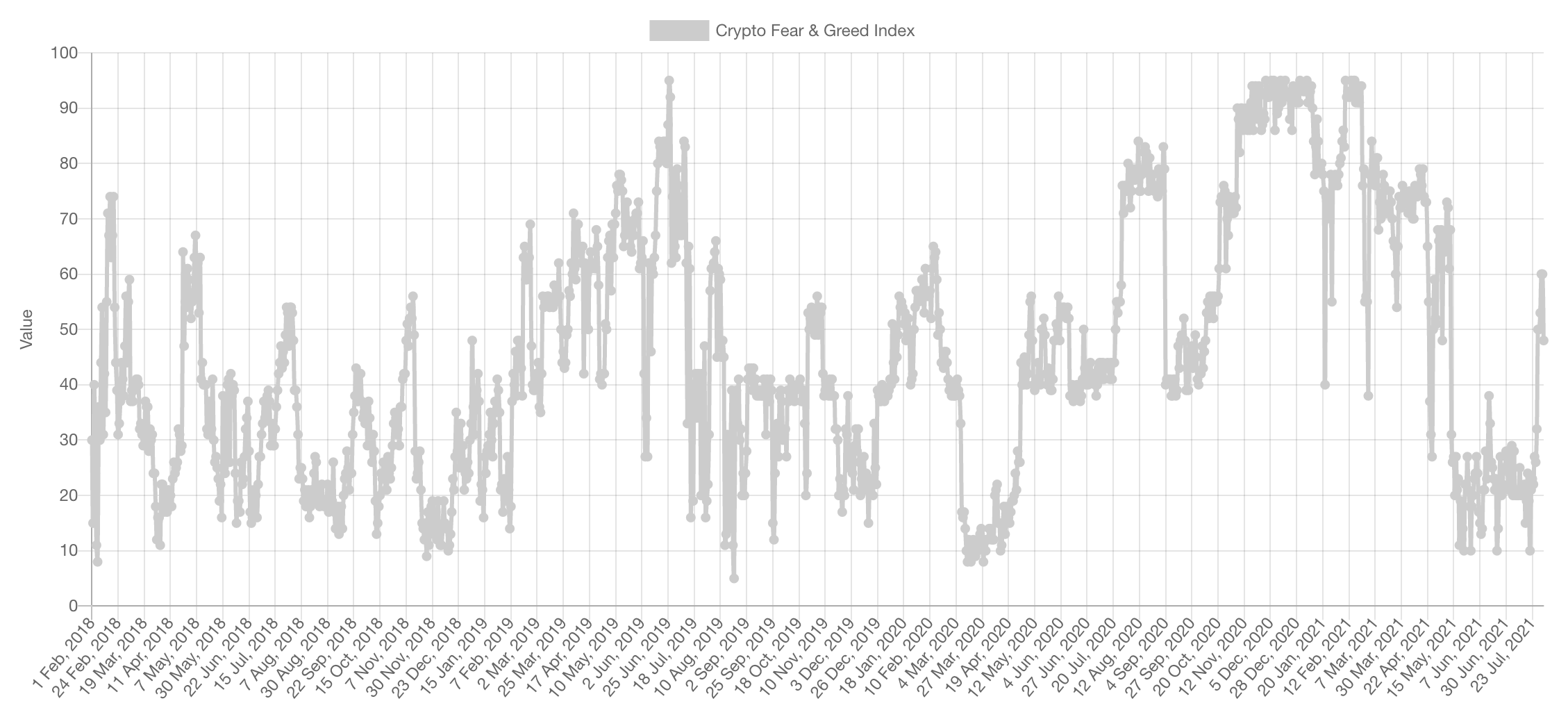

Market Sentiment

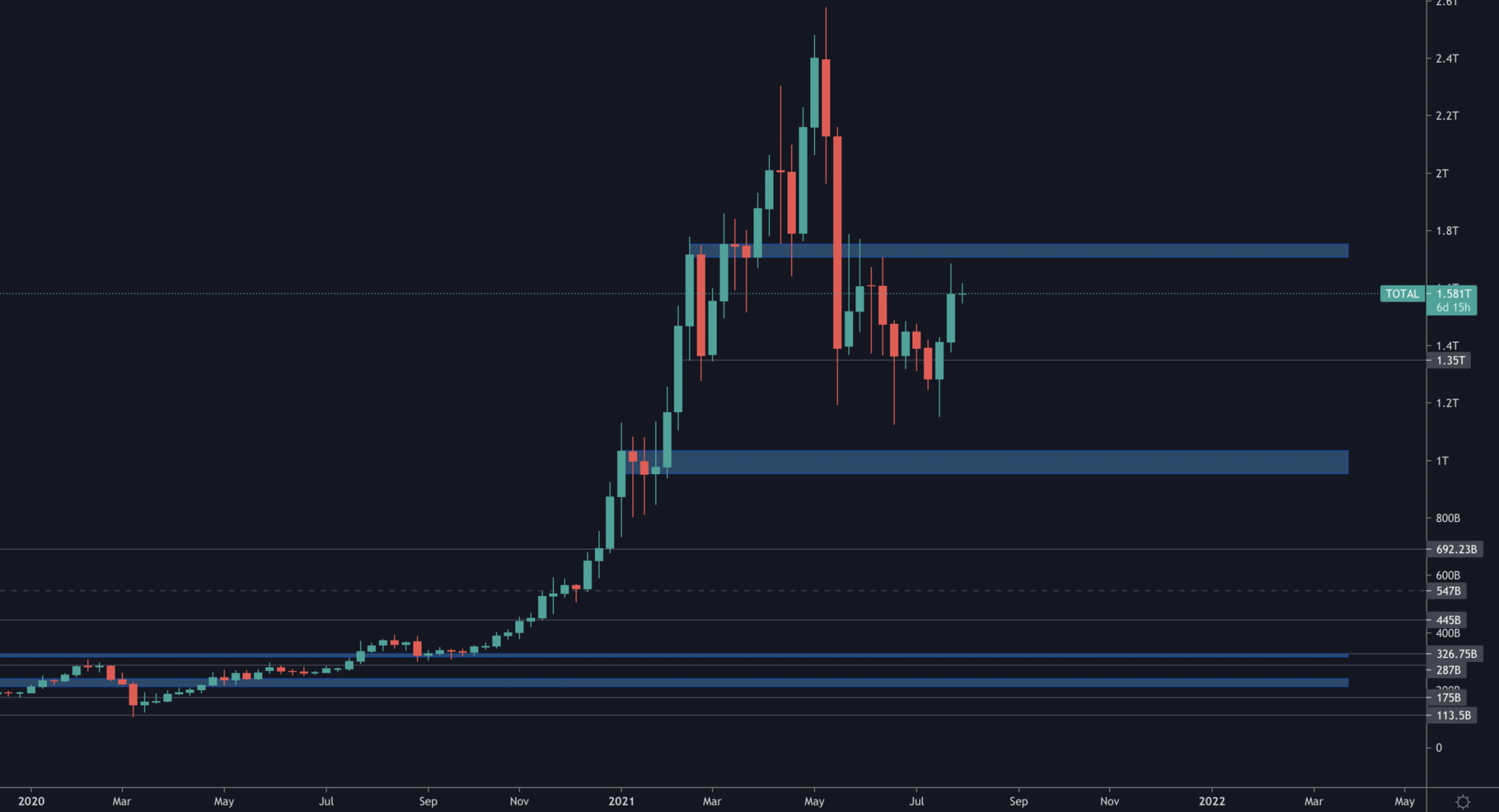

Market Indexes

Total Market Cap

The Total MCap index remains in the same [$1.35T-$1.75T] range and now nearing the upper bound of the range. Should this index see a breakout, it is likely to act as the last straw before a market-wide recovery (full) - non confirmed yet.

