Weekly Technicals Pro - Volume 67

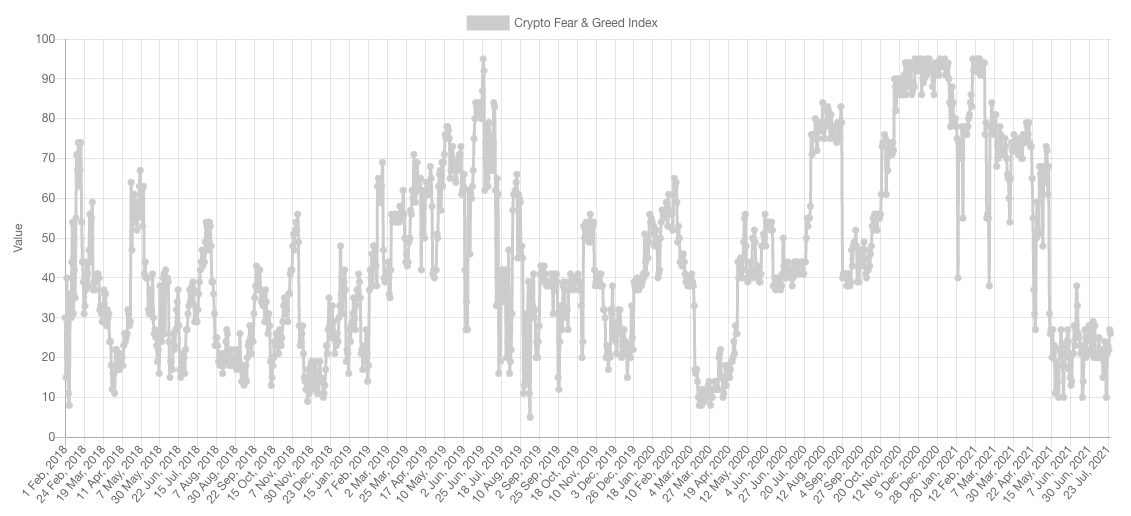

The market rallied off the spring under $30,000, yet market participants maintained a Fearful sentiment anyway. This, by far, has been the longest period of time that the sentiment remains in a constricted region near very high levels of Fear. On previous occasions, they've all been opportunities in hindsight.

If you liked the bullish engulfing candles on the daily timeframe, you're going to love them on the weekly.

