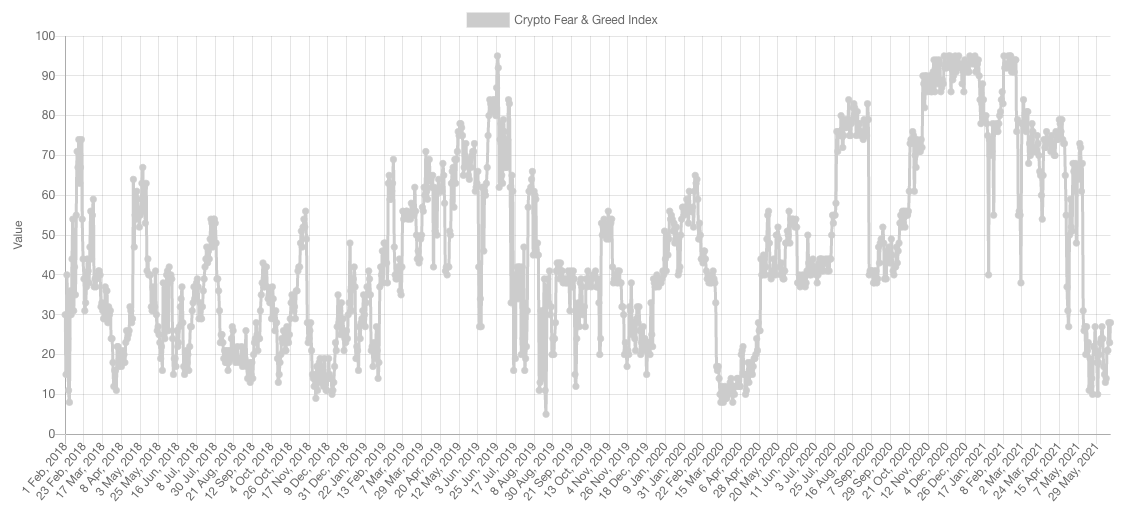

Market Sentiment

Market Indexes

Total Market Cap

The Total MCap remains ranging between $1.35T and $1.7T. Until price breaks out of this range, price action will remain indecisive. We attribute higher odds to an upside breakout followed by a rally to $2.5T than a breakdown, however confirmation only comes via daily candle closures above/below the range. The reason we attribute higher odds to an upside break is because of the prevailing fear and unchanged fundamentals of BTC and ETH.

Altcoins Market Cap

The Alts MCap found support at $650B and remains headed towards the next key level which sits at $1.115T.

Bitcoin

As stated last week, the rejections from $40,000 on the weekly timeframe communicated that a test of range lows was likely and that is exactly what happened before a push back up to $40,000. Despite the latest rally, only a daily break of $40,000 can confirm that recovery is underway.

Ether

ETH flipped $2,500 back from support into resistance which states that ETH is currently at resistance. If it were to rally towards $3,200, a reclaim would need to take place first because otherwise it's another test of $2,150 that is on the line.

RUNE

RUNE is testing $8.85 as resistance currently which communicates that $5.75 is still on the cards. Of course, BTC dictates what happens in this market and hence if it breaks out from $40,000, a broad market relief rally would take place - including for RUNE.

SNX

After having broken the ~$10.50 liquidity area, SNX has been on the way to $7.50 as that is where support is.

DOT

Similar to BTC, DOT is ranging between $19.40 and $27. Until a range breakout takes place, we cannot make assumptions as to where price goes next. A break of $19.40 would lead to $15 whereas a break of $27 would lead towards $40.

SOL

SOL held up better than the majority of this market. Currently it is trading at the $36 level of support which pice must hold or else a fall to high $20s is on the line. A break of $40.75 would lead towards $50.

SRM

SRM played with fire this weekend by breaking $3.79. Luckily this was reclaimed on the daily timeframe with a bullish engulfing candle which shows it was a deviation and that $4.50 is once again on the cards.

FTT

FTT's price action is communicating that $25 is next based on a levels' basis. A reclaim fo $35 would invalidate it.

XRP

Similar to BTC, TOTAL and DOT, XRP is ranging and stuck between two levels: $0.79 & $1. A breakout (either way) would communicate where price would head next with high odds.