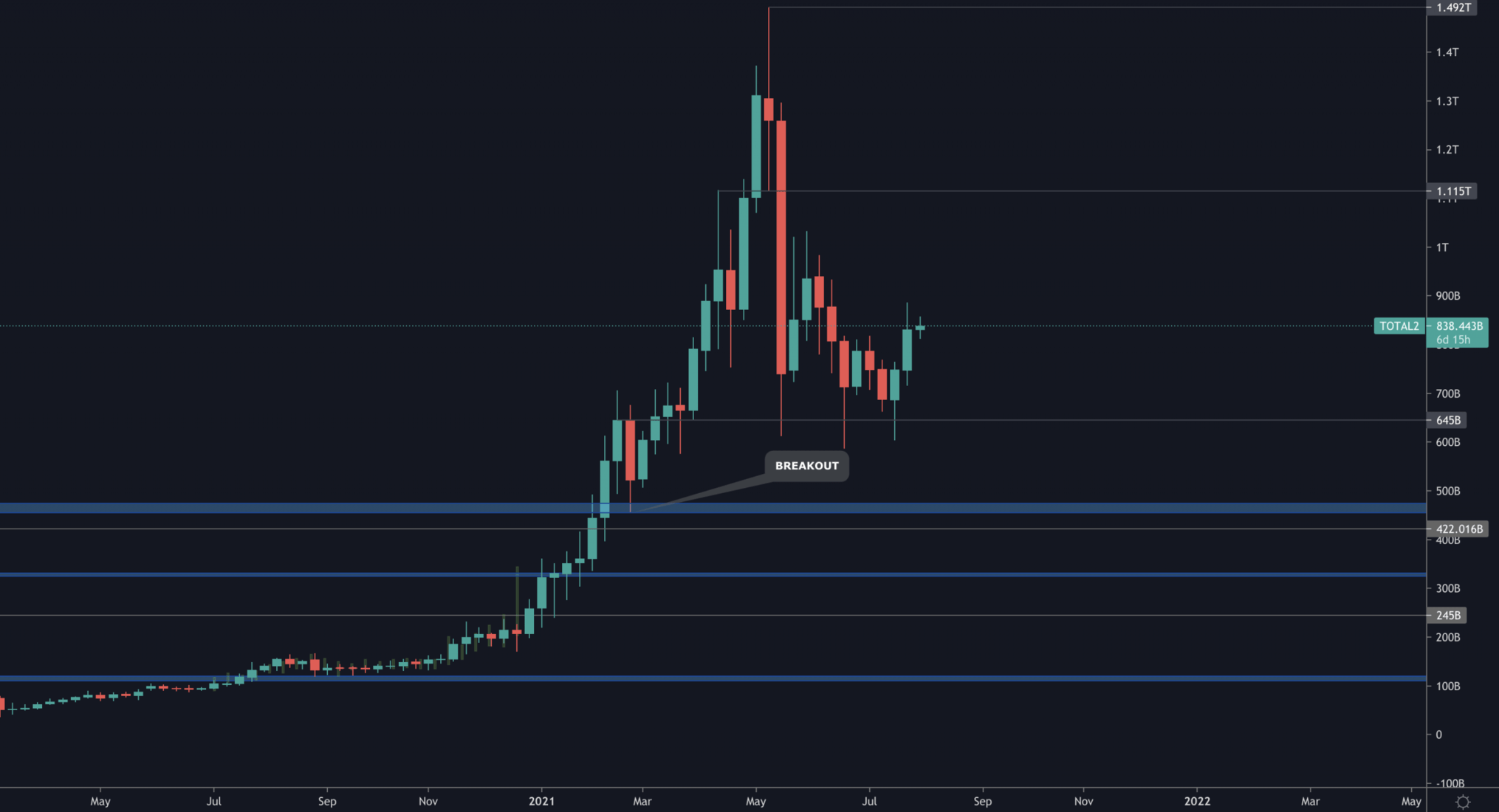

Altcoins Market Cap

Literally the breakout that we'll not be fading and try to short into is the Alts MCap breakout from the 2017 highs. For us, long-term that'd likely be the dumbest (excuse our language) action any crypto investor could take.

From a key levels perspective, price found support once againn at $645B and is headed towards $1.115T.

