Weekly Technicals Pro - Volume 64

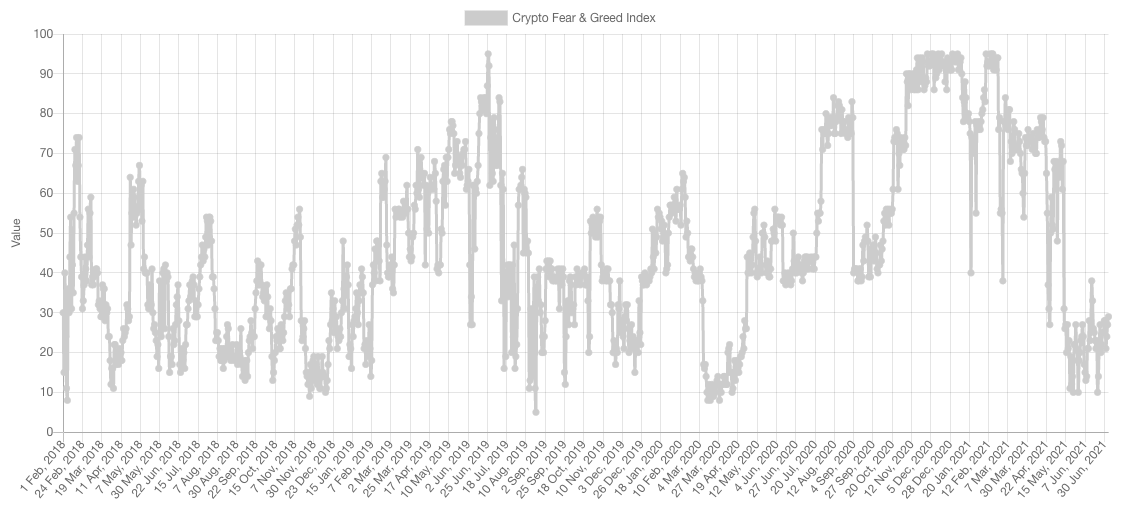

The sentiment has not spent as much time in a tight range near Extreme Fear since this data began being recorded in early 2018. This current stay at these low levels of sentiment is longer than what we saw in the late 2018 crash and March 2020 Black Swan event.

Market Sentiment

Market Indexes

Total Market Cap

The Total MCap is nicely respecting $1.35T as support which sets the stage for a rally towards $1.7T. Price action remains range bound but a breakout in either way is imminent and our bets remain on an upside breakout.

Altcoins Market Cap

The Alts MCap also rebounded from the $645B level of support which still sets the stage for a test of $1.115B.

BTC

Bitcoin's price remains in the same [$30,000-$40,000] range. Price has shown strong demand the previous week and indecisiveness this week. So far, price is chopping around with no clear direction and until a breakout takes place we cannot make assumptions.

