Weekly Technicals Pro - Volume 60

The Total MCap is currently ranging between $1.35T and $1.7T. Should it be able to reclaim the upper bound (blue area), then the index would be poised to see a recovery taking it back towards $2.5T. If we zoom into the daily timeframe, we can take a look at the two possible scenarios 👇

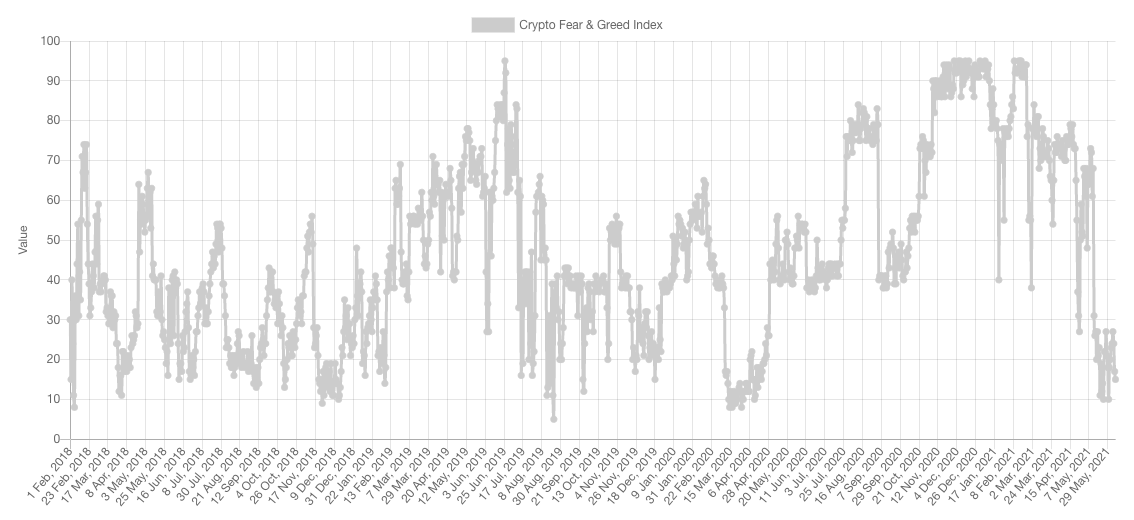

Market Sentiment

The market sentiment is still in Extreme Fear despite the recovery seen by certain assets. This is not an out of the norm situation because it is often the case that market participants get shaken out of boredom. Historically, the market sentiment never lasted for too long at such extreme levels of fear.

Market Indexes

Total Market Cap

Price action has been registering higher lows since the 23rd of May and meeting a single horizontal resistance. This can be intuitively explained by the fact that buyers keep stepping in at higher prices, whereas sellers aren't being able to go down in price. The more tests a resistance gets, the more sell orders get depleted. This is commonly referred to as an ascending triangle formation. For that reason, we attribute higher odds of an upside breakout taking place over the breakdown under $1.35T.

Altcoins Market Cap

The Alts MCap found significant demand at the previous high set by the market in February. Since then, the recovery on Alts has been happening at a faster rate than BTC's. The next upcoming level for this index is $1.115T after which we must monitor whether a reclaim takes place or not as it'll help us determine whether a full recovery takes place or not.

Bitcoin

Bitcoin is still ranging between $30,000 and $40,000. What the weekly timeframe is communicating to us is a potential drop to the range low as the past two weekly candles show weakness from buyers as they got overpowered by the $40,000 sellers.

Ether

As stated in previous volumes of weekly technicals, despite the severity of the retracement, ETH is technically retesting the previous high as support on the weekly timeframe. We can also see a clear difference in buyers' interest between BTC & ETH. Buyers have been stepping up in a more robust manner on ETH and pushing its price towards a potential full recovery over the coming weeks - or what is commonly referred to as the Dalai Lama pattern. Let's zoom in for a more intricate view.

This is ETH on the 4H timeframe, what we immediately see is the creation of an ascending triangle; a bullish pattern formation which in this case targets $4,000. The reality is, this pattern is being forced by buy and sell walls through a Coinbase market participant, and therefore monitoring changes in the orderbooks as explained yesterday in Discord Pro will be crucial to see the upcoming movement on ETH. Lastly, we'll delve into ETH/BTC to further investigate which asset is likely to outperform in the coming weeks.

ETH/BTC just recently broke out of a 2.5+ years of consolidation where we saw ETH outperform BTC. When this ratio was near 0.04, we had stated that a fair valuation would be 0.08 - which was achieved. Currently the ratio has overhead resistance at 0.085; if price is able to overtake it on the weekly timeframe, then a a rise towards 0.12 would be on the cards. The question is: If that were to happen, would that be the top or the start of a new era? The answer lies in the fundamentals.

DOT

Rationality is the top requirement for successful investing and trading, rationality's antonym is wishful thinking. Right now we are seeing DOT's price reject $27. A requirement and primordial rule to enter a safe zone is a reclaim of $27 on the daily timeframe for DOT.

SNX

SNX is still creating lower highs and lower lows on the weekly timeframe. For that to change, a weekly reclaim of $14.10 will be necessary and that would represent a change in trend from bearish to bullish. As of now, buyers are stepping in right above ~$10 where support lies, if that support were to be lost on the daily timeframe, then a test of $7.50 would come next. Given the panic"ky" nature of market participants, the former scenario seems to be the most probable one.

RUNE

RUNE's price is currently having trouble going over $11.50 - while this is not a key level it does represent where price created set a candles close low on the way up in April. Crossing that level on the weekly timeframe will be crucial for further upside. In the meantime, $10.35 is acting as support and hence RUNE is stuck between a rock and a hard place for now.

FTT

FTT's weekly chart is perhaps one if the worst one's/most bearish out of the few. That means a recovery bounce would likely happen but a lengthy consolidation and time of correction may be on the cards here. From a key levels perspective, paired with FIB retracement levels, a test of $43 is likely. However, the 4H timeframe disagrees as we'll see below.

Similar to ETH, FTT's chart has formed an ascending triangle on the 4H timeframe, which is successful would lead to $50 - not only $43. This a pattern to monitor.]

SOL

The fastest recovery title goes out to SOL. $40.75 has been turned from resistance into support on both the daily and weekly timeframes. A retest of it is likely, followed by a rally towards $50.

SRM

SRM has $4.50 acting as support, as long as this is valid, the next key level is $6.40.