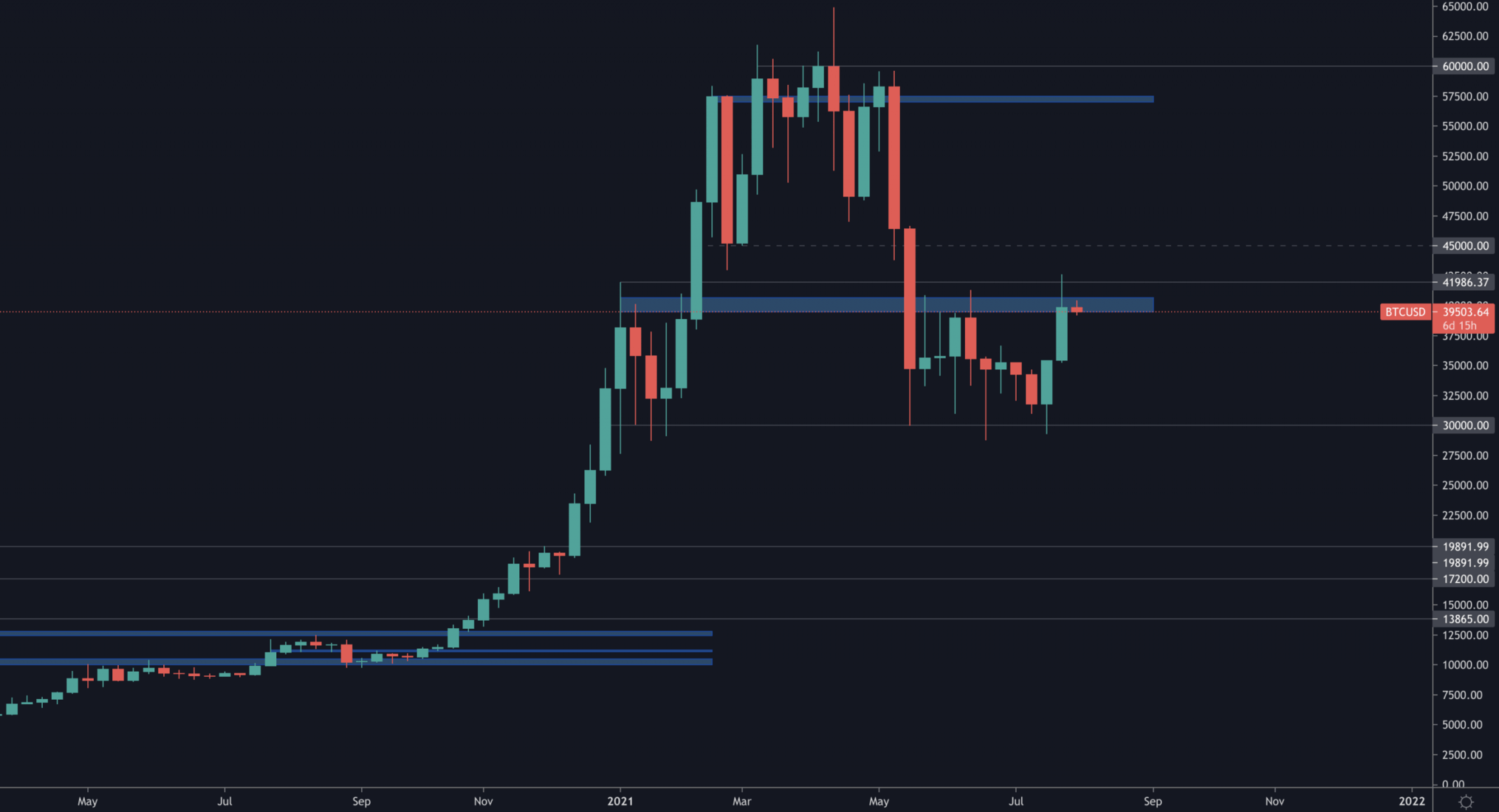

BTC

Bitcoin is at resistance. Despite the breakout on the daily timeframe (which remains valid) we did not see that translate into the weekly timeframe. We must remain careful and rational even in the face of 10 consecutive green candles.