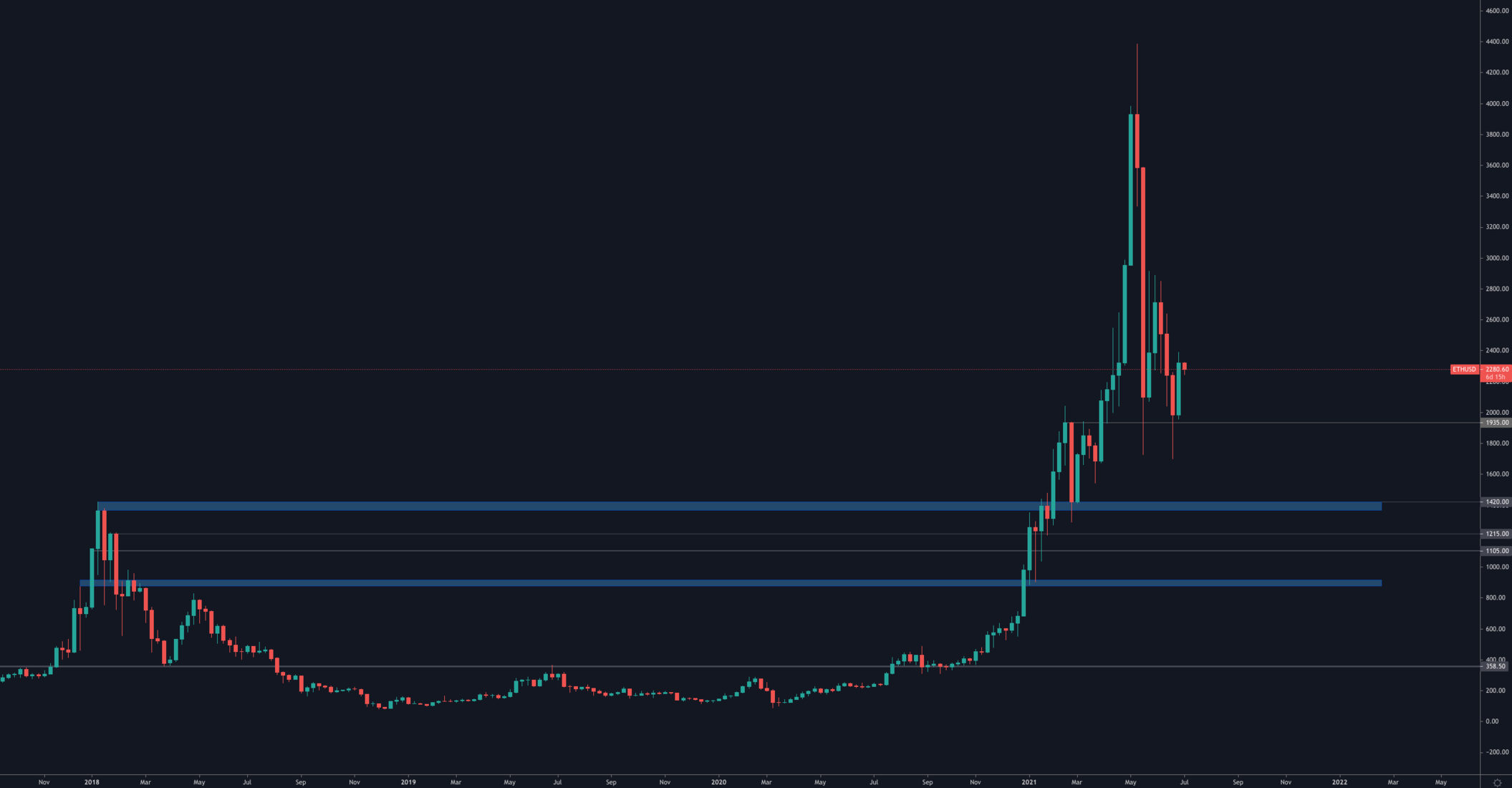

ETH

ETH has tested the $1,935 level of support once more and found support. For a recovery confirmation, price will need to reclaim above the previous $2,800 high on the weekly timeframe.

DOT

While DOT is maintaining its price above the $15 level of support the demand has thus far been very weak. To enter a safe zone, DOT must reclaim $19.40 as it remains in danger of falling towards single digit numbers at this point.

SNX

Nothing like seeing DeFi rise back in a sudden large green move. On the weekly timeframe we can see two important developments:

- Reclaim of $7.50 which turns it from resistance into support

- Bullish engulfing candle on the weekly timeframe communicating strength

RUNE

RUNE has not yet shown significant strength, though we must state that it is above the $5.75 level of support. As previously stated, the recovery would only be confirmed after a weekly reclaim of the thick white line: $11.50.

SOL

SOL is currently struggling with the $36 level of resistance. However, it has been tested multiple times on the daily timeframe which weakens the supply there after each touch so that opens up higher odds of a breakout.

SRM

Despite SRM respecting S/R on the weekly timeframe, price must reclaim $3.79 on the daily timeframe in order to see any sort of upside continuation or rallies.

FTT

FTT has reclaimed $25 and has $35 next on the cards.

MINA

MINA is trading in a very tight range with support underneath at $1. However, these consolidations after listing dumps take a while to end (several months) and we speculate the bottom would set somewhere around [$0.75-$1].

XRP

To catch up with the remainder of the market, XRP must reclaim $0.79 for further upside, otherwise $0.47 is on the cards till then.