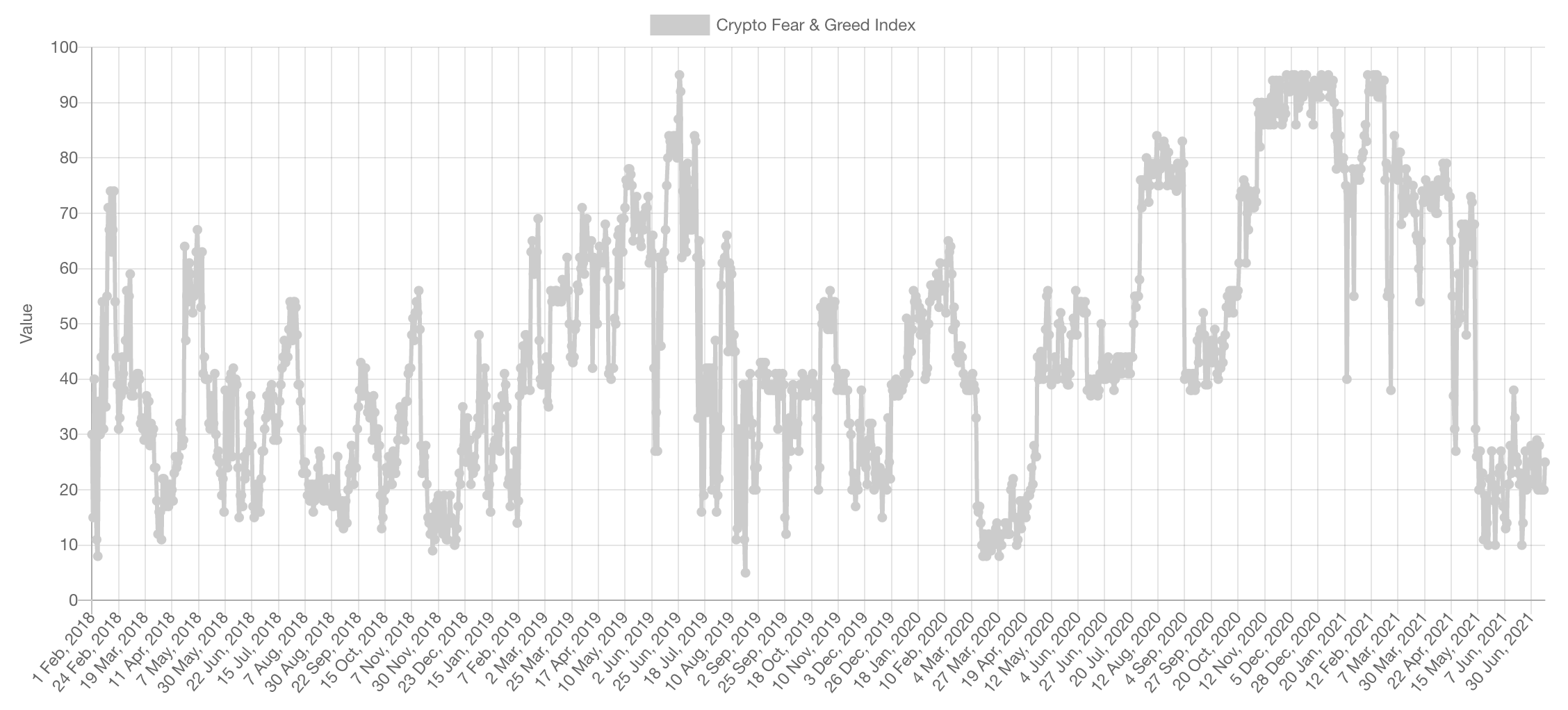

Market Sentiment

Historically, this metric has not lasted long around the Fear/Extreme Fear levels and has caused reversals. Of course, the market cannot be timed through this particular oscillator but it does act as a confluencing factor.

Market Indexes

Total Market Cap

The Total MCap remains respectful of the $1.35T level of support. As long as the latter is true, the next level is $1.7T. We must keep in mind that prices are ultimately ranging between $1.35T and $1.7T which means there will be no clear direction of where the crypto market comes next until a breakout takes place.

Altcoins Market Cap

The Alts MCap has retested $645B. On a level by level basis, the next key level is $1.115T.

BTC

Bitcoin's price is still stuck in the same [$30,000-$40,000] range and the market has not yet decided where the breakout will occur from. There are higher odds that an upside breakout takes place than a downside one, however as the market has not communicated it yet we cannot make assumptions here. Nonetheless, a breakout is imminent.