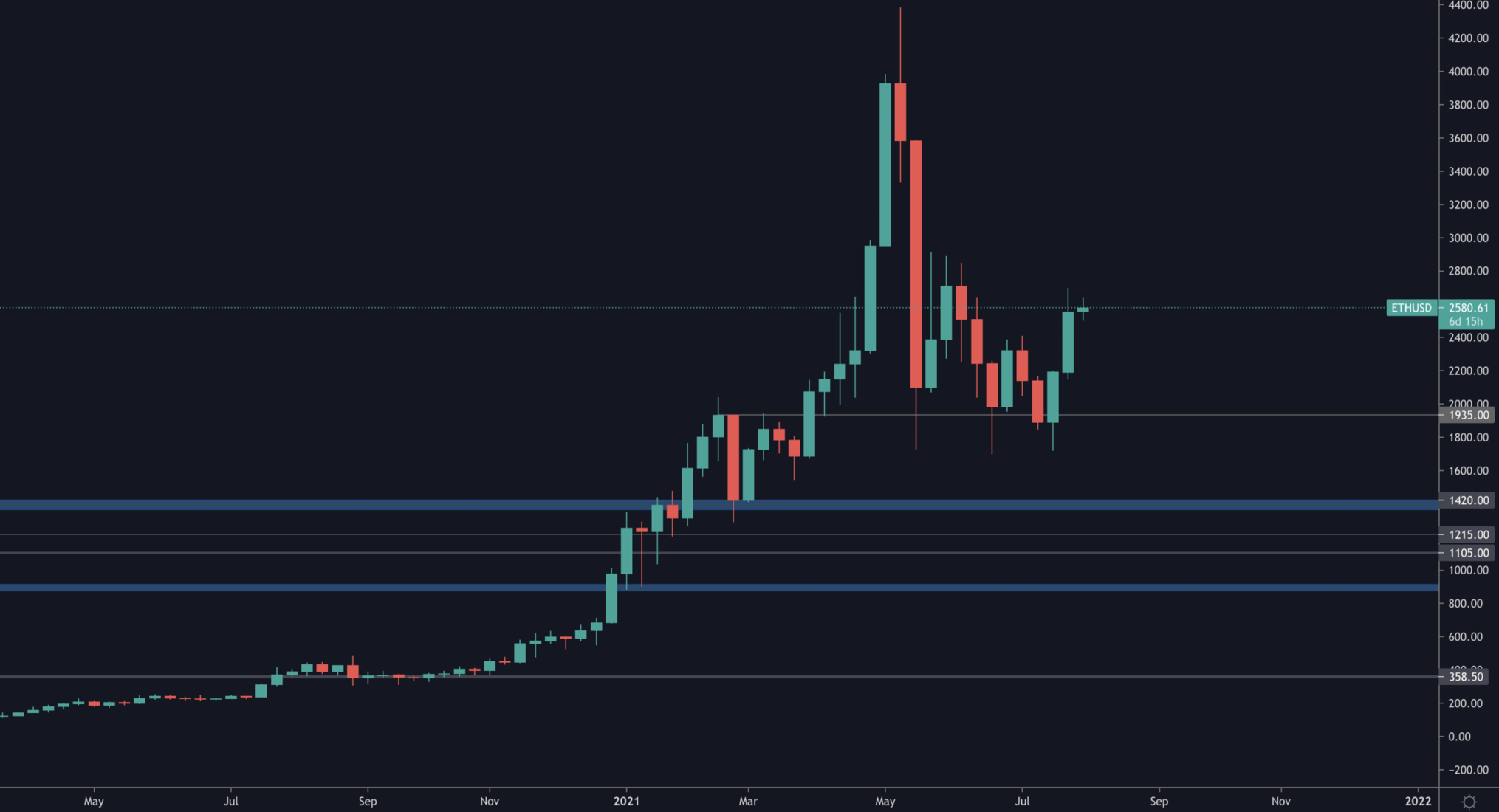

ETH

ETH has managed to set an intermediate higher high and break the bearish market structure temporarily with that. The tough level of resistance is [$2,900-$3,000]. We'll need to monitor how price reacts to it and more importantly when the Total MCap breaks out.

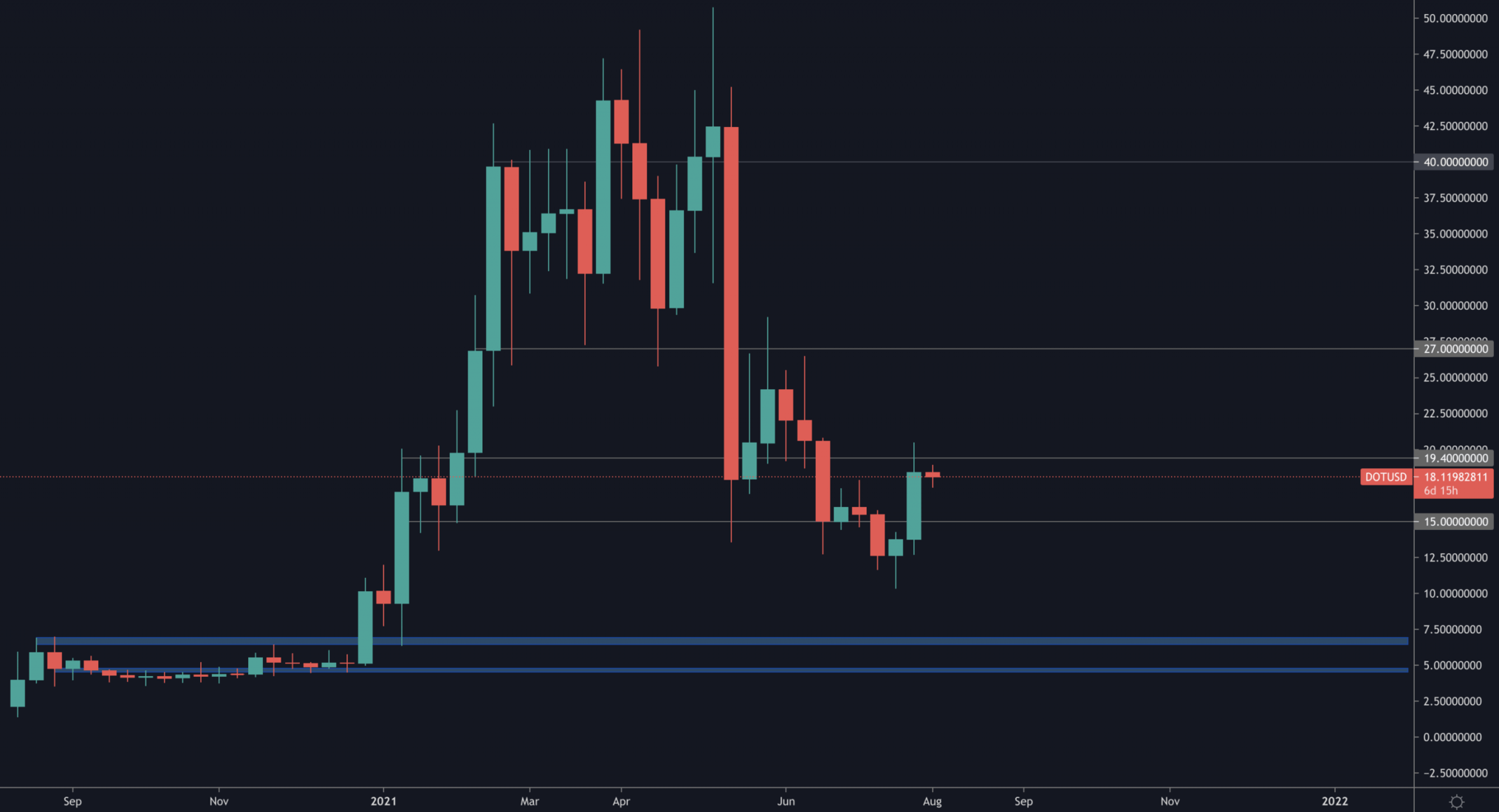

DOT

DOT also saw an intermediate change in market structure by reclaiming $15 and is now testing $19.40 as resistance. If we see a reclaim on the daily timeframe then $27 would come next.