Market Sentiment

Short Squeeze

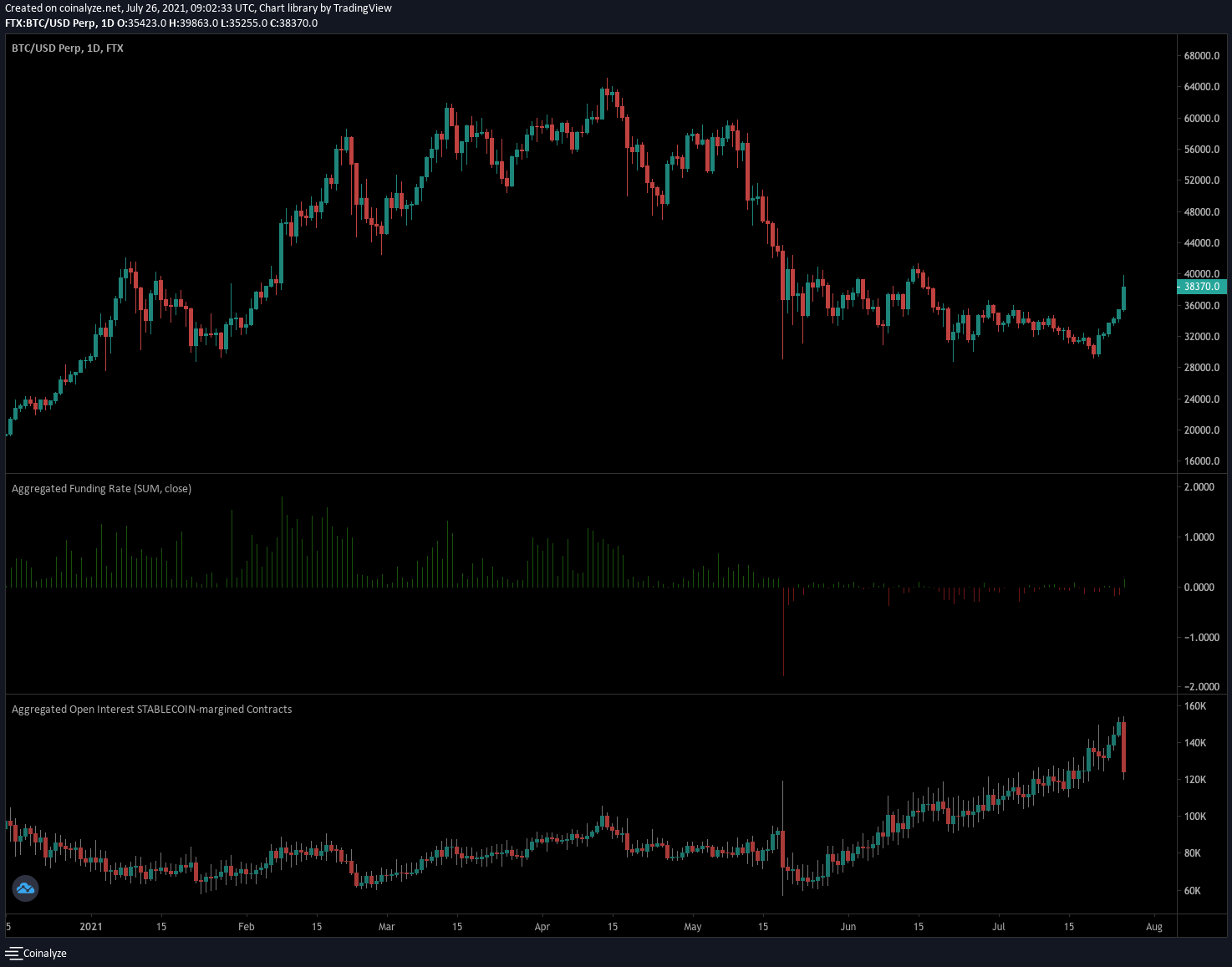

Let's take a closer look into something more accurate and factual than the market sentiment: Exchange Data.

Perpetual Futures are the most commonly traded contracts in the crypto-space and hence looking at its data helps us understand how traders' are positioned and which side is most vulnerable. You already know the conclusion from the "Short Squeeze" heading lol.

The chart above shows us two pieces of data: Funding Rate and Open Interest.

- Funding Rate: The standard funding rate is +0.01%. When bulls are offside and longing too much, the funding rate turns excessively positive which makes it attractive to short in such instance to collect the large funding payments. Conversely, the opposite happens when bears are offside and the funding rate turns excessively negative. What we saw here is a special case of elongated negative funding rate for multiple weeks which meant traders were getting paid to long BTC.

- Open Interest: The open interest tells us how many contracts are open on the market. During BTC's very boring range, shorts have been piling on to the market and that can be seen by the increased open interest. How do we know they're shorts? Common sense as people were excessively bearish/fearful and the negative funding rate.

When one side goes offside by becoming too heavy, it becomes risky for them as they can become forced sellers. If traders are getting paid to long and price is at support, chances are that price will go up - or at least it has reasonable odds of doing so. By price going higher, the shorts go from profit to underwater to they point where they no longer accept the loss and want to get out or get liquidated. Despite the move from $30,000 to $35,000, we only saw the short squeeze begin today and that can be seen via the sharp decrease in OI.

This will likely keep going (albeit not in a straight line) until the OI resets near an average of 90-100k on this scale.

Market Indexes

Total Market Cap

The Total MCap reclaimed $1.35T on the weekly timeframe and closed a bullish engulfing candle which increases the odds significantly of there being a rally that takes the market back towards $1.7T+.

Altcoins Market Cap

The Alts' MCap did not close a bullish engulfing weekly candle but did maintain support at $645B. From a pure technical perspective, as long as that level holds then $1.115T is next for alts.

Bitcoin

Bitcoin found a lot of demand on the touch of $30,000 and closed a very bullish candle that was filled to the absolute top. What came afterwards was a short squeeze as was explained above.

Despite the advance, BTC remains in the same [$30,000-$40,000] range and we cannot make assumptions before a breakout. Though we still attribute higher odds to an upside break.

Ether

ETH reclaimed $1,935 with strength and also formed a bullish engulfing candle on the weekly timeframe. Given that shorts are too heavy and the fact that EIP1559 is on the horizon (pre-news catalyst), ETH is likely to reach $3,000 over the next few days/weeks.

DOT

DOT is still creating lower highs and lower lows - even on the weekly timeframe. However, due to the fact that the market leaders (Bitcoin & Ether) have both registered bullish engulfing candles on the weekly timeframe, we'll be closing this DOT hedge at breakeven.

SNX

SNX tested $7.50 once again and from there the market is likely to rebound higher towards $11. A reclaim of $12.40 can change things for SNX as it'd be breaking the bearish market structure.

RUNE

RUNE is in a very uncertain spot in the short-term given the attacks we've seen happen. Price is ranging between $3 and $4 at this moment in time - that is from a trader's perspective.

From an investor's perspective, if the vision and fundamentals remain unchanged then that's exactly that: nothing has changed.

SOL

SOL saw a spike in demand from low $20s but was unable to close a weekly candle above $28.50. So far, we are seeing weakness amongst altcoins and strength amongst majors (BTC/ETH).

SRM

SRM must reclaim $3.79 for further price appreciation with more decent odds than what is presented here. The positive aspect for price is that the weekly timeframe is respective its' $2.88 line in the sand.

FTT

Route to $35 underway and approaching.

MINA

MINA has been rallying with the remainder of the market. Upon the reclaim of $1.03, it set a target of $2.