Volumes are drying up and that usually happens before a big move either way.

ETH

On the weekly timeframe, ETH is at the $1,950 level of support and that is what's holding price and hinting an incoming recovery. The latter would only be invalidated by a break of $1,950.

DOT

DOT is above the $15 level of support but is in a bearish market structure consisting of lower highs and lower lows and demand has not been high on relief rallies by any means which is concerning. Should $15 break, DOT would head towards single digit prices.

SNX

SNX the outperformer. SNX has reclaimed $12.40 on the daily timeframe on a very slight basis, for now the ~$11 liquidity area is support and price has likely put in a bottom at $5.50.

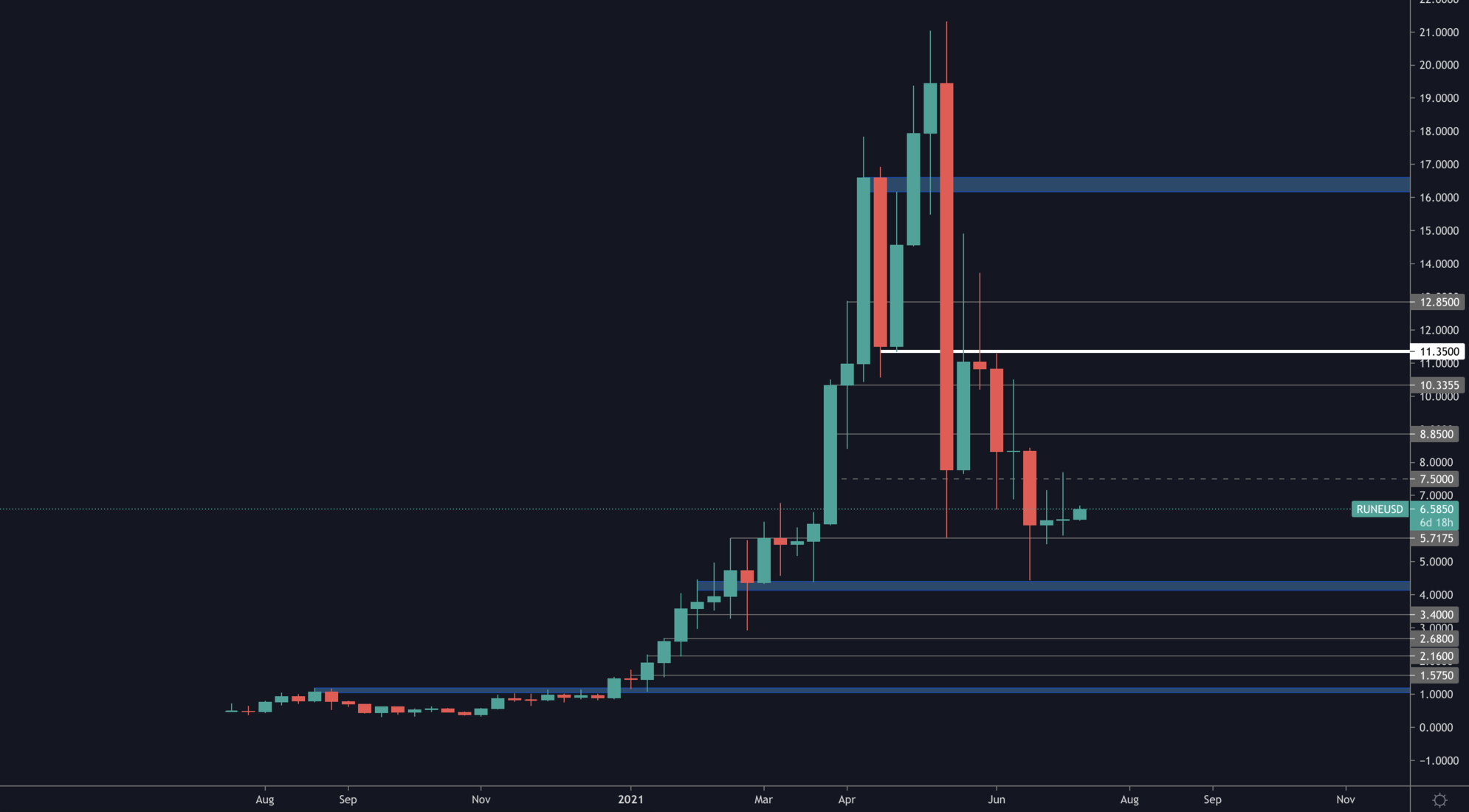

RUNE

RUNE is above support but demand has not been high in recent weeks on relief rallies, which is also concerning. Either way, RUNE only enters a safe zone and heads towards recovery once a weekly candle closes above the $11.50 weekly level.