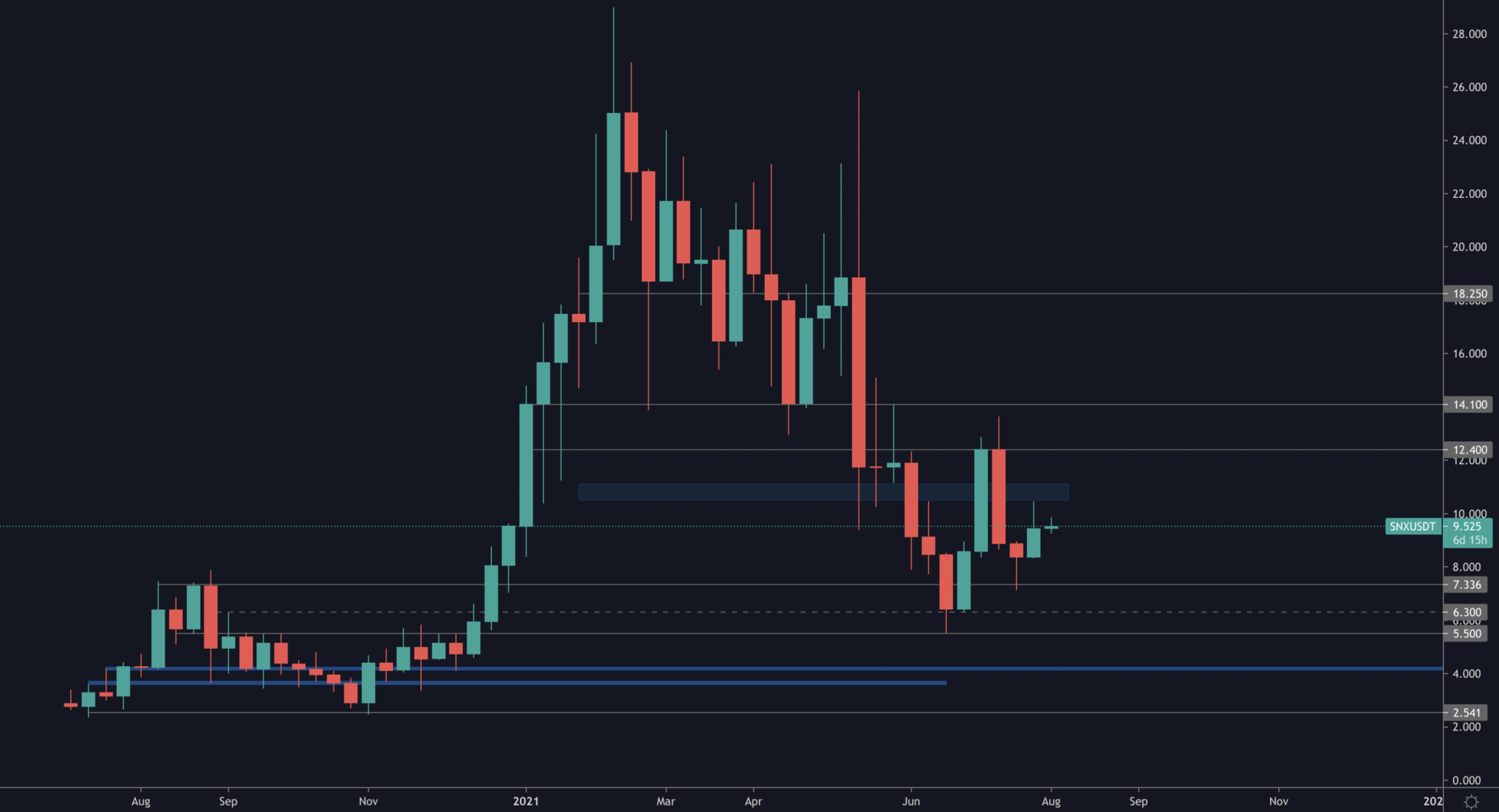

SNX

SNX is following a similar pattern to post-DeFi 2020 Summer. As of now, price is in between levels (in mid-air) and hence we can't make out judgements on the next short-term direction yet.

