascent from the recent breakout from the 2017 highs. This index is in mid-air and not near support at the moment - which is why we are avid fans of entering when supports are reached and the remainder of the market turns bearish (sentiment only).

BTC

Bitcoin's weekly chart is not particularly bullish. In fact, the majority of the attention is flowing towards alternative assets (i.e. Alts). Bitcoin can continue slowly falling down in price until it reaches the $45,000 level of support. The invalidation of downside (weekly timeframe) would happen via a closure above $60,000.

Assuming further downside does happen, we expect the institutional bid to come back strongly again as it has been shallow recently.

ETH

ETH's price chart has been textbook bullish: perfect retests and rallies. The short-term price action confused many, which is why zooming out is always crucial. We are still in our swing long initiated form $1,430 and we still are targeting $3,000.

SOL

SOL made it right after ETH in Weekly Technicals Pro this week because it is Solana SZN after all.

Price action continues to pull major advances on the daily timeframe. Supports are not near at the moment as the closest one sits at $40. SOL is in price discovery.

Our interest lies away from short-term price action and close to mid-term $100.

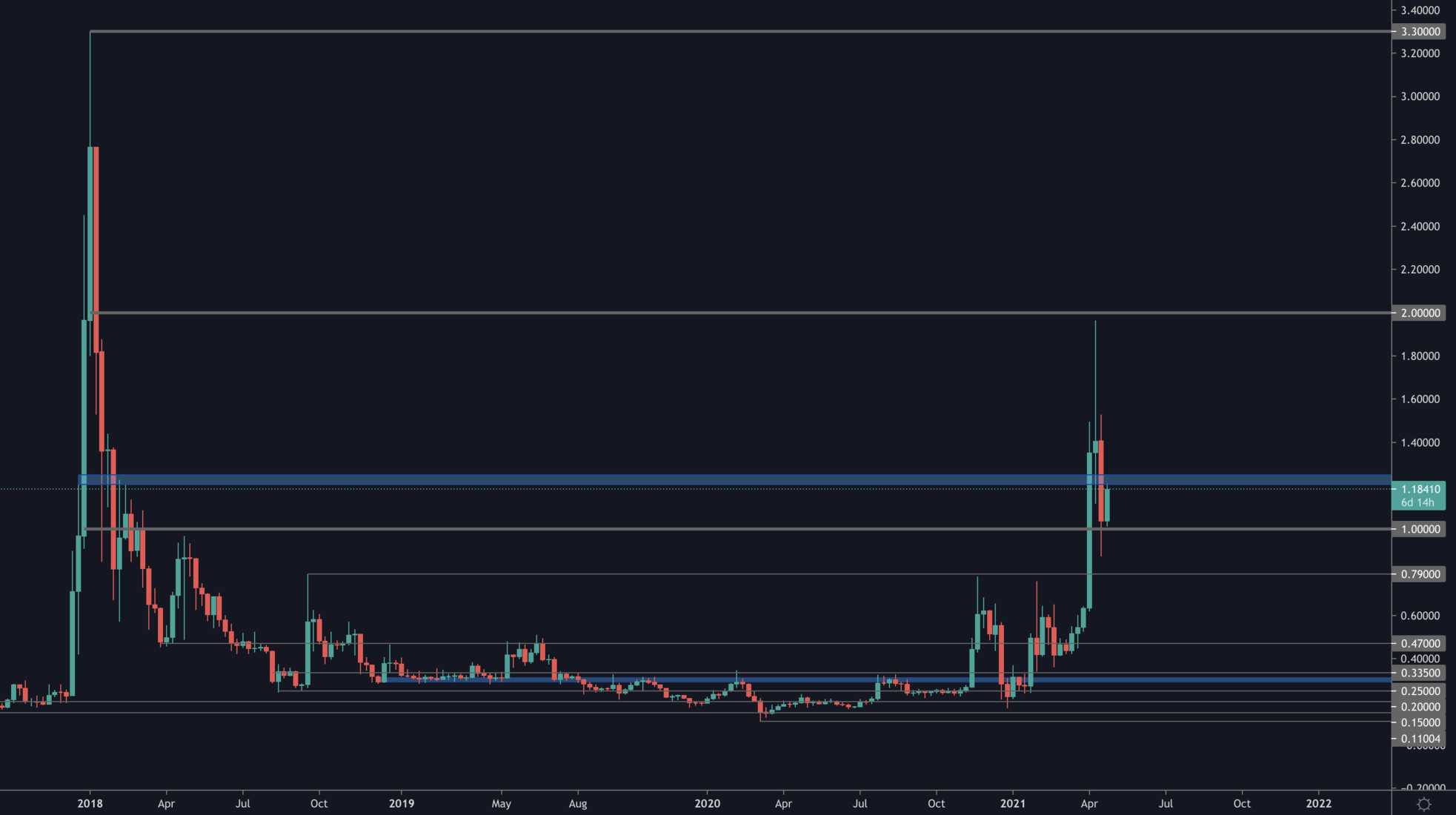

SRM

Patience and a vision pay handsomely. Since the accumulation break earlier in 2021 from $1.40, SRM has grown by over 600%. It has finally reached the double-digit territory with a new support at $8.50.

RAY

RAY seems near for a $12.50 breakout which would lead prices into price discovery with a first stop at $20.

DOT

DOT has retested $27 for support, from here it seems likely that $40 is reached next. Invalidation would be a daily closure under $27.

SNX

SNX has reached $14 and price is finding demand. We expect SNX to likely bottom in the [$12-$14] region before invalidating the recent bearish market structure it has built.

RUNE

RUNE broke through $12.85 and found support near $10. The daily candle closure is trading above $12.85 but a reclaim only comes via a daily candle closure above it - which would resume price discovery.

Market attention ebbs and flows, right now it is on the Solana ecosystem but RUNE is fundamentally valuable which means it inevitably will come back in the future - especially when the caps are raised.

XRP

Poor price action from XRP - broke the $1.25 level of support. Would require a reclaim for further upside and another chance at $2+.