SOL

SOL has been unable to cross $36 and is communicating an incoming test of $28.50. We must also say that demand on SOL during relief rallies has been quite high and hence "if" the market enters a price recovery in the coming weeks, SOL would be at the forefront of it.

SRM

Despite the weekly timeframe respecting the 2020 DeFi summer weekly candle closure high, SRM is in a dangerous zone with high risk of downside towards $1.40 unless it reclaims $3.79 on the daily timeframe.

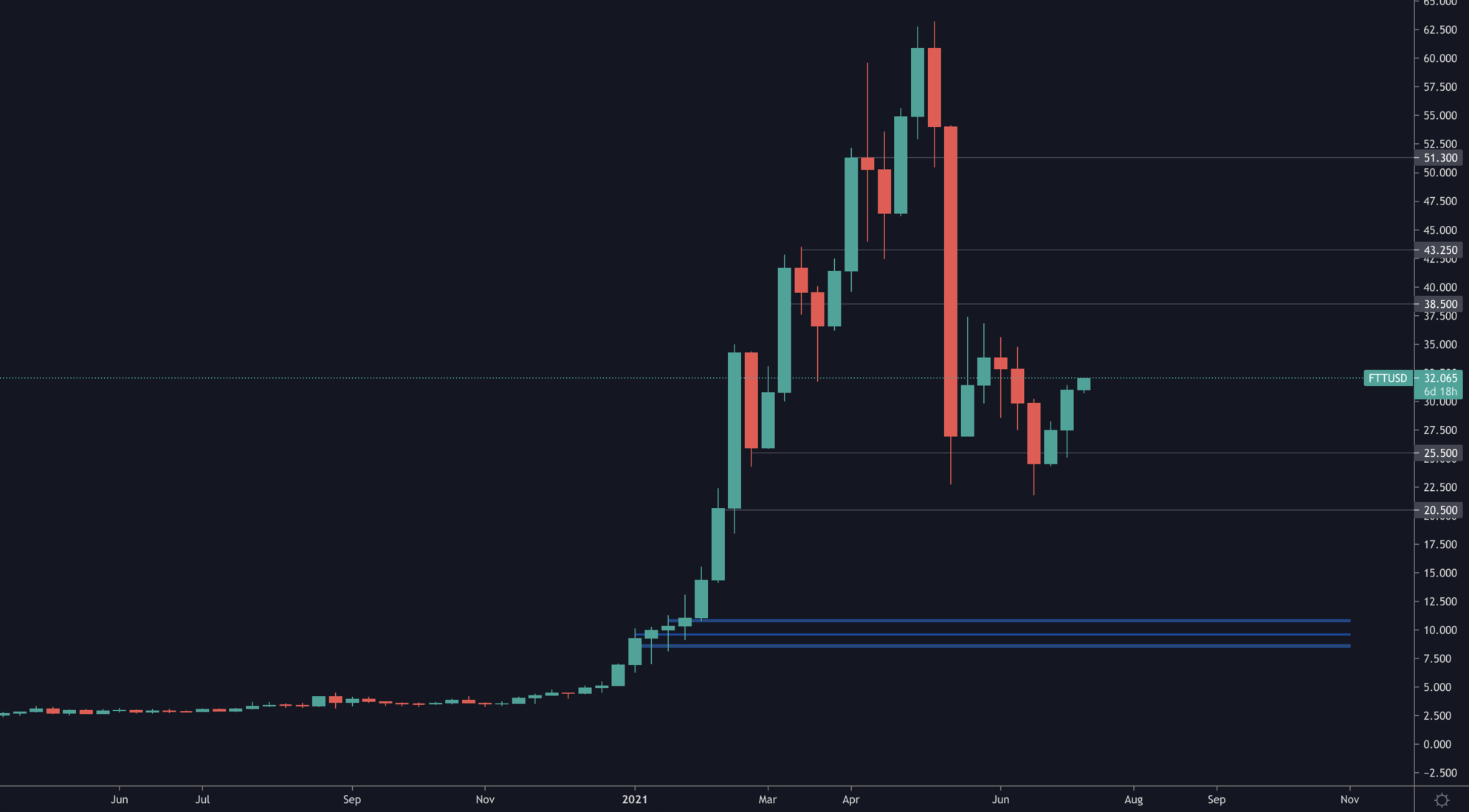

FTT

FTT has reclaimed the $25 level of support and began a rally headed towards $35.