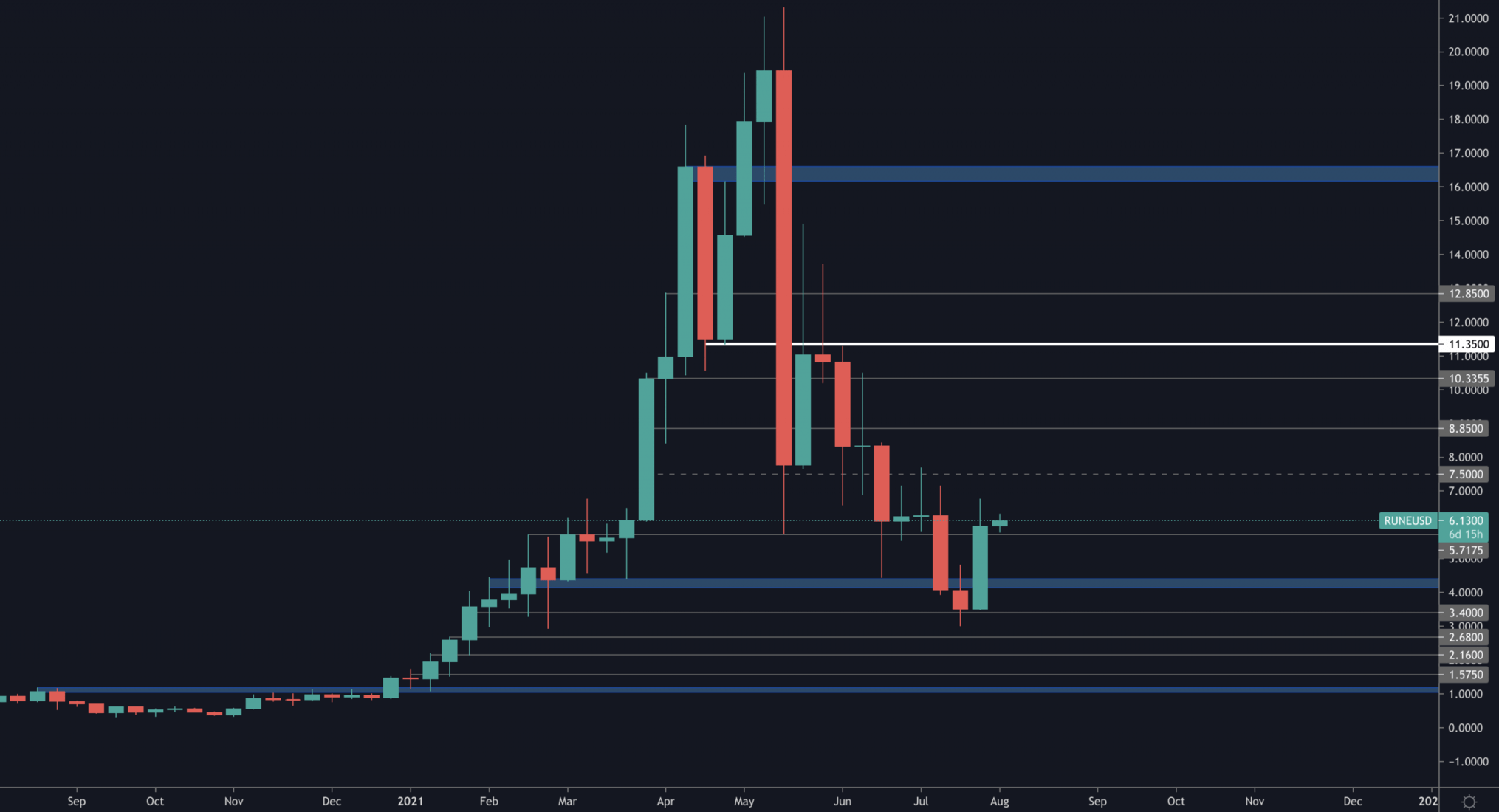

RUNE

RUNE had a massive week (+70%) and managed to turn $5.75 from resistance to support which sets the stage for a run towards $8.85.

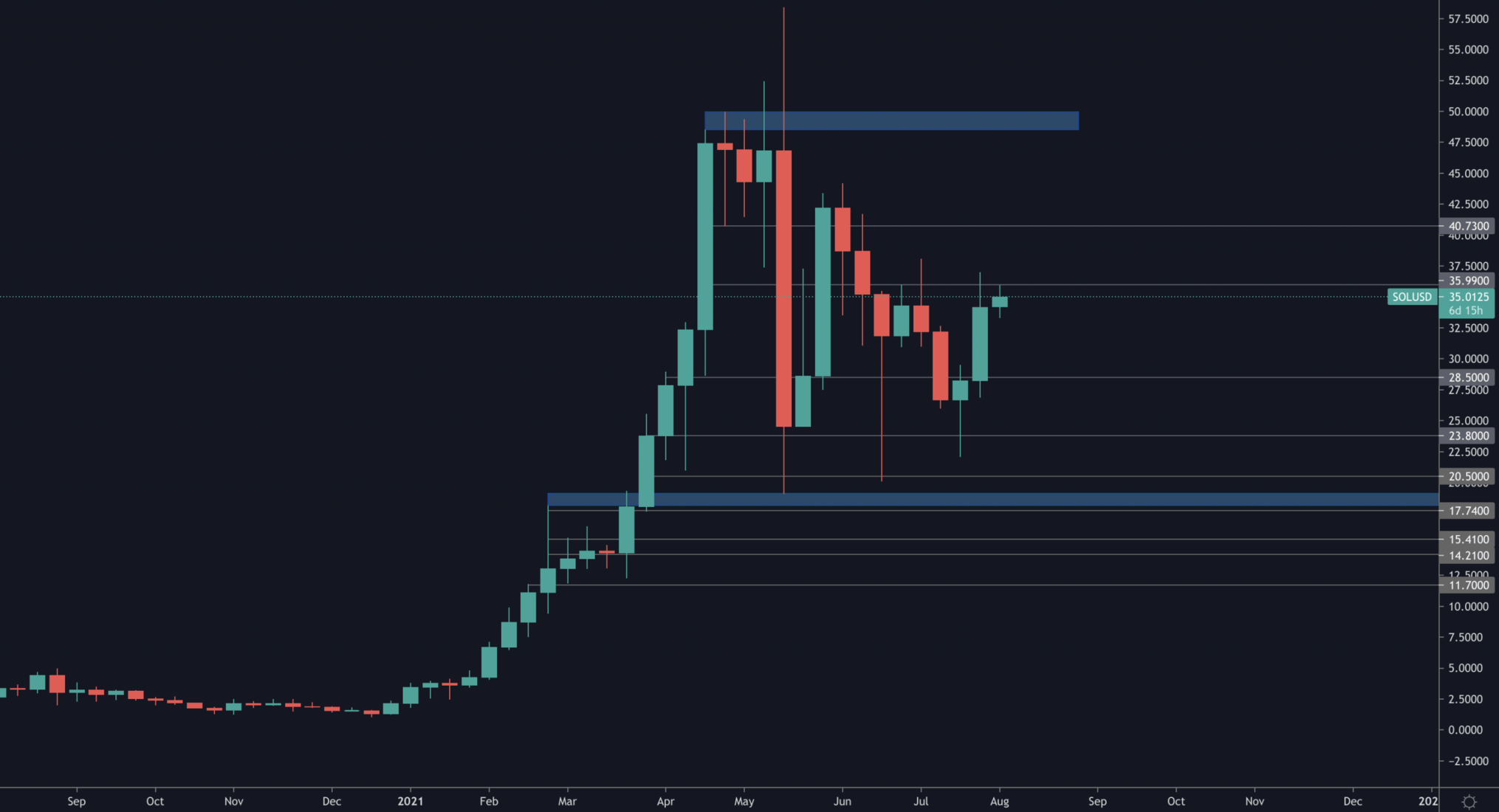

SOL

One of the best looking charts in crypto today given how fast it retraced a good portion of the May crash. As of now, price is at the $36 level of resistance. Unlike most other cryptocurrencies, SOL set out lower highs and higher lows (not lower lows). This price constriction eventually finishes with a breakout and change in market structure either by creating a higher high or a lower low and we attribute to it being the former.

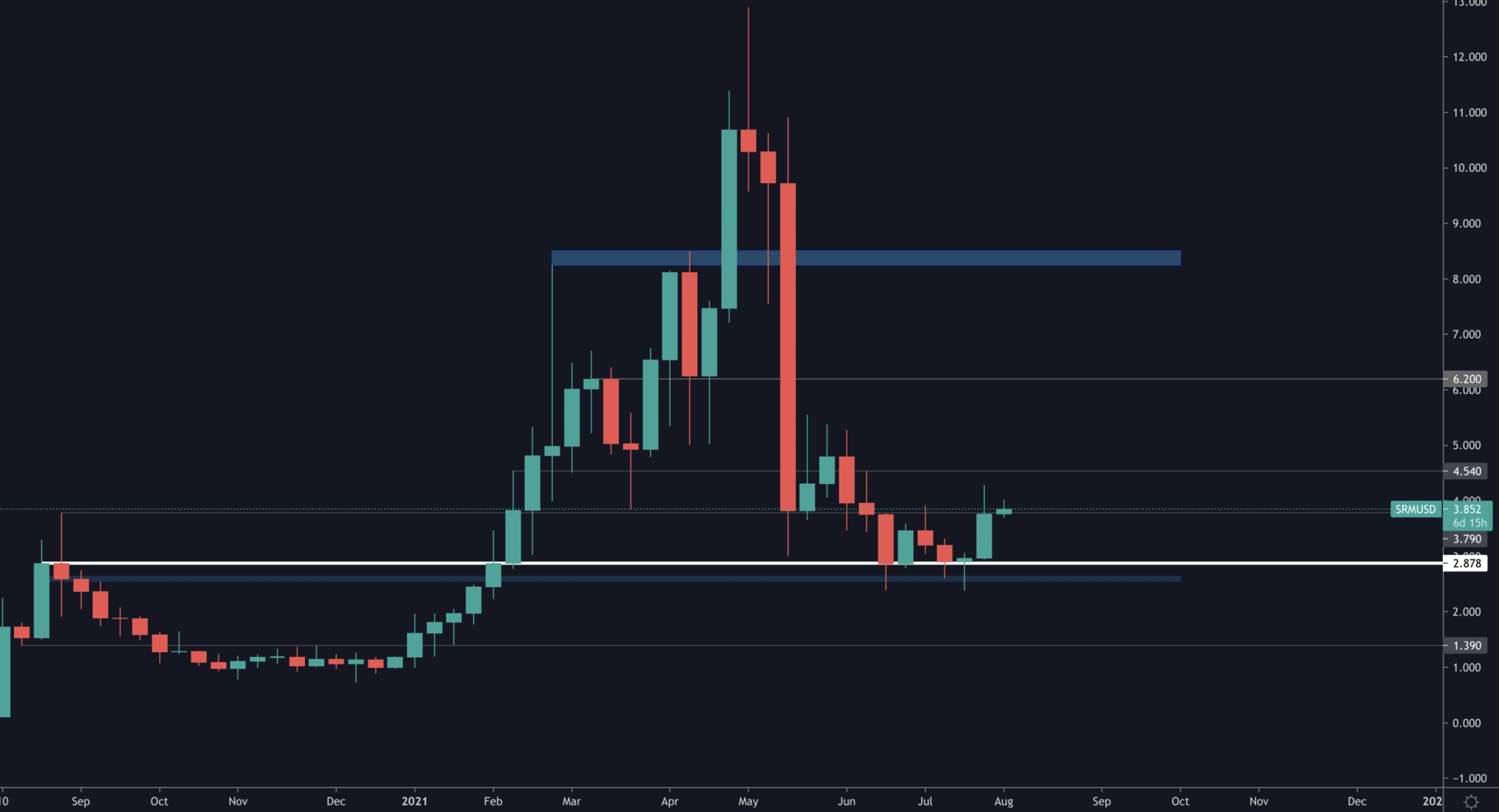

SRM

SRM has reclaimed $3.79 on the daily timeframe after a lengthy period of consolidation. On the weekly timeframe, levels are still respected but the major issue arose form the daily timeframe. Now that it's been reclaimed, the next level is $4.50.

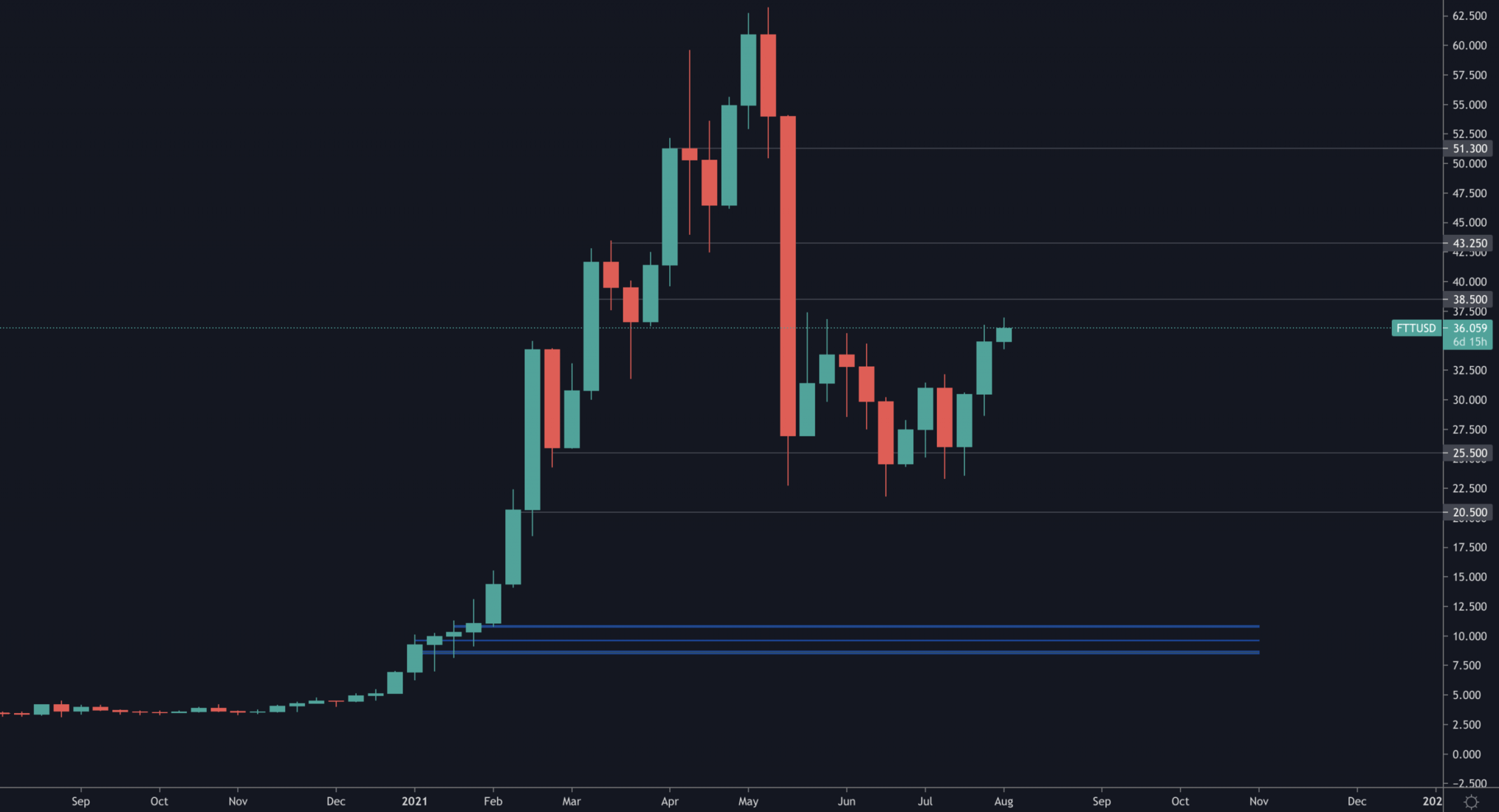

FTT

Another asset with an intermediate change in market structure. FTT is headed towards the weekly level of $38.50 after having achieved $35.

MINA

MINA is en-route to $2 with higher highs and higher lows.

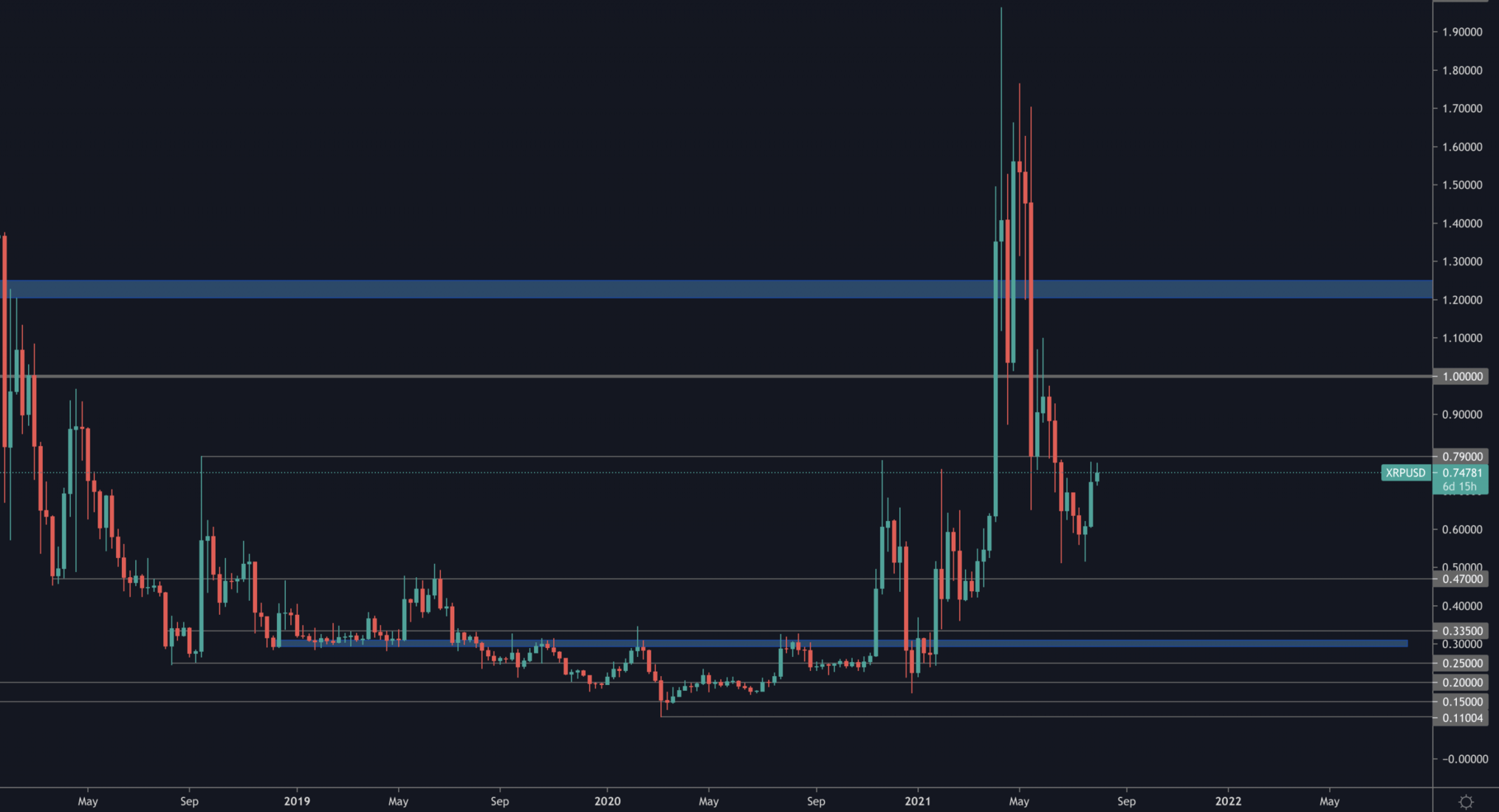

XRP

Sitting at resistance and would need to reclaims $0.79 